Startups Weekly: Investors are keeping terms friendly —instead they say ‘no’ more often

[Editor's note: Want to get this free weekly recap of TechCrunch news that startups can use by email? Subscribe here.]

Multiple liquidation preferences, full-ratchet anti-dilution clauses and pay-to-play provisions are some of the words that still haunt startup founders who survived downturns in decades past. So far in this downturn, though, investors seem to be sparing the brutal terms that tend to surface when the money has all the leverage.

Why? It's easier to let a company fail by saying no to funding* than it is to hold them along with terms that can't possibly inspire the common stockholders - or so one can read between the lines from investors, founders and tech lawyers that Connie Loizos talked to for TechCrunch this week.

Overall, investors seem to fear hurting their long-term reputations and missing out on the next great company, same as it has been in the startup world for many years. Again, at least so far.

As lawyer Mike Sullivan, a partner and head of the corporate group in Orrick's San Francisco office, notes, there simply aren't enough deals being closed right now to draw any sweeping conclusions. "I haven't seen investors try to take advantage of companies as a result of the crisis," says Sullivan," but I don't have a lot of data points. I think it's still too early to tell whether we'll see the terms that we saw in the nuclear winter of 2001 and 2002," after the dot-com boom ended.

Your mileage may vary, of course. One New York attorney said that the harshest terms recently were coming from growth-stage firms on the East Coast, who had always been more focused on the numbers anyway.

*Speaking of saying no, a new report out by tech law firm Fenwick & West details a sharp decline in Silicon Valley funding in March that we all knew was happening. More analysis by Alex Wilhelm over on Extra Crunch.

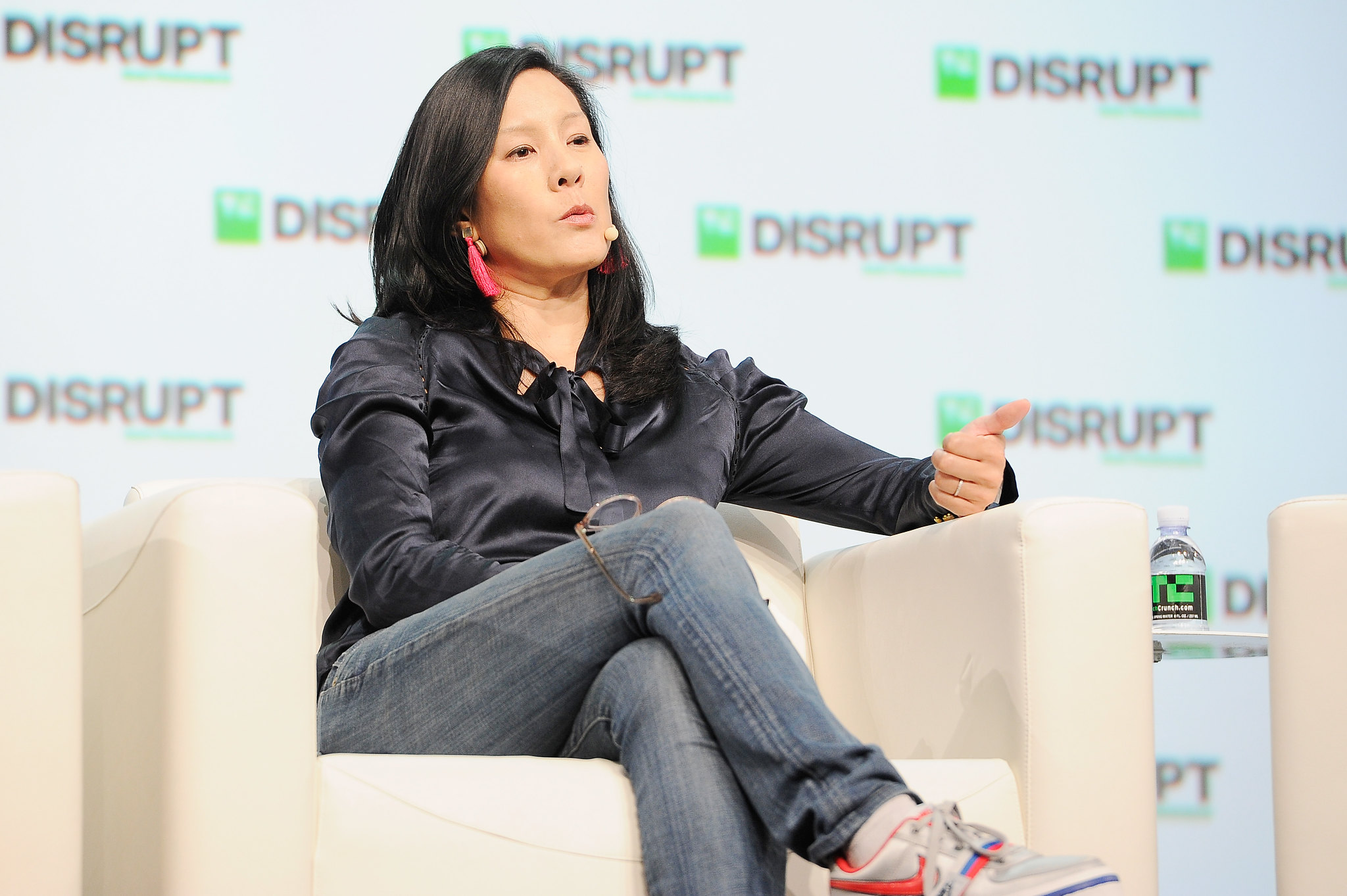

Many venture firms that started out small a decade or two ago became later-stage as their portfolios grew along with booming markets. Now they have a lot of later-stage work to do. The result is that founders may have more success with raising from dedicated early-stage investors than with multi-stage founds. Here's more on the dynamic, as described by Aileen Lee of Cowboy Ventures to Jordan Crook in our first (and very popular, thanks for attending everyone) live video call in a series that we're calling Extra Crunch Live:

But I think the multi-stage firms that, say, have an early-stage fund and a growth fund, they're in a different zone. Oftentimes, they have many portfolio companies that have really high burn rates and they have a lot of money, so they've got a different level of triage going on with those portfolio companies. Also, in some cases, because the market's been so hot for the past 10 years, they've had a shopping list of companies that they wish they had been able to invest in, and maybe those companies may take an extra $50 million or $100 million dollars right now. So, a lot of the multi-stage firms are going to focus on getting a little more money into Stripe or Airbnb or the companies that they wish they had exposure to.

She goes on to note that many investors are now ready to start investing generally, and she's now spending 50% of her time talking to new companies (versus almost all portfolio work just a couple of weeks ago).

Image Credits: Freepik / Kristina Astakhova (opens in a new window) / Getty Images

The boom in spontaneous social appsClubhouse has been getting the most attention in some tech circles lately, but it's part of a much larger trend that Josh Constine has been tracking for TechCrunch. The 'spontaneous' apps that make it easy to talk to everyone else now in quarantine could also break down existing barriers in how we communicate long into the future. Here's how he defines the concept:

What quarantine has revealed is that when you separate everyone, spontaneity is a big thing you miss. In your office, that could be having a random watercooler chat with a co-worker or commenting aloud about something funny you found on the internet. At a party, it could be wandering up to chat with group of people because you know one of them or overhear something interesting. That's lacking while we're stuck home since we've stigmatized randomly phoning a friend, differing to asynchronous text despite its lack of urgency.

The big question is if people will stay spontaneous once thing normalize and we all can go back to our old routines. Given the long-term trends toward remote work and more private, personalized communication, I agree with Josh that we're looking at a real part of the future.

Oh also, want to hear about Clubhouse more, still? Don't miss Equity Monday this past week.

Image Credits: Paper Boat Creative / Getty Images

What fintech investors see in the pandemicIn our latest set of weekly investor surveys for Extra Crunch, we checked in with top fintech investors about how they are dealing with the pandemic, and separately, what trends they are focusing on long-term. Here's Matt Harris of Bain Capital Ventures on what it takes for a fintech startup to survive (and succeed) now:

Around TechCrunchThe survival of fintech startups through 2020 is less about stage and more about the two dimensions I mentioned earlier - vulnerability in terms of cash balance, burn, and durability of revenue, and direct impact of COVID-19 on their topline. Regardless of stage, startups will face both operational and fundraising challenges. Many of the companies that survive will do so out of sheer luck of their business model or fundraising timing, while others will have to actively change the way they operate in today's world. In general, we've seen the most strength in B2B focused companies with recurring revenue models, particularly those focused on helping businesses automate and move analog processes online.

Extra Crunch Live: Join Mark Cuban for a Q&A on April 30 at 11am ET/8am PT

Extra Crunch Live: Navigating the pandemic with an equitable lens

Throw us your best 60-second pitch on May 13 at Pitchers and Pitches

Introducing the Digital Startup Alley Package for Disrupt SF

Across the WeekTechCrunch

Y Combinator officially shifts its next accelerator class to fully remote format

The pandemic will force sports to reimagine the fan experience

How to make sense of the coronavirus chaos

What is contact tracing?

Can employers mandate COVID-19 testing?

Extra Crunch

An IPO? In this economy?

Dear Sophie: How can we support our immigrant colleagues during layoffs?

The changing face of employment law during a global pandemic

6 investment trends that could emerge from the COVID-19 pandemic

Will China's coronavirus-related trends shape the future for American VCs?

From Alex:

Hello and welcome back to Equity, TechCrunch's venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week we had a choice of all sorts of news, but as we cut the show together as a group Danny pushed all the funding rounds up. So, when Alex and Natasha jumped into the show we had a bunch of good news to cover. We're avoiding COVID-19 news, but the pandemic is just a part of the broader stories we want to tell. For the foreseeable future, coronavirus will be always be part of our interviews. But the conversation can't start and stop there.

So what was on the docket? Three things: Accelerator news for the early-stage founders, funding rounds, of course, and some layoff news that was worth mentioning as it might trickle down beyond the unfortunate hosts.