Global Nuclear Fuel Update

Uranium oxide, the basic fuel for nuclear power plants, has recently sold at prices not seen in the past 13 years. In fact, the price is less than the cost of production in many cases. That could be a problem, because little is being done to increase the fuel supply, even though the world is adding new and larger reactors.

Late last year, the Organisation for Economic Co-operation and Development's Nuclear Energy Agency and the International Atomic Energy Agency released a joint 550-page report titled Uranium 2016: Resources, Production and Demand. It was the 26th edition of the now-biennial report, commonly referred to as the Red Book,with data current as of January 1, 2015.

One potentially concerning revelation was that total identified uranium resources had only increased by 0.1% since the previous report had been issued. A reason cited for the minuscule uptick was that very little investment had been made in exploration due to depressed uranium market conditions.

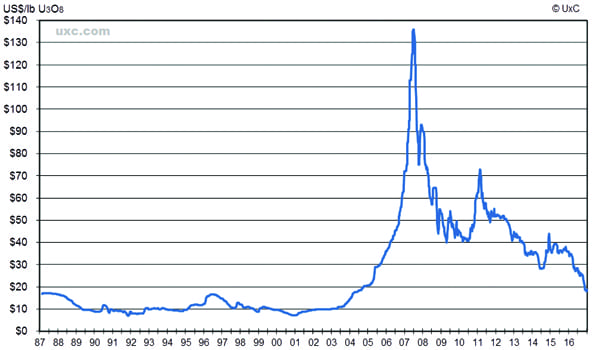

Indeed, the price for uranium oxide (U3O8) has been in a death spiral (Figure 1). In November 2016, U3O8 was selling at prices not seen since 2004. At roughly $18/lb, the price was less than the cost of production for most suppliers.

1. A rollercoaster ride. The spot price for uranium peaked at about $136/lb in June 2007 bolstered by hype of a nuclear renaissance. An economic downturn and the Fukushima disaster quickly dashed hopes of a resurgence, causing the market to plunge. Recently, U3O8 traded at 13-year low-about $18/lb. Source: The Ux Consulting Co.

The Nuclear Fuel Supply ChainUranium is a metal-about as common as tin or zinc-that is found in many rocks on Earth in concentrations of two to four parts per million. It is also found in seawater, but at about three orders of magnitude less than on land (around three parts per billion).

The nuclear fuel supply chain is divided into four key processes: mining, conversion, enrichment, and fabrication.

Mining. Most U.S. uranium is mined using the in situ leach mining technique, also known as in situ recovery (ISR). In the in situ method, wells are drilled into the uranium deposit, and then a solution, such as oxygenated groundwater, is circulated through the ore (Figure 2). That causes the rock to oxidize.

2. "Well" done. In this image, uranium is being extracted from a site near Crow Butte, Neb., using the in situ recovery method. Wells are drilled into the deposit and a solution is circulated through the ore. Courtesy: Cameco Corp.

Oxidized uranium is soluble and leaches into the circulating solution. After the "pregnant" mixture is pumped back to the surface, a treatment process is used to extract the yellow-colored uranium. The "yellowcake" is then dried and packaged in 55-gallon drums for shipment to a conversion facility.

While ISR accounted for about 51% of world uranium production, conventional mining techniques are also widely used. In conventional mining, rock is excavated-either from underground mines (about 27% of world production) or from open-pit mines (about 14%)-and transported to a mill. At the mill, the ore is ground or crushed and placed in big tanks, where it leaches into sulfuric acid or an alkaline solution. The solution, similar to the one produced during the in situ process, is taken through a series of refinement steps to extract the U3O8.

A few other uranium recovery techniques not covered here make up the balance of production.

Conversion.Although uranium is not particularly rare, the fissile isotope (U-235) accounts for only about 0.7% of natural uranium. Most reactors are designed to use enriched uranium, that is, uranium in which the U-235 has been concentrated to between 3.5% and 5%. Before uranium can be enriched, however, it must be converted to its gaseous form.

During the conversion process, impurities are removed and the uranium is combined with fluorine to create uranium hexafluoride (UF6) gas. The gas is pressurized and cooled until it liquefies. The liquid UF6 is drained into 14-ton cylinders, where it is further cooled to its solid state. The cylinders are then shipped to an enrichment plant.

Enrichment.Although a number of uranium enrichment processes have been demonstrated, only two have operated on a commercial scale: the gaseous diffusion process and the gaseous centrifuge process. As recently as 2000, half of all enriched uranium was produced using the gaseous diffusion technique; however, today the centrifuge process has completely replaced gaseous diffusion.

The gas centrifuge enrichment process uses several rotating cylinders in series and parallel formations. The machines are interconnected to form trains and cascades. When rotated at high speeds-from 50,000 revolutions per minute (rpm) to 70,000 rpm-the heavier UF6 gas molecules, which include the most common uranium isotope found in nature (U-238), move toward the outside of the cylinder, while the lighter molecules, containing U-235, remain closer to the center.

Streams of slightly enriched uranium are withdrawn from the centrifuge and sent to the next-higher stage, while streams of slightly depleted uranium are recycled back to the next-lower stage, until eventually the desired enrichment level is obtained. The enriched UF6 is then packaged in cylinders for shipment to a fuel fabrication plant.

Fabrication. There are various types of fuel fabricated for different reactors around the world (see sidebar), but the most common fuel is low-enriched uranium (LEU) fuel for light-water reactors. The fabrication process begins by heating the solid UF6 to return it to its gaseous form. The gas is then chemically processed to form LEU uranium oxide (UO2) powder.

The powder is pressed into pellets, sintered into ceramic form, and loaded into zirconium alloy tubes. The alloy typically contains about 95% zirconium combined with various other metals designed to enhance mechanical properties and resist corrosion. Zirconium is a good choice due to its low cross section for absorption of thermal neutrons, effectively making it transparent to the fission process in the reactor core. The tubes, known as fuel rods, are constructed into fuel assemblies containing up to 264 rods. Some of the more common assemblies have a 5-inch to 9-inch cross section and measure about 12 feet long.

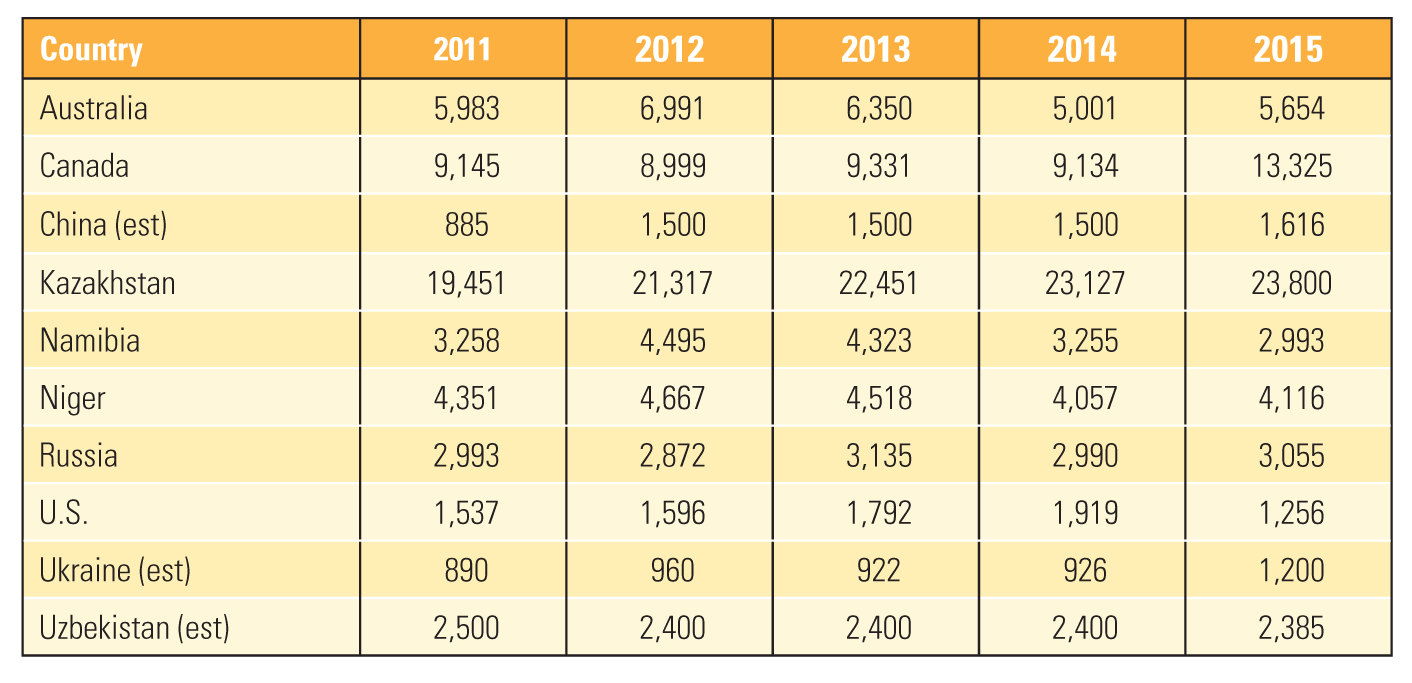

Today, Kazakhstan is the world's leading uranium producer (Table 1). And while Australia leads the world by a wide margin in reasonably assured recoverable uranium resources (Table 2), Canada has the most tier-one (best-margin) assets.

Table 1. Top uranium-producing countries. Kazakhstan and Canada accounted for more than 60% of all the world's mined uranium in 2015 (values shown are in tons). Of countries not listed here, none produced more than 400 tons. Source: World Nuclear Association

Table 2. There's uranium in them thar hills. Uranium resources are found all around the world. This table shows the tons of uranium available in various recovery cost categories for the 10 countries with the largest estimated reserves. (NA = data not available) Source: Organisation for Economic Co-operation and Development Nuclear Energy Agency and the International Atomic Energy Agency

The Temrezli project in Turkey offers one example of the difficult situation faced by uranium mining companies under current market conditions. The project, located near the town of Sorgun, approximately 125 miles east of the capital city of Ankara, is central Turkey's largest identified uranium deposit. Uranium Resources Inc. (URI) acquired the project in 2015 when the company merged with Anatolia Energy Ltd.

According to URI's 2016 annual report, an independent pre-feasibility study (PFS) was completed in February 2015. The PFS assumed the project would produce an average of 825,000 pounds of U3O8 per year during an initial 12-year mine lifetime. Under such conditions, the study projected the all-in sustaining production costs for the project would be $30.12/lb of U3O8.

With the price of U3O8 less than $18/lb, the decision to move forward is a difficult one. However, as one of AREVA's experts explained to POWER, mining projects such as Temrezli often take 10 years to go from discovery into production, so putting them on hold because of market price fluctuations isn't always practical. Often, companies have to move forward with the hope that prices will recover sufficiently to make the project successful in the long run.

Tim Gitzel, president and CEO of Cameco Corp., one of the world's largest uranium producers, with headquarters in Saskatoon, Saskatchewan, expects prices to rebound. "It is a question of 'when', not 'if' more uranium is needed," Gitzel wrote in the company's most recent annual report. "There is still going to be a need for more uranium-perhaps even more so now that many projects have been delayed or cancelled in the wake of low uranium prices."

Cameco follows a unique stage-gate process when developing its projects. The process includes several defined decision points during the assessment and development stages. According to the company, it reevaluates each project based on current economic, competitive, social, legal, political, and environmental considerations, and it only proceeds to the next stage if the project continues to meets the company's criteria. Cameco has scaled back development of its Yeelirrie and Kintyre properties in Australia and at its Millennium deposit in the Athabasca Basin of Saskatchewan, based on this methodology.

With uranium prices down, Gitzel implied that Cameco has had to make other tough decisions. "We've been very active in 2016," he said in a question and answer video posted on the company's website. "We made the decision to take down production at Rabbit Lake-not an easy decision to take but we did. At the same time, we took down production in Wyoming and Nebraska."

Cameco's capital expenditure and exploration budgets have both been cut by about 50% over the past few years. But the company is not cutting production at one of its newest developments-Cigar Lake (Figure 4). In fact, the company expects Cigar Lake to reach full production of 18 million pounds per year in 2017.

4. Tier-one asset. The Cigar Lake project in northern Saskatchewan, shown here, began commercial production in May 2015. It is the world's highest-grade uranium mine. Courtesy: Cameco Corp.

Will Demand Grow?Most industry observers agree that the price of uranium will recover. They point to new nuclear power plants in China, Russia, South Korea, and India as demand drivers, even as questions loom over reactors in Japan and other parts of the world. But as markets have proven again and again, they are not always predictable. Many experts believed U3O8 was poised for an uptick last year when prices were in the $30s, but that obviously didn't materialize.

According to the Red Book, 437 reactors totaling 377.4 GW of net capacity were connected to the grid when its data was compiled. As such, it estimates that the world's uranium requirements were 56,585 tons per year. Looking forward, the Red Book estimates that between 418 GW and 683 GW of nuclear capacity will be online in 2035. Based on the projected increase in capacity, it says as much as 104,740 tons of uranium would be needed per year by then.

Although the industry appears capable of meeting the demand, it may not be as easy as it sounds. AREVA, which has its 23 million pound annual production split roughly in thirds between Canada, Kazakhstan, and Niger, said various permitting hurdles, environmental impact studies, governmental and local hearings, and build-out challenges make bringing mines into production a lengthy process.

The company spokesperson said AREVA maintains close relationships with governmental representatives. In Niger, its operations represent a significant contributor to the country's employment and economy, and in Kazakhstan, its properties are partially owned by the state entity Kazatomprom. Situations such as those can help maintain stable and secure operations.

As the Red Book concludes, "The challenge in the coming years is likely to be less one of adequacy of resources than adequacy of production capacity development due to poor uranium market conditions." Is the market going to bounce? Only time will tell. If you were speculating, would you be buying or selling uranium? Share your insights in the comments section at the bottom of the online version of this story by visiting powermag.com. a-

-Aaron Larsonis a POWER associate editor.

The post Global Nuclear Fuel Update appeared first on POWER Magazine.