Twilio confirms it is buying Segment for $3.2B in an all-stock deal

Twilio today announced its biggest acquisition to date, spearheading a stronger move into customer data management alongside its existing API-based tools for building and running communications services.

Twilio is paying $3.2 billion to acquire Segment, a technology startup that lets organizations pull in customer data from one app into another, by way of APIs, and use its platform to better control the movement of that customer data, used for marketing and other applications that benefit from customer identification and segmentation.

This is an all-stock deal - specifically in Twilio Class A common stock, on a fully diluted and cash free, debt free basis" and it is expected to close in Q4 2020. Segment will become a division of Twilio, the companies said.

The deal was first reported to be in the works on Friday. (FWIW we'd also gotten the same tip and had been investigating it when that story got published. Our sources had said that the deal was going to be between $3 billion and $4 billion, and announced possibly as soon as today.)

The deal underscores how Twilio is moving deeper into customer engagement services, both for marketing data and other purposes (putting it into closer competition with the likes of Adobe).

Data silos destroy great customer experiences," said Jeff Lawson, co-founder and CEO of Twilio, in a statement. Segment lets developers and companies break down those silos and build a complete picture of their customer. Combined with Twilio's Customer Engagement Platform, we can create more personalized, timely and impactful engagement across customer service, marketing, analytics, product and sales. We are thrilled to welcome Segment to the Twilio team."

Together, Twilio and Segment have an incredible opportunity to build the customer engagement platform of the future," added Peter Reinhardt, Segment's co-founder and CEO. We created Segment to help businesses set themselves apart in the digital age and deliver rich, connected customer experiences built on high-quality data. By joining forces and applying our customer data platform to Twilio's engagement cloud, we'll be able to make the entire customer experience seamless from end-to-end."

This is Twilio's biggest acquisition since it picked up SendGrid for $2 billion to add email to its range of communications tools back in 2018. Segment was last valued at $1.5 billion at its last raise.

Acquiring Segment is a natural progression of how Twilio has evolved over the last decade.

Twilio first made its name as a startup in 2008 by providing an easy way for companies to integrate text and voice services into their apps. Using APIs and few lines of code, companies could tap into the fast-growing world of smartphone and app usage by putting the tools to communicate with their users directly into their apps.

Over time, those basic tools have taken more shape with a wider range of communications sources such as email and chatbots, and with a more focused set of applications aimed at different verticals using them, and more tools to enable and better manage customer relations, and also tools to better identify, segment and work with those customers.

Using acquisitions to build that part of the business is part of the company's strategy. One source tells us that Twilio actually tried to acquire Intercom, the customer relations messaging service, back in 2014 and 2015. The companies could not agree on a price at the time, our source said. (Watch this space?)

These days, Twilio's Solutions business is focused on applications in marketing, customer service and customer identity. All of these are big use cases for Segment, which has some 20,000 customers using its platform to collect, clean and control" customer data.

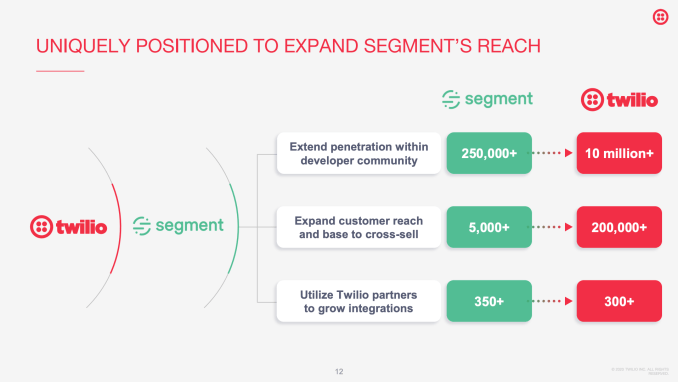

For Segment, it's a big step up in terms of scope and potential companies to target with its tools:

Acquiring Segment could also bring a more customers to the Twilio platform, opening the door to upselling those customers with other services Twilio offers. And given Segment's stated focus on providing better tools to handle customer data more responsibly, in an environment where awareness (and breaches of this area is only growing by the day, it gives Twilio a much stronger product set to speak to that need.

There are also some interesting synergies already. Not only are both built around the architecture of using APIs to integrate other services/port data from one place to another, but there's an existing integration between the two, which may be getting used a lot already.

And as one source pointed out to us, there are already a lot of what the source referred to as Xwilions" (ex-Twilio people) working at the smaller company.

They include CFO Sandy Smith, advisor Sandy O'Gorman, and CSO Colleen Coolidge, who has also hired a number of ex-Twilio engineers.

You might argue that customer service (the main idea of what Twilio has been building) and customer experience (Segment's jam) are different things, but the two are connected: one of the big by-products of communications is data, and companies will be looking for better ways of linking up the creation of it, with the repurposing/use of it. In other words, the two complement each other.

We've updated this post with a few insights from the Twilio/Segment conference call earlier today.