2020 was a record year for Israel’s security startup ecosystem

From COVID-19's curve to election polls, public temperature checks to stimulus checks, 2020 was dominated by numbers - the guiding compass of any self-respecting venture capital investor.

As a VC exclusively focused on investments in Israeli cybersecurity, the numbers that guide us have become some of the most interesting to watch over the course of the past year.

The start of a new year presents the perfect opportunity to reflect on the annual performance of Israel's cybersecurity ecosystem and prepare for what the next twelve months of innovation will bring. With the global cybersecurity market outperforming this year's panic-stricken expectations, we carefully combed through the figures to see how Israel's market, its strongest performer, compared - and predict what it has in store.

The cybersecurity market continues to draw the confidence of investors, who appear to recognize its heightened importance during times of crisis.

The cyber nation" not only remained strong throughout the pandemic, but even saw a rise in fundraising, especially around application and cloud security, following the emergence of remote workflow security gaps brought on by social distancing. Encouraged by this, investors have demonstrated committed enthusiasm to its growth and M&A landscape.

Emboldened by the sector's overall strength and new opportunities, today's Israeli visionaries are developing stronger convictions to build larger companies; many of them, already successful entrepreneurs, are making their own bets in the industry as serial entrepreneurs and angel investors.

Image Credits: YL Ventures (opens in a new window)

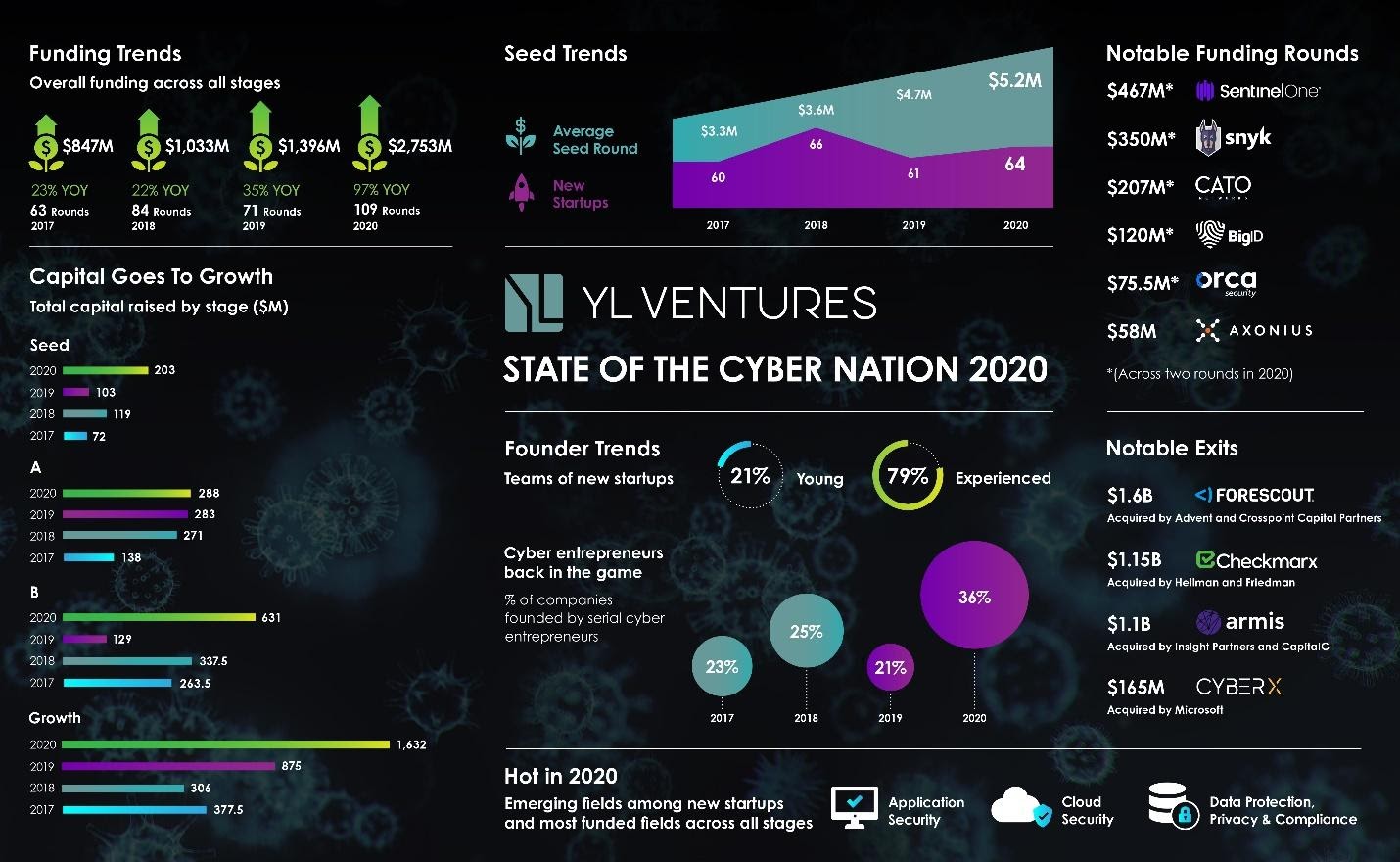

The numbers also reveal how investors are increasingly concentrating their funds on larger seed rounds for serial entrepreneurs and the foremost industry trends. More than $2.75 billion was poured into the industry this year to back companies across all stages, a 97% increase from last year's $1.39 billion. If its long-term slope is any indication, we can only expect it to continue to grow.

However, though they clearly indicate progress, the numbers still make the need for a demographic reset clear. Like the rest of the industry, Israel's cybersecurity ecosystem must adapt to the pace of change set out by this year's social movements, and the time has long passed for true diversity and gender representation in cybersecurity leadership.

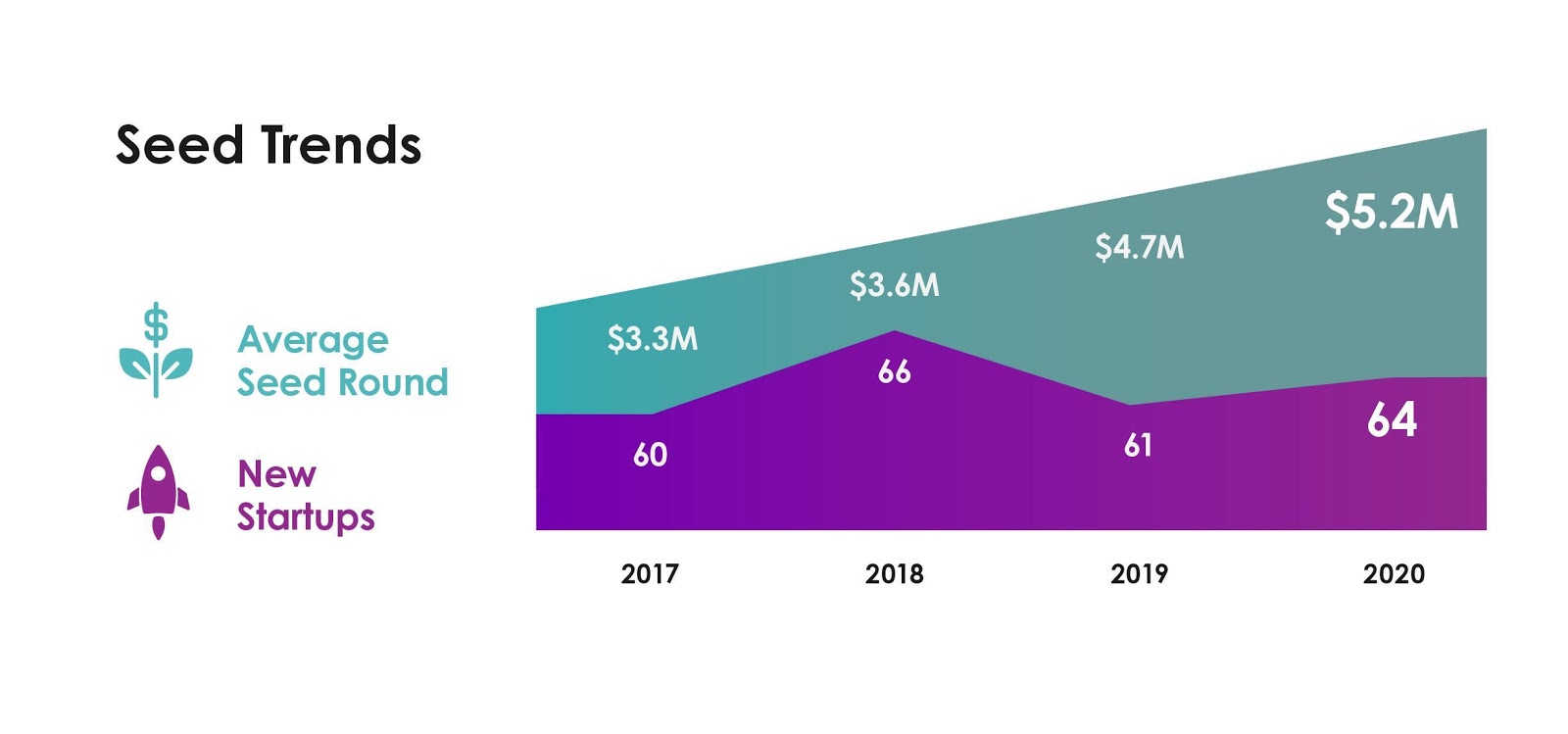

Seed rounds reveal fascinating shiftsAs the market's biggest leaders garner experience and expertise, the bar for entry to Israel's cybersecurity startup ecosystem has gradually risen over the years. However, this did not appear to impact this year's entrepreneurial breakthroughs. 58% of Israel's newly founded cybersecurity companies received seed rounds this year, totaling 64 seeded companies in 2020 compared with last year's 61. The total number of newly founded companies increased by 5%, reversing last year's downward trend.

The amount invested at seed hit an all-time high as average deal size in 2020 increased by 11%, amounting to an average of $5.2 million per deal. This continues an upward trend in average seed rounds, which have surged over the last four years due to sizable year-on-year increases. It also provides further support for a shift toward higher caliber seed rounds with a strategically focused and all-in" approach. In other words, founders that meet the new bar for entry are raising bigger rounds for more ambitious visions.

Image Credits: YL Ventures

Where is the money going?2020 proved an exceptional year for application security and cloud security startups. Perhaps the runaway successes of Snyk and Checkmarx left strong impressions. This year saw an explosive 140% increase in application security company seed investments (such as Enso Security, build.security and CloudEssence), as well as a whopping 200% increase in cloud security seed investments (like Solvo and DoControl), from last year.