Navajo Nation Ends Bid to Acquire 2.3-GW Coal Plant

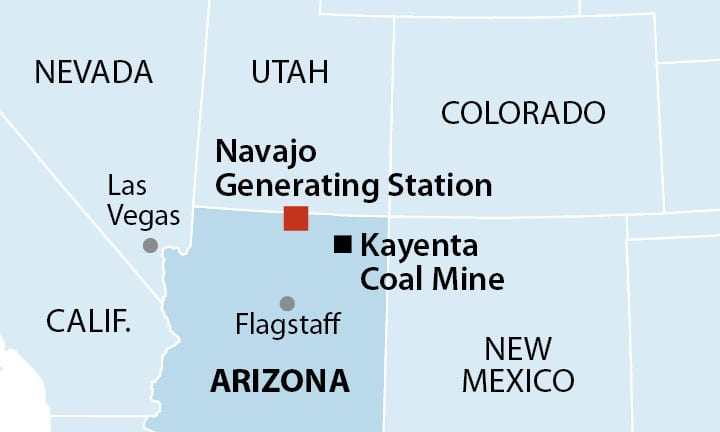

After a Navajo tribal council on March 21 voted 11-9 to block acquisition of the Navajo Generating Station (NGS) and Peabody Energy's Kayenta coal mine, the Navajo Transitional Energy Co. (NTEC) announced it would drop its bid to keep the 2.3-GW coal-fired plant near Page, Arizona, open.

NTEC, a company wholly owned by the Navajo Nation, and which owns the Navajo Mine in Fruitland, New Mexico, said on March 22 that the decision by the Navajo Nation Council's Naabik'iyati' Committee was prompted in part by "continued demand by the owners of the Navajo Generating Station that the Navajo Nation provide an unlimited guarantee of any liability for the decommissioning of the plant."

In its statement on Friday, NTEC said it was "forced to cease its acquisition effort." It added, "For too long, outside corporations have plundered our land and harmed our environment. With the creation of NTEC, for the first time in history, a tribal entity exercised its sovereignty to regain control of their natural resources and exercised that authority to move forward on the guiding principles of protection of our tribal government, tribal members, and environment over profit."

IEEFA: NGS Struggling to FInd CustomersAccording to researchers at the Institute for Energy Economics and Financial Analysis (IEEFA), the decision "spells closure" for both NGS and the Kayenta mine. However, David Schlissel, IEEFA's director of resource planning analysis, claimed the decisions were in the best interest of the Navajo people: "NTEC's proposal, had it been allowed to proceed, would've meant serious long-term economic damage to the Navajo Nation." Schlissel has previously pointed to a number of economic and financial setbacks associated with NTEC's plan.

NGS suffers from a "lack of apparent customers to buy power from an NTEC-operated plant. The current owners of NGS are closing it because it can no longer compete with cheaper gas-fired and renewable generation," IEEFA said. Among other concerns are "The burden of cleanup liabilities that would come with owning NGS and the Kayenta mine, a burden that would likely have cost hundreds of millions of dollars," it also noted. NGS, meanwhile, has postponed high-cost maintenance needed to operate the plant over the two years that closure has been anticipated, it said. "According to SRP [Salt River Project], which operates the plant, the deferred maintenance totaled between $150 and $200 million for all three units at NGS, or between $50 and $67 million, on average, per unit," Schlissel said.

IEEFA analysis suggests that if NTEC paid for the deferred maintenance for only two of NGS's units, it would "lose between $20 and $53 million, just during the five years 2020-2024. And this assumes that NTEC is able to reduce average NGS productions costs to $28.05 per MWh from the $41.72 per MWh that SRP has projected, something that is highly doubtful, and that energy market prices remain as low as forward prices now suggest," said Schlissel.

NGS's utility owners-which include SRP, Arizona Public Service Co., Tucson Electric Power Co., and NV Energy-announced in February 2017 that they would no longer own and operate the plant after its lease ended on Dec. 22, 2018.

In 2017 and 2018, Peabody Energy sought buyers to keep NGS open, hiring investment firm Lazard to look for new potential owners for the plant. In April 2018, George W. Bilicic, vice chairman of Investment Banking at Lazard, told a U.S. Congressional committee that preliminary discussions between the current owners and a potential investor, Middle River Power, suggested its current owners were willing to purchase power from NGS, albeit at lower volumes and for a shorter tenure (of between three to five years). In September 2018, however, Middle River Power announced it would end its bid to buy NGS, saying it was unable to secure commitments from other parties to purchase enough power to keep the plant in the black, Schlissel noted.

Though the plant's owners granted several extensions and began discussions with NTEC to pursue a possible asset transfer in October 2018, on Feb. 28, 2019, they moved forward with decommissioning the plant.

The Dying Effort to Keep NGS Open"While the owners have been willing to explore avenues for NTEC to assume ownership of NGS, NTEC is not able to provide the required assurances to protect the plant's owners, their customers and shareholders in the event of a sale," SRP, a community-based public power utility which serves the greater Phoenix area, said on Feb. 28. "Because of the time challenges to meet their decommissioning obligations, the owners will continue to move forward with plans to decommission NGS later this year."

The NGS owners also said they would continue to fulfill their commitments to the Navajo Nation and 500 full-time NGS employees (90% of whom are Navajo) as they prepare to cease operations of the plant.

The plant's three 750-MW units began operations between 1974 and 1976. According to SRP, it cost $650 million to build, but plant owners have invested $645 million in environmental controls. In the 1990s, owners spent $420 million on new sulfur dioxide scrubbers and $45 million between 2009 and 2011 to reduce nitrogen oxide emissions.

NGS, which is powered by low-sulfur bituminous coal from the Kayenta Mine located 78 miles away, serves customers in Arizona and Nevada. It supplies more than 90% of the power needed to pump water through the Central Arizona Project (CAP), which is both the single largest end-user of power and the single source of renewable water supplies in Arizona.

The closure is of specific concern for CAP, which told POWER on March 25 that more than 5 million people and 350,000 acres of irrigated land depend on it for reliable delivery of "reasonably priced water."

"Since the NGS owners decided last year to close NGS at the end of 2019, CAP has been working diligently to ensure we will have the energy we need to deliver water in 2020," DeEtte Person, a CAP spokesperson, told POWER.

"Thus far, the CAWCD board has approved a 5-year purchase power agreement with Salt River Project and a 20-year purchase power agreement with AZ Solar 1, LLC. Other resources will be hydropower with Hoover Dam to firm up the solar power and buying power on the open market. The CAWCD board directed that no more than 20% of our energy shall come from any single source."

-Sonal Patelis a POWER associate editor (@sonalcpatel, @POWERmagazine)

Updated (March 26): Adds comments from CAP, which sources 90% of its power from NGS.

The post Navajo Nation Ends Bid to Acquire 2.3-GW Coal Plant appeared first on POWER Magazine.