The Bittersweet Power of Hybrids

The post The Bittersweet Power of Hybrids appeared first on POWER Magazine.

A quest for reliability and flexibility is driving significant interest in hybrid and co-located resources, but their widespread integration could hinge on how they are defined and valued in wholesale electricity markets.

The power industry is sometimes still discussed as a set of monolithic tribes, each loyal to a distinct fuel-oriented culture, always seemingly at conflict in an ever-present struggle for market share. But when considered as a whole, the only monolithic aspect about the industry is its core mission: to safely, affordably, and efficiently keep the lights on. Amid a changing landscape, where decarbonization, decentralization, and digitalization have taken root and flourish, survival is translating into a complex quest for flexibility. Profitability has meant fluidity in front of and behind the meter; business models that reach non-traditional energy users, such as for heating and transportation; and the embrace of multiple technologies that champion reliability and value.

Increasingly, for power companies, that has meant looking at generators in more complex configurations-as hybrid projects that leverage the best qualities of two or more resources to make the most of declining costs, efficiency, and favorable policies. However, because industry is still grappling with the challenges" of a changing landscape, a concrete definition of what constitutes a hybrid power plant is still tentative in nature and evolving," as the non-profit Electric Power Research Institute (EPRI) noted in September. The definitions for such technologies are expected to become clearer and more precise in due course of time through discussions with [independent system operators (ISOs) and regional transmission operators (RTOs)] stakeholders, utilities, regulators, energy storage and renewable technology stakeholders, market participants and other experts," it said.

A Fuzzy DefinitionEPRI, for its part, boils the definition of a hybrid resource down to a resource facility consisting of multiple co-located assets comprising different technologies that can potentially inject and/or withdraw energy whereas the operation of any or all technologies has interdependencies (physical or otherwise) between the technologies." That definition, which notably encapsulates multiple fuel sources and energy conversion types, and includes variable energy resources (VERs) and electric storage resources (ESRs), is broad. It encapsulates, for example, a combined cycle gas turbine plant with co-located assets, including steam turbines and combustion turbines that are dependent on each other through a heat recovery steam generator.

But the wide scope of the definition is purposeful, EPRI said, because it allows for a multiple participation model" and even gives the model room to change throughout the life of the plant or even within a day." By comparison, definitions, which are still evolving, from the nation's largest wholesale market operators, are more specific. The California ISO, for example, in July 2020 defined a hybrid resource as a generating facility, operated as a single resource ID at a single point of interconnection (POI), whose component generating units use different fuel sources or technologies." The Midcontinent ISO (MISO) describes a hybrid resource as market participation as a single asset for a generating facility with interconnection service that is less than the total generating facility capacity and that has multiple energy production devices that have more than one fuel source." The Electric Reliability Council of Texas (ERCOT), meanwhile, specifies that a hybrid resource-one or more energy storage systems combined with one or more wind and/or solar generators behind a single POI"-should be DC-coupled, because AC-coupled resources are covered by existing market rules. For now, at least, hybrid-related definitions from the New York ISO (NYISO), ISO New England (ISO-NE), and PJM Interconnection focus heavily on energy storage combinations. The more specific approach taken by ISOs/RTOs, notably, has some support of industry, including by staff at the Federal Energy Regulatory Commission (FERC), which favors reserving hybrid" for configurations that include a storage component.

Poised for Increased Market ParticipationHowever, EPRI's wide-ranging definition is also important because it encapsulates the already substantial fleet of existing hybrid power plants (some which have existed for decades) that Lawrence Berkeley National Laboratory (LBNL) identified when it began tracking and mapping existing hybrid plants across the U.S. earlier this year. By the end of 2019, LBNL found at least 125 co-located hybrid plants of larger than 1 MW that pair two or more generators or storage at a single POI, or full hybrids that feature co-location and co-control, were already operational-an aggregate 14 GW. Some of the most common configurations include wind+storage (13 projects, 1,290 MW wind, 184 MW storage), PV+storage (40 projects, 882 MW PV, 169 MW storage), and fossil+storage (10 projects, 2,414 MW fossil, 91 MW storage)," it said.

|

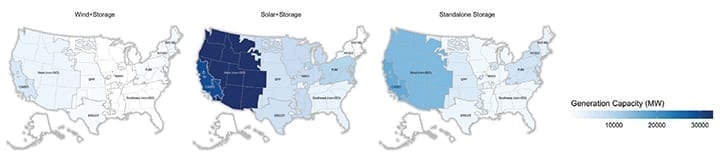

1. At the end of 2019, solar+storage was the most dominant hybrid type in interconnection queues, followed by wind+storage, but both were mostly concentrated in the Western U.S. Source: Lawrence Berkeley National Laboratory |

Of perhaps more significance is that commercial interest in hybrid power is poised to grow exponentially. By the end of 2019, while more than 367 GW of solar plants were in the interconnection queues for seven ISOs/RTOs and 30 utilities, 102 GW-or about 28%-of that capacity was proposed as a hybrid, mostly pairing PV with battery storage. Meanwhile, while 225 GW of wind capacity sat in queues, 11 GW of wind mostly paired with storage had also been proposed (Figure 1).

POWER's analysis of Energy Information Administration data, meanwhile, shows that while the bulk of ISO interconnection queue requests are for solar+storage and wind+storage, mostly in CAISO and ERCOT, a handful of projects pair natural gas with solar and storage, mainly in PJM. Also notable, meanwhile, is that most hybrid project developers have requested participation in varied energy, capacity, and ancillary services markets.

Economics Are a Driving FactorThe surge in interest for hybrid power is primarily being fueled by improving economics. At a plant level, hybrid resources promise to reduce balance of plant costs because resources share certain cost components, such as inverter costs, and ISO interconnection and market participation costs. At a system level, they can facilitate the integration of VERs and enhance the performance and capability of resources by adding operational flexibility. In its March 2020 report, for example, LBNL found that hybrid renewable+battery storage represented significant value premiums over standalone VERs-even though costs have fallen dramatically for solar, wind, and battery storage technologies. LBNL also found that power purchase agreement (PPA) prices for hybrid projects in the U.S. fell by more than 50% between 2015 and 2019.

Costs are becoming increasingly important as more states, like Massachusetts, are placing value on cleaning the peak," which is driving clean energy pairing to help time shift to late afternoon and into the evening peak hours, noted Enel North America, a company that has publicly committed to deploying at lease 1 GW of storage as part of what it calls a renewables+storage solution" over the next two years in the U.S. Enel also underscored that markets with price volatility are attractive to storage-plus developers because batteries are uniquely situated to provide ancillary services faster and more accurately than traditional resources in addition to their ability to ramp energy production almost instantaneously."

The potential opportunities to expand market penetration is also a driver. Despite the breadth and dynamism" of power company energy storage projects, regional differences exist with respect to penetration of energy storage resources, as the Edison Electric Institute (EEI), which represents all investor-owned power companies, said. Electric utilities are simply looking to maximize the value of energy storage for the benefit of all customers," it said, and hybrids could offer a lucrative vehicle.

But according to the American Council on Renewable Energy, a national pan-renewable organization, the trend is also being spurred by changing federal policy. Solar+storage is a particularly beneficial symbiotic relationship" for an existing investment tax credit (ITC), it noted. The ITC, which is currently at 26% and phases down annually, requires hybrid and co-located resources to charge from the onsite solar resource at least 75% of the time for their first five years of operation. Wind+storage may be less common because it doesn't benefit from a tax credit, but also because wind tends to be less variable in very short-term operations," it said.

Addressing Key ChallengesProbing industry's apparent interest in hybrids, FERC on July 23 brought together several stakeholders to better understand how developers are configuring projects for future market participation. As Jessica Bayles, an associate with law firm Stoel Rives, told POWER, The panelists largely agreed that there are two primary configurations for hybrids: the 1R' configuration, where storage and generation are co-controlled and have one resource ID, and the 2R' configuration, where storage and generation are co-located' but have two independent resource IDs," she explained.

While co-located resources have dominated so far, the RTOs/ISOs are seeing more co-controlled resources in their queues. Panelists tended to agree that while true 1R hybrid resources offered more operational value, co-located 2R resources still offered synergies and posed less challenges for the RTOs/ISOs," she said. Among the biggest challenges panelists highlighted, meanwhile, were getting the participation model applicable to hybrid resources right, addressing market mitigation for hybrid resources interconnection issues, and fully valuing and remunerating storage for its capabilities, she said.

Over the short-term-until more ISOs adopt hybrid participation options, at least-co-located configurations may continue to dominate the hybrid landscape. The distinction of hybrid versus co-located is primarily related to how the resource participates in the market (how it is bid, dispatched, etc.) rather than how it is built and developed from an engineering perspective," and if an ISO does not have a hybrid participation option, the engineering configuration becomes moot," Enel said.

How an owner chooses a project's configuration is ultimately determined by the use-case value. For now, co-located configurations perform better within PPA contractual constraints. Many offtakers are looking for PPAs for energy and [renewable energy credits], and are not interested in the capacity or ancillary service value that the battery brings. Thus, a developer may have offtake contracts for the renewable asset that necessitate offering the renewable separately from a storage device," it explained.

EPRI, meanwhile, pointed to a set of challenges RTOs and ISOs will need to iron out as they consider the participation of hybrid resources as a single resource, essentially allowing them to offer market services at the POI as would, for example, thermal generators. One big concern is visibility. Because a single resource hybrid plant operator would essentially self-manage" its resources, there is general uncertainty about how the resource would be modeled, and what their capacity value will be.

Yet another sizable concern is whether VER hybrids will retain features that are typically included in market participation models for standalone wind and solar resources. Generally speaking, ISO VER participation models do not assess penalties, often referred to as uninstructed deviation penalties, to VER resources if they do not achieve their dispatch instruction," the American Wind Energy Association explained. It is not clear whether VER hybrids will retain this feature, which typically involves a dynamic upper operating limit based on a meteorological forecast, or whether VER hybrids will be assessed uninstructed deviation penalties."

Based on their hybrid stakeholder processes, only CAISO, ERCOT, and ISO-NE currently plan to allow VER hybrids to retain the dynamic upper operating limit, as long as the ratio of VER capacity to the hybrid's total capacity meets a still undefined minimum threshold. Given the significant number of hybrid and co-located resources that are expected to enter wholesale markets, ISOs, their stakeholders, and hybrid and co-located resource developers should proactively work to resolve these issues and adjust ISO market rules and practices as needed, to facilitate the efficient entry and operation of hybrid and co-located resources," the industry group said.

-Sonal Patelis POWER's senior associate editor.

The post The Bittersweet Power of Hybrids appeared first on POWER Magazine.