10 Power Sector Insights from the IEA’s World Energy Outlook 2019

The post 10 Power Sector Insights from the IEA's World Energy Outlook 2019 appeared first on POWER Magazine.

The International Energy Agency's (IEA's) November 2019-released World Energy Outlook 2019 (WEO2019) is studded with interesting findings about emerging trends in the power sector. Here are 10 from the Paris-based autonomous intergovernmental organization's latest annual report.

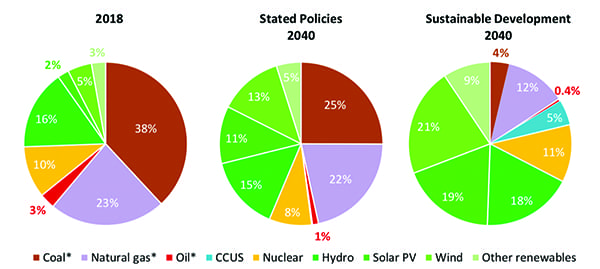

Explosive Solar Growth. Perhaps the most stunning finding is that IEA expects explosive growth for solar photovoltaic (PV) capacity through 2040. If countries pursue existing and already announced policies (a WEO2019 scenario that was formerly known as the "New Policies Scenario," and which the IEA renamed the "Stated Policies Scenario" in the new report), global installed solar capacity could surge from 495 GW in 2018 to 3,142 GW by 2040, and in just 15 years it could surpass coal and gas to become the largest source of installed capacity. If considered in terms of generation, the IEA suggests solar PV will grow from 592 TWh to 4,705 TWh-from a 2% share of global electricity generation today to 11% in 2040. The IEA is optimistic about other renewables too, especially wind, which could make up 13% of global generation in 2040, buoyed by offshore installations (see below), but also geothermal, which could grow from 90 TWh today to 316 TWh in 2040 (when it could make up 1% of global generation).

|

1. The global electricity generation mix in 2018 compared to what it could be in 2040 under two possible scenarios are shown in these pie charts. The International Energy Agency's (IEA's) "Stated Policies" scenario factors in current and already announced policies, whereas the "Sustainable Development" scenario is fully aligned with the Paris Agreement, which has an objective of holding the increase in the global average temperature to well below 2C above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5C. Source: IEA, World Energy Outlook, 2019 edition (WEO2019) |

Overall, the report suggests the share of renewable generation-not capacity-could nearly double, from 26% today to 44% in 2040, surpassing coal as early as 2026. Combined, solar PV and wind generation's share could surge from 7% to 24%. Comparatively (Figure 1), the share of fossil-fired generation could fall in 2040-down from two-thirds, where it has hovered for decades. Coal's generation share, which grew fivefold between 1970 and 2013, could decline from 38% today to 25% by 2040, though natural gas-fired generation, which has tripled over the past 22 years, is set to surge nearly 50% by 2040, owing largely to the cheap shale gas supply.

Flexibility to Grow 'Faster than Electricity Demand.' Power system flexibility is a special focus in the WEO2019. Researchers completed an exhaustive hour-by-hour analysis of power systems worldwide to gauge how countries are managing power plant acceleration and deceleration in response to changes in electricity supply and demand. While the report expects thermal power plants will continue to provide the bulk of flexibility through 2040, it also suggests batteries, demand response, and sector coupling will play pivotal roles. Battery storage, in particular, is accelerating. In 2018, developers added 3 GW to bring cumulative battery capacity to 8 GW. By 2040, owing to regional targets and dramatic cost reductions-the IEA predicts four-hour system costs could fall from $400/kWh to less than $200/kWh-batteries could provide 330 GW of flexibility. India could lead that growth, followed by China, the U.S., and the European Union (EU). However, that growth will require electricity market reforms ranging from scarcity pricing, operating reserve prices, frequency control ancillary services, and capacity mechanisms, some of which are already in place.

Net-Zero Targets Are Catching On. By the end of September 2019, more than a third of the world (65 of the world's 195 countries, along with the EU) had set or was actively considering long-term net-zero carbon targets. Several cities and states had made similar announcements, as well as major companies, which are increasingly driven toward decarbonization owing to an increased focus by shareholders on risks to investment from energy transitions and climate change impacts.

Gas Infrastructure Decarbonization Ramping Up. The WEO2019 also dedicates an entire chapter to gas infrastructure, noting the next decade will be "critical," because short-term decisions on whether to invest could have major implications. The reason: Interest in electrification, which promises to provide "modern energy services with no emissions at the point of use." The trend is tangible: global power demand has risen 60% faster than gas demand in final energy consumption since 2000, says the IEA.

But while electrification has a huge potential, the WEO2019 emphasizes there are limits to how quickly and extensively it could occur. It says current electricity infrastructure is not well-suited to deliver all types of energy services, such as to shipping, aviation, heavy-freight trucks, and certain industrial processes, and a future switch would depend heavily on variable generation, which raises practical issues, such as meeting demand for large-scale high-temperature heat. To secure a role in a low-emissions energy system, gas infrastructure must adapt to decarbonized gases, such as low-carbon hydrogen and synthetic methane (produced from fossil fuels with carbon capture or via electrolysis using renewables or nuclear) or biomethane (such as landfill gas). These aren't currently competitive with the natural gas supply today, but the IEA still urges policymakers to consider them in long-term strategies.

A Mixed Bag for Power Sector Investment. Energy investment stabilized in 2018 at more than $1.8 trillion, following three consecutive years of decline, but for the fourth year in a row, the power sector exceeded oil and gas supply as the largest investment sector. The WEO2019 projects that global power sector investments will total $20 trillion over the period through 2040-20% higher than annual spending from 2010 to 2018-representing 50% of total energy supply investment worldwide. The report also notes that annual power sector investment could average $900 billion to 2040. It suggests about $500 billion will be spent on power plants, including $360 billion for renewables, and more than $400 billion for networks, including $15 billion for battery storage. Annual spending could double for nuclear power-with more than 10% going to lifetime extensions-but it could fall by half for coal-fired power plants, and by 90% for oil-fired capacity.

Technology Costs May Favor Renewables. Using a value-adjusted levelized cost of electricity (LCOE), which does not include environmental externalities or network integration costs, the WEO2019 suggests solar PV will become the most competitive source of power in 2020 in China and India, and largely close the gap with other sources by 2030 in the EU and U.S. It suggests the global average LCOE of solar PV will fall by about 50% from 2018 to 2030. The competitiveness of conventional power plants could depend heavily on the availability of low-cost resources and market conditions. However, "In general, existing conventional power plants are more competitive with renewables than new builds, because they usually need to cover only their short-run fuel and maintenance costs to continue operations, and capital investment for refurbishment is lower than for new construction," it says.

Coal Power Not Going Away Soon. Under the stated policies scenario, global carbon emissions from the power sector will remain stable through 2040-even though power generation rises by almost 60%, owing largely to the renewables surge and continuing efficiency improvements at fossil fuel plants, especially natural gas plants. India, meanwhile, is set to overtake the U.S. in carbon dioxide emissions before 2030 to become the second-biggest emitter, behind China. Global emissions of sulfur dioxide could fall another 40%, nitrogen oxide by 25%, and particular emitter by 33%.

|

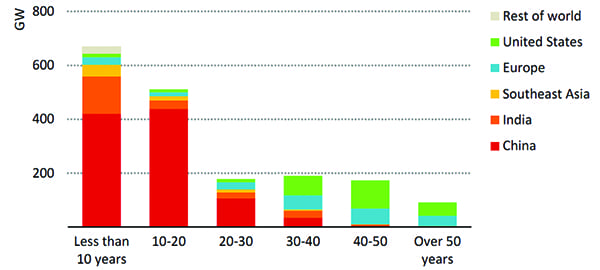

2. This chart shows global coal-fired power capacity by plant age. Asia is home to 90% of coal-fired power plants under 20 years of age. Source: IEA, WEO2019 |

In a special focus on coal plant emissions, meanwhile, the WEO2019 suggests more than 700 GW of the world's total 2,080 GW coal capacity worldwide is more than 25 years old today (Figure 2), but it refutes calls to shut even that amount down immediately, noting, "it would leave many countries short of sufficient supply and significantly compromise electricity security. Applying a strict lifespan limit to existing coal-fired power plants would also entail immediate financial challenges to the owners, which are a mix of state-owned and privately held companies." Around the world (and mostly in Asia), it notes, more than $1 trillion of capital invested in the existing coal fleet has yet to be recovered.

The agency offers a more "multifaceted approach" to tamping down carbon emissions from coal that depends on markets and economic implications, including retrofitting units with carbon capture, utilization, and storage (CCUS), or biomass co-firing equipment or repurposing them to provide system adequacy and flexibility. Those options, however, will likely be costly. CCUS would currently cost more than $1 billion/GW, it says.

Affordability Will Be a Concern in the Age of Electrification. According to the IEA, policymakers are specifically concerned about affordability as the emphasis on electrification continues. A WEO2019 sensitivity analysis identified three of the largest uncertainties that could affect future affordability: fossil fuel prices, the cost of wind and solar PV, and the cost of capital for all power generation technologies. However, it concludes that no single factor will yield changes higher than 12%.

The Next Big Market: Africa. Electricity demand in sub-Saharan Africa, where more than half the population have no access to power, is set to soar, and the IEA is optimistic that African countries will make progress to improve access rates. However, it notes, achieving full access by 2040 will require a significant expansion of the power system. By 2040, electricity output in the region could expand from 225 TWh today to more than 900 TWh. It will likely be supplied mainly by on-grid power, but decentralized solutions could also be heavily adopted. "Although on-grid solutions have traditionally served as the most cost-effective option to supply electricity in areas close to an existing grid, the falling costs of stand-alone solar PV and battery storage technologies as well as new business models using digital and appliance innovations are making these solutions more competitive," the WEO2019 says.

A Gust for Offshore Wind. Finally, the IEA is especially optimistic about offshore wind's potential to tackle the separate challenges facing energy transitions, noting that it is competitive (and could therefore enable low-carbon power and hydrogen production), flexible, affordable, and reliable. It projects that offshore wind capacity is set to grow into a $1 trillion business as current installed capacity expands from 23 GW installed in 2018 to 345 GW in 2040. Of specific note is that new offshore wind projects already have annual capacity factors of 40% to 50% or above, matching those of gas-fired plants in many markets, and significantly exceeding that of solar PV. Innovation in technology has improved turbine capacities and platform options, and new geospatial analysis shows its potential is enormous and widespread. However, the sector may still face challenges without long-term plans that emphasize effective system integration, including for transmission infrastructure.

-Sonal Patelis a POWER senior associate editor (@sonalcpatel, @POWERmagazine)

The post 10 Power Sector Insights from the IEA's World Energy Outlook 2019 appeared first on POWER Magazine.