IoT Network Companies Have Cracked Their Chicken-and-Egg Problem

Illustration: Greg Mably

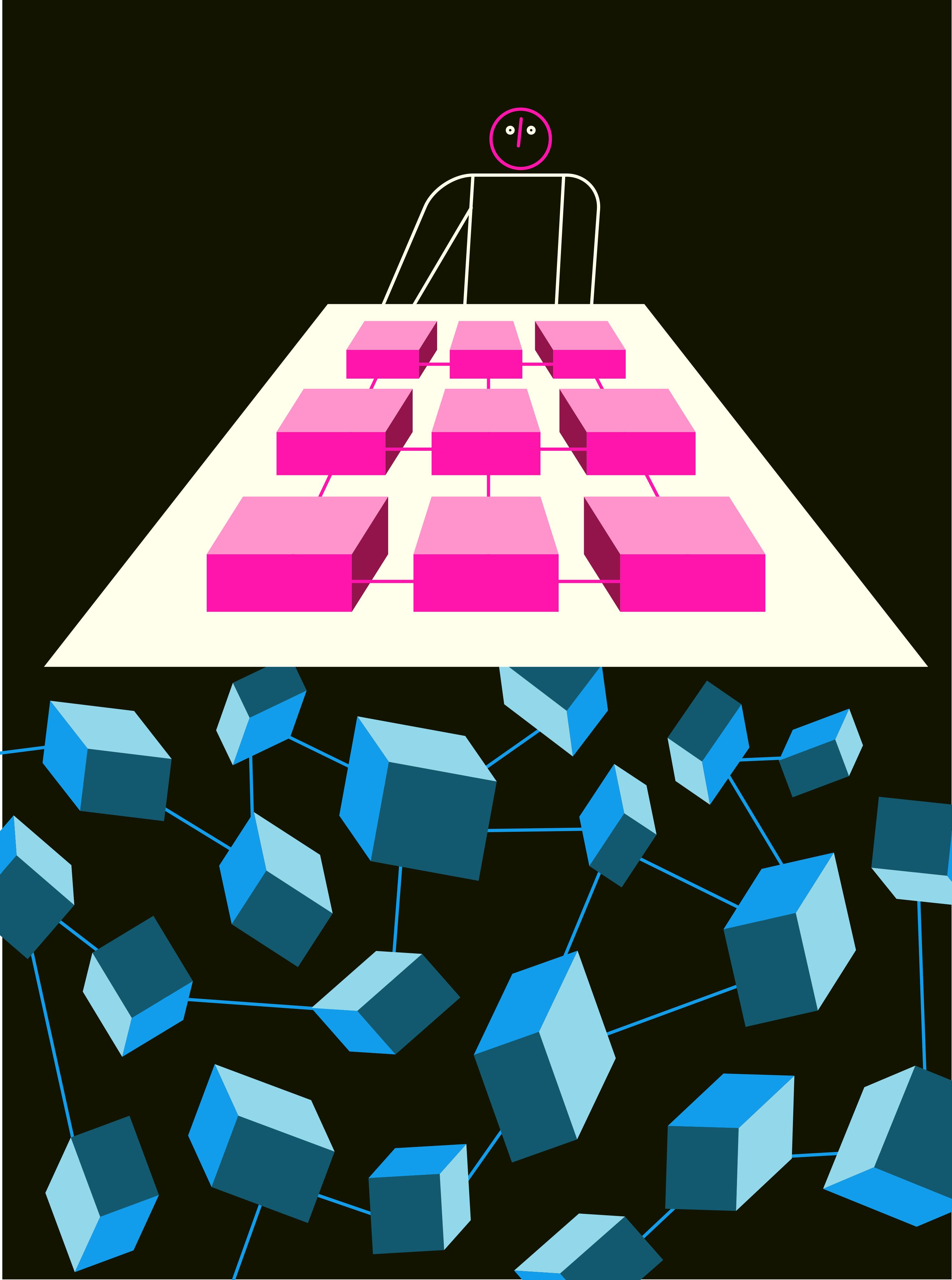

Illustration: Greg Mably Along with everything else going on, we may look back at 2020 as the year that companies finally hit upon a better business model for Internet of Things (IoT) networks. Established network companies such as the Things Network and Helium, and new players such as Amazon, have seemingly given up on the idea of making money from selling network connectivity. Instead, they're focused on getting the network out there for developers to use, assuming in the process that they'll benefit from the effort in the long run.

IoT networks have a chicken-and-egg problem. Until device makers see widely available networks, they don't want to build products that run on the network. And customers don't want to pay for a network, and thus, fund its development, if there aren't devices available to use. So it's hard to raise capital to build a new wide-area network (WAN) that provides significant coverage and supports a plethora of devices that are enticing to use.

It certainly didn't help such network companies as Ingenu, MachineQ, Senet, and SigFox that they're all marketing half a dozen similar proprietary networks. Even the cellular carriers, which are promoting both LTE-M for machine-to-machine networks and NB-IoT for low-data-rate networks, have historically struggled to justify their investments in IoT network infrastructure. After COVID-19 started spreading in Japan, NTT DoCoMo called it quits on its NB-IoT network, citing a lack of demand.

Personally, I don't believe in business models for [low-power WANs]," says Wienke Giezeman, the CEO and cofounder of the Things Network. His company does deploy long-range low-power WAN gateways for customers that use the LoRa Alliance's LoRaWAN specifications. (LoRa" is short for long-range.") But Giezeman sees that as the necessary element for later providing the sensors and software that deliver the real IoT applications customers want to buy. Trying to sell both the network and the devices is like running a restaurant that makes diners buy and set up the stove before it cooks their meals.

The Things Network sets up the stove" and includes the cost of operating it in the meal." But, because Giezeman is a big believer in the value of open source software and creating a sense of abundance around last-mile connectivity, he's also asking customers to opt in to turning their networks into public networks.

Senet does something similar, letting customers share their networks. Helium is using cryptocurrencies to entice people to set up LoRaWAN hotspots on their networks and rewarding them with tokens for keeping the networks operational. When someone uses data from an individual's Helium node, that individual also gets tokens that might be worth something one day. I actually run a Helium hotspot in my home, although I'm more interested in the LoRa coverage than the potential for wealth.

And there's Amazon, which plans to embed its own version of a low-power WAN into its Echo and its Ring security devices. Whenever someone buys one of these devices they'll have the option of adding it as a node on the Amazon Sidewalk network. Amazon's plan is to build out a decentralized network for IoT devices, starting with a deal to let manufacturer Tile use the network for its Bluetooth tracking devices.

After almost a decade of following various low-power IoT networks, I'm excited to see them abandon the idea that the network is the big value, and instead recognize that it's the things on the network that entice people. Let's hope this year marks a turning point for low-power WANs.

This article appears in the November 2020 print issue as Network Included."