Silicon Valley real estate asking prices fall 12% from peak

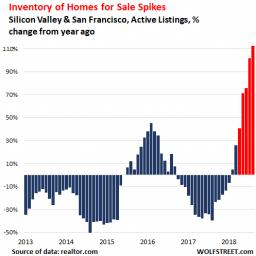

There are more houses for sale in San Mateo County, Santa Clara County and San Francisco County than at any time since 2013; inventory in December was up 113% year-on-year, and asking prices have fallen by 12% since their peak.

It's the most expensive real estate in America, and widely considered recession-proof due to the startups, universities, and other draws that bring buyers to the market.

But increases in inventory are driving prices down: the number of properties with price cuts in December rose 455% year-on-year.

As Wolf Richter notes, the market may come back if the 2019 IPO season -- Uber, Palantir, Lyft, Airbnb -- is successful and creates a bunch of fresh-minted millionaires, but with a market crash on the horizon, this is a big if.

With inventories for sale rising, as sales are slowing, a whiff of competition is settling in among sellers, who have to determine where the market is today, not where it was last year, and if they want to sell their property, they have to price it where the buyers are. But buyers aren't where they were a year ago, and the bidding wars have receded into history, and mortgage rates have jumped from a year ago. The right property, priced right will sell. But if it's priced off the market, it will likely sit. This is starting to sink in. And sellers are cutting their asking prices.

In December, the number of properties on the market with price cuts in Silicon Valley and San Francisco combined skyrocketed by 455% from a year earlier to 444. This chart shows the year-over-year percentage change for each month, with the red bars denoting when bubble trouble began:

Housing Bubble Trouble in Silicon Valley & San Francisco [Wolf Richter/Wolf Street]

(via Naked Capitalism)