Fintechs could see $100 billion of liquidity in 2021

- 2019 saw a stampede of fintech unicorns

- 2019 looks to continue another lights-out year for fintech startups

Three years ago, we released the first edition of the Matrix Fintech Index. We believed then, as we do now, that fintech represents one of the most exciting major innovation cycles of this decade. In 2020, all the long-term trends forcing change in this sector continued and even accelerated.

The broad movement away from credit toward debit, particularly among younger consumers, represents one such macro shift. However, the pandemic also created new, unforeseen drivers. Among them, millennials decamped from their rentals in crowded cities to accelerate their first home purchases to the benefit of proptech companies and challenger mortgage players alike.

E-commerce saw an enormous acceleration in growth rates, furthering adoption of online payments platforms. Lastly, low interest rates and looming inflation helped pave the way for the price of Bitcoin to charge toward $30,000. In short, multiple tailwinds combined to produce a blockbuster year for the category.

In this year's refresh of the Matrix Fintech Index, we'll divide our attention into three parts. First, a look at the public stocks' performance. Second, liquidity. Third, we highlight one major trend in the sector: Buy Now Pay Later, or BNPL.

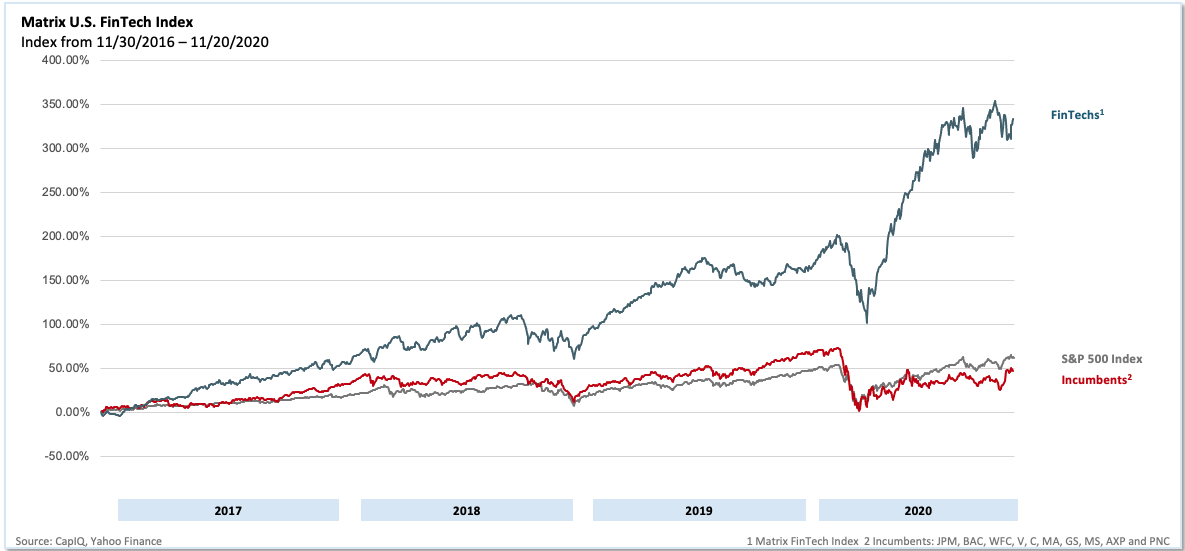

Public fintech stocks rose 97% in 2020For the fourth straight year, the publicly traded fintechs massively outperformed the incumbent financial services providers as well as every mainstream stock index. While the underlying performance of these companies was strong, the pandemic further bolstered results as consumers avoided appearing in-person for both shopping and banking. Instead, they sought - and found - digital alternatives.

For the fourth straight year, the publicly traded fintechs massively outperformed the incumbent financial services providers as well as every mainstream stock index.

Our own representation of the public fintechs' performance is the Matrix Fintech Index - a market cap-weighted index that tracks the progress of a portfolio of 25 leading public fintech companies. The Matrix fintech Index rose 97% in 2020, compared to a 14% rise in the S&P 500 and a 10% drop for the incumbent financial service companies over the same time period.

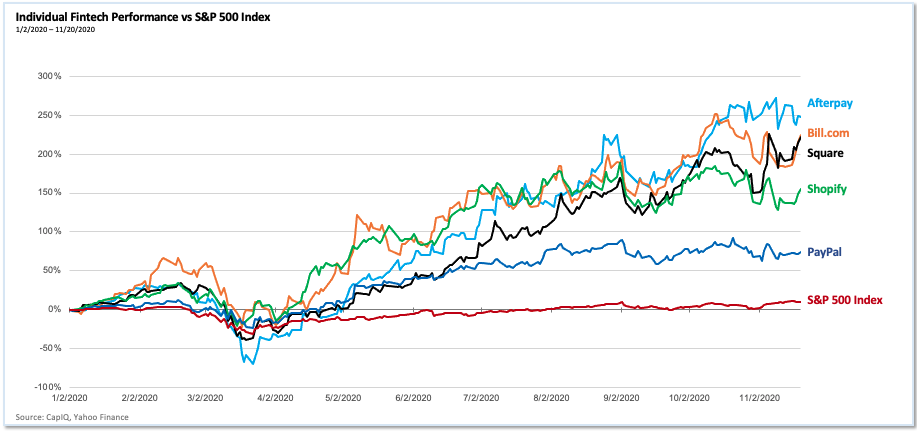

2020 performance of individual fintech companies vs. SPX Image Credits: CapiQ, Yahoo Finance

Matrix U.S. Fintech Index, 2016 -2020 Image Credits: CapiQ, Yahoo Finance

E-commerce undoubtedly stood out as a major driver. As a category, retail e-commerce grew 35% YoY as of Q3, propelling PayPal and Shopify to add over $160 billion of market capitalization over the year. For its part, PayPal in the third quarter signed up 15 million net new active accounts (its highest ever).