Y Combinator graduate H1 closes on $12.9 million for its professional healthcare database

Just months after graduating from Y Combinator, href="https://h1insights.com/"> H1 Insights, the LinkedIn for the healthcare industry has raised $12.9 million in a new round of funding.

"It's a better way to connect the ecosystem," says co-founder Ariel Katz. The company already has over 8 million profiles for healthcare professionals in its database and is generating multiple millions of dollars in revenue, according to Katz. The company said it's seen 350% growth over the last year and already counts 35 pharmaceutical companies among its customers.

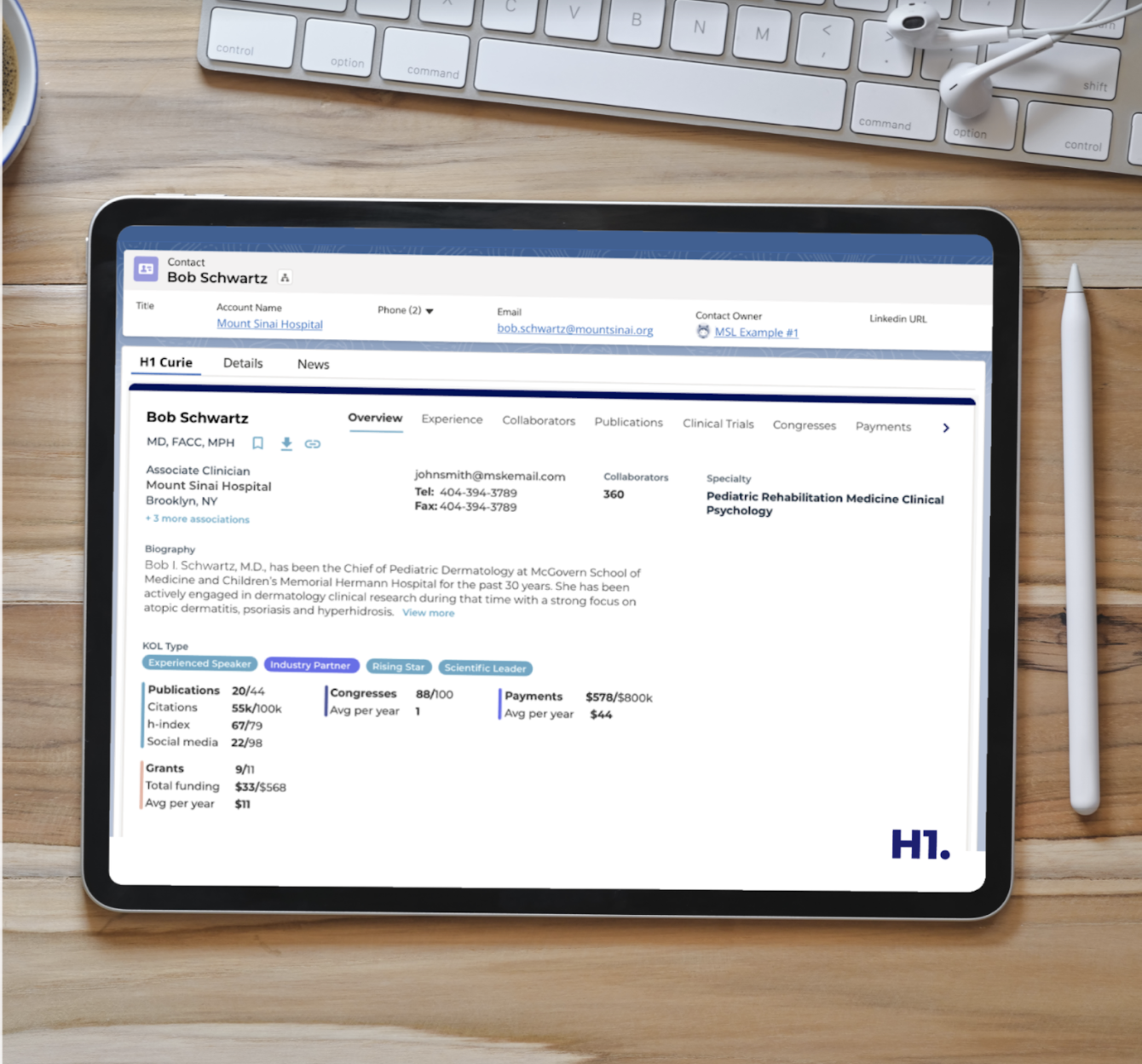

H1 Insights is giving the healthcare industry the ultimate professional database

By scraping public records and working with healthcare systems, payers, and data brokers H1 has amassed perhaps the most comprehensive profiles of medical professionals and service providers including their expertise, interests, publications, location, speaking engagements, and involvement in clinical trials.

Katz envisions a service that allows doctors to communicate with each other across specialties and a better way for pharmaceutical companies to find physicians that can be relevant to new pharmaceutical trials and treatments.

And the company continues to see growth even with pharmaceutical companies freezing their clinical trials. The outbreak of COVID-19 has forced most companies to halt clinical trials as most patients avoid hospitals for nearly everything but the most vital medical procedures, but H1 Insights offers services for pharmaceutical companies' medical affairs department, who are still looking for healthcare officials to collaborate with, says Katz.

The company's $12.9 million Series A round closed in February and was led by Menlo Ventures . Other investors included Baron Davis Enterprises (the eponymous personal investment vehicle for the NBA star), ClearPoint Investment Partners, Cloudera co-founder, Jeff Hammerbacher, Liquid 2 Ventures (the investment fund founded by former NFL superstar Joe Montana), Novartis dRx, and Underscore VC.

H1 signed its term-sheet in February, but wasn't forced to reprice its round as the pandemic began to spread. With that cash now in hand, the company is poised to go on a massive hiring spree, says Katz.

"Advances in machine learning and AI are creating new opportunities to leverage data for a positive impact on human health," said Greg Yap, partner at Menlo Ventures, and a new addition to the H1 board. "H1 is harnessing the power of this data and providing a robust platform for pharma, biotech and life sciences companies to connect with healthcare professionals. Their early traction is promising and shows that it meets a clear need for the industry."