Electrification: Too Much of a Good Thing?

The post Electrification: Too Much of a Good Thing? appeared first on POWER Magazine.

Electrification has been a much-touted driver for the global energy transition toward decarbonization. But though an all-electric future could have vast implications for the power and gas sectors, achieving it may not be so smooth.

Though it may seem "electrification" has invaded the energy lexicon of late, according to Google, the term has been trending for decades. In fact, compared to the early 2000s, its use has diminished in recent years, which may be because its meaning has changed over time. As Mark Howard, CEO and president of the Electric Power Research Institute (EPRI) suggested, "electrification" initially pointed to "the extension of electrical service to people who lacked it," referencing efforts, for example, by the U.S. federal government's 1930s-established Rural Electrification Administration to connect roughly 90% of the nation's rural dwellers to the grid.

That definition is still relevant in developing countries, but in the context of a modern grid the conversation about electrification has today shifted toward efficiency. "In moving electrification beyond the basic (and binary) question of haves and have-nots, [efficient electrification] looks to an [integrated energy network] to help achieve the most efficient use of energy, the cleanest production, delivery and use of that energy, and measurable benefits to consumers, workers, drivers, and others," Howard said. It's why the International Energy Agency (IEA) projects that while electricity's share of final energy consumption could soar to 31% by 2040 from about 20% today, the overall final use of energy could grow only moderately-and even fall, he said. That points to several benefits for the energy system overall: One, it becomes "cleaner" at the point of use, and two, it becomes more dynamic, positioning it to absorb "more technology, more systems, and more participants," he said.

|

1.ABB, which is expanding its e-mobility business through the provision of fast-charging stations, in January 2018 became a partner of the ABB FIA Formula E Championship-a fully-electric race series. The company says its high-power direct-current fast-charging stations are able to deliver enough energy for 100 kilometers of range in just four minutes. Courtesy: ABB |

As experts told POWER, if viewed broadly, the three end-use sectors electrification could transform sizably are transportation, advanced heat pumps, and industrial process equipment. As Guido Jouret, chief digital officer (CDO) at ABB, told POWER in February, the Zurich-based power and automation technology group is convinced that the transportation sector will have perhaps the most sizable impact on load growth, which is why it has of late sharpened its focus on the electric vehicle (EV) fast-charging market (Figure 1). The company forecasts that most forms of transportation will be electrified by 2035, which will mean "we're going to need 70% more electricity," he said.

The main reason ABB is so bullish on the adoption of EVs, he said, is driven by innovation in battery technologies. Within "a year or two, the cost [of] buying an EV will start to get cheaper than a similar internal combustion engine [ICE] car," and at that point, people "will simply vote with their wallets," Jouret said. Refuting some projections that EV adoption will be stymied by battery lifetimes, he added, "We think that some of the initial doom and gloom around battery life is over and done," noting that more companies are introducing effective efforts to help consumers manage battery degradation.

Echoing several experts POWER talked to at DISTRIBUTECH International in January, Jouret suggested the rapid EV uptake will start with light trucks. "Electric vans today are already competitive with ICE. Not only that, they're being prodded and encouraged by local regulation, so cities like London and Paris are saying they don't want ICE delivery vehicles in their city centers by 2025." The second wave of adoption, "which is already happening," will come with passenger cars, followed by long-range trucking and shipping. "Last to adopt power will probably be the airplanes, because the weight and energy density is at a premium," he said.

While the IEA agrees transportation is poised to affect average power demand, it says, citing a "Future is Electric" scenario (which it introduced in 2018 to explore the limits of end-use electrification), that a larger impact may come from electrification of buildings and space heating. Meanwhile, among emerging sectors that promise to boost load growth are indoor agriculture and edge-computing, as Mark Feasel, president of Schneider Electric's North American Smart Grid business, told POWER. However, Feasel cautioned that understanding where the potential lies is highly dependent on a number of factors, such as economic growth, existing infrastructure, and existing electric demand and supply.

The Limits of End-Use ElectrificationThese are crucial challenges-and they aren't the only ones. According to the IEA, even in the most optimistic case, how quickly and extensively electrification can occur is limited. Under the "Future is Electric" scenario, for example, the IEA assumed that policies will remove non-economic barriers to the deployment of electric end-use technologies, that a rapid adoption of connected devices lead to more power demand in buildings and data centers, and that universal electricity access is achieved worldwide by 2030.

Still, it concluded that electricity is not well-suited to deliver all types of energy services, for example, to shipping, aviation, heavy-freight trucks, and certain industrial processes. "While in the future these sectors could use fuels that have been generated using electricity (such as hydrogen or synthetic fuels), these liquid or gaseous fuels would need a separate delivery infrastructure," it noted. Also, and as crucially, making the switch to electricity raises a number of practical issues. To achieve full-fledged efficient electrification in the industrial sector, for example, the provision of large-scale high-temperature electric heat would require significant changes in their design and operation.

The economic case is also a valid concern. Industrial facilities, for example, tend to have long lifetimes and slow turnover of capital stock. Also, the highly integrated nature of industrial processes could mean that changing one part of a given process would often require changes to other parts. "In the buildings sector, meanwhile, installation of an electric heat pump in place of existing gas heating can mean an intrusive retrofit with a much higher upfront capital cost than replacing an inefficient boiler with an efficient one," said the IEA. "In addition, many high-rise urban buildings are not suitable for heat pumps."

A Burden on the Grid?Under its highly optimistic "Future is Electric" scenario, the IEA projects that average global electricity demand would grow by about 3% per year to 2040 to accommodate new sources of direct and indirect electricity use. Because electrification is a key facet of decarbonization, it would necessitate a massive ramp up of low-carbon generation, adding a new burden to some already heaving, aging grids around the world. The prospect of new wind and solar additions, meanwhile, would require "huge increases" in storage capacity to accommodate shifting hourly, daily, and seasonal demand. "For example, if heating in all buildings in Europe was switched to electricity using heat pumps, peak winter electricity demand would increase by more than 60%," the IEA projected. Today, it noted, batteries still cannot cope with large seasonal swings, and the expansion of pumped storage hydropower is limited by geography.

The solution would need to be twofold, Jouret said. First, it would require the build-out of more high-voltage direct-current (HVDC) transmission. Second, it would need an overhaul of the distribution grid to become a "bi-directional peer-to-peer grid," in somewhat the same way that the "telephone network became the internet." Key to that overhaul will be finding ways to stabilize that infrastructure for reactive power. "We need a much more agile, much more dynamic grid that's able to cope with that and achieve the goal of stability of supply and demand," he said.

As some experts noted, however, overhauling of the distribution grid to accommodate demand from EVs will require massive investment and serious regulatory wrangling. Doug Houseman, principal consultant with 1898 & Co., a Burns & McDonnell company, is not optimistic. "You take a typical 5-kV line, and that line might support one household in 10 having an EV-any EV beyond that and the circuit is in trouble," he told POWER. "If we're going to get 100% of the cars being electric at any point in the future, we're going to have to think about rebuilding all of the distribution grid-not just a piece of it-all of it. We're going to need to literally tear down all of it and replace it." Houseman underscored that the feat is immense, and that it will require "starting early, which means changes to regulation, changes to legislation, [and] changes to the way utilities think."

|

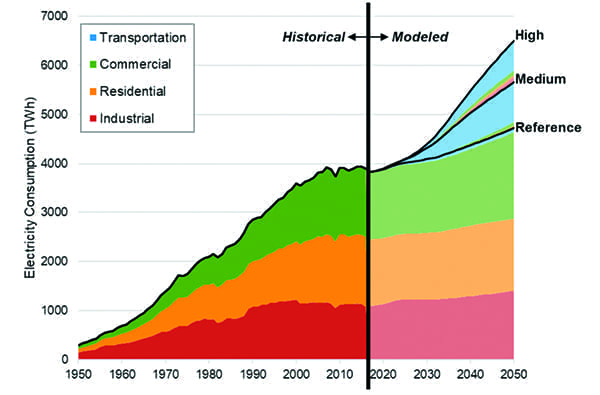

2. In its June 2018 Electrification Futures Study, the National Renewable Energy Laboratory (NREL) projects that even with "limited impacts" from electrification, U.S. electricity consumption could increase 21% over the 2016-2050 period (using moderate assumptions about technology changes), resulting in a compound growth rate of 0.65% per year. In the medium and high scenarios, which assume "widespread electrification," electric consumption growth is 45% and 67%, respectively (compound annual growth rates of 1.2% and 1.6%, respectively). Source: NREL |

For U.S. utilities, specifically, the prospect of "deep electrification" will require major investment to prepare for a projected load increase of up to 56 TWh from EVs alone (Figure 2), and much more with electrification of buildings, heating, and industry, said Omar Al-Juburi, a partner in Ernst & Young LLP's Power & Utilities group and EY Americas' Digital Grid leader. But, "if they are well-prepared, utilities can capture new revenue opportunities from emerging EV value pools that improve the reliability and resilience of the power system," he said.

Meanwhile, though the IEA encourages policymakers to engage on grid modernization efforts, it also urges them to consider the value of "overlapping infrastructure," such as a parallel gas infrastructure, because it "adds a layer of resilience compared with an approach that relies exclusively on electricity." The risk exists, it noted, that the development of new electricity networks may not increase "at the pace needed to displace existing fuels while meeting energy service demands." Electrification, it noted, won't happen "instantaneously." The IEA has even promoted a gradual pace of electrification uptake owing to uncertainties that could affect future affordability of power, such as they involve grid modernization costs, fossil fuel prices, the cost of wind and solar PV, and the cost of capital for all power generation technologies.

Aside from a surge in electricity demand, as a key tenet of decarbonization, electrification could further reshape electricity mixes around the world. In a June 2018 study, the National Renewable Energy Laboratory suggested "widespread electrification" would tamp down demand-side fuel use of gasoline by 74%, 35% for diesel, and 37% for natural gas in 2050 (in a "high" scenario). The lab also noted, however, "it is possible that some of the reduced on-site natural gas use would be offset by greater gas-fired generation."

|

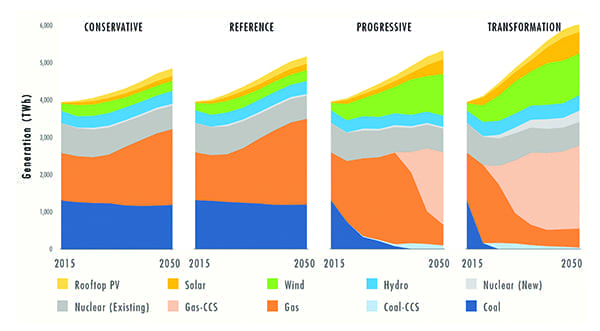

3.Electric sector generation mix over time by technology and scenario. In the Reference scenario, technology costs and performance improve over time across the economy, in some cases rapidly, based on anticipated technology trends. The Conservative scenario considers a slower decline in the relative cost of electric vehicles. In the Progressive scenario, carbon is valued at $15/ton CO2 starting in 2020, and in the Transformation scenario, carbon value starts at $50/ton CO2 in 2020. Source: U.S. National Electrification Assessment, Electric Power Research Institute, 2018 |

EPRI, meanwhile, projected in its 2018 U.S. National Electrification Assessment that in a conservative case (which assumes a slower decline in the cost of EVs), if electricity consumption soars from 21% in 2015 to 32% of final energy consumption in 2050, natural gas use would grow 33%. In the "Transformation" case (which assumes a stringent carbon price), if electricity's share surges to 47% of final energy consumption, natural gas use would still grow 18% (if gas generation is equipped with carbon capture and storage), mainly because EPRI assumes that even in this case, carbon-free generation (renewables and nuclear) would only make up half the generating profile (Figure 3).

Tangible Progress Around the WorldWhile it's difficult to measure current progress, it is clear that electrification has made some headway in some regions around the world. According to the Edison Electric Institute (EEI), a U.S. trade group for investor-owned utilities, about 1.3 million of the 260 million passenger vehicles today are EVs, and activity on the regulatory front to accommodate them has ticked up. Meanwhile, electric utilities are today investing $1.4 billion in programs to help accelerate the electrification of the transportation sector, largely to deploy charging infrastructure for EVs, EEI said.

In Europe, where 63% of the region's total final energy consumption is projected to become electric by 2050, the power sector is making a concerted effort to electrify transport, buildings, and industrial processes. Power sector trade group Eurelectric said it is "engaged to ensure that electrification in industry is economically and ecologically sound. Hydrogen and other carbon-neutral alternatives will also play a role and drive indirect electrification, using clean fuels which are produced with the help of carbon-neutral power as well."

In Asia, every country has a "very diverse requirement" for electrification based on their current generation capacity and need for additional power to fuel their social and economic growth, said Narsingh Chaudhary, executive vice president and managing director for Black & Veatch Asia's power business. Thailand, for example, has reported a significant increase in the number of EVs registered in 2019, while Singapore was identified as a top Asian destination to set up data centers, he noted. Among key trends Chaudhary outlined for POWER are that regional leaders have started investing in "integrated power infrastructures," which "take advantage of different generation, transmission, and distribution technologies to help utilities overcome the pitfalls of aging infrastructure assets while meeting rising customer demand for energy that is renewable and reliable."

Digital transformations have also begun to play a key role in Asia's electrification ambitions. "Digital transformations address core challenges of grid stabilization, renewables integration supported by energy storage systems, peak load management, system flexibility, and reliability in a holistic manner. One opportunity the region is considering is the remote and integrated management of assets for the complete value chain through data analytics and predictive maintenance," he said. a-

-Sonal Patelis a POWER senior associate editor.

The post Electrification: Too Much of a Good Thing? appeared first on POWER Magazine.