Federal Appeals Court Upholds New York’s Nuclear Subsidies

New York's subsidies of nuclear power are legally sound, the U.S. Court of Appeals for the Second Circuit has concluded. The decision comes two weeks after the Seventh Circuit upheld a similar measure in Illinois.

The development marks a victory for the nuclear industry, which has been financially crippled by the rise of cheap gas power and a proliferation of renewables. But it is a setback for independent power producers, who have railed against state "bailout" programs to keep nuclear plants operating for economic reasons.

A Bitter DisputeThe Second Circuit decision in Coalition for Competitive Electricity, et al. v. Zibelman, et al.(17"2654"cv) on September 27 affirms a July 2017 federal district court judgement that dismissed challenges against the zero emission credit (ZEC) program adopted in August 2016 by the New York Public Service Commission as part of its Clean Energy Standard. The program seeks to reduce greenhouse gas emissions in the state by 40% by 2030.

The plaintiffs in the case are a group of competitive power generators led by trade group Electric Power Supply Association (EPSA); it includes Dynegy, Eastern Generation, NRG Energy, and Calpine Corp., among others. In their appeal of the district court ruling, the plaintiffs disputed the constitutionality of the ZEC program, which grants state-created and state-issued credits to participating nuclear plants-all owned by Exelon: FitzPatrick, Ginna, and Nine Mile Point-to subsidize their zero-emission attributes of electricity. They argued that the program is unconstitutional because it is pre-empted under the Federal Power Act (FPA) and violates the dormant Commerce Clause.

Among the plaintiffs' chief complaints was that the ZEC program influences prices in wholesale electricity markets overseen by the Federal Energy Regulatory Commission (FERC), and distorts the market mechanism for determining which generators should close. The generators pointed to a unanimous decision in April 2016 by the U.S. Supreme Court (Hughes v. Talen Energy Marketing), which held that state subsidies to power generators are preempted by the FPA if they are "tethered" to FERC-regulated wholesale power participation. That decision, they alleged, prompted New York's Public Service Commission to recommend in July 2016 that the subsidy's formula be based instead on an estimated "social cost of carbon."

The defendants-which included officials from the New York Public Service Commission, and were backed by Exelon Corp.-argued that the case should be dismissed because the plaintiffs lacked a "private cause of action" to pursue their pre-emption claims, and that the plaintiffs' claims "fail as a matter of law."

(For an in-depth analysis of the legal concerns in these cases, see: "Connecticut, Ohio, Pennsylvania Make Substantive Gains for State Nuclear Subsidies, November 1, 2017).

On Thursday, the Second Circuit concluded that the plaintiffs failed to identify a "tether" between the ZEC program and wholesale market participation (as opposed to "prices") as determined under Hughes. Plaintiffs also failed to identify any clear damage to federal goals, it said. That's why the ZEC program is neither "field" or "conflict" preempted. Finally, plaintiffs also lacked standing to the Commerce Clause claim, it ruled.

The Second Circuit court's conclusions are consistent with the Seventh Circuit's September 13 ruling in Elec. Power Supply Association v. Star (No. 17"2433, 2018), which essentially left the door open for states to subsidize generation as long as the state does not directly set the wholesale market price. In that decision, which was hailed as a victory for Exelon's hard-fought ZEC program under the Illinois Future Energy Jobs Act, the Seventh Circuit also ruled that the program does not directly impact wholesale power prices.

According to Raymond Gifford and Matthew Larson, energy partners at Wilkinson Barker Knauer LLP, legal experts who have published insights on market interventions, the decision "just reinforces what we learned from the Seventh Circuit earlier this month: If you are a state considering 'around market' action, they look ever more enticing with increasingly diminished litigation risk so long as you can satisfy the narrow standard of showing the state program is not tethered to market participation."

That aspect of the decision is perhaps most noteworthy: "The Second Circuit makes clear the notion of tethering espoused by the U.S. Supreme Court in Hughes is limited, and tethering is unlawful only if ties to market participation, not market prices," they explained.

What it means is that "The courts are making clear they will not step in and save the markets absent a tie to the market analogous to Hughes," they said. "It is all eyes on FERC."

A Triumph for NuclearFor Exelon, the Second Circuit decision, like the Seventh Circuit's, is a boon for the profitability of its nuclear fleet, which dominates 60% of its power generation portfolio. Exelon Nuclear, which is headquartered in Kennett Square, Pennsylvania, owns more than 19.6 GW of capacity from 22 reactors at 13 facilities in Illinois, Maryland, New York, and Pennsylvania-and it employs more than 11,000 professionals to run the fleet.

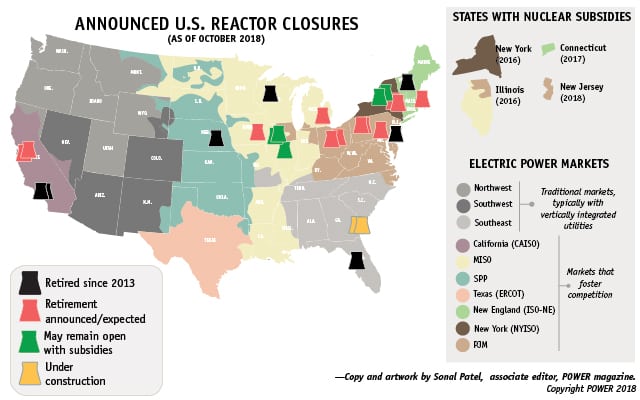

The company has often painted a dire picture for the future of nuclear power, a sentiment echoed by the Nuclear Energy Institute (NEI), a trade group that represents many American nuclear plant owners. Industry concerns are founded on recent developments that spurred the premature retirement of 5.3 GW of nuclear generating capacity between 2013 and 2018. Among them was the 625-MW Oyster Creek Nuclear Generating Station in New Jersey, which Exelon shuttered earlier this month. Another 12 nuclear reactors of about 11.2 GW have announced retirement plans, and could shut down between 2019 and 2025, the NEI notes.

Since 2013, low natural gas prices, market dynamics, technical issues, and policies that favor renewables have precipitated the closure or announced retirement of several nuclear reactors. Source: POWER

In comments filed with FERC in October 2017, Exelon noted that merchant nuclear plants in all regions are facing a shortfall of market revenues relative to costs, and without corrections to the market and full compensation for the attributes, "the nation will suffer a massive wave of premature retirements," it said.

Since last October, however, Exelon-along with the larger nuclear industry-has enjoyed a steady string of triumphs. On May 23, New Jersey's Gov. Phil Murphy signed a bill that establishes a zero-emissions certificate program that will prop up PSEG's 2,282-MW Salem and 1,180-MW Hope Creek nuclear plants, which account for 95% of the state's carbon-free resources. The state joins not only New York and Illinois, but also Connecticut, whose governor last year signed a controversial bill allowing Dominion's Millstone plant to participate in its clean energy procurement process. Ohio and Pennsylvania are emerging as the next nuclear subsidy battlegrounds, experts widely agree.

On Thursday, Exelon said it was "pleased" at the decision. It touted the "zero-carbon, resilient, and affordable electricity" that nuclear power offers.

The NEI, in a September 27 statement sent to POWER,also celebrated the decision. "Two appeals courts have unanimously found that these electricity generation programs do not conflict with the federal government's jurisdiction to regulate wholesale electricity markets," it said. "In both cases, the Courts agreed that states, which bear primary responsibility for the health and welfare of their citizens, can use ZEC programs to compensate nuclear power plants for the carbon free attribute of the electricity nuclear plants produce."

Maria Korsnick, NEI president and CEO, added: "With state action, we preserve one of our best clean energy assets and protect public health."

EPSA to FERC: Do Something

EPSA, the trade group that represents leading independent power producers and marketers, meanwhile, said it would review the federal court's opinion and "consider all its available legal options in due course."

The group, however, also strongly urged FERC to step in to uphold the integrity of wholesale market values. "Regardless of any further legal steps EPSA may pursue, EPSA underscores that the 2nd Circuit and 7th Circuit courts each relied on representations from the U.S. Government that FERC can effectively address any adverse impacts that ZEC nuclear bailouts have on wholesale power markets. FERC must now do what it told the two courts of appeal it would do," EPSA President and CEO John Shelk said in a statement sent to POWER.

Shelk noted that even while FERC, along with the U.S. Department of Justice, backed Illinois in a brief filed with the Seventh Circuit this May-essentially arguing that ZEC programs do not preempt federal statute-the federal body had recently "found in a contested proceeding that adverse impacts from nuclear ZECs make existing PJM wholesale market rules unjust and unreasonable and thus unlawful under the Federal Power Act."

Shelk was referring to a pivotal FERC decision on June 29 that rejected approaches by PJM to reform its capacity market, even as it acknowledged that its integrity and effectiveness has been increasingly and "untenably threatened" by state subsidies for preferred generation resources. Comments from PJM on a proposed new approach are due to FERC on October 2 (Docket EL18-178-000).

"FERC now has a legal duty to establish effective mitigation measures to keep ZEC bailouts and certain other out-of-market subsidies from producing the uncompetitive outcomes that prompted EPSA to pursue this litigation in the first place," Shelk said.

NRG Energy, a company that has long been a vocal critic of state nuclear subsidies, in a statement on September 27 told POWER that it was also "disappointed by the court's ruling," and that it will evaluate whether to appeal the decision. "ZECs continue [to] interfere with the proper functioning of the wholesale market and are a bad deal for consumers because they needlessly increase the cost of electricity to consumers," it said.

| For more information about ZECs and associated legal battles, see these in-depth POWER magazine stories: Appeals Court Backs Illinois' Nuclear Subsidies (September 13, 2018): Details about the Seventh Circuit's decision to uphold Illinois's nuclear subsidies. FERC Nixes PJM's Fixes for Capacity Market Besieged by Subsidized Resources(July 5, 2018): Analysis of FERC's rejection of PJM's approaches to reform its capacity market. FERC determined PJM's MOPR renders the grid's tariff "unjust and unreasonable," but it noted "With each such subsidy, the market becomes less grounded in fundamental principles of supply and demand." FERC moved to consolidate two proceedings and set a "paper hearing" to address a proposed alternative. DOJ, FERC Back Illinois in Nuclear Subsidy Fight (May 31, 2018): Analysis of DOJ/FERC brief submitted to the Seventh Circuit in support of state subsidies Connecticut, Ohio, Pennsylvania Make Substantive Gains for State Nuclear Subsidies(Nov. 1, 2017): Summarizes state measures to subsidize nuclear power, breaks down legal contentions. Group Will Appeal Ruling That Backs N.Y. Nuclear Subsidies(July 26, 2017): Details about the judgement from the federal district court that was taken up by the Second Circuit, and resulted in a decision on September 27. Appeal Filed After Judge Dismisses Challenge to Illinois' ZEC Program (July 17, 2017): Details about the U.S. District Courtfor the Northern District of Illinois's judgement, a case that was appealed and was taken up by the Seventh Circuit and resulted in a decision on September 13. Six Glaring Interventions in Competitive Markets - Beyond the Trump Plan(June 7, 2018): Details and analysis about interventions that are roiling several wholesale power markets. More about issues facing wholesale electric markets: U.S. Electric Markets in Transition(January 2017) Duck Hunting at the California Independent System Operator(March 2017) New York's Ambitious Transitions: Who Wins? Who Loses? Who Knows?(May 2017) MISO: Avoiding the Mess Facing Other Wholesale Competitive Electric Markets(July 2017) Could Success Spoil ISO-NE?(September 2017) PJM: Can the Big Dog Deal with State Interference? (November 2017) |

-Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)

The post Federal Appeals Court Upholds New York's Nuclear Subsidies appeared first on POWER Magazine.