Vestas, Siemens Gamesa, GE Top Wind Turbine Growth

The post Vestas, Siemens Gamesa, GE Top Wind Turbine Growth appeared first on POWER Magazine.

An energy and finance research group on Feb. 18 said Siemens Gamesa Renewable Energy's (SGRE's) offshore wind installations make it far and away the market leader in that category, while Danish wind turbine manufacturer Vestas continues to lead the onshore and overall wind turbine market.

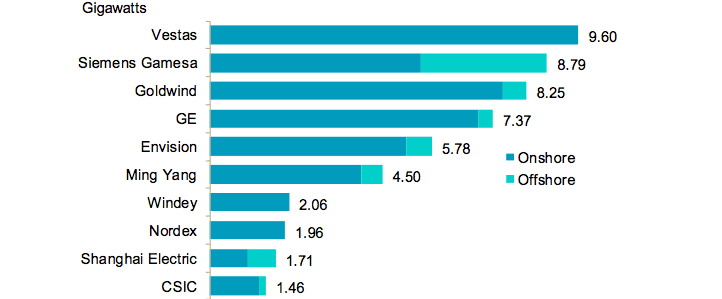

The report published Tuesday from BloombergNEF (BNEF) said Vestas took an 18% share of the wind turbine installation market in 2019-down from its 22% share in 2018-adding 9.6 GW of fully commissioned wind generation capacity (Figure 1), all of it onshore. BNEF said 53.2 GW of onshore wind generation capacity was added worldwide in the past year, with offshore additions bringing the overall new wind generation capacity total to just under 61 GW. Four companies accounted for about 55% of new wind power turbine installations: Vestas, SGRE, Goldwind of China, and General Electric of the U.S.

SGRE's dominance of the offshore market moved the Spain-based company to second place in the global rankings, up from fourth in 2018.

1. The top 10 global wind turbine manufacturers in 2019, ranked by installations of wind generation capacity entering commercial operation. Total fully commissioned wind capacity in 2019 was 60.7 GW. MHI Vestas capacity is not attributed to Vestas-organizations must own more than 50% of a subsidiary to receive credit. The top 10 from 2018: 1) Vestas 2) Goldwind 3) SGRE 4) GE 5) Envision 6) Enercon 7)Ming Yang 8) Nordex 9) Guodian UP 10) MHI Vestas Source: BloombergNEF

1. The top 10 global wind turbine manufacturers in 2019, ranked by installations of wind generation capacity entering commercial operation. Total fully commissioned wind capacity in 2019 was 60.7 GW. MHI Vestas capacity is not attributed to Vestas-organizations must own more than 50% of a subsidiary to receive credit. The top 10 from 2018: 1) Vestas 2) Goldwind 3) SGRE 4) GE 5) Envision 6) Enercon 7)Ming Yang 8) Nordex 9) Guodian UP 10) MHI Vestas Source: BloombergNEFBNEF's team of analysts annually reviews global wind power installations. The analysis includes only those projects that have been fully commissioned. BNEF said global commissioning of wind projects increased 22% in 2019 from 2018, thanks mostly to growth in the U.S. and China, and growth in the offshore wind market. The group said it expects a 24% rise in onshore and offshore project commissioning-or an additional 75 GW-this year.

Another company moving up in the rankings last year was GE Renewable Energy, which commissioned 7 GW of onshore wind generation capacity in 2019, a 40% jump from the 5 GW it brought online in 2018. Almost half of all new wind capacity projects in the U.S. last year installed GE turbines, pulling GE ahead of Vestas in terms of U.S. capacity. SGRE had the largest percentage increase in U.S. capacity, nearly tripling its total according to BNEF, and moving past Nordex into third place in the overall U.S. rankings.

SGRE recently was named as the turbine supplier for the massive 2,640-MW Dominion Energy Virginia Offshore Wind project, the largest announced project in the U.S. market to date.

Growth in U.S., China"Underpinning each of the leading onshore players is a strong presence in either the U.S. or China," said Oliver Metcalfe, wind analyst at BNEF and lead author of the "2019 Global Wind Turbine Market Shares" report. "2020 is set to be another strong year for installations in China and the U.S., as developers rush to build before subsidies lapse, but uncertainty post-2020 could expose some bigger players unless they diversify to new growth markets."

Vestas' 4-percentage-point drop in market share was the largest among the top 10 onshore turbine manufacturers. The top five global onshore turbine makers were unchanged from 2018, though growth in the Chinese market and increased installations there moved Ming Yang, Windey, and Dongfang Electric to sixth, seventh, and ninth place, respectively.

BNEF said slower growth in specific markets had a negative impact on some companies. "Enercon and Senvion saw commissioned capacity plummet as Germany's onshore wind market collapsed due to a shortage of available sites, litigation and drawn-out lead times for projects," BNEF said. "Suzlon suffered a similar fate in India, where project execution challenges resulted in installations falling short of expectations."

The report said 30.4 GW of generation capacity was added in the Asia Pacific region in 2019, followed by 13.3 GW in the Americas. The report said 9 GW of capacity was added in Europe. BNEF said its database noted new wind farms began full commercial operation in 43 countries last year.

SGRE's domination of the offshore market continued, with the company more than doubling its installations compared with 2018. SGRE commissioned almost 2 GW off the coast of the UK, including the 1.2-GW Hornsea Project One. The second part of the Hornsea project, a 1.4-GW installation, is scheduled to come online in the North Sea in 2022.

"This bumper year for offshore wind is just the start. If you look past a likely blip in 2020, installations are set to accelerate, breaking the 10 GW-a-year barrier in 2023," said Tom Harries, head of wind research at BNEF. "This growth outlook has led to intense competition between turbine makers. At the moment, the advantage lies with the manufacturer selling the most powerful turbine. Industrializing the production of a slightly smaller turbine through higher volumes could lower costs and prices. The opportunities for turbine makers to offset lower prices with long-term maintenance contracts is less clear than it is in onshore wind."

-Darrell Proctor is a POWER associate editor (@DarrellProctor1, @POWERmagazine).

The post Vestas, Siemens Gamesa, GE Top Wind Turbine Growth appeared first on POWER Magazine.