Paducah Laser Nuclear Enrichment Facility Gets Fuel but Not Formal Construction Decision

While GE-Hitachi Global Laser Enrichment (GLE) confirmed it hasn't made a formal decision to proceed with licensing or construction of a laser enrichment facility at Paducah, Ky., the Department of Energy (DOE) announced it has agreed to sell depleted uranium to the company over a 40-year period to help produce nuclear power plant fuel.

The DOE said that GLE would finance, construct, own, and operate the Paducah Laser Enrichment Facility proposed for a site near the DOE's Paducah Gaseous Diffusion Plant in western Kentucky. The commercial facility is expected to use, under a Nuclear Regulatory Commission (NRC) license, depleted uranium to produce natural uranium, which will then be used for production of fuel for U.S. civil nuclear reactors. The agreement provides for the sale of about 300,000 metric tons of DOE-owned high-assay uranium hexafluoride (DUF6) inventories for re-enrichment using proprietary SILEX technology to produce natural-grade uranium.

Yet, as a GE Power spokesperson told POWER on November 11, GLE "has made no formal decision to proceed with licensing or construction of the facility."

Many Champions, No Progress

General Electric (GE) currently has a 51% share in GLE along with Hitachi (25%) under the GE-Hitachi (GEH) joint venture. Canadian uranium mining giant Cameco owns the remaining 24%. GLE was born under GE's banner in early 2006, as it won exclusive rights to commercially develop the SILEX laser isotope separation process technology under an agreement reached with Australian technology firm Silex Systems Ltd.

In September 2012, GLE got the NRC's unprecedented approval to build and operate a first-of-its-kind full-scale laser uranium enrichment facility on a proposed 1,600-acre tract of land at the company's global headquarters in Wilmington, N.C., where GLE operated a fuel fabrication plant. In 2013, GLE submitted a proposal to establish an additional uranium enrichment facility at the Department of Energy's Paducah enrichment site in Kentucky (the agency's first-generation gaseous diffusion plant at that site was closed in May 2013).

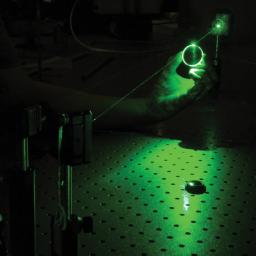

The technology's most hailed advantage is efficiency. To date, uranium enrichment-which involves increasing the atomic concentration of the active U-235 isotope from 0.7% in natural uranium to about 5% that is required for reactor fuel-has either employed gas diffusion, a first-generation technology that is now considered obsolete, or gas centrifuge technology. All enrichment around the world is currently performed by gas centrifuge technology, which was originally developed in the 1940s. According to Silex Systems, enrichment is the most difficult and costly step in making nuclear fuel for power reactors, because about 35% to 40% of total fuel costs are based on current market prices. The company's third-generation laser-based technology provides much higher enrichment process efficiency compared to earlier methods, potentially offering significantly lower overall costs, it said.

However, efforts to commercialize the technology have faltered due to dismal nuclear power and fuel market outlooks. Silex Systems noted that challenging market conditions have been exacerbated by the slow pace of restarts of reactors in Japan following the Fukushima disaster, as well as premature closures of a number of reactors in the U.S. and Europe. "Demand for enrichment and uranium remains low and accordingly prices are currently depressed," it said.

In April this year, noting it continued to experience difficult conditions in nuclear fuel markets, GEH informed Cameco and Silex Systems of its desire to reduce its equity interest and ultimately exit GLE. "GEH's decision is due to evolving business priorities at GEH and follows the restructuring of GLE operations announced in 2014," GE told POWER in an e-mailed statement on November 11. "GEH continues to work closely with Cameco, Silex and other potential investors to restructure GLE operations and facilitate the continued progress of the laser enrichment technology."

The decision has prompted Silex Systems, a company that has slashed its workforce by 75% since June 2014 owed primarily to market conditions, to review funding alternatives to help commercialize its technology. The company said on November 11 that it has secured an "exclusive option" to acquire GEH's 76% interest in GLE. "Discussions continue with several potential strategic investors, including a number of parties currently engaged in due diligence activities," Silex Systems said.

A Significant Agreement

However, both Silex Systems and GLE concur that the agreement with the DOE allowing it to purchase a portion of the agency's inventory of depleted uranium hexafluoride is an important step forward. "Securing the right to acquire depleted uranium hexafluoride from the Department of Energy is a key factor in GLE's plans to potentially license, construct and operate the Paducah laser enrichment facility," noted Bob Crate, GLE's president and CEO.

Silex Systems, meanwhile, said the agreement is a "pivotal event" in the commercialization of SILEX technology. The company optimistically forecast, taking into account prevailing market conditions and required regulatory approvals, that GLE's proposed Paducah laser enrichment facility could be built and start operating in the early 2020s.

Silex also said that the company and GLE are mulling the possibility of using a U.S. federal loan guarantee to support financing of the project.

Enriching but Not Profitable

For the DOE, the agreement is integral to efforts to further its environmental cleanup mission. The agency's Paducah gaseous diffusion plant was commissioned in 1952 to enrich uranium for national security applications, but it later also enriched uranium for commercial nuclear power plants.

United States Enrichment Corp. (USEC), a company that was spun off from the federal government, began operating the facility in 1998, but that proved to be unprofitable. The plant was shut down by USEC in 2013, because it couldn't compete in the market. That ultimately left the U.S. without a domestically developed uranium enrichment capability for the first time since the Manhattan Project. (USEC emerged from bankruptcy in March 2014 as Centrus Energy.)

Since the DOE took over the plant's enrichment facilities in 2014, it has worked to deactivate the plant in preparation for decontamination and decommissioning, while it continues to perform environmental cleanup at the site, which began in the late 1980s. "Cleanup includes groundwater remediation, inactive-facility demolition, conversion of depleted uranium to more stable forms for reuse or disposal, and other projects," the agency said.

The agreement to sell its inventory of depleted uranium will contribute to two key Energy Department mission areas, said Energy Secretary Ernest Moniz in a November 10 statement: "To fulfill the federal government's responsibility to manage the safe storage and disposal of nuclear materials and to enable nuclear power, America's largest source of zero-carbon energy and an important enabler for reduced greenhouse gas emissions."

-Sonal Patel, associate editor (@POWERmagazine, @sonalcpatel)

The post Paducah Laser Nuclear Enrichment Facility Gets Fuel but Not Formal Construction Decision appeared first on POWER Magazine.