Lightspeed and Max Levchin bet on Balance to bring B2B payments into the digital world

Consumer payments is by no means a solved problem (I'll trigger one hundred blockchain people if I say otherwise), but it sure as heck a pretty improved one. Checkout is a breeze with modern tools ranging from Stripe and PayPal to Fast and Rapyd to Apple and Google Pay. If you happen to need financing, on-the-spot lending platforms like Affirm, which recently debuted on NASDAQ and is currently valued at $26 billion, will extend that financing nearly instantaneously.

Then you head over to B2B payments ... and you recoil in horror as you migrate away from a utopian future of promise to the ruins of an antiquated past. A mash-mash of payment methods from paper checks to wire transfers get sent against invoices, none of which are automatically synchronized across financial information systems. Financing is complicated and offered by a bank through - gasp - an actual phone call. Shudder, because there probably involves a fax machine somewhere in that loop.

Balance is looking to modernize all of it, as fast as possible.

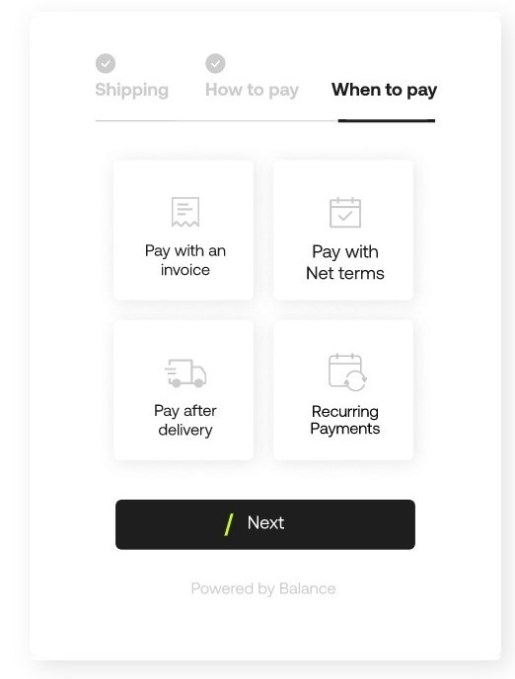

Balance offers efficient B2B payments that allows merchants to offer a variety of payment methods including ACH and bank wires as well as a variety of payment terms including payment on delivery, net payment terms, and payment by milestone. Behind the scenes, Balance underwrites the terms of those transactions requiring financing by evaluating the risk of the customer, the merchant, and the specific payment terms selected. Balance is built on top of Stripe and offers all of Stripe's credit card payment options, but then extends far beyond them.

Balance's checkout flow includes options to pick financing terms and means of payment. Photo via Balance.

Take, for instance, your typical SaaS offering. Typically, employees will buy individual seat licenses to the software with their corporate cards (managed maybe with Brex), a payment facilitated through Stripe or PayPal. As a company spends more and more on that particular software, one of the two parties will reach out and negotiate a comprehensive enterprise rate for single payment. It is here that Balance becomes key. That full payment could be done on Balance, with net 30 payment terms using a bank wire all automatically synced against an invoice offered by the service to the customer.

B2B payments is a massive market measured in the tens of trillions globally, which is perhaps one reason why Balance has an all-star fintech investing syndicate behind its seed round. It raised $5.5 million from Tal Morgenstern of Lightspeed, Stripe and Max Levchin through his SciFi VC. Lightspeed previously backed Levchin's Affirm. Balance was part of the summer 2020 batch of Y Combinator, although declined to appear at demo day and remained in stealth as its seed round had already been locked in. UpWest Labs, which invests in Israeli companies heading to the U.S. market, also invested.

Balance was founded by Bar Geron and Yoni Shuster in late 2019 to early 2020 and came through their experience working at PayPal together. PayPal is a key part of the story," Geron said, describing how the duo learned about the consumer payments world. Shuster stayed on at PayPal, while Geron headed to Behalf, a company that also works on B2B financing and cash flow management. Geron said that Behalf was a pain point solution" to the challenge of offering net payment terms, but that the company didn't attempt to digitize the mostly analog model of payments. Geron saw an opportunity and linked up with Shuster to take a more expansive approach to the problem.

Balance founders Bar Geron and Yoni Shuster. Photo via Balance.

Our dream is to make B2B payments as easy as car payments," Geron said. What we wanted to do is to make it as easy as Stripe ... take a snippet of code and just put it on your site." With that in place, Balance's other features like invoice syncing and financing become instant features.

Through Y Combinator, the team learned that other tech companies constantly confronted these problems, and that they would serve as useful first customers. The critical customers though in Geron's mind are B2B marketplaces where there are few solutions to synchronize the complexities of marketplace transactions. Geron says that we have several customers in that space." Another key customer segment are service providers who work on milestone-based payments, such as 20% upfront and 80% on delivery. We automated [all that] and put it online," he said.

Balance makes money on what is known as a factoring fee" where it pays the merchant ahead of the payment from the customer. Geron noted its 2%, although the actual rate varies based on the risk involved.

The two founders are based in Israel, although like most startups these days, they have a distributed workforce.