YouTube has seen soaring growth in South Korea

Earlier this week, Google released revenue figures for YouTube for the first time in the product's history, revealing that the video service pulled in $15.1 billion in advertising revenues in 2019. Growth was 31% year-over-year during the quarter - strong growth for such a late-stage property, but of course, everyone always wants more. The company also claimed that it had an audience of more than 2 billion users - making it among the most popular products in the world.

Part of that global success comes from countries like South Korea, where YouTube has long been a serious laggard to local video players, but which has managed to penetrate the market much more heavily in recent years.

According to the latest data from Wiseapp, an app usage and retail revenue data service for the Korean market which is sort of a fusion of App Annie and Second Measure, YouTube has seen dizzying growth over the past few years, particularly among older, non-millennial users.

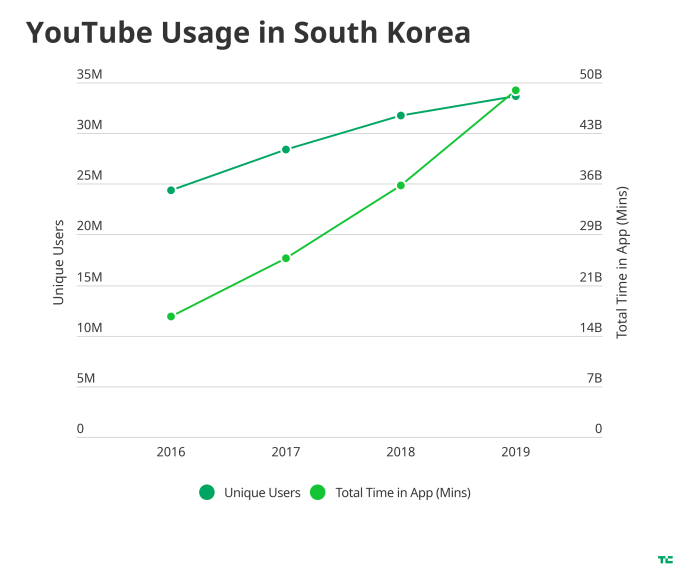

Based on data from Android users, YouTube has seen consistent increases in unique users in the market, almost to a point of saturation. At the end of 2019, Wiseapp estimated that YouTube had nearly 34 million Android users, up 6% from 2018 and 38% from 2016.

Data from Wiseapp, exclusively depicting Android users

For context, South Korea has a population of about 51.5 million, and local polling from Gallup puts Android penetration at roughly 80% overall. One serious caveat here is that there is a huge age discrepancy between Android and iPhone users - iPhone penetration among twenty-somethings is nearly half, while its penetration among users over 50 is in the low single digits.

While YouTube has had users aplenty for years, what's been striking has been seeing the increase in the average view time on the platform. Again, for Android users measured by Wiseapp, YouTube increased its total minutes viewed on its platform by 38% last year, and has seen 187% growth since 2016. The platform isn't just getting more users, but deepening engagement with those users over time.

A Google PR representative would not confirm third-party data about the platform's performance, but did say in a statement to TechCrunch that the hours of content uploaded to Korean YouTube channels grew by 50% between 2018 and 2019. The company also said that as of February 2019 (the most recent data available), "there are over 12,000 channels with over 10K subs, over 2000 channels with 100K subs and more than 200 channels with 1M+ subs in Korea."

What's changed in the local market? A handful of trends are lining up in YouTube's favor, helping it break through local competitors for the lucrative online video market.

First and perhaps most importantly according to local sources, more and more creators have moved their businesses to YouTube from other competitors due to better creator economics on the platform.

As Cynthia Kim at Reuters discussed in a profile article last year about the changing job market in South Korea, "YouTube creator" is a new career path for some young people interested in focusing on their interests and expressing their thoughts online for income. From the article:

"Among elementary school students, YouTube creator is now the fifth-ranked dream job, behind being a sports star, school teacher, doctor or a chef, a 2018 government poll showed."

As those creators have migrated to YouTube, so have users, or so the thinking goes. And so you see the number of popular channels increase, and the total number of video hours uploaded growing quickly to capture that increased usage.

Another dynamic at play is globalization. While many Koreans grew up watching Friends or Home Alone in their drive to learn English and compete effectively on the country's harrowing college entrance exam, YouTube offers a much wider vista into all kinds of places beyond those depicted by Hollywood.

As one former senior Korean technology executive, who once managed a competing product to YouTube, explained to me, the challenge for local players is that they just don't have the kind of global content library that is attractive for users. Local players have local content, and while engagement remains high, they lack the extended global content that platforms like YouTube can provide.

What's interesting is that Korean globalization has also worked the other direction. Korean dramas and Korean pop bands like BTS have expanded dramatically in global popularity over the past decade. Google said in its statement that the top 25 Korean bands on YouTube now receive 90% of their views from outside the country.

In short, YouTube has broken into an app ecosystem that is almost entirely local, and has even done so in a tough demographic like older users which have been particularly impervious to non-Korean apps. Messaging app KakaoTalk remains the country's most popular app, and the only other top-ranked foreign app is Instagram at number eight with an estimated 10 million Android users from Wiseapp's calculation.

While some analysts were surprised at YouTube's smaller than expected revenue numbers, it is clear that the platform is making headway in a variety of other international markets. As other emerging digital economies like India, Africa and Southeast Asia come online, expect even more competition in this category between this big global video product and local competitors.

With $4B food delivery acquisition, Korea poised to enter upper tier of startup hubs