How to Retire Forever on a Fixed Chunk of Money

These last two articles have focused on how common it is for early retirees to continue making money after they say goodbye to the cubicle. I share stories like that because I've seen it happen in so many lives, including my own. Plus, if you do it right, work is fun.

These last two articles have focused on how common it is for early retirees to continue making money after they say goodbye to the cubicle. I share stories like that because I've seen it happen in so many lives, including my own. Plus, if you do it right, work is fun.

But the downside of all this "side hustle" talk is that you can take it too far, and people start to think that early retirement is possible only if you keep making money afterwards. To the point that I've now been hearing many thirtysomething millionaires saying things like,

"Sure, the numbers say I've easily reached financial independence, but I'm not even going to touch my nest egg until I'm 60.

So these days, I just do a bit of unpleasant consulting work here and there to cover my expenses and to get the employer subsidized health insurance. "

On top of that, it is hard to get mainstream financial advisers to admit that there is such thing as a finite chunk of money that you can live safely on, forever. They say stuff like, "Financial independence is great, but truly retiring from making money? Forget it."

Related: your spending can be more efficient if you channel it through a good rewards credit card.

This is where Mr. Money Mustache puts a stake in the ground.

Because it IS absolutely possible and in fact very easy, to make a chunk of money last through your lifetime. There is no magic or unusual risk or hope involved, it's just plain math.

Even with all the complexities of the modern financial world with its booms and busts, OPECs and Brexits and the churning sea of changing politicians and dictators, it still all boils down to a really simple number. And we can illustrate it with this really simple example:

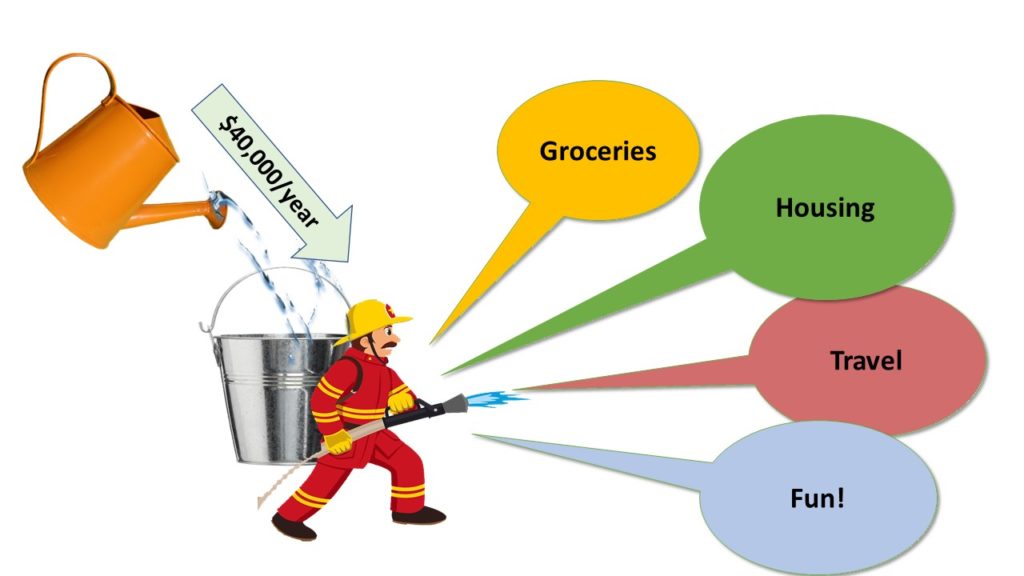

Let's say you want to be able to spend $40,000 per year, for life, and have that spending allowance continue to grow with inflation. And you never want to make another dollar from work in your lifetime.

In this situation, the following three sentences represent the entire universe of probability for you:

- If you retire with $800,000 in investments, you will probably make it through your whole life without running out of money (a 5% withdrawal rate)

- If you start with a $1 million nest egg (a 4% withdrawal rate), you will very likely never run out of money

- If you start with a $1.33 million chunk (a 3% withdrawal rate), it is overwhelmingly certain that you'll have a growing surplus for life.

Now, these statements do all depend on the continued existence of a productive human race which continues to innovate and trade and not destroy its own productive capacity.

But you know what?

- In the event of a global apocalypse, you won't be thanking yourself for spending those last few years in the office accumulating a few last shares of index funds anyway.

- The strategies described in this blog are designed to shift us all to a more sustainable, healthy, productive economy. So when you live a Mustachian lifestyle, you're boosting the likelihood of an apocalypse-free future for all of us. Thus, because of you, We are all going to do just fine.

So. A fixed chunk of money is about as safe a retirement strategy as you'll ever find.

It's safer than relying on any job, because keeping a steady job depends on the overall economy remaining healthy enough to feed your company, your company remaining solvent, and you remaining productive and useful to that company.

Meanwhile, a good investment portfolio just depends on the world economy in general continuing to exist.

But once you've got that chunk, how do actually convert it into a safe stream of lifetime income?

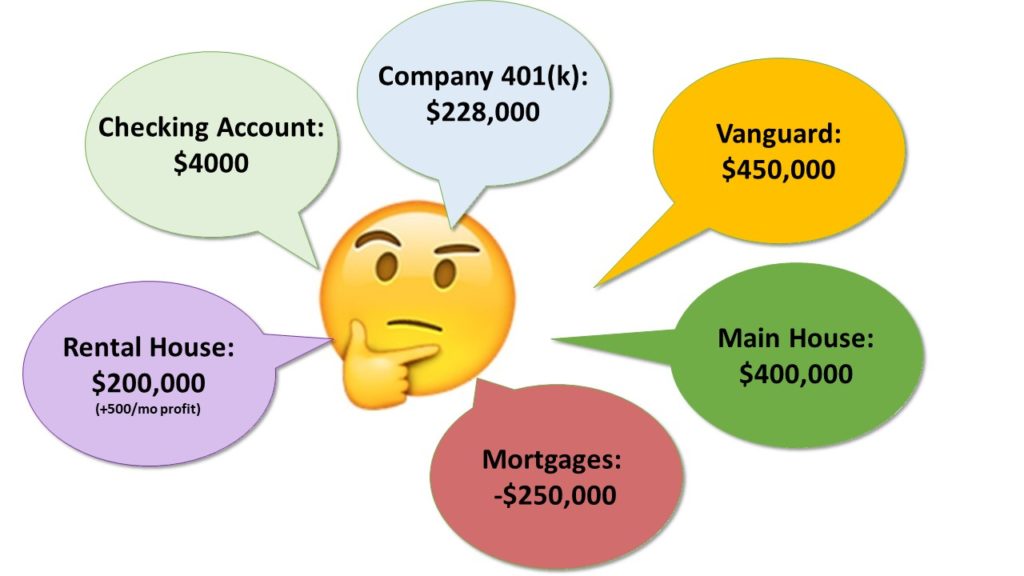

In other words, most of us get to the door of financial independence with something like this:

A complex financial picture with lots of dollar signs - but can you retire on it?

But what we really want is something like this:

This is how money flow really works in early retirement..

So What Is The Problem?

Most people get stuck on the same three questions:

- What investments do I use to provide a lifetime of income?

- A big chunk of my savings are in 401k or pension, locked up until I'm 59. How do I retire at 35?

- How can I pay for (US) health insurance on a $3300 per month budget, when I've heard monthly premiums can exceed $1200 per month for a family of four?

The great news is that there are easy answers for all three. They are just not widely known because true early retirement (with no backup income) is such a rare field that very few people write about it. So let's bang out those answers right here:

Investments:

The Simple Path to Wealth is a short book on investing that convinces you that the simplest strategy is also the best.

As always, I suggest that you only need one thing: a generous bucketload of low-fee index funds. It can even be a single index fund if you want to keep it even simpler: Vanguard's VTI "Total Stock Market Exchange Traded Fund"

Whether you own these funds through your company's 401(k) plan, or the brokerage account of your choice, or a Vanguard account, or through an automatic management service like Betterment* as I do, doesn't matter. What matters is that you are buying pieces of real, profitable companies, which pay dividends and appreciate over time.

Okay, got the funds, Now What?

Okay, you're 35 years old, you have saved exactly one million dollars, and handed in your resignation.

At this point, you will probably have at least two chunks of money: a normal chunk (also known as a taxable account), and a retirement chunk (perhaps a 401k, IRA, or pension).

Let's suppose it is divvied up like this:

When you retire early, you Use up your taxable accounts first.

When you retire early, you Use up your taxable accounts first.

On your first day of freedom, you log into your account, find the option for what to do with dividends, and set those to get automatically deposited into your checking account.

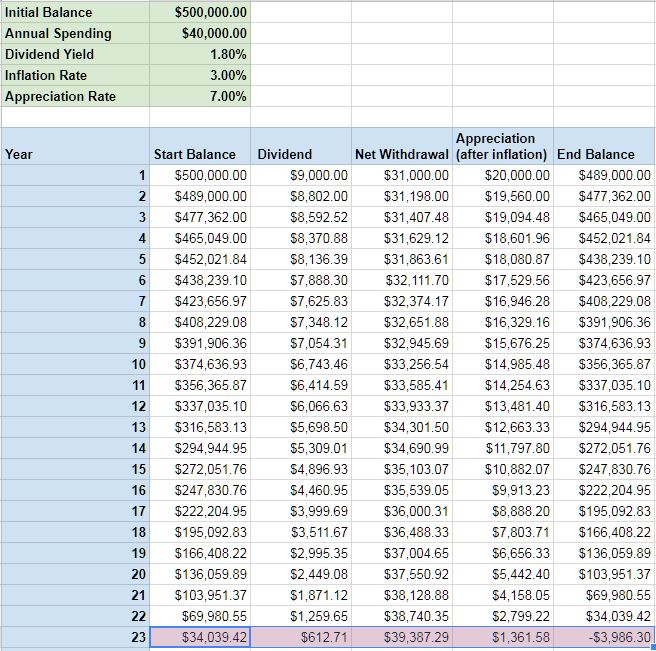

Right now, the VTI fund happens to pay a 1.89% annual dividend, which means that the $500,000 account in that green box above will pay $9000 in annual dividends straight to you.

Then, if you're shooting for $40,000 of annual spending, simply set up an automatic monthly withdrawal of an additional $31,000 per year ($2583 per month) to be sent to your checking account, which is set to automatically pay off your credit card, which you use to buy your groceries.

But Won't I Run Out of Money If I Do This!?

That's the magic of early retirement math - the answer is NOPE! Because check out how this plays out:

- Because of those withdrawals, your account will lose a few shares every year.

- But because of natural stock market growth, your account will be fighting back and each share will be worth a bit more.

- Thus, your money lasts much longer than it would if you were just keeping it all in a checking account or stuffed in your mattress.

- So a quick spreadsheet simulation of this drawdown reveals that your account survives almost 23 years. At which point you are 58 years old - almost eligible for penalty-free withdrawal of your true retirement money.

- BUT, during this whole time, that other $500,000 in your retirement account grew untouched (and untaxed), and it's now worth about $1.2 million dollars even after accounting for future inflation**. In other words, you have WAY more than enough to live on forever at that point.

Here's a quick spreadsheet with simple assumptions and 4% after-inflation stock market returns. In this situation the first 500 grand lasts about 23 years.

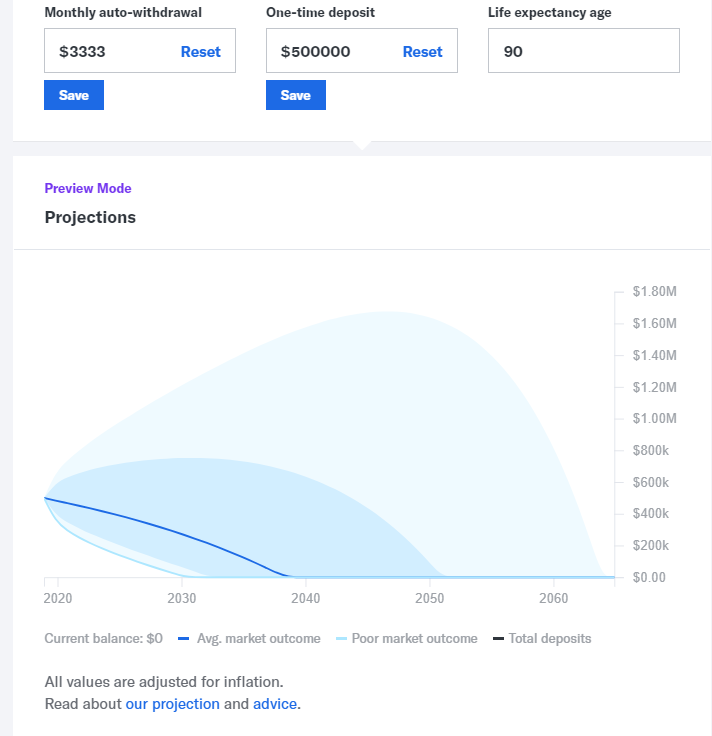

And here's the same thing, except I did it in Betterment's fun retirement income simulator, using a 95% stock portfolio. This version is slightly less optimistic, but still gets us out to almost 20 years in the most probable scenario.

If you have a really large locked-up retirement balance and a small taxable account, you might want to tap into the retirement account sooner. There are ways to do that penalty-free too, see this earlier MMM article for a few ideas.

The overall lesson: It doesn't matter how you have your investments split up between normal investments and retirement accounts. It just matters how much you have in total.

Heck, even if you are stuck with a $1 million house occupying a huge part of your net worth, you can convert that into livable money: sell the house, put the cash into index funds, and use the resulting cash stream to rent a spiffy but reasonably priced house or apartment in the lovely walkable area of your choice.

Okay, What About Health Insurance?

If you are stuck in the world's most expensive medical care market like I am, the most profitable investment of all may be salads, bikes, and barbells because these virtually eliminate the "lifestyle diseases" that trigger about 75% of US healthcare spending.

But even so, most people choose to insure against surprise medical bills, and people with existing medical needs depend on help with those costs.

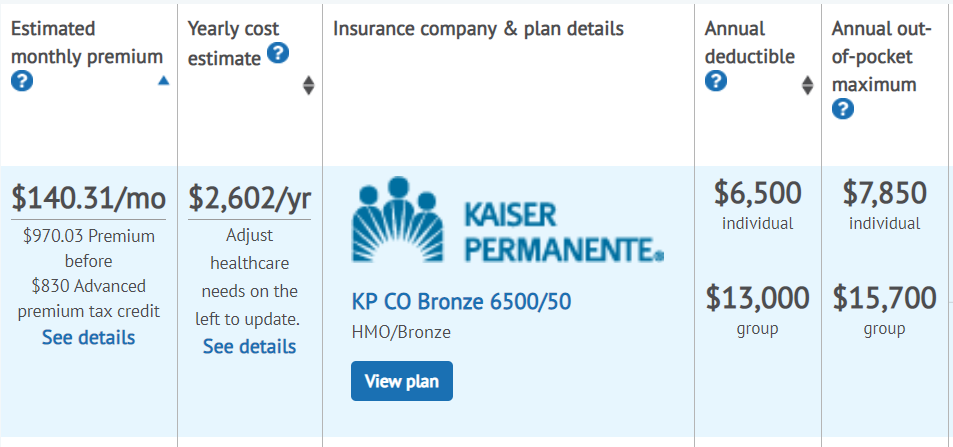

The good news is, the politically controversial Affordable Care Act actually handles this much better than most people assume. If I go to healthcare.gov right now (or in my case the Colorado-specific equivalent) and put in a hypothetical 4-person family with a $40,000 annual income in my zip code right now, I see this:

This represents a cost reduction of $830 per month relative to what a high-income person would pay for the same coverage. So in other words, the United States just has a progressive tax bracket system like other rich countries, chopped up a little differently. It's not great and to be clear, this is shitty health insurance because it has a high deductible. But at least it's not a retirement-buster.

Other Things You Probably Don't Need To Worry About But Everybody Does

What if Stocks fall or My Cost of Living Goes Up?

Stock market crashes are never permanent. In the long run, the market always goes up. So all that happens during a crash is that those few shares that you do sell during those brief times when the market is down, will hurt your account balance just a bit more. Within a year or two, the market is back up and your remaining stocks are more valuable than ever. If you want even further reassurance, you could just choose to spend a bit less money during this time.

As for your cost of living going up faster than inflation - it rarely happens. And if it does, you can adjust by spending less in other areas. Most things are in your control, especially if you take a big-picture view. You can shop around, move, and alter your lifestyle in a million different ways, and in fact this is really good for you.

Standard retirement advice is based on protecting people from any form of hardship or change, which is completely counterproductive. In the right quantity, these are the backbone of a good life and the fuel for personal growth. Without them, you will melt into a whining puddle in front of a television that endlessly blares Fox News.

Every Financial Advisor (even Betterment!) Seems to Suggest Lots Of Bonds, - Why Does MMM Only Hold Stocks?

The quick answer is that stocks earn more money on average, especially right now in 2018 with bond yields so low. Sure, stocks are more volatile, but volatility only bothers fearful people who look at the stock market every day and fret when it jumps around. As a Mustachian, you don't do this. Lower stock prices are simply a temporary sale on stocks.

What About All Sorts of Other Stuff Not Covered in this Article?

The absolute key to success in early retirement, and indeed most areas of life, is to get the big picture approximately right and not sweat the small stuff. And design the big picture with a generous Safety Margin, which allow lots of slop and mistakes in your original forecasts and allows you to still come out with a surplus.

For example, in the story above I assumed a $40,000 annual spending rate, which is way more than almost anyone really needs to live well here in the US, especially once your kids are grown. I completely ignored Social Security, which will benefit most people at a level between $1000 and $2500 per month for a big portion of their older years. I ignored any incidental income or inheritances or profits you might make on selling your house someday, and the list goes on.

So that's the line in the sand.

Although I personally think working hard almost every day after your retirement is good for you, it is also completely optional, and you do not have to earn any money at it if you don't want to.

A chunk of money is a perfectly good retirement plan, and the math doesn't care if you are retiring at 5 years old or 85. If you get the numbers right, you're set for life.

--

*Betterment, Wealthfront, and Personal Capital are investment management systems known as "Robo-Advisors", which typically buy shares on your behalf and then add on features like rebalancing, tax loss harvesting and personalized advice. I happen to use Betterment because I like the interface and benefit from their tax loss harvesting more than pays for their service fees in my own tax situation.

Betterment purchases a flat rate advertising banner elsewhere on this site, although I don't get paid for mentioning them or for any new customers they might get. And blog affiliates/advertisers have no say in what I choose to write.

** For this calculation, I assumed the stock market delivers a 4% rate of return including dividends, after inflation. (or roughly a 6-7% total annual return)