How COVID-19 accelerated DoorDash’s business

DoorDash filed to go public today, publishing numbers that showed rapid growth, enhanced profitability and an improving cash flow record which helped explain how the company had grown to a $16 billion valuation while private. The unicorn's impending liquidity event will enrich a host of venture capital firms that bet on its eventual maturity.

Instead of posting this entry of The Exchange on Monday, we've put it out today for your Friday and weekend reading. Enjoy! - Alex and Walter.

But notable in DoorDash's impressive results is the impact of COVID-19, accelerating secular trends already in place, and boosting the unicorn's growth. Before we get into pricing this IPO and guessing what the company might be worth, let's strive to understand what portion of its 2020 business gains could stem from the pandemic - and might not persist into the future.

We're not being pessimistic; we merely want to better understand the company. And DoorDash agrees with our general thrust, writing in its S-1 filing that 58% of all adults and 70% of millennials say that they are more likely to have restaurant food delivered than they were two years ago," adding that it believes the COVID-19 pandemic has further accelerated these trends."

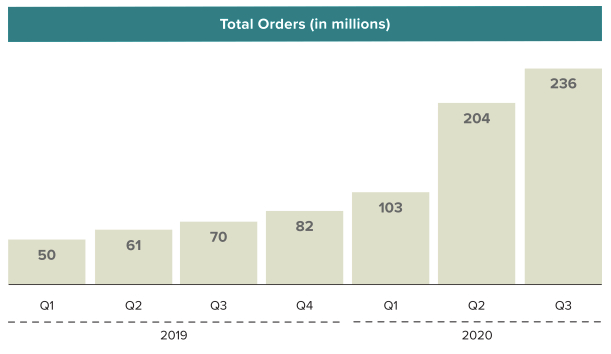

Even more, elsewhere in its filings DoorDash states plainly that COVD-19 led it to experience a significant increase in revenue, Total Orders, and Marketplace [gross order volume] due to increased consumer demand for delivery, more merchants using our platform to facilitate both delivery and take-out, and improved efficiency of our local logistics platform." The company then went on to warn investors that the circumstances that have accelerated the growth of our business stemming from the effects of the COVID-19 pandemic may not continue in the future, and we expect the growth rates in revenue, Total Orders, and Marketplace [gross order volume] to decline in future periods."

We're not idly speculating.

Let's observe how DoorDash's growth accelerated from 2019 through 2020 and then peek at how the company's economics improved during the same period, giving the company a shot at adjusted profitability for the full year, a nearly unheard of result in the on-demand market.

GrowthDoorDash generates revenue when a customer orders food via its service, splitting the total bill of food costs, taxes, fees and tips, distributing them to itself, the merchant creating the goods and the delivery person.

In an illustrative" example that DoorDash notes its 2019 approximate average per-order information," the split works out as follows:

- Bill: $32.90

- Merchant: $20.10, or 61%

- DoorDash: $4.90, or 15%

- Delivery person: $7.90, or 24%

Given that the company is giving us old data and DoorDash's performance has been stellar this year in terms of generating more gross profit, I wonder what has happened amidst 2020's upheaval. But, the old numbers do for what we need, which is to understand the link between gross order volume (GOV) and DoorDash revenue. When the former goes up, the latter goes up.

So, as orders rise: