Kenya turns to its mobile-money dominance to stem the spread of COVID-19

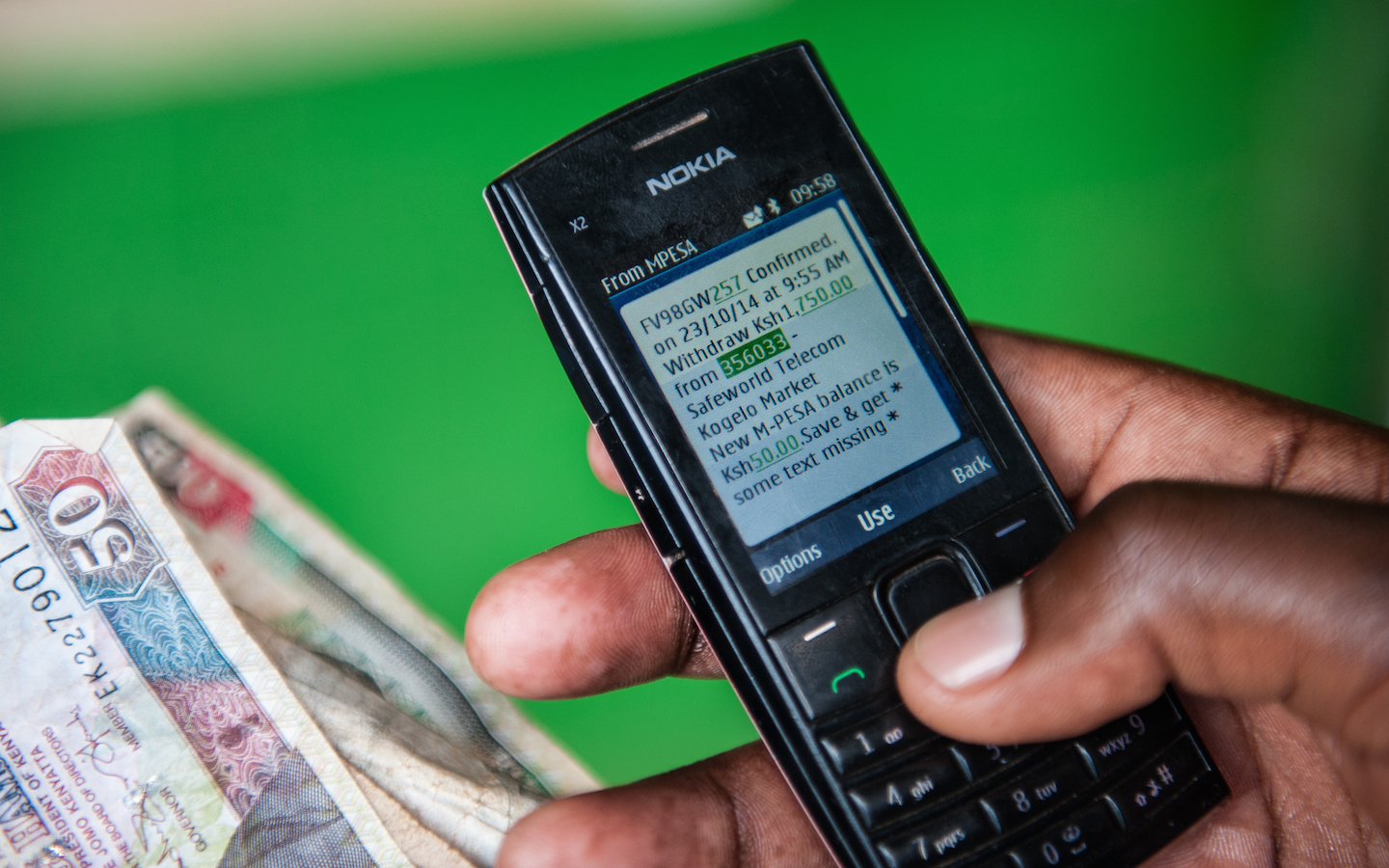

Kenya's largest teleco, Safaricom, will implement a fee-waiver on East Africa's leading mobile-money product, M-Pesa, to reduce the physical exchange of currency in response to the COVID-19 outbreak.

The company announced that all person-to-person (P2P) transactions under 1000 Kenyan Schillings (a $10) would be free starting Tuesday for the next 90 days.

The move came after Safaricom met with the country's Central Bank and per a directive from Kenya's President Uhuru Kenyatta "to explore ways of deepening mobile-money usage to reduce risk of spreading the virus through physical handling of cash," according to a release provided to TechCrunch from Safaricom.

To increase the use of digital-payments over cash, the East African telecom will also allow SMEs to increase their daily M-Pesa transaction limits from 70,000 Kenyan Schillings to 150,000 (a $700 to $1500).

The measures represent the ability of the Kenyan government to use digital-finance as a lever to influence social-distancing and P2P transactions in an infectious health crisis.

M-Pesa has 20.5 million customers across a network of 176,000 agents and generates around one-fourth ($531 million) of Safaricom's a $2.2 billion annual revenues (2018).

In some respects, having all that output on one platform represents systemic risks to Kenya's economy. But in the case of a global health pandemic spread by human contact, the dominance of mobile-money in the country provides a policy-tool to encourage digital vs. physical contact on a wide scale through financial transactions.

Kenya has only three cases of COVID-19 (aka coronavirus), according to Worldometer, but the country is taking cautionary measures. President Uhuru cancelled two foreign meetings due to the virus, the univeristy of Nairobi shut-down classes and a number of companies in the country are encouraging workers to telecommute, according to local sources and press reporting.