Jared Kushner took home millions, paid little or no tax for years

Jared Kushner borrowed money to put down tiny down-payments on properties, paid himself millions from the rents generated by those properties, then used aggressive depreciation markdowns to declare an operating loss every year, meaning that he paid no tax at all from at least 2012 to 2016, and very little tax in the three years proceeding it.

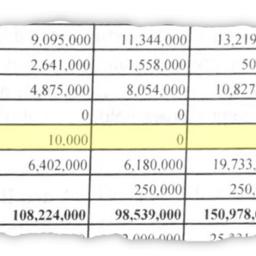

Someone gave the New York Times a 40-page dossier prepared by Kushner and his advisors as part of a loan application; the documents detail Kushner's tax situation from 2009-2016.

The deductions mirror those used by Donald Trump -- whose own finances were the subject of a Times report based on leaked documents -- though, unlike Trump, Kushner did not engage in "outright fraud."

Kushner is advisor to his father-in-law, the President of the United States, who is situated to substantially overhaul the tax system. This overhaul could close the loopholes that let real-estate developers pull in millions and pay nothing in tax, or expand them.

Unlike typical wage earners, the owners of such companies can report losses for tax purposes. When a firm like Kushner Companies reports expenses in excess of its income, the result is a "net operating loss." That loss can wipe out any taxes that the company's owner otherwise would owe. Depending on the size of the loss, it can even be used to get refunds for taxes paid in prior years or eliminate tax bills in future years.

Mr. Kushner's losses, stemming in large part from the depreciation deduction, appeared to wipe out his taxable income in most years covered by the documents.

He is reporting the losses even though he bought his properties with borrowed funds. In many cases, Mr. Kushner kicked in less than 1 percent of the purchase price, according to the documents. Even that small amount generally was paid for with loans. Mr. Kushner's credit lines from banks rose to $46 million in 2016 from zero in 2009, the documents show.

The result: Mr. Kushner is getting tax-reducing losses for spending someone else's money, which is permitted under the tax code. Depreciation deductions are available in other industries, but they generally don't get to take losses related to spending with borrowed money.