Tech stocks (and the stock market) are tanking thanks to rising interest rates

Tech stocks tanked today amid a broader stock market slide as nervous investors worried that the 10-year bull run in public stocks may be coming to an end.

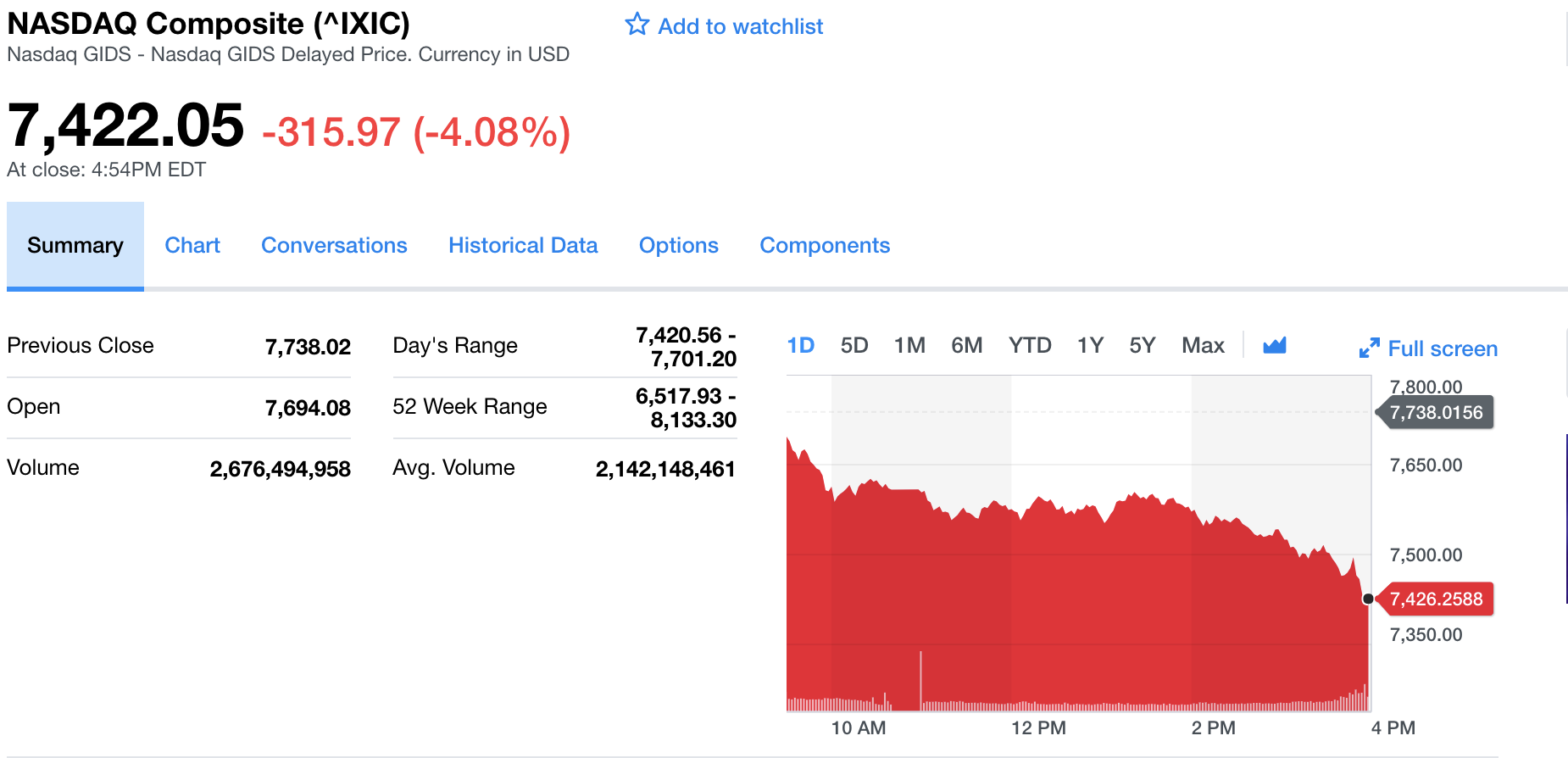

The S&P 500 dropped 3.3 percent while Nasdaq composite index (which is the market where many of the largest U.S. tech companies are traded) lost 4 percent of its value, falling 315.97 points. The net result is that the hand of the market is crushing stocks and high-growth technology companies are bearing the brunt of the beating.

A few points drove the selling, including rising inflation and interest rates as well as a move by the Fed to tighten policy. Further, Wall Street experts noted, as interest rates rise, many big money movers are making big money moves and taking money out of the stock market to invest in more secure bonds with guaranteed rates of return.

Stocks like Amazon (down 6.15 percent) and Tesla (down 2.25 percent) led in the downturn as stocks like Walmart remained relatively unscathed at -1.36 percent.

The NYSE Arms Index reflected the turmoil, rising to 1.19 from .5 today. The Arms Index moves over 1.0 when the market is down.

As our former correspondent and current Crunchbase editor, Alex Wilhelm, noted on Twitter, the big five lost a bunch of money today. And by a bunch we mean $191 billion. That's not chump change.

-$191 billion in big 5 market cap jesus pic.twitter.com/uXZFPmheLy

- alex (@alex) October 10, 2018