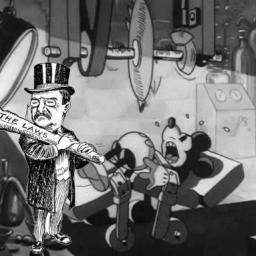

The case for breaking up Disney

Disney has always been a problematic company, from its crypto-minstrelsy (and not-so-crypto-minstrelsy) to its perpetual copyright extensions to its censorship activities to its gender stereotyping to its anti-union work and so on, but, as anti-monopoly activist Matt Stoller (previously) writes, under CEO Bob Iger the company has changed into an entirely different kind of corporate menace: a monopolist committed to crushing competition, rather than an entertainment company that -- whatever its other sins -- was ferociously committed to making movies, TV shows, theme parks, art and toys.

Stoller points to Iger's acquisition spree -- ABC, ESPN, Marvel, Lucas, Pixar, Fox, Maker Media (and licenses for Muppets, Avatar, etc) -- as the key to understanding the change in the company's nature. Where once Disney was a powerhouse of proprietary, studio-created stories and characters (albeit many of them based on public domain fairy tales), under Iger the main sources of new Disney products and stories has been other companies that it purchased. And of course, none of those purchases would have been permitted under the version of antitrust law that led to the founding and growth Disney -- it wasn't until Ronald Reagan, Robert Bork, and every US president since systematically dismantled antitrust that these kind of acquisitions became possible.

This growth strategy warps the competitive landscape in all kinds of ways (not just would would-be animation studio founders, who are now gasping for market oxygen in a monopolized marketplace). Disney is now reportedly insisting on "block booking" from cinema owners -- that's the (once) illegal practice whereby a movie studio only permits cinemas to exhibit its top films if they also agree to take its turkeys -- while simultaneously clawing back all of its (and now, Fox's) old films from exhibition in the nation's 600 struggling independent cinemas. This could push these indies -- already struggling with the hyper-concentrated, monopolized movie theater market, which underwent massive concentration thanks to lax antitrust enforcement -- over the edge, meaning that the kinds of movies that depend on these theaters for exhibition would have nowhere to go.

Then there's Disney's new streaming service, Disney+, which is priced at $6.99, below the rate of any of the other streaming services -- a price that Iger himself admits will lose the company money -- with the goal of acquiring more customers than any of the other streaming services, cross-subsidizing the service with it studios and theme-parks, until they can be crushed or acquired by Disney as well.

This has lots of economic consequences for other sectors as well, but the most obvious one is what it will do to creators, whose contractual royalties for re-releases and TV/cable will simply vanish, basically re-creating the old studio system in which actors and other creators were treated as property by the studios, literally bought and rented out or sold to other studios. After all, Disney has always used the existence of new distribution channels to weasel out of its obligations to pay its talent, and this could be the mother of all royalty-dodges.

As Stoller points out, this isn't just bad for artists, it's bad for audiences. Markets depend on customers making choices to discipline sellers who provide substandard or overpriced goods. But if Disney is able to establish and then maintain a monopoly on both home entertainment and theatrical exhibition, it needn't fear the market -- it can dictate to its audience what they will watch.

There are some important tech policy implications of all this: first is that as streaming becomes the key battleground for the entertainment giants, we're going to see a redoubled effort to ban DRM circumvention, redesigning the entire home computing ecosystem to resist user-modification, shutting out new market entrants who want to serve the demand for more flexible devices and systems (and there will be lots of collateral damage to streamrippers, file-hosting services, source-code repositories, security research, etc).

The second -- and even more dramatic -- implication of all this is that in a non-neutral internet environment, Disney is going to have to contend with the fact that its two major competitors have merged with monopolistic telcoms/cable companies: Universal/Comcast and Time-Warner/AT&T. These companies have both the technical capacity and -- thanks to Trump and his FCC Chairman, Ajit Pai -- the legal right to degrade or cap their customers' connections to Disney+, adding $10 or even $20/month to the priced-to-move $6.99 subscription fee.

What's more, 5G is total bullshit, and will not save them. Viacom has proven itself catastrophically bad at being an online service provider, so maybe they're ripe for a merger, acquisition or joint venture.

Given the abysmal state of competition law enforcement in America, they'd probably get away with it.

It's Time to Break Up Disney: Part One [Matt Stoller/Big]

(via Naked Capitalism)