2021 Prediction #3: Get ready for more GameStops as hedge funds are no longer the only bullies in town

Sorry I got my puts and calls mixed-up in the e-mail version of this column. It should now be fixed. My 16 year-old copy editor says he won't make that mistake again. - Bob

Sorry I got my puts and calls mixed-up in the e-mail version of this column. It should now be fixed. My 16 year-old copy editor says he won't make that mistake again. - Bob

Today is my birthday. Thirty-five years ago today I was drinking coffee in my Palo Alto kitchen when the Space Shuttle Challenger exploded on TV. Thirty years ago today my father fell over, instantly dead of a heart attack while walking between gates in the American Airlines terminal at DFW. I was expecting a call, just not that one. Life is full of surprises and some of them aren't good, as hedge funds are learning this week while their fortunes are determined by millennial traders in shares of GameStop, the venerable video game retailer. This is all part of the new normal.

Day Trading of stocks and options was a big deal during the dot-com era 25 years ago. Traders" intent on closing-out their positions at the end of each day would hype this stock or that on Internet discussion boards, counting on artificial volatility and good timing to both buy and sell (or sell and buy) before the other guy - one trader against the world. That's NOT what is happening here with GameStop, AMC, Bed Bath & Beyond, Blackberry, etc. This is coordinated action of thousands of traders toward a specific and guaranteed profitable end.

Day Trading died because pretty much everybody involved lost all their money. I know your brother-in-law was the happy exception, but the vast majority of day traders lost their shirts, learned a lesson and moved-on. Again, what's happening this week is NOT Day Trading.

What's happening this week is more like the origin story of George Soros betting against the British Pound in 1992. Soros was the biggest player in this gambit, but there were many others doing the same thing. The UK Government, through the Bank of England, was trying to limit volatility in British Pound trading to no more than +/- six percent so Soros - already a well-established London trader - bought 10 BILLION in German Marks using British Pounds, driving the Mark UP and the Pound DOWN far beyond the six percent limits. Soros was betting the Bank of England would do whatever it took to defend the Pound, which meant selling Marks and buying Pounds, no matter what the price. And that's exactly what happened on what came to be called Black Wednesday. At the end of that day Soros closed-out his position 1 BILLION richer, an implied interest rate of 10 percent PER DAY, which is loan shark territory though on a global scale.

George Soros believed that there was no way he could lose so he went for broke. It certainly wasn't a good thing for the UK, but that trade is still lauded as among the BEST in history.

But if Soros was good, why is Wall Street complaining that GameStop is bad? That's because hedge funds - like those old Day Traders - are being burned at their own game.

Hedge funds like those involved in GameStop are inherently bullies. They find a public company that is weak (GameStop is struggling to even survive in the new era of downloadable games) then either buy a ton of shares and use those to bully the company into specific corporate actions that are profitable for the hedge fund OR they simply short the company shares, betting it will falter or even go out of business.

Shorting means selling shares with the intent of re-buying them later (covering the short) hopefully at a lower price. It's a bet that the shares will drop in price, producing a profit. If the company goes out of business and the short never requires covering, that's a profit of 100 percent. You don't have to actually own GameStop shares to short them, either. Your broker will borrow shares from some other account, lend them to you to sell, then it all gets resolved at the end when the short is covered or the target company dies.

A way to make even more money from this trade is by using options rather than actual shares, in this case buying call options. When you buy a call, you're hoping that the price of the underlying stock goes up. You make money with calls when the price of the option rises, or when you exercise the option to buy the stock at a price that's below the strike price and then sell the stock in the open market, pocketing the difference. Options cost less than actual shares so they are a form of leverage allowing you to make (or lose) more money per dollar actually in your account.

Now here's the rub: 138 percent of GameStop shares were shorted. Theoretically that's not possible, of course. You can't sell more of something than even exists. Yet from time to time that's exactly what happens because of another concept called GREED.

Somebody (brokers in this case) makes money on all those shorts or calls, no matter how the trade is eventually resolved. Even though the contracts apply to shares that don't actually exist, a contract is still a contract.

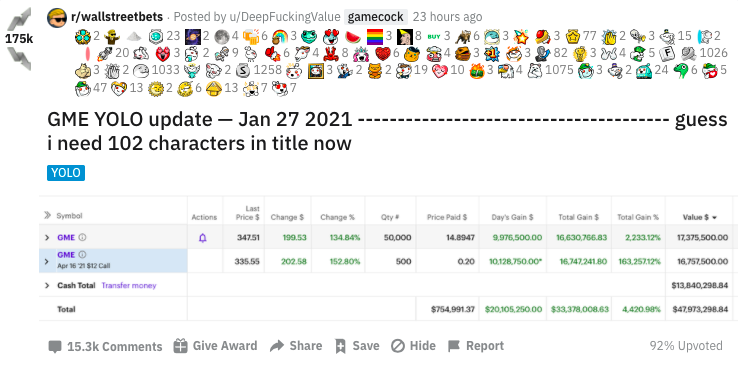

The seminal GameStop trade that started all this was Redditor u/DeepFuckingValue buying GameStop puts - the right to sell (rather than buy - that would be a call) GameStop shares at a specific strike price. As of yesterday this $53,000 trade had grown to about $48 million with $14 million of that in cash. That's some Deep Fucking Value.

Communicating over the WallStreetBets subreddit, thousands of similar traders - many of them trading for free on phone apps like RobinHood - piled-on, driving UP the price of GameStop shares, making it more and more expensive for the shorts to cover their positions.

Communicating over the WallStreetBets subreddit, thousands of similar traders - many of them trading for free on phone apps like RobinHood - piled-on, driving UP the price of GameStop shares, making it more and more expensive for the shorts to cover their positions.

Remember, with GameStop shorted 138 percent, it might actually be IMPOSSIBLE to cover those shorts at any price. Something had to give. Either the kids going long on GameStop would accept a lower price OR the hedge funds would have to throw-in their towels, literally going out of business.

Here's where the bullies start complaining about being bullied.

The hedges screwed themselves, but the risk they took usually works out. Only this time they are faced with an unorganized collective mindset that's not just a non-professional group of traders but ANTI-professional traders who frankly don't give a damn about some hedge fund's survival.

And so they twist the knife.

Remember these are gamers who spend hours each day winning or losing, living or dying in their game. They've found an edge in GameStop and they aren't going to give it up. Everyone of these small investors is a George Soros.

Today many brokers - even RobinHood - are limiting trading of AMC, GameSpot, BB&B, Blackberry and Nokia. This is within the brokers' right to do - for a short time to adjust for irregularities" in trading and to prevent fraud. Only fraud isn't involved here, just the relentless pursuit of perfectly legal profit on a grand scale. This will ultimately land in court where the brokers, institutions, hedges, and probably even the regulators are hoping the gamers will by then have lost interest and moved-on. Not likely, given the class-action potential for this case.

I've seen claims today that RobinHood is selling some of these shares without customer consent to protect them." If true, you know there has to be an incredible insider story there waiting to be told.

What about the regulators? Well they let the hedges bully for decades so it is difficult to say gamers can't be bullies, too. Which is why this problem won't be going away unless the shorts stop shorting so much. If the hedges hadn't been so greedy, this would never have happened.

Gordon Gekko may have been wrong after all: maybe greed ISN'T good.

The post 2021 Prediction #3: Get ready for more GameStops as hedge funds are no longer the only bullies in town first appeared on I, Cringely.

Digital Branding

Web DesignMarketing