Why investors are cheering the Uber-Postmates deal

This morning as the markets rally, shares of Lyft are up 3% while Uber shares are up 6%.

Why is Uber so far ahead of Lyft, its domestic ride-hailing rival that is suffering from the same economic impacts? It appears that investors are heartened that Uber has closed its Postmates acquisition after both firms danced around each other for some time, leading to all sorts of leaks that wound up being not coming true.

The Exchange is a daily look at startups and the private markets for Extra Crunch subscribers; use code EXCHANGE to get full access and take 25% off your subscription.

This explains why Uber investors are excited about Uber's Postmates buy; what about the smaller company is making Uber shares so buoyant? Let's take a walk through the numbers this morning.

If we reexamine Uber Eats' recent growth, contrast it to Ubers Rides' own growth, mix in Eats' profitability improvements along with Postmates' own financial results, we can start to see why public investors might be heartened by the deal.

If we reexamine Uber Eats' recent growth, contrast it to Ubers Rides' own growth, mix in Eats' profitability improvements along with Postmates' own financial results, we can start to see why public investors might be heartened by the deal.

Afterward, we'll toss in a note about how Postmates may provide Uber some narrative ammunition heading into earnings. This exercise should be fun, and a good break from our recent IPO coverage. Let's get into the numbers.

Growth, lossesIn case you are behind, Uber is buying Postmates for $2.65 billion in an all-cash deal. Uber estimated that it would issue around 84 million shares to pay for the transaction. At its share price as of the time of writing, the deal is worth $2.72 billion at Uber's newer share price. For reference, that price tag is about 4.8% of Uber's current-moment market cap.

To understand why Uber would spend nearly 5% of its worth to buy a smaller rival, let's remind ourselves of the performance of the group that it will plug into, namely Uber Eats.

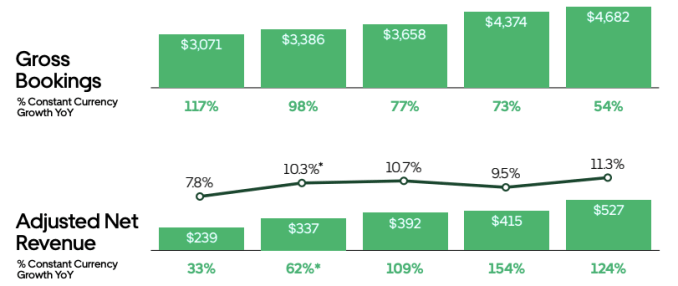

From Uber's Q1 2020 financial reporting, the following chart will ground our exploration, showing how Eats has performed in recent quarters:

Via Uber's financial reporting. Q1 2019 on the left, Q1 2020 on the right.