AEP Will Shutter Nearly Half its Giant Coal Power Fleet—5.6 GW—by 2030

The post AEP Will Shutter Nearly Half its Giant Coal Power Fleet-5.6 GW-by 2030 appeared first on POWER Magazine.

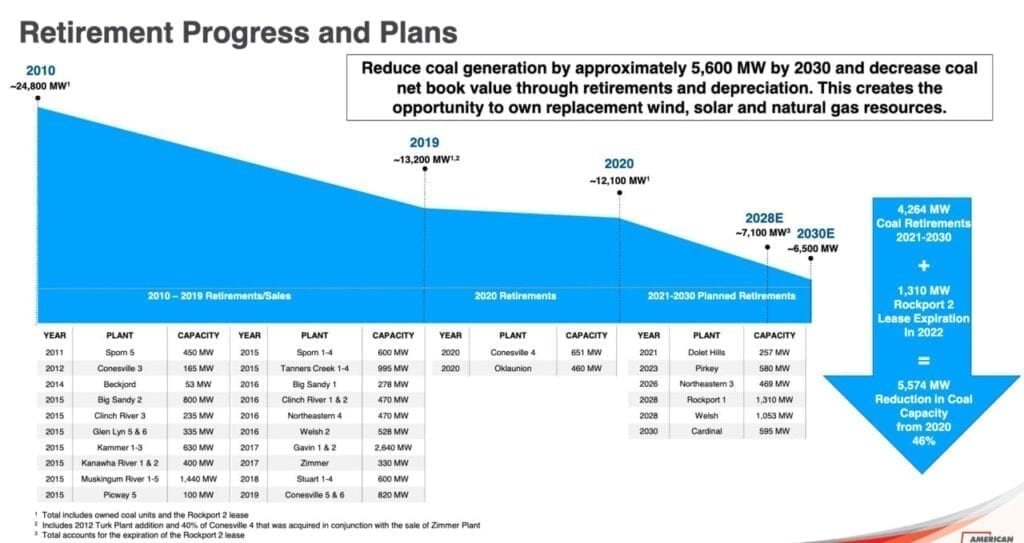

American Electric Power (AEP) will shut down or refuel 5.6 GW of its 2020 coal-fired power fleet by 2030 to comply with environmental rules-including recent revisions governing federal coal ash and effluent limitations-and rebalance its portfolio in a bid to meet ambitious climate goals.

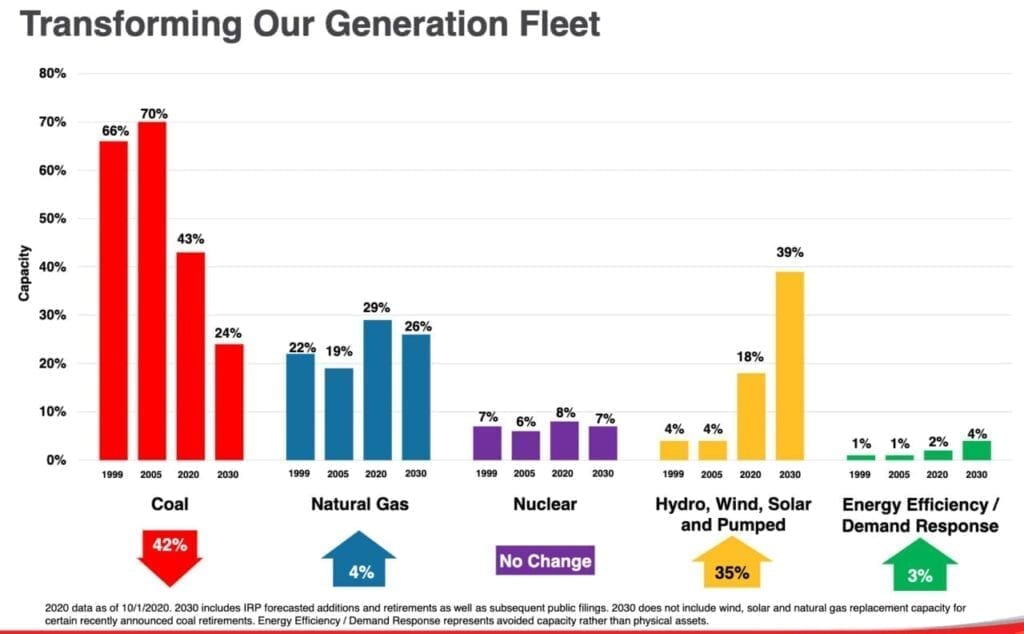

The move is bold for the Columbus, Ohio-based generating giant, which has historically relied on and heavily supported coal power. At the beginning of 2020, about 43%-12.1 GW-of its 23.4-GW generating fleet was coal-fired, which was already a drastic reduction compared to 2005, when it owned 24.8 GW of coal capacity, and coal made up 70% of its portfolio.

According to documents the company shared at the 55th Edison Electric Institute Financial Conference on Nov. 9, coal's share of AEP's portfolio is now slated to fall to 24% by 2030 through the closure of eight plants.

American Electric Power on Nov. 9 said it will retire, refuel, or sell 46% of its 2020 12.1 GW coal capacity, a total 5.6 GW, by 2030. Courtesy: AEP ( EEI 2020 Handout)Speeding Up Retirements

American Electric Power on Nov. 9 said it will retire, refuel, or sell 46% of its 2020 12.1 GW coal capacity, a total 5.6 GW, by 2030. Courtesy: AEP ( EEI 2020 Handout)Speeding Up RetirementsSince 2010, AEP has already sold or retired nearly 13.5 GW of coal power. This year alone, keeping with ambitions it announced in September 2019 that it would seek to go net-zero by 2050, it has shuttered two coal units-a total 1.1 GW: the 651-MW Conesville 4 in Ohio, and the 460-MW Oklaunion plant in Texas.

In its June 2020 corporate accountability report, the company reiterated plans to retire the 650-MW Dolet Hills Station in Louisiana by 2021; the 469-MW Northeastern Unit 3 in Oklahoma by 2026; the 1.1-GW Rockport Unit 1 in Indiana by 2028; and AEP's 595-MW portion of the three-unit, 1.8-GW Cardinal Plant in Ohio by 2030.

However, compliance plans AEP plans to file this month for the U.S. Environmental Protection Agency's (EPA's) Coal Combustion Residuals (CCR) rule will show the company will also retire the 580-MW Pirkey Plant in Hallsville, Texas, in 2023. AEP will also cease using coal" at the 1.05-GW Welsh Plant in Pittsburg, Texas, in 2028, the company said on Nov. 5.

Meanwhile, though AEP plans to make upgrades to the ash pond system and continue operation of the 1.31-GW Unit 1 at the two-unit Rockport Plant in Indiana-and continue to run that unit until its previously announced retirement date of 2028-it will not renew the lease for the 1.31-GW Unit 2 when it expires in 2022.

To comply with existing regulations, AEP plans to shutter existing ash ponds and replace them with dry bottom ash handling systems or new lined ash ponds at four other plants-a combined capacity of 6 GW-to meet requirements under the EPA's CCR and Effluent Limitations Guidelines (ELG) rules by 2023. Three of these facilities are in West Virginia: the 2.93-GW Amos Plant in Winfield, the 1.3-GW Mountaineer Plant in New Haven, and the 1.56-GW Mitchell Plant in Moundsville. The fourth facility is the 258-MW Flint Creek plant in Gentry, Arkansas.

AEP said two other coal plants-the 477-MW Turk Plant, in Fulton, Arkansas, (and which is the nation's only ultrasupercritical unit) and the 469-MW Northeastern 3 in Oologah, Oklahoma-currently meet CCR and ELG standards. But as noted above, AEP will shutter Northeastern 3 by 2026.

Coal Plant Costs Are a Major ConsiderationEconomics are a major factor in AEP's spate of recently announced closures. The company, like other U.S. coal generators, is grappling with refining cost estimates of complying with environmental rules against a number of factors.

One of them is that it's uncertain whether more stringent requirements will be imposed by several states when they finalize state implementation plans (SIPs) to comply with federal rules-even those the Trump administration recently revised to provide more flexibility to coal plant operators. Other major cost considerations include the actual performance of pollution control technologies installed and the changing costs for new pollution controls.

In its latest 10-Q filing on Oct. 22, for example, AEP points to uncertainty related to periodic revisions to the National Ambient Air Quality Standards (NAAQS); regional haze requirements under the Clean Air Visibility Rule; regulation of hazardous air pollutant emissions under the Mercury and Air Toxics Standards (MATS); implementation and review of the Cross State Air Pollution Rule; and the EPA's regulation of greenhouse gas emissions under Section 111 of the Clean Air Act.

Pivotal to AEP's more recently announced closures are the CCR and ELG, Obama-era rules that the Trump administration recently revised. This August, the EPA promulgated a final CCR rule to include a requirement that unlined CCR storage ponds must cease operations and initiate closure by April 2021. While the revised rule provides two options that could allow facilities to extend the date (to October 2023 or October 2028) by which they must cease receipt of coal ash and close the ponds, the deadline for seeking an extension under either option is quickly approaching-Nov. 30, 2020.

The EPA's October 2020-finalized ELG rule, meanwhile, establishes additional options for reusing and discharging small volumes of bottom ash transport water, and it provides an exception for retiring units, and it also extends the compliance deadline to no later than December 2025. But that rule, along with the EPA's recent actions on flue gas desulfurization wastewater and bottom ash transport water permitting, could still require technology additions and retrofits.

At the same time, AEP is complying with a March 2020-enacted Virginia law that requires it to close ash disposal units at the retired Glen Lyn Station by removing all coal combustion material, a project that it says will boost costs by up to $199 million.

For now, AEP suggests, that future investments to meet existing and proposed requirements could range from about $500 million to $1 billion through 2026."

Legal Disputes Also A FactorBut it's unclear whether those estimates account for costs related legal headaches the company is fielding. AEP's 2.2-GW Rockport facility, for example, has been embroiled in a New Source Review (NSR) dispute since 2007, when it reached a consent decree with the Justice Department, the EPA, eight northeastern states, and environmental groups that required installation of several pollution control retrofits.

Rockport's operators, AEP subsidiaries AEGCo and Indiana Michigan Power Co., are also engaged in a legal battle with Wilmington Trust Co., a company that bought the plant under a sale-and-leasback transaction in 1989 and continues to lease the facility to AEP. In 2013, the Wilmington Trust Co. filed a complaint in federal district court that alleged it would be unlawfully burdened by modifications in 2010 to terms of the NSR consent decree after Unit 2's lease expired in December 2022.

In July 2019, AEP sought and was granted a fifth modification to the consent decree, which essentially allowed the operators to extend a deadline to retrofit Rockville 1 until December 2028, but it removed the requirement to retrofit, refuel, or re-power Rockville 2 in exchange for additional pollution control retrofits.

AEP abided by terms of the consent decree and completed the installation of selective catalytic reduction (SCR) technology at Unit 2 in June 2020. But as noted above, AEP will not renew Unit 2's lease when it expires in 2022, and it will shutter Unit 1 as planned in 2028.

Finding More Economic ReplacementsAny decision to retire a plant-whether it is regulated or competitive-is also compounded by a need to replace it with an option that must be both economically and environmentally sustainable, AEP says.

Here, too, how states will act is of prime consideration. AEP, for example, is working to comply with Virginia's April 2020-enacted clean energy legislation to end all fossil-fueled generation by 2045.

Then there are corporate responsibilities. Shareholders are closely scrutinizing, under environmental, social, and governance (ESG) expectations, how AEP will achieve declared long-term goals to reduce its fleet-wide carbon emissions by at least 80% from 2000 levels by 2050 (and 70% by 2030). The net-zero goal, AEP underscores, is aspirational."

But at the EEI Financial Conference on Monday, AEP said its emissions reduction strategy is tied to long-term incentive compensation"-and it is already making progress. At the end of 2019, the company's total estimated carbon dioxide emissions of about 58 million metric tons translated to a 65% reduction from its 2000 figures. It achieved those reductions for the most part through its dramatic reductions in coal capacity.

Over the long-term, AEP hopes to boost its renewables fleet to balance a growing reliance on natural gas. On Monday, it said that between 2021 and 2030, it plans to add 3.7 GW of new solar, 4.2 GW of new wind, and 1.6 GW of new gas resources. It will also spend 71% of its capital on grid modernization, including in transmission and distribution, and most of the remainder (14%) on acquiring and contracting new renewables.

How AEP expects its generation fleet could transform through 2030. Courtesy: AEP ( EEI 2020 Handout)

How AEP expects its generation fleet could transform through 2030. Courtesy: AEP ( EEI 2020 Handout)Performance optimization of its existing generation will also a key priority. Initiatives AEP described on Monday include digital tools, such as machine learning and predictive capabilities to minimize fossil unit operational and maintenance (O&M) costs while maintaining improved performance.

Finally, Technological advances, including energy storage, will determine how quickly AEP can achieve zero emissions while continuing to provide reliable, affordable power for customers," the company said.

-Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).

The post AEP Will Shutter Nearly Half its Giant Coal Power Fleet-5.6 GW-by 2030 appeared first on POWER Magazine.