Gen Z spends 10% more time in non-game apps than older users

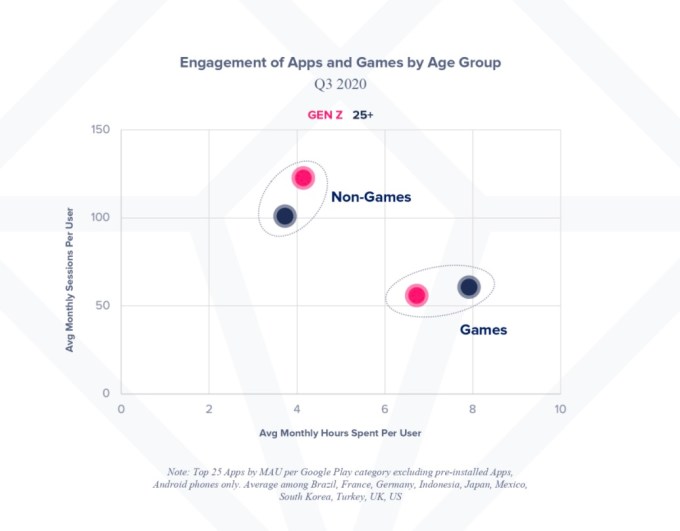

A new report released today by App Annie digs into how Gen Z consumers engage with their smartphones and mobile apps. According to data collected in Q3 2020, Gen Z users spend an average of 4.1+ hours per month in non-gaming apps, or 10% longer than older demographics. They also engage with apps more often, with 20% more sessions per user in non-gaming apps at 120 sessions per month per app, compared with older groups.

This app engagement data is only a view into Gen Z trends but is an incomplete analysis as it only focuses on select markets, including the U.S., U.K., Brazil, France, Germany, Indonesia, Japan, Mexico, South Korea and Turkey. It also included only data collected from Android devices, which doesn't provide as full a picture.

App Annie found that Gen Z is more likely to use games than older users, but they don't access them as often or use them as long. Those ages 25 and older actually spent nearly 20% longer in their most-used games and accessed them 10% more frequently. Both demographics spent more total time gaming than using non-game apps, on a monthly basis.

Image Credits: App Annie

One breakout in the games category for Gen Z users, however, was the casual arcade game Among Us!, which just became the third-most played game worldwide, thanks to its team-based multiplayer features and the surge of Twitch streams. When Rep. Alexandria Ocasio-Cortez played the game on Twitch last night, it became one of the biggest-ever Twitch streams, peaking at 435,000 concurrent viewers.

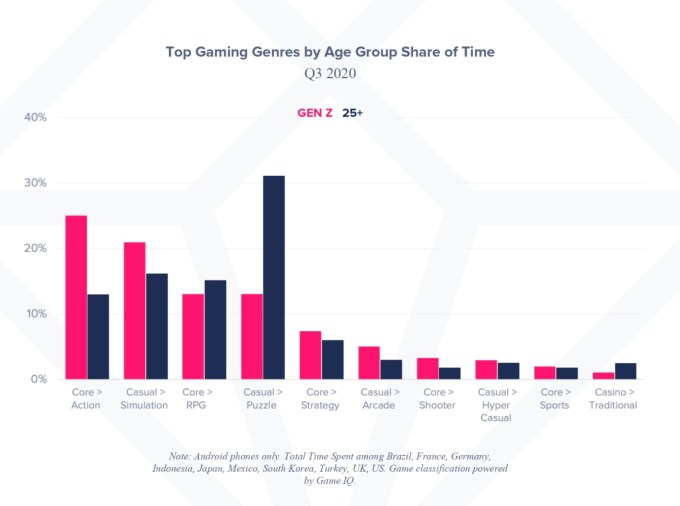

Other popular Gen Z games include Match-3 games like Candy Crush Saga and Toon Blast, action games like PUBG Mobile and Free Fire, and casual simulation games like Minecraft Pocket Edition and Roblox.

Image Credits: App Annie

The report also examined what apps Gen Z users prefer across a range of non-game categories across both iOS and Android.

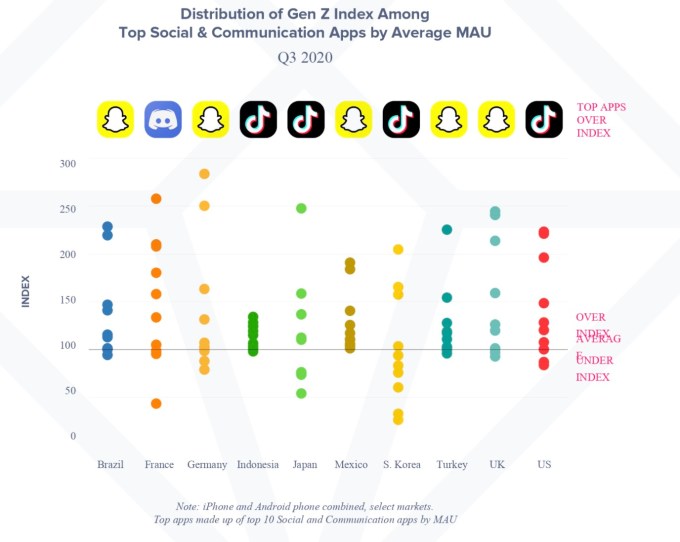

TikTok and Snapchat, in particular, stood out as the top over-indexed social and communication apps among Gen Z in 9 out of the 10 markets analyzed for this report. This comes on the heels of Snap's blowout earnings yesterday, where the social app topped analyst expectations and saw daily user growth climb 4% to 238M.

Discord is also seeing strong growth, particularly in France, as mobile and remote gaming has become an epicenter of social interactions during the pandemic.

Image Credits: App Annie

Among entertainment apps, Twitch was the top over-indexed app in 6 out of the 10 markets for Gen Z users, though live streaming niconico was popular in Japan.

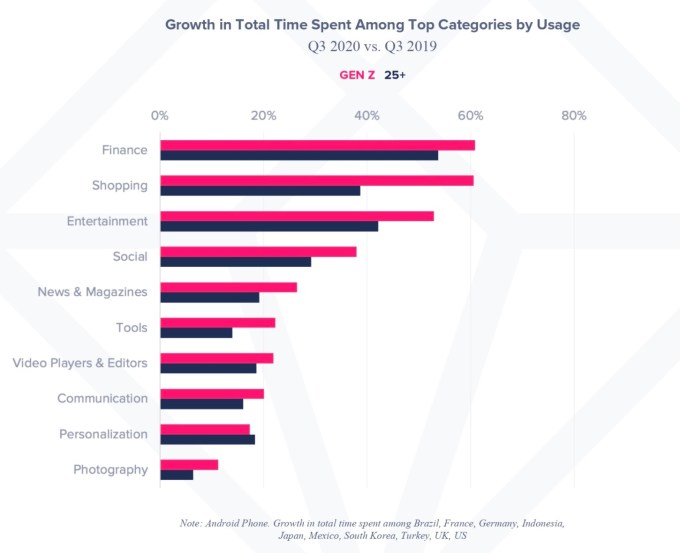

App Annie found that finance and shopping apps haven't yet reached a broad Gen Z audience, but are demonstrating promising growth.

Image Credits: App Annie

Few finance apps over-index with Gen Z, though the demographic tends to interact with non-bank fintech apps like Venmo, Monzo, and DANA. In South Korea, a top app was peer-to-peer payments app Toss, which also offers loans, insurance and credit.

Top Gen Z fashion apps, meanwhile, included Shein, ASOS, Shopee and Mercari.

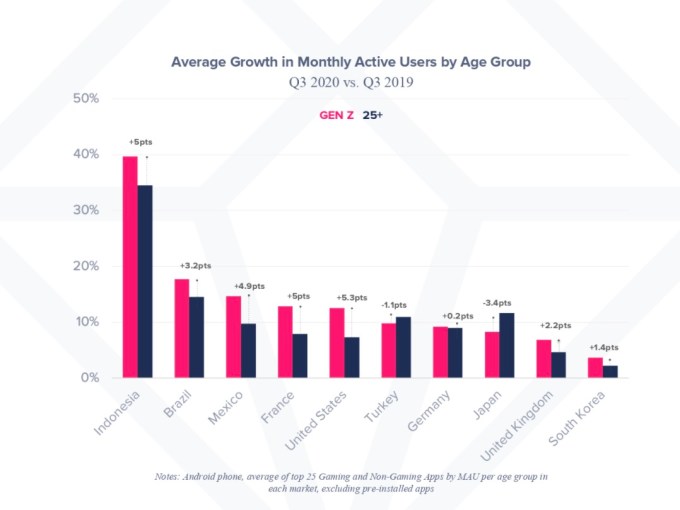

Overall, active Gen Z users are rising faster across the markets analyzed, compared with older groups, with emerging markets like Indonesia and Brazil, seeing the most growth.

Image Credits: App Annie

App Annie noted that Gen Z is becoming one of the most powerful consumer segments on mobile, as 98% own a smartphone and have an combined estimated spending power of $143 billion annually.

Gen Z has never known a world without their smartphone. They see the world through this mobile first lens," said Ted Krantz, CEO, App Annie, in a statement about the report's findings.