X1 Card is a credit card based on your income, not your credit score

There are many reasons why you could have a good or a bad credit score. But if you're just entering the job market, you may end up with reliable income and a low limit on your credit card. X1 Card wants to solve that by setting limits based on your current and future income instead of your credit score.

The company says some customers can expect limits up to five times higher than what they would get from a traditional credit card. And that limit can move up if you get a promotion at your job for instance.

The consumer credit card industry has been almost untouched by tech and has relied on the archaic credit score system. Max [Levchin], David [Sacks] and I have similar scores - that makes no sense!" co-founder Deepak Rao told me. We reimagined the credit card from the ground up to have smarter limits, intelligent features, modern rewards and a new look."

Depending on your creditworthiness, you'll get a variable APR of 12.9 to 19.9% and a balance transfer fee of 2%. There's no annual subscription fee and X1 Card doesn't change any late fee or foreign transaction fee.

Behind the scene, X1 Card is built by Thrive, the company that created ThriveCash, a loan platform that lets you get a credit line based on offer letters for an upcoming summer internship or your first full-time job after college.

You can then borrow as much as 25% of your total internship salary or 25% of your first three paychecks if it's a full-time job. There are some fees, but it can be helpful if you're signing a new lease and you don't have any money on your bank account for instance.

Thrive has raised $10.25 million in funding from PayPal and Affirm founder Max Levchin, former Twitter COO Adam Bain, Craft Ventures general partner David Sacks and others. Read TechCrunch's Natasha Mascarenhas article on ThriveCash if you want to learn more about that product.

Thrive gives loans to students based on summer internships and job offers

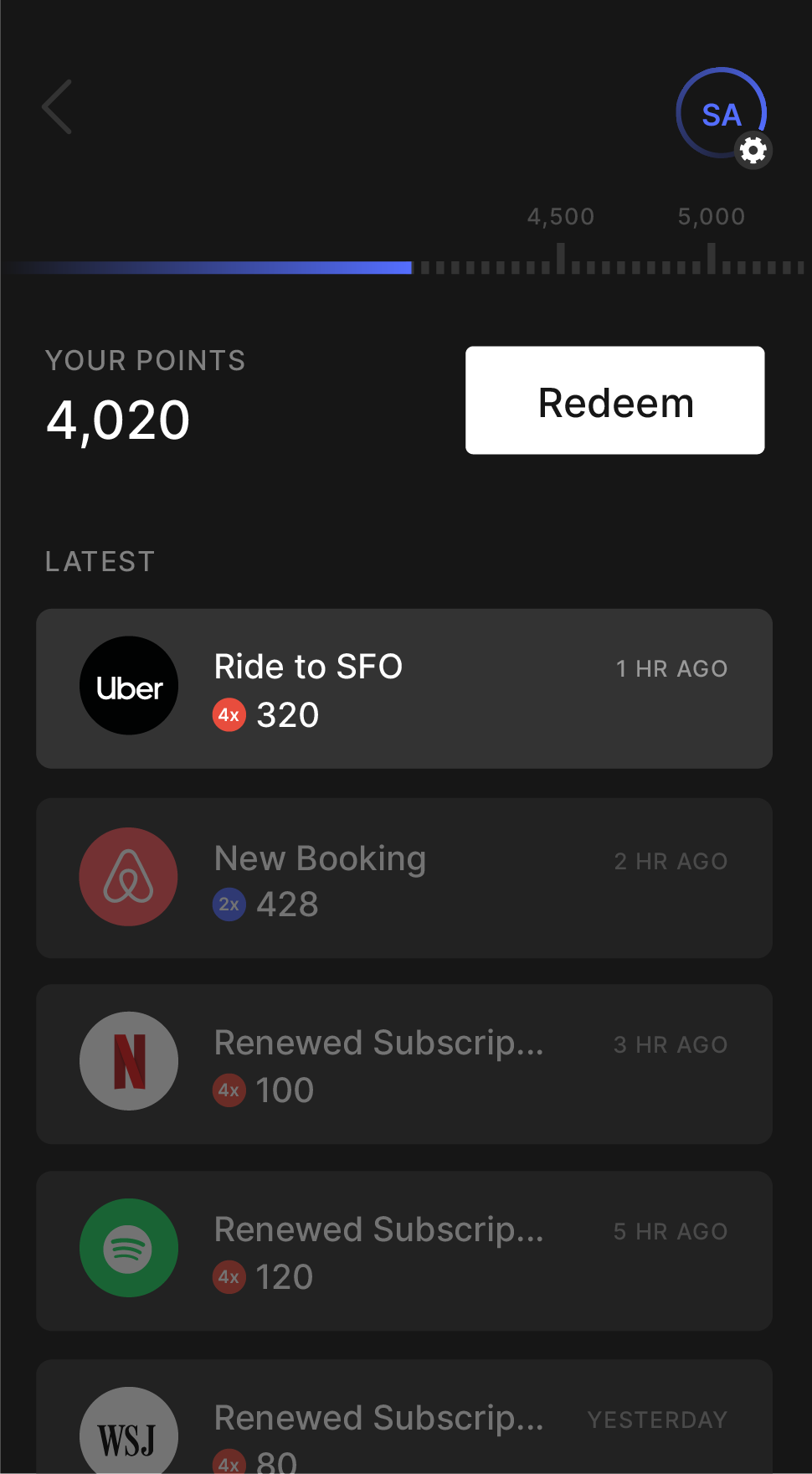

Coming back to X1 Card, the card is a stainless steel Visa card that works with Apple Pay and Google Pay. It helps you track your subscriptions in different ways. First, you can cancel your subscription payments from the app. If you're trying out a new service and they require you to enter your credit card information to start a free trial, you can also generate an auto-expiring virtual credit card.

If you receive a refund, X1 Card sends you a notification. You can also attach receipts to your transaction in the app.

When it comes to rewards, X1 Card uses points. You get 2x points on all purchases by default - there's no category or retailers that give you special rewards. If you spend more than $15,000 using the card in a year, you get 3X points. If you refer a friend, you get 4X points on your purchases for a month - each new referral adds an extra month with 4X points. Points can be redeemed at retail partners, such as Apple, Airbnb, Delta, Everlane, etc.

In other words, it's a credit card. But what makes this product more interesting than your average Chase-branded card is that it wants to disrupt the credit score system. It's going to be interesting to see if people can really get higher limits with that system.

Image credits: X1 Card