Dynegy Will Merge with Vistra Energy to Beat Market Volatility

To strengthen balance sheets and thwart market woes afflicting generators in competitive markets, Dynegy Inc. and Vistra Energy will merge, creating a company that is projected to have a value greater than $20 billion.

Dynegy, which operates a power plant fleet of 27 GW, will merge into Vistra Energy, the parent company of TXU Energy and Luminant, whose fleet's capacity centered in Texas amounts to 18 GW. The companies announced the merger on October 30 after their boards of directors approved it and the companies executed a definitive merger agreement for a tax-free, all-stock transaction.

Leveraging the Retail FactorIn a joint press release, the companies said: "The combination of Dynegy's generation capacity and existing retail footprint with Vistra Energy's integrated [Electric Reliability Council of Texas (ERCOT)] model is expected to create the lowest-cost integrated power company in the industry and to position the combined company as the leading integrated retail and generation platform throughout key competitive power markets in the U.S."

The joint company's installed capacity fleet will now expand to about 40 GW, 60% of which is natural gas-fired, and 84% of which is in the competitive market footprints of ERCOT, PJM, and ISO-New England. It expects about half its gross margin will be derived from capacity revenues and retail margin.

According to Vistra Energy President and CEO Curt Morgan, the merger will be lucrative because it leverages Vistra's retail and commercial operations with Dynegy's combined cycle gas turbine (CCGT) fleet and geographically diverse portfolio. It creates "a company with significant earnings diversification and scale."

The combined enterprise is projected to have "the lowest-cost structure in the industry and will benefit from weather and market diversification that, when combined with Vistra Energy's balance sheet strength, will provide a platform for future growth," he added.

For Dynegy, the lure of a merger with Vistra was based on Vistra's "strength in retail," which combined with Dynegy's infrastructure and generation capabilities "will provide an unmatched, highly efficient integrated business in key competitive markets," said Dynegy President and CEO Bob Flexon.

When the transaction closes as expected in the second quarter of 2018, the new company's headquarters will be in Irving, Texas, though it will retain retail offices in Houston, Texas; Cincinnati, Ohio; and Collinsville, Illinois. Morgan will serve as president and CEO, Bill Holden will serve as Chief Financial Officer, and Jim Burke will be Chief Operating Officer. Dynegy's Bob Flexon will continue serving as CEO through April or when the transaction closes. Meanwhile, the company's 11-member board of directors will have eight members from Vistra's board and three members from Dynegy's board.

The transaction still needs regulatory approvals from the Federal Energy Regulatory Commission, the Federal Communications Commission, the Public Utility Commission of Texas, the New York Public Service Commission, and other customary closing conditions. While the transaction is subject to approval by the shareholders of Vistra Energy and Dynegy, it will not require "any refinancing of Vistra Energy's or Dynegy's debt, but preserves flexibility for opportunistic refinancing at, or after, closing," the companies said.

Gaining a Competitive Foothold in Rocky MarketsAlong with a number of independent power producers operating in competitive markets, both Vistra and Dynegy are bleeding financially, suffering an onslaught of sustained low wholesale power prices, an oversupplied renewable generation market, and low natural gas prices, along with other factors.

Vistra Energy earlier this month moved to halt its own financial hemorrhage stemming from unprofitable conditions in ERCOT by announcing plans to shutter three coal-fired power plants-the 1.9-GW Monticello plant, the 1.1-GW Sandow Power Plant (which includes a 2009-built unit), and the 1.2-GW Big Brown plant-in early 2018.

Dynegy, which owns about 45 power plants in 12 states, in August reported losses of $300 million as it wrote off the value of Midwestern coal-fired power plants. A year earlier, the company reported second-quarter losses of $803 million. Though burdened by heavy debt, earlier this year the company also closed on a $3.3 billion deal to buy 17 (mostly gas-fired) power plants from France's Engie.

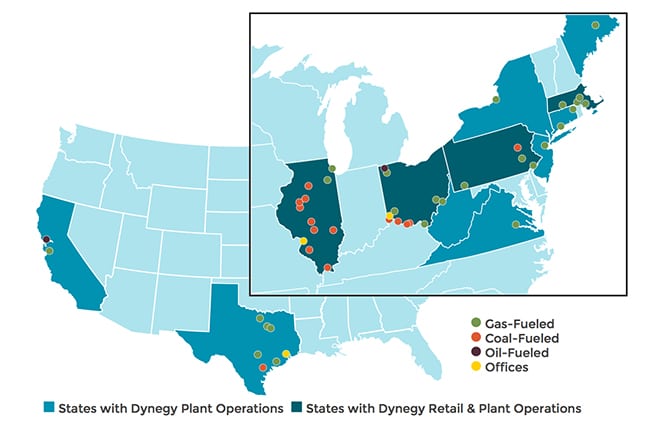

Dynegy owns 27 GW at 43 power plants in California, Connecticut, Illinois, Maine, Massachusetts, New Jersey, New York, Ohio, Pennsylvania, Texas, Virginia, and West Virginia. Courtesy: Dynegy

And while the company has been fairly transparent about its fight to preserve the integrity of the wholesale markets-and specifically against zero emissions credits to prop up uneconomic nuclear plants-this past week it lauded legislation introduced in Illinois' General Assembly that could ensure its coal plants in downstate Illinois stay open. The measure involves the takeover of capacity procurement for Ameren's downstate service territory-currently handled by the Midcontinent Independent System Operator (MISO)-by the Illinois Power Agency, an independent state entity that procures power on behalf of the state's utility customers.

The bill, Dynegy said on October 26, "will create a functioning capacity market in the service area through a subsidy-free, fuel-neutral competitive power auction run by the Illinois Power Agency, consistent with the MISO tariff that has been approved by the Federal Energy Regulatory Commission.

In downstate Illinois, about 20% of power generation capacity has been retired within the past two years, and another 30% percent of the total downstate resources are at risk of closure over the next three years, "due to an inability to cover operating costs," the company said. In comments to FERC filed on October 23, Dynegy said that the Department of Energy's proposed grid reliability rule would "be especially helpful in the MISO market, where MISO has already acknowledged that its capacity market is not providing the compensation necessary to allow for investment in new facilities or the retention of existing facilities."

The situation is so dire, the company said, that MISO CEO John Bear in May wrote Illinois Gov. Bruce Rauner a letter calling for the state to develop a "resource adequacy mechanism that will ensure there are sufficient electric resources available to meet customer needs."

-Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)

The post Dynegy Will Merge with Vistra Energy to Beat Market Volatility appeared first on POWER Magazine.