State PSC Puts Vogtle Future in Georgia Power’s Hands

State regulators in Georgia have voted not to cancel the troubled nuclear expansion project at the Vogtle Electric Generating Plant near Waynesboro, Georgia, and lead owner Georgia Power has agreed to a set of conditions that the utility must meet in order to continue the project.

Georgia Power is one of four utilities with a stake in the two new AP1000 reactors at Vogtle, and it is the only one regulated by the state Public Service Commission (PSC). The commission at a December 21 meeting said Georgia Power's current plan, in which it has sought PSC approval of some additional project costs being passed on to ratepayers rather than shareholders, is not acceptable. Georgia Power said it would agree to new marching orders for the project, which includes reductions to the utility's return on equity (ROE) from the expansion.

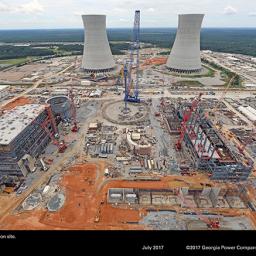

The move by the Georgia PSC today comes after years of delays and cost overruns for the project, which included the bankruptcy of Westinghouse, the original lead contractor, amid finger-pointing and squabbles among those working on the project as to who should be blamed for its troubles. Commissioners today said part of their decision to not cancel the project is because Georgia Power has shown progress in construction over the past several months.

Costs for the expansion, which was originally approved in 2009 and scheduled for startup in 2016, have ballooned to more than $25 billion according to some estimates, although Southern Co. in August said its estimated costs to finish construction of the two new AP1000 reactors would be less than $20 billion. The new 1,117-MW reactors, Units 3 and 4 at Vogtle, would join two existing 1,215-MW General Electric reactors at the site. Units 1 and 2 have been in operation since the late 1980s.

Vogtle would have been the second major U.S. nuclear power expansion project to be canceled this year; the similar V.C. Summer project in South Carolina, which also involved construction of two new AP1000 reactors, was abandoned in late July. That project was about 64% complete, and like Vogtle was plagued by years of delays and billions of dollars in cost overruns.

PSC staff, in a December 19 filing about the Vogtle project, blamed Georgia Power for the failures of the project-saying the project lacked proper oversight from the outset-and said the utility has used flawed analysis to make the expansion's economic picture brighter.

"The project was not managed effectively," the PSC staff brief said. "This failure resulted in delays and increased costs, and the company had some control over these increased costs." Commissioners repeated those assertions today, noting it was partly behind the decision to reduce Georgia Power's ROE for the project moving forward.

Recent congressional action also threatened the financial viability of the Vogtle project. The tax bill moving forward in Congress does not include a provision to extend a credit for nuclear power projects to those placed in service after January 1, 2021, when the current federal production tax credit for new nuclear power generation is scheduled to expire. Georgia Power has estimated that tax credit would be worth about $800 million for the project; the new Vogtle reactors are scheduled to come online in November 2021 and November 2022, respectively.

The tax bill also provided an incentive to make a decision on the project's future by year-end, a reason the PSC moved the deciding vote to today from its originally scheduled date in February 2018. A cancellation now, rather than in 2018 or beyond, would preserve $150 million in tax advantages for the project partners.

Recent Hearings

Three days of hearings on the project that began December 11 at the PSC headquarters in Atlanta drew both supporters and opponents of the project. Most of the discussion centered on the cost of continuing construction, particularly on how much of the burden should be placed on ratepayers. PSC staff earlier had recommended Georgia Power, the lead partner on the project with a 45.7% ownership stake, assume more of the cost. The utility, one of four partners in the project, has said its share of the total cost of construction is currently $12.2 billion.

Three other municipal utilities own the remainder of the project-Oglethorpe Power at 30%, Municipal Electric Authority of Georgia (MEAG) at 22.7%, and Dalton Utilities at 1.6%.

PSC Vice Chairman Tim Echols has been a nuclear power supporter; he wrote about his pro-nuclear stance in August in The Wall Street Journal. Last week Echols said it was clear public opinion was against continuing the project. "I probably received about 120 emails that I've responded to with constituents asking us to cancel the plant, maybe six that have said move forward on the plant," he said during last week's hearings.

Echols, in questioning Mary G. Korsnick, CEO and president of the Nuclear Energy Institute and one of just a few witnesses testifying before the PSC in support of the project, asked whether he should tell ratepayers they have a "patriotic" duty and opportunity to support continued construction.

"So, what do I say to my constituents regarding the patriotic-the patriotic duty that we have?" Echols asked Korsnick. "Is there a patriotic duty that you-you live in Washington-that you see Georgia as having an opportunity to keep alive an industry that is struggling, for whatever reason, whether it's Fukushima or low natural gas prices or Westinghouse bankruptcy? What do I say to my constituents in terms of our patriotic opportunity?"

Korsnick answered in support of continuing the project. "Completion of the Vogtle reactors will signal that the United States continues to be a significant force in the global nuclear industry. If the U.S. forgoes its role as a leader in the global nuclear industry, the world will look to active nuclear nations like China and Russia for leadership, which will put them in a position to develop future international standards for nuclear energy technology use."

Bad Economics

PSC staff earlier this month said the reactors were "uneconomic" to complete. Staff said the latest filing from Georgia Power showed the company would receive $5.2 billion to complete the project, but ratepayers would pay an additional $14 billion. And staff for the first time-in the latest of 17 semi-annual reports on construction progress-recommended not passing along costs to ratepayers for work already completed.

The advocacy staff's recommendation on December 1 said, "We conclude that certain costs already incurred by the Company are not reasonable to allocate to customers. Furthermore, we conclude that certain costs in the Company's estimate of future costs are also unreasonable to allocate to customers and instead should be allocated to the Company and its shareholders."

Georgia Power CEO Paul Bowers as recently as November said, "Based on all the factors considered, completing both units represents the best economic choice for customers and preserves the benefits of a carbon-free baseload generation for the state of Georgia." But prior to last week's hearings, Bowers asked PSC Chairman Stan Wise-who earlier had said he was leaving the commission after today's vote-for an agency decision prior to year-end. That would allow owners to take advantage of the current corporate tax rate of 35% if the project were canceled, as opposed to the lower 20% rate proposed in the new tax bill before Congress, which would represent a savings of $150 million as noted earlier.

Westinghouse, the main contractor for the project, declared bankruptcy in March 2017. Georgia Power took over the lead role, with Southern Nuclear-the nuclear arm of Southern Co., the parent of Georgia Power-overseeing the project. In late August 2017, global engineering firm Bechtel took over as lead contractor.

The project was dealt a blow on December 12, when the Jacksonville Electric Authority (JEA) in Florida said it supported canceling the expansion. The utility has a contract to buy electricity from the two new units through one of the plant's co-owners, the Municipal Electric Authority of Georgia (MEAG). JEA called for cancellation after credit-rating agency Moody's cited JEA's financial obligations of more than $1.7 billion to the Vogtle project as a reason for lowering its financial outlook from "stable" to "negative," The Florida Times-Union reported.

Ratepayer Costs

An analysis by the Southern Alliance for Clean Energy (SACE) shows Georgia Power's 2.5 million ratepayers on average have been paying about $100 annually in "nuclear cost recovery fees" to help finance the project's continued construction, with residential customers paying more, allowing lower costs for industrial customers under Georgia's 2009 Nuclear Energy Financing Act.

"The average residential customer, using 1,081 kWh per month, has paid $484 toward the cost of Plant Vogtle through September 2017," SACE's John D. Wilson wrote in a blog posted on the SACE website. "Of that total, residential customers have paid about $153 per household to provide industrial customers with $319 million in rate savings."

Peter Bradford, a witness at last week's hearing who is a former state regulator in New York and Maine, and a former member of the Nuclear Regulatory Commission (NRC), was among those who said the project should be abandoned. He testified on behalf of the SACE.

"My own experience licensing and regulating two dozen nuclear units [and extricating my home state from two that had become uneconomic through massive cost overruns] tells me that Georgia Power's record to date and the fact that the units have a long way to go suggest a high probability of further cost overruns and delays," Bradford said. "The search for what Wall Street calls 'the dumb money,' that is, the investor who takes an inordinate share of the risk in return for a nominal share in whatever returns may be realized, now aims inexorably at Georgia Power's customers."

Analyst: Units No Longer Needed

Matt Cox, who does energy modeling for The Greenlink Group in Atlanta, and testified on behalf of Georgia Interfaith Power and Light and the Partnership for Southern Equity, said lower demand for electric power in the years since the project was first approved shows the new Vogtle units are not needed.

"In 2007, Georgia Power projected a 2016 peak demand that was almost 5,000 megawatts higher than the actual peak demand in 2016," he said on December 13, the final day of hearings. "That's about the same as five Vogtle units, and roughly a 30 percent error in the projection."

Cox said, "Bringing both units online would increase the energy burden of the average household in Atlanta's low-income communities by an additional $110 per year from today's levels. Conversely, deferring the units and relying on efficiency, solar, and power purchase agreements would decrease this burden by $127."

Atlanta attorney Jeff Berhold, who specializes in antitrust law, said the PSC could be in a difficult position regarding federal antitrust law and the project, due to a recent deal among the four ownership partners. The agreement said if the PSC disallows any costs of the expansion, any of the partners could unilaterally cancel the project.

"The parties have agreed that Georgia Power will raise its retail rates, including retail rates in the customer choice market, by insisting that the commission assure Georgia Power full recovery of the additional investment and financing costs for the Vogtle project," said Berhold, a former U.S. Department of Justice attorney. "[The agreement] requires Georgia Power to raise retail rates by mandating that the company pass its entire investment and financing costs to customers in retail rates. Such an agreement has the intent and effect of raising all prices, regulated and unregulated, in the customer choice market."

Said Berhold: "Part of the problem with [the co-owner agreement] is that it can be read as a threat " essentially a boycott among the members of the agreement that, we're not going to build Vogtle 3 and 4 unless you do what we want, as far as these costs and passing them on into the rate base and the prices." Wise, however, said he was not concerned about that agreement, saying it is "outside, I think, the jurisdiction of this commission."

For more information about the events leading up to today's decision, read POWER's recent coverage of the Vogtle expansion:

- Georgia PSC Will Decide Vogtle's Fate on December 21

- Vogtle Hearings Underway; Tax Law Change Could Speed Resolution

- Toshiba Will Make Remaining Vogtle Payments by mid-December

- Georgia Regulators: Change Vogtle Economics or Cancel Project

- DOE Offers Another $3.7 Billion in Loan Guarantees for Vogtle Project

- Westinghouse Asks Court to Stop Cancellation of Vogtle Contract

- Vogtle Partners Will Proceed with Beleaguered Nuclear Expansion

- Bechtel In, Fluor Out as Vogtle Construction Continues

-Darrell Proctor is a POWER associate editor (@DarrellProctor1, @POWERmagazine)

The post State PSC Puts Vogtle Future in Georgia Power's Hands appeared first on POWER Magazine.