Coal Power Plant Post-Retirement Options

Deciding to retire a coal-fired unit is often a tough call, but even tougher decisions follow. The next steps taken by a generation owner have multiple economic, environmental, and stakeholder consequences.

Since 2000, U.S. generating companies (Gencos) have announced the closure of more than 200 coal-fired power plants, totaling 102 GW of generating capacity. Closures have exceeded previous estimates made by the Energy Information Administration (EIA). As recently as 2014, the EIA had estimated 60 GW of plant closures, comprising 150 sites and about 500 boiler-turbine units. Although most of the press coverage of plant retirements focuses on closure announcements, that's not the end of the story. Several significant decisions then need to be made about the short- and long-term disposition of those units.

About 35 of the 200 announced sites (representing 600 units) have been demolished and another 15 have been sold for redevelopment. For remaining sites, Gencos are looking for solutions that meet safety, environmental, financial, schedule, and stakeholder goals for their shareholders and communities. Gencos, engineers, contractors, developers, and investors have learned important lessons from the recent closures and have developed best practices. Those lessons and practices are the focus of this article.

Timing of Plant RetirementsRetirements are nothing new. Thomas Edison built the first power plant, Pearl Street Station in lower Manhattan, in 1882 (the same year POWER magazine launched) and demolished it in 1895. In the 21st century, Gencos close power plants because they lose money every month, or because of the effective date of a regulation, or because they become too unreliable.

The primary recent drivers of retirement announcements have been low natural gas prices and new environmental regulations-especially the Mercury and Air Toxics Standards (MATS), Clean Water Act Section 316(b), and the Coal Combustion Residuals rule. Other contributing factors have included more competitive markets and a variety of regional and state-level policies involving renewables and carbon pricing.

Most of the power plants being closed today were built in the 1940s to 1960s, before the Clean Air Act was passed in 1970. Many have minimal air pollution controls, use once-through cooling water, and sluice wet coal ash to ponds. Scrubbers, closed-loop cooling, and dry ash handling are current requirements or will be phased in over the next few years. Because much of the older capacity tends to be smaller units under 300 MW, which are not economical to retrofit, they are therefore retired. Many closures coincided with the MATS deadlines in 2015 and 2016, at a time when natural gas prices were at historic lows.

Now that MATS deadlines have passed, additional closures are being announced by companies including Dynegy (5,000 MW) and DTE Energy (2,100 MW). Economics, renewable energy mandates, and reduced demand for electricity are driving these additional closures.

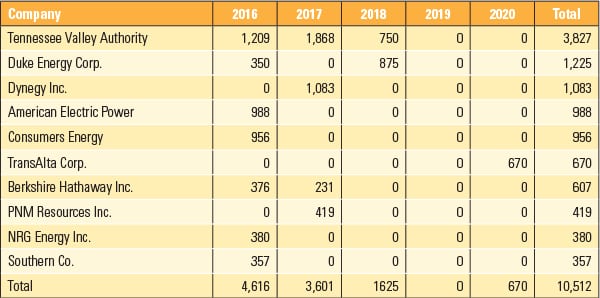

Power plant closure activity began on the East and West Coasts in oil-fired plants, because of the high cost of fuel. Closures are now occurring in the coal belts, the Upper Midwest, and the Southeast. There are even some coal-fired plant closures in western states (Table 1). The most recent was the announced partial closure of Colstrip in Montana (see "Colstrip Units 1 and 2 Will Shut Down by 2022").

|

Table 1. 10 largest companies by coal capacity (MW) with announced retirements 2016 to 2020. Source: SNL |

Investor-owned utilities, independent power producers, cooperatives, and municipal power companies are all closing plants. If their sites aren't repurposed in some way, these previously productive assets sit totally unused, adding no value to Gencos or to their communities.

Closing Coal Plants: The Financial StoryPower plant decommissioning and redevelopment projects are all about risk, money, and who pays.

When a power plant shuts down, revenue ceases but costs do not. Some owners quantify their costs, which may be allocated over many cost centers. Best-in-class companies also determine real estate valuations and exit strategy costs so they can make informed decisions about whether to redevelop, hold, or sell.

"Who pays" has emerged as a very interesting question. In states that are still regulated, decommissioning costs could be passed through to ratepayers, subject to public service commission approval. In deregulated states, shareholders would pay for decommissioning, subject to management approval.

Because there is no legal requirement to demolish an old power plant, and no return on this investment, management typically chooses not to spend significant money to decommission a site. Developers may purchase a site as-is and bear the decommissioning costs in exchange for a lower purchase price. Finally, the government may step in with economic development incentives to decommission and redevelop sites and create jobs.

As a Genco, if you are in a Regional Greenhouse Gas Initiative state (see sidebar "Carbon Pricing") where you can recover the cost of closing plants through the rate base, it is often wise to do so. In deregulated states, conversely, shareholders have to pay for those costs up-front, and more case-making must typically be done to secure board approval for the $10 million to $20 million price tag.

Carbon Pricing The Regional Greenhouse Gas Initiative states (Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New York, Rhode Island, and Vermont) participate in a cap-and-trade market for carbon dioxide (CO2) emissions. In the most recent auction, more than 15,000,000 CO2 allowances were sold for $4.53 each, for a total of $68.3 million. Proceeds were used for energy efficiency, renewable energy, and greenhouse gas abatement programs. Carbon pricing has not been factored into power pricing in many of the coal states. Because coal-fired power plants produce CO2 emissions at twice the rate of combined cycle gas turbine plants, carbon pricing would increase the cost of electricity from coal plants further, making them less economical to run. Regardless of the final fate of the currently stayed federal Clean Power Plan, most industry observers expect increased limits on carbon emissions of one form or another in the future. |

More progressive companies take some action with the properties-from tearing them down or selling them, to treating them as a group to clear underperforming assets from their balance sheets. Other companies simply accumulate the old sites without action, quickly leading to 10- to 15-year-old power plants on the books, costing money, presenting risk, and placing a drag on earnings.

Preparing for RetirementDecisions affecting power plants are made at the highest levels of Genco organizations, and planning takes time. There are multiple stakeholders-including executives, operations, asset management, engineering, environmental, security, IT, legal, and real estate-so it's important to know who is in charge. Often, asset managers are called on to manage the process and pull together the various stakeholders. Corporate boards and public utility commissions also may play a role.

Assets are complicated and may affect a diversified power system. To date, there have been no significant reports of unplanned outages as a result of retirements. Nevertheless, once a decision has been made to retire a plant, the owner must notify contractual counterparties, the independent system operator or regional transmission operator, and the North American Electric Reliability Corp. (NERC). NERC will determine whether reliability issues exist and may determine "Reliability Must Run" status, which may include payment provisions to the generating company.

Before deciding what to do with a unit headed for retirement, it is important to understand the value of the site and the costs to carry and decommission it (see sidebar "The Costs of Closure"). It's also important to be proactive, rather than reactive. A clear plan is essential-either you run the project or the project runs you.

The Costs of Closure Deciding to retire a plant doesn't mean an end to expenses. Here are some of the common financial considerations. Decommissioning Costs.These may include utility separation, asbestos and hazardous material abatement, structural demolition, salvage and scrap recovery, remediation, and restoration of the site to a safe, environmentally sound condition. Decommissioning costs are affected by: a- The quantity of asbestos and regulated materials a- The presence or absence of a building a- Labor markets a- Demolition means and methods a- Proximity to scrap markets Redevelopment Costs.These include site planning, acquisition, entitlements, new construction, and commercial operation. Land acquisition costs are generally equal to fair market value less site preparation costs, including decommissioning. The development cycle can range from as little as two years to much longer, typically lasting at least three years. Investment capital is generally available to finance development costs. Cash Flow. Cash flow is generally negative during decommissioning and redevelopment but may be partially offset by the sale of salvage, scrap, and real estate. Salvage and scrap are recovered during structural demolition and sold for market value into mostly commodity markets. Copper and steel scrap prices are cyclical year over year and within each year. Market prices have declined significantly from historic highs of $400/metric ton of steel and $4/pound of copper. Salvage and scrap values are not generally sufficient to offset all abatement and demolition costs. Real estate values may be insignificant or very high, and values may exceed $1 million per acre in certain markets, depending on redevelopment potential. |

Gencos, engineering firms, real estate experts, developers, investors, and contractors have developed best practices for decommissioning and repurposing power plant sites. They include:

a- Front end engineering design studies or playbooks for decision support

a- Owner's engineering services for structural inspections

a- Regulated materials surveys

a- Environmental site investigations

a- Asset recovery strategies

a- Permit requirements and plans and specifications

a- Valuation and highest and best use studies from real estate firms

a- Prequalifying abatement and demolition contractors based on their experience, safety, and financial accomplishments

a- Stakeholder relations addressing the impact of power plant closures on communities

Seven Post-Retirement OptionsAs operations wind down, power plant transformations become projects and, possibly, real estate transactions. Post-retirement options typically include the following seven routes.

Retirement and Decommissioning.Decommissioning includes abatement, removal of regulated materials, structural demolition, remediation, and restoration of a site suitable for beneficial use. Of the 200 or so announced closures since 2000, about 35 sites have been decommissioned. Many of these sites are suitable for new generation, ports and terminals, or industrial, commercial, or mixed-use development. In shale gas regions, retired power plant sites can be transformed into pad sites in support of petrochemical plants.

Decommissioning costs for a typical 500-MW coal-fired power plant range from $5 million to $15 million net of scrap. The schedule is typically 18 to 30 months.

As-Is Sale for Decommissioning and Redevelopment.Some Gencos opt to sell closed power plants as-is, because these sites have significant redevelopment potential. Developers may be willing to assume the risk of decommissioning in exchange for a reduced purchase price.

Retrofit: Conversion to Natural Gas. Conversion from coal to natural gas can be the most economical solution for a Genco, and there are about 30 gas conversion projects under way across the country. Costs include bringing in the gas and retrofitting the boiler system and plant infrastructure. (See "Natural Gas Conversions of Existing Coal-Fired Boilers" in the August 2011 issue of POWER.)

Conversion to natural gas eliminates the need to install scrubbers for SO2, mercury, and toxic substances. It also eliminates generation of coal combustion residues, although legacy coal ash would still need to be managed. There may still be a need to install NOx scrubber technology. Heat rate would not change significantly from 10,500 Btu/kWh and would still be 30% higher than combined cycle gas turbine heat rates. Nevertheless, these can be very good projects, especially given the abundant supply of inexpensive natural gas.

Fuel conversion project costs vary, depending on the length of the pipeline and the complexity of boiler and facility work. Costs range from $25 million to $75 million and typically take 12 to 18 months.

Replacement with New Generation.Replacement of aging coal-fired steam turbine generation with new gas turbines can be very powerful. It enables the Genco to produce power at a low price without investing in extensive pollution controls. New gas turbine technology offers fast startup times that are compatible with renewable energy systems. The project may be able to use existing infrastructure and balance-of-plant facilities. Construction of new gas turbine plants ranges from one to three years and may be completed prior to closure of existing facilities.

Gencos can also acquire existing gas turbine plants through corporate transactions for about 50% of the cost of new build, without the risk or delays of new construction.

Sale for Redevelopment.Power plant sites may have significant redevelopment potential, because they are large consolidated properties, located on the water near cities or industrial areas. In these cases, it may be possible to sell power plants as is. Buyers may be willing to decommission plant structures in exchange for a risk-adjusted lower purchase price. Remediation costs can be included and risks can be managed through the use of contract terms, escrows, and environmental insurance.

The value of any property depends on what you can do with it, and it may make sense to engage real estate professionals to prepare valuation or "highest and best use" studies. That requires examining the following factors:

a- Physical possibility is determined by the size, shape, topography, and other physical characteristics.

a- Legal permissibility is defined by zoning, government prohibition, easements, or other covenants.

a- Financial feasibility means that the proposed use of a property must generate adequate revenue to justify the costs of construction plus a profit for the developer.

a- Maximally productive means the use must generate the highest net return (profit) to the developer. Competing uses are often considered for a given site. The selected use is often the alternative that maximizes return to the developer.

Sale for redevelopment is often a preferred option for Genco owners because it allows them to monetize an asset and mitigate risk going forward. Often, these sites are "upside down," meaning the costs of decommissioning, remediation, and restoration exceed the asset value.

Owner-Controlled Decommissioning. In some cases, Gencos may not be able to sell a site, and they may not want to give up a site that may be useful for new generation or transmission. In these cases, they may opt to decommission aging plants to reduce risk, monetize salvage and scrap, and prepare a site for future Genco use. They would reduce their carrying costs for taxes and security, and reduce the risk of an accident or environmental incident. In some markets, these projects can be cash positive. With this option, it is more likely that Gencos would have to pay decommissioning costs out of pocket.

No Action. Gencos have made the no action decision on the majority of closed power plants nationwide. Management is reluctant to act because of costs, risk, and the attitude that "we're not in the real estate business." Economic drivers are unknown until some engineering and real estate studies are performed. There are no federal or state requirements to decommission or sell these facilities, so they sit idle. As the number of closed plants grows, this issue will become more visible, especially to local communities.

Be PreparedAmerican Gencos have been closing and decommissioning power plants for more than a century. Only about 20% of the power plants recently slated for closure have been decommissioned to date (Table 2). That means there is a lot of work ahead to reposition these sites for beneficial use as industrial or commercial facilities.

|

Table 2. Estimated power plant closure announcements, decommissioning projects, and sales since 2000.Source: TRC, based on EIA data |

Florida Power & Light (FPL) has successfully completed decommissioning of several steam turbine sites and replacement with combined cycle gas turbines. FPL has improved their heat rate and cost structure dramatically.

Con Edison has sold several sites in New York City (NYC) for redevelopment as mixed use projects. The company sold these sites for significant value and shared decommissioning costs with the purchaser. Con Edison also replaced lost capacity with combined cycle technology at a nearby site. Initial development includes a NYC public school and 800 units of high-rise residences. This process began in 2000, new power capacity was completed in 2005, decommissioning was completed in 2008, and new development was completed in 2014.

Gencos have options for units facing retirement, but they need a playbook to define and evaluate alternatives. The right strategy, executed well, can be very powerful for both the owner and the local community. Unfortunately the wrong strategy, even if it is executed well, can hurt for a long time. a-

-Ed Malley(EMalley@trcsolutions.com) is vice president of TRC.

The post Coal Power Plant Post-Retirement Options appeared first on POWER Magazine.