Offshore Wind Finding Direction in U.S.

The post Offshore Wind Finding Direction in U.S. appeared first on POWER Magazine.

Europe has a big head start globally when it comes to generating power from offshore wind installations. The U.S. has lagged due to a variety of factors, including the need to work through regulatory issues. Industry insiders, though, agree the sector is poised for rapid growth off American shores.

Offshore wind installations already are delivering on their promise as a transformative technology for power generation, with projects off European coasts providing proving grounds for the industry. U.S. adoption of offshore wind has been slower, owing in part to regulatory issues and political will.

|

1. The Block Island wind farm off Rhode Island, a POWER Top Plant in 2017, is still the only operating offshore wind installation in the U.S. Several new projects, though, are expected to come online over the next few years. Courtesy: Deepwater Wind |

The first commercial offshore wind farm in the U.S.-the 30-MW Block Island installation off the Rhode Island coast (Figure 1)-began operation in late 2016, and as of April 2020 is still the nation's only operating project. The U.S. Department of Energy (DOE) said recently the country has the potential to access more than 2,000 GW of offshore wind power along the nation's coasts and the Great Lakes, and several projects are in the development stage, most along the Eastern Seaboard.

More Offshore Wind News: Orsted Projects Delayed by Pandemic

Offshore wind has proven to be invaluable to other parts of the world but that doesn't mean it's not without its challenges, both from a political and infrastructure development standpoint," said Anthony Bond, president of BOND Civil & Utility Construction-a company based in the Boston, Massachusetts, suburb of Medford-in a question-and-answer session with POWER. We've been hearing about offshore wind for quite some time, but I think the development of larger turbines [up to 12 MW per turbine] coupled with the lessons learned' from Europe and more reasonable price points will finally allow offshore wind to take off. I think the challenge will be aligning all lines of government to ensure that it goes forward."

That alignment has been lacking as companies line up to pursue offshore wind projects, only to be stymied by government red tape. The Trump administration through the Bureau of Ocean Energy Management (BOEM) last year raised concerns among U.S. developers when it delayed the 800-MW Vineyard Wind project off Massachusetts, calling for further environmental review of the installation, saying it needed to look at the combined impacts of all projects planned off the East Coast. Industry analysts have said those types of issues must be solved for the U.S. offshore sector to grow.

I would call it the two C's, commercialization and conformity," said Robert Freedman, an energy expert and partner in the Project Development & Finance practice at New York-based Shearman & Sterling, told POWER. Conformity is, you need some type of uniform set of rules that people can understand, that people can trust are the same, and can be applied similarly. The EU [European Union] has a directive for offshore wind, a much more uniform regime. The U.S. has a patchwork... even with the BOEM, it's not clear how it will be applied. When you have that type of situation, where [you] just don't have the conformity among different jurisdictions and even within the same agency, a clear path or message, that's going to make it very difficult."

Freedman added, As far as commercialization, there similarly needs to be a clear path, as to this is the technology we're going to use." He said the investment community is looking for environmental, social, and governance (ESG) platforms. The next move is toward next level, commercializing ESG," he said. There's too much uncertainty right now. How am I going to deal with a situation like the Vineyard issue? What if the project gets delayed, and how do I know when [it will be in operation]?"

What is lacking is a coherent public policy program supportive of the offshore space," John Miller, ESG senior research analyst with Calvert Research and Management, told POWER. In the U.S., most prime offshore locations are owned by the federal government, requiring leasing and environmental negotiations with the BOEM. Wholesale power markets are regulated by the federal government via FERC [Federal Energy Regulatory Commission], but most of this day-to-day is executed by the ISO [independent system operator] or RTO [regional transmission organization], requiring successfully bidding into these markets. Lastly, the states dictate final rate structures for consumers, meaning a project will need to successfully manage the utility-level offtake process. All three of these negotiations are time-consuming and lack developed processes or timelines. Further, all three of these negotiations can be project killers, either from an environmental/permitting perspective or from cost."

Looking to EuropeFabio Fracaroli, senior director, ABB Power Grids, told POWER the U.S. should look to Europe for examples of how to grow the offshore wind industry. Europe has been pioneering the evolution of offshore wind. In 1991, Denmark's Vindeby was the world's first offshore wind farm. Europe has been successful in their offshore wind efforts due to differences in their policy, regulatory, and market conditions. Differences in the relative market conditions there also offered an avenue for them to bring this forward earlier."

Fracaroli continued: Globally, but especially in the U.S. [with its regulated and deregulated structure], renewables need to compete with other energy sources in terms of cost, and in the early years, wind power was one of the more expensive sources out there. Countries like Germany offered quite a bit in terms of incentives, which made offshore wind projects viable. Now, wind power has achieved more of a parity with other sources, where it can compete on a more level playing field in terms of cost. We're also seeing heightened focus and more local incentives now in the U.S. to make these projects more attractive to develop from an economic standpoint, notwithstanding the obvious environmental benefits."

Said Miller: European countries, specifically the UK, Germany, and increasingly Denmark, have committed to direct policy support seeking to commercialize offshore wind technologies. Policy support has included national utility level feed in tariffs (FITs), which require utilities to buy power from select technologies or pay penalties; capacity auctions limited to offers from offshore wind; or price support through auctioned contracts for differences payments, which insure a stable payment level over the period of the power purchase."

Miller acknowledged that policy support has not been perfect in Europe. Questions about the cost of FIT programs and long-term fixed payments agreed [to] in the early 2010s have led to changes in policy programs and a pass-through of final billing burdens on European consumers. What this policy support has done, however, is to begin the process of commercializing a new technology, building the logistic and manufacturing base need for cost-effective installation, and driving down total production cost curves through economies of scale," he said.

Billions in Economic ImpactThe U.S. Offshore Wind Power Economic Impact Assessment," published in March by the American Wind Energy Association (AWEA), estimates that developing 30,000 MW of offshore wind along the East Coast could support up to 83,000 jobs and deliver $25 billion in annual economic output by 2030."

Offshore wind is key to the future of clean energy development in the U.S. and will add to a thriving wind power industry that already represents the largest source of renewable energy in the country," said AWEA CEO Tom Kiernan in a news release about the report. The offshore wind industry will create tens of thousands of jobs and provide billions of dollars to the economy, while delivering on its enormous untapped potential to power major population centers up and down the East Coast."

According to the report, AWEA anticipates 20,000 to 30,000 MW of offshore wind capacity will be operational by 2030," and could bring investment of $57 billion. The report estimates that developing that amount of offshore wind generation capacity will support up to 45,000 jobs by 2025 and 83,000 jobs by 2030."

That growth likely hinges on government support and a better structure for permitting. As an example, the Trump administration through the BOEM now expects to issue a record of decision on the Vineyard Wind project in December of this year, revised from the original date of August 2019, and three years after the developers submitted their original construction and operations plan to the agency.

Walter Cruickshank, deputy director of the BOEM, speaking at an offshore wind conference in Galveston, Texas, in February, acknowledged the permitting process for Vineyard Wind has been problematic. Cruickshank said after the BOEM issued a draft environmental impact statement (EIS) for Vineyard Wind, the East Coast market became very competitive," with several more projects proposed.

It became clear to us that we had not considered the full range of environmental impacts in the draft EIS," Cruikshank told the Texas audience. That included possible impacts to regional fishing and resulted in the BOEM calling for a new supplemental draft EIS. Vineyard Wind, located about 15 miles south of Martha's Vineyard and featuring 84 MHI Vestas 9.5-MW turbines spaced about 0.8 miles apart, is now expected to come online in 2023.

|

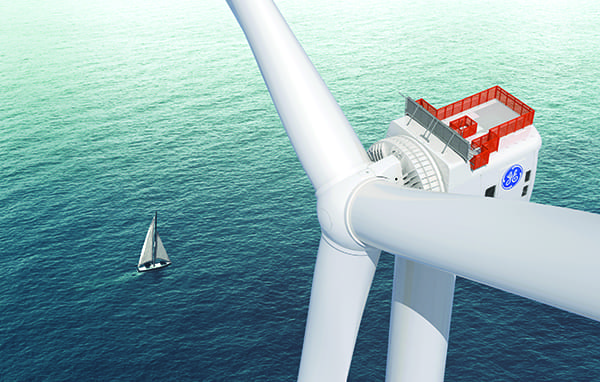

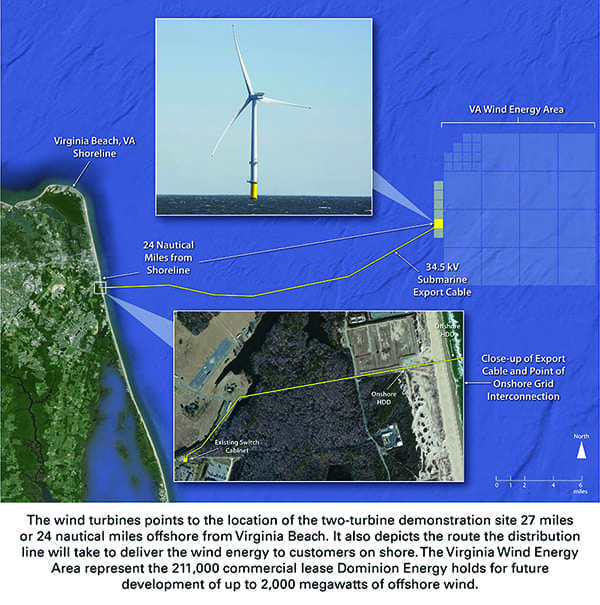

2. The Coastal Virginia Offshore Wind project was the first U.S. offshore wind project approved by the Bureau of Ocean Energy Management. It is expected to begin service this year. Courtesy: Dominion Energy |

In the meantime, other smaller projects move forward. The Coastal Virginia Offshore Wind project (Figure 2), which a few years ago was the first offshore wind project approved by the BOEM, could begin service this summer. The project, part of Dominion Energy's commitment to have 3,000 MW of solar and wind energy under development or in operation by the start of 2022, features two 6-MW Siemens Gamesa wind turbines and is located about 27 miles off the coast of Virginia Beach, Virginia.

Connecticut, Maryland, Massachusetts, New Jersey, New York, and Virginia have targets to procure a total of 25,400 MW of offshore wind generation capacity before 2035. State leaders are seeing the environmental and economic promise of offshore wind and are stepping in to provide the vision and policies to help this industry quickly achieve scale," said Kiernan.

And Spain's Iberdrola, which controls Avangrid in the U.S., in late March announced two pilot offshore projects, saying it wants at least one floating turbine installation operating in 2022, with a second soon after. The company said it's looking to install floating turbines alongside bottom-fixed projects.

Oil and Gas Companies Take Investment RolesMuch of the investment in offshore wind is coming from companies with a long history of energy development-namely, oil and gas firms, in part because of their experience drilling and working in offshore environments. Mike Williams, deputy director of the Minneapolis, Minnesota-based BlueGreen Alliance, in an interview with POWER said, The folks behind Vineyard Wind, all of them have sizable backing, and most are out of the oil and gas industry. Offshore wind is such a capital-intensive effort, I couldn't imagine a small startup participating. That's where you see the oil and gas folks coming in, because they have the human infrastructure and financial infrastructure. I definitely see it playing out that way, with the big oil and gas companies shifting their focus, not necessarily away from oil and gas, but to get a new, consistent revenue source."

It's also no surprise European companies are driving much of the offshore wind work in the U.S. Most of the companies that we have seen so far have been a mixture of international firms with large offshore wind portfolios, such as Orsted and Avangrid, mixed with regional utilities like Eversource, PSEG, and Dominion," said Bond. I think based off the lessons learned from Europe, the international firms realize that they understand how to develop the offshore portion of the work, but need the support from the local utilities in the permitting and onshore portion of the work."

Orsted U.S. Offshore Wind, a division of Denmark-based Orsted, recently opened a U.S. innovation hub in Providence, Rhode Island. Orsted bought Providence-based Deepwater Wind in 2018; Deepwater Wind was the original operator of Block Island.

Orsted, whose U.S. operations are jointly headquartered in Providence and Boston, wants to use the hub to meet with U.S.-based startups and small companies to discuss early-stage technologies for the offshore wind industry. Thomas Nygaard Hamann, Orsted's head of strategy, digital and innovation based in Copenhagen, said the company hopes this will help companies bring solutions to the offshore market faster, accelerating the U.S. industry.

In essence, a lot of this is really about taking the global know-how that we bring on this industry and connecting that to novel innovation in the U.S.," said Hamann.

Technology AdvancementsNew technologies also are expected to drive growth in offshore wind, as improvements are made in turbine design and underwater cabling to transmit power from the installation site to onshore substations and storage facilities.

|

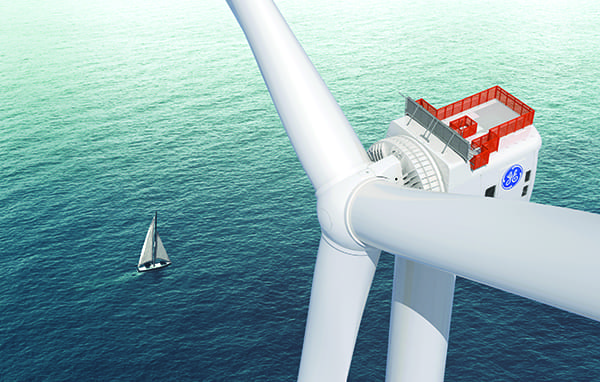

3. GE's Haliade-X 12 MW wind turbine features a 220-meter rotor, a 107-meter blade, and digital capabilities. One Haliade-X 12-MW turbine can generate up to 67 GWh of gross annual energy production, based on wind conditions at a typical German North Sea site. Courtesy: GE Renewable Energy |

The offshore wind industry has tremendous long-term growth potential as new technology developments will contribute to making offshore wind a more competitive source of renewable energy," Vincent Schellings, general manager for Engineering & Product Development for Offshore Wind at General Electric, told POWER. He noted GE's Haliade-X 12-MW turbine (Figure 3), considered at the moment the world's most powerful offshore wind turbine. One turbine will generate enough clean power for up to 16,000 European households, helping to make offshore wind a more competitive source of energy... we consider the Haliade-X the right turbine at the right time to serve the growing offshore wind market in the U.S. and globally."

Siemens Gamesa is considered the top player in the offshore wind turbine market, with more than 70% of the world's market share. The company last year introduced the SG 10.0-193 DD, which the company calls a turbine evolved from five generations of proven offshore direct-drive technology." The 10-MW turbine is the largest of several Siemens Gamesa models launched over the past half-dozen years, ranging in size from 6 MW to 10 MW.

The largest international wind turbine original equipment manufacturers (OEMs) all have large offshore turbine machines in development and/or for commercial sale," noted Garrett Moran, wind generation senior manager at ICF, a Virginia-based consulting and technology services company. GE is prototyping its new Haliade-X 12MW-220m machine, and Siemens Gamesa Renewable Energy (SGRE) just recently announced its SG 11MW-200m direct-drive offshore machine. A key factor in offshore wind is the robustness and lifetime of the offshore machinery."

Moran noted offshore turbines come with different issues than their land-based counterparts. Given that O&M [operations and maintenance] costs are significantly higher offshore due to the obvious access issues, OEMs have designed offshore turbines to be efficient, robust, and long-lived. A lot of the OEMs targeting offshore wind have designed larger machines and rotors with direct-drive generators. These direct-drive machines do not utilize a traditional gearbox, which is one of the most expensive and time-consuming components to replace in wind turbines. Direct-drive technology is less complex than gearboxes and less prone to failure, which improves O&M costs critical for offshore machines in maintaining favorable project economics."

Fracaroli said floating wind farms also will spur offshore growth. Floating platform technology, in particular, will be essential to the delivery of offshore wind in deeper water depths, which also will be key to the development of the industry on the [U.S.] West Coast. Automation and drone technologies will help reduce O&M cost in the industry by supporting the ability to monitor and inspect assets remotely. As the industry grows, the more technologies will advance."

|

4. Hywind Scotland is the world's first commercial offshore project using floating turbines. The 30-MW wind farm is located at Buchan Deep, 25 kilometers offshore Peterhead, Scotland, and provides renewable energy to the mainland. Courtesy: Oyvind Gravas / Woldcam / Statoil |

The world's first commercial project using floating turbines is Hywind Scotland (Figure 4), a wind farm developed by Statoil (now Equinor) with five 6-MW Siemens Gamesa turbines located about 18 miles off Peterhead, Scotland. The project is operated by Hywind (Scotland) Limited, a joint venture of Equinor and Masdar.

Potential GrowthGrowth in offshore wind also could be helped by the move toward hydrogen as an energy source. Belgium earlier this year said electricity generated by Belgian offshore wind farms will be used for electrolysis to split water into oxygen and hydrogen, with the hydrogen available as an energy source in a variety of applications. Belgium at present has more than 1.5 GW of operating offshore wind capacity, with a goal of having about 4 GW online by the end of the decade.

Shell and Gasunie in February disclosed plans for what the group has said will be Europe's biggest green hydrogen project, powered by up to 10 GW of offshore wind in the North Sea. The oil and gas infrastructure group said it will advance the NortH2 project in conjunction with Groningen Seaports, with a large hydrogen electrolyzer sited in Eemshaven in the Netherlands. The partners want the first hydrogen production by 2027, from 3 GW to 4 GW of offshore turbines, with the fleet as large as 10 GW by 2040, with output of 800,000 metric tons of green hydrogen annually.

Orsted's 1.4-GW Hornsea 2 project, which will be the world's largest offshore wind farm when it starts commercial operation (expected in 2022) in the North Sea, will power green hydrogen production under a program called the Gigastack project, led by ITM Power and supported by the UK government. The program is designed to deliver hydrogen via stackable" 5-MW electrolyzers produced in gigawatt-scale factories for large-scale generation. Hornsea 2 will feature 165 Siemens Gamesa 8-MW turbines.

Freedman said both floating wind farms and hydrogen production are significant" achievements for the sector. I think in terms of the turbines, it's happening," he said. It's really turbine technology that I hear the most about. In particular on the West Coast, where you have very deep water, the floating turbines, I think that is a significant technology development. Green hydrogen has been sort of a side discussion, and that's something that could be beneficial. So now we have dual efforts, we have power, and we have green hydrogen as well."

Williams of the BlueGreen Alliance said there is serious interest" in the potential of offshore wind for bulk and cost-effective production of green hydrogen. This is where we start to see the future clean economy really interacting with itself," he said. It's quite hard to produce goods without using a fuel feedstock that is not a fossil fuel... as well as electrifying shipping and aviation. Creating hydrogen as a fuel is incredibly important. Locate a hydrogen production facility at a port, creating the jet fuel of the future or the fuel to run America's steel mills. We could see a whole domestic clean economy, all without greenhouse gas emissions, all made in America. Hydrogen is a big part of that effort."

Bond, like Freedman, noted how advancements in turbines, and production of hydrogen, are the two biggest technological advances that are out there... the increasing output of the turbines, which continue to jump significantly every couple of years, as well as green hydrogen' development. Green hydrogen is a potential new business line that would further enhance the viability and longevity of the offshore wind market for the U.S. and other countries."

He continued: Being that offshore wind is a proven technology in many parts of the world, we need to find a way to maximize all outputs of the technology in a way that is thoughtful yet effective and make sure the U.S. leads the conversation on any new fronts. I would hope that our goal is to not play catch-up but [to] lead the conversation for future generations."

-Darrell Proctoris associate editor for POWER.

The post Offshore Wind Finding Direction in U.S. appeared first on POWER Magazine.