India’s Power Industry Struggles to Solve Pollution Problems

In a bid to tamp down pollution, India's government in December 2015 notified the country's coal generators they would need to meet-for the first time-new emissions limits for nitrogen oxides (NOx), sulfur dioxide (SO2), and mercury, as well as tightened limits for particulate matter (PM) and water consumption. The gazetted notification gave new plants until January 2017 and existing plants just two years-until December 2017-to curb those pollutants.

But on November 17, 2017, in an affidavit filed with the Supreme Court of India, the Ministry of Environment, Forest, and Climate Change (MoEFCC) recognized the timeframe wasn't feasible. India produces 80% of its power with coal, and electricity is an "essential commodity and [an] uninterrupted power supply in the country needs to be ensured at all times, therefore, many units cannot be taken out for retrofitting at the same time and it has to be done in phases, so as to avoid [a] problem in the power supply," it said, asking the high court for an "appropriate order" to extend compliance deadlines until at least 2022.

In the affidavit, the MoEFCC also urged the court to relax a ban it issued in October of pet coke and furnace oil use by power generators and the cement sector in three states (Uttar Pradesh, Rajasthan, and Haryana) that flank the National Capital Region, which is battling an unprecedented smog crisis (Figure 1). The MoEFCC noted that while state-owned natural gas processing and distribution company GAIL was looking into what it will take to make power generation through gas competitive with coal plants, it was clear that India does not have enough domestic natural gas to fuel its power sector. "Present availability of domestic natural gas is only 23 [million metric standard cubic meters per day]," it said. That's enough to fuel 5 GW of power capacity, against a demand of 120 GW to 160 GW for the whole country.

As the court contemplates these matters, coal generators across the country are exploring the most economic and technically feasible options to comply with the MoEFCC's new environmental rules. Dr. Rahul Tongia, a fellow with New Delhi-based Brookings India, explained to POWER that generators have asked the government to temper emissions limits stipulated in the original edict, as well as to phase them in, focusing first on PM and NOx last. Currently, "compliance with the new norms is limited, especially for plants that need retrofitting, and it's not clear when these would get implemented in full," he noted. "If the past is any guide, then much of the benefits of a five-year delay could be lost-instead of testing, learning, and implementing in phases, there might be limited action at the beginning, and a scramble near the end."

In a paper he authored for Brookings India in February 2017, Tongia noted that India's environmental focus rests on PM, specifically, fine particulates (PM 2.5)-even though SO2 and NOx, which, emitted as gases, convert to PM after atmospheric reactions. "India used to claim that its coal was low-sulfur, and hence [flue gas desulfurization (FGD)] wasn't required," he noted. Meanwhile, the data for how many plants have actually installed SO2 controls to comply with the new limits is scarce.

According to the International Energy Agency's (IEA's) Clean Coal Centre, many coal generators have individual deadlines for installation of pollution controls, but delays are expected owing to a number of issues as India attempts to introduce mass retrofits or new technologies. The country will need to tackle technical difficulties; financial issues associated with introducing multiple technologies at the same time; a lack of local suppliers; and a subsequent need to import technologies as well as all materials and reagents. Then it must grapple with a lack of local skills and expertise. "The utilities have no experience in continuous emissions monitoring," it noted in a February 2018 report.

NOx Compliance: A Pipe Dream?The IEA Clean Coal Centre's report specifically highlights India's coming troubles associated with its stringent new NOx limits. The new rules require coal plants built before 2004 to emit less than 600 milligrams (mg) of NOx per cubic meter (m3). Plants installed after 2003 and before 2017 must emit no more than 300 mg/m3, and plants installed after January 1, 2017, must limit NOx emissions to 100 mg/m3.

Significantly, however, as Sanjeev Kumar Kassi, who serves as director for thermal engineering and technology development at India's Central Electricity Authority, noted: "Globally available [selective catalytic reduction (SCR)] system[s] for reducing NOx emissions are not proven for Indian coal having high ash contents. No proven and established control technology suited to our high-ash Indian coals exists and pilot studies [are] needed before deploying any technology."

The IEA points out that many boilers in India already have overfire air and deploy fuel biasing, but only a few have low-NOx burners. (That point has been contested by an expert on the Indian power market, who notes that because Indian plants did not have pollution standards before the 2015 announcement, no overfire air was ever used.) To meet the new limits, more than 300 units may require SCR, it said. Though SCR achieves the highest NOx removal rates of all NOx controls (at 80% to 90%), it is also the most expensive option. Installing SCR systems in existing units may also be technically difficult, owing to plant layout. "For example, an extensive change in duct work, an [induced draft] fan, and other equipment will be required, for which there will have been no provision made in the existing design. There will be a need for reagent storage, an injection grid, and the associated installations."

An SCR for a 500-MW unit could also consume 2,500 tons per year of ammonia, but the use of ammonia as a reagent will cause new environmental and safety concerns. An SCR system would also require extra outages for inspection and replacement of the SCR catalyst, which is subject to high rates of erosion due to the ash content of the coal, and it may not reach the three-year average lifetime achieved with international steam coals. Then, "installation of the new system will lead to changes in [operations and maintenance] and greater auxiliary power consumption due to the increased pressure drop in the system," it said.

The Challenge of Control System SupplyBeyond those challenges, India will likely need to import NOx control systems "as they are not manufactured in India" and ensure they are suited to Indian conditions. Citing Kassi, IEA noted that India is already facing a limited supply of desulfurization systems. Consequently, the installation of NOx control technology at a rate of 20,000 MW/yr for a total 256,000 MW capacity (made up of 175,200 MW of existing units plus 80,800 MW under construction) would take more than 10 years.

Cost increases are also inevitable, with implications for the country's power reliability, and grid operators will be forced to take into account plant outages needed for modifications and retrofits. The IEA suggests that a high demand for pollution control systems within the short timescale could raise the energy tariff by an estimated 1/kWh. For plants older than 15 years, any increase in tariffs could hamper recovery of the investment within their remaining lifetime. For plants whose construction began before the new limits were introduced, delays and cost increases related to redesign are inevitable.

However, Ravi Krishnan, founder of global consulting firm Krishnan & Associates, also cited in the report, told POWER that competition among pollution control manufacturers is fierce in India. "I personally don't believe that there's a shortage of suppliers because there are at least 30 to 35 emission control companies around the world who are all centered into India, because the market for worldwide coal-fired emissions control technologies are dwindling. Coal-fired power plants are no longer being built in many parts of the world and some are being shut down because of revenue pressures from gas." Krishnan said demand for emission control technologies is dependent on new markets like India. "In fact, at a recent bid at NTPC, I think there were close to 25 to 30 suppliers. There are a lot of Chinese, European, American, Korean, and Japanese suppliers with [joint ventures] in India," he said.

For now, despite several hurdles on the horizon, a few major players are evaluating NOx control technologies. The country's largest power generator NTPC currently is carrying out eight pilot projects for installation of SCR and selective non-catalyst reduction (SNCR). Results for these projects are expected in 2019, and the IEA noted that "utilities are not expected to make decisions before the outcome of these tests is clear." Indian power equipment maker BHEL is also testing its own SCR catalyst on a pilot scale. Recognizing the market's potential, global equipment manufacturers have also jumped into the game. Doosan Babcock and Doosan Heavy Industries recently developed low-NOx burners specifically for such applications.

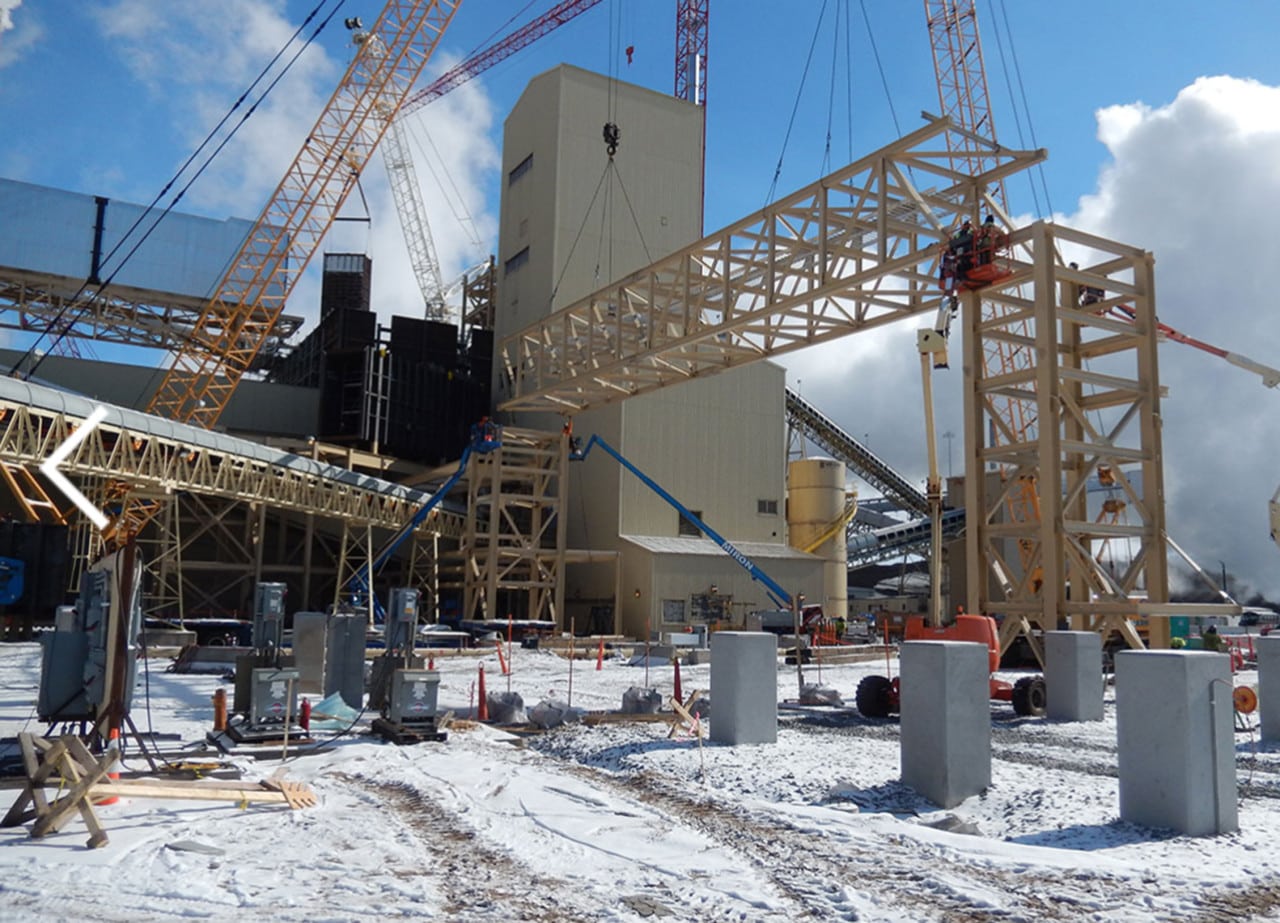

However, SCR isn't the only option, noted the IEA. Generators may also consider multipollutant control technologies like ReACT (Regenerative Activated Coke Technology), which was conceived in Germany in the 1950s and has been used successfully in Japan and in the U.S. (Figure 2); Haldor Topsoe's SNOX, an FGD system that can remove NOx and particulates from flue gas; Tri-Mer's UltraCat, a ceramic filter technology; and Linde's LoTOx, a process that uses low-temperature ozone injection to oxidize NOx for capture in an FGD system. "Although, there are no multi-pollutant systems developed specifically for high ash coals, it appears that the existing ones can be applied successfully," the IEA noted. The potential of the ReACT system in particular for Indian high ash coals has reportedly been recognized by the Indian government and utilities. However, both cost and water availability should be important considerations in the technology selection process in India, it added.

Still, "It may be years before the exact effect is known of Indian coals on these systems. Hence contracts with potential suppliers should have some flexibility and there should be provisions for future possible technical changes," the IEA said.

-Sonal Patelis a POWER associate editor

Updated (June 4): Adds note perspective about IEA's claim that many boilers in India already have overfire air.

The post India's Power Industry Struggles to Solve Pollution Problems appeared first on POWER Magazine.