Jumia narrows losses, as its payment service grows in financial results

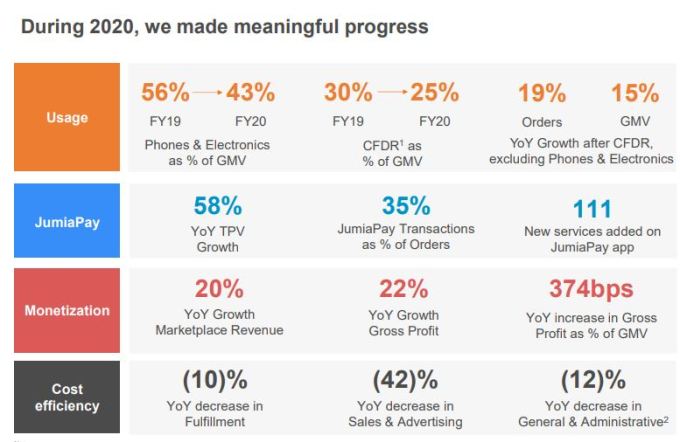

After years of losses, African e-commerce giant Jumia claimed significant progress towards profitability in its Q4 2020. Backing that claim, Jumia reported record gross profit and some improvements to its cost structure.

The company wrote in its earnings release that while 2020 has been a challenging year operationally with COVID-19 related supply and logistics disruption," it had also proven transformative" for its business model.

Let's examine its financial results to see how Jumia fared during the pandemic year and see if we can see the same path to profitability discussed in its written remarks.

The resultsJumia's core metrics were uneven in 2020. The company saw its user base grow by 12% in 2020, from 6.1 million customers in 2019 to 6.8 million customers. That means the company added 700,000 customers in 2020 compared to the 2 million customers it acquired the year before.

Other metrics were negative. The company's gross merchandise value (GMV), the total worth of goods sold over a period of time, grew 23% from the previous quarter to 231.1 million. The company said this was a result of the Black Fridays sales in the quarter. However, when compared year-over-year, Q4 GMV was down 21% as the effects of the business mix rebalancing initiated late 2019 continued playing out during the fourth quarter of 2020," Jumia wrote.

Image Credits: Jumia

In terms of orders made on the platform, Jumia saw a 3% year-over-year drop from 8.3 million in Q4 2019 to 8.1 million in Q4 2020. But while the company's metrics were mixed during Q4 and the full-year 2020 period, there were encouraging signs to be found.

Last year, Jumia's Q4 gross profit after fulfillment expense was 1.0 million. We reported at the time that the number's positivity was commendable if merely another mile of the company's path to profitability.

The company built on that result in 2020, allowing it to report a record gross profit after fulfillment expense result of 8.4 million in the final quarter of last year. From a full-year perspective, the numbers are even starker, with Jumia managing just 1.5 million in 2019 gross profit after fulfillment expense; in 2020, that number grew to 23.5 million.

That Jumia managed those improvements while seeing its 2019 revenues of 160.4 million slip 12.9% in 2020 to 139.6 million is notable.

JumiaPay and improvement in losses and expensesThere are other metrics that are encouraging for Jumia.

Its gross profit reached 27.9 million in 2020, representing a year-over-year gain of 12%. Sales and Advertising expense decreased year-over-year by 34% to 10.2 million, while General and Administrative costs, excluding share-based compensation, came to 21.8 million in the year, falling 36% year-over-year.

In 2019, Jumia incurred a massive 227.9 million in losses, a 34% increase from 2018 figures of 169.7 million. But that changed last year as Jumia reported a smaller 149.2 million in operating losses, representing a 34.5% decrease from 2019.

Jumia adapts Pan-African e-commerce network in response to COVID-19

Turning from GAAP numbers to more kind metrics, Jumia's Q4 2020 adjusted EBITDA loss also decreased. The company recorded an adjusted EBITDA of -28.3 million in the final quarter of 2020, falling 47% year-over-year from 2019's 53.4 million Q4 result. For the full 2020 period, Jumia reported 119.5 million in adjusted EBITDA losses, down 34.6% from FY19's -182.7 million result.

Jumia lost less money on an adjusted EBITDA basis in 2020 of any of its full-year periods we have the data for. Still, the company remains deeply unprofitable today and for the foreseeable future.

FintechJumia's fintech product, JumiaPay, has been a factor behind its improving metrics.

In Q1 2020, it processed 2.3 million transactions worth 35.5 million. That number grew to 53.6 million from 2.4 million transactions in Q2 2020. In the third quarter of last year, it recorded 2.3 million transactions with a payment volume of 48.0 million. For Q4, JumiaPay performed 2.7 million transactions worth 59.3 million.

In total, JumiaPay processed 9.6 million transactions with a total payment volume (TPV) of 196.4 million throughout 2020. TPV increased by 30% in Q4 2020 from its 2019 result and 58% in 2020 as a whole.

JumiaPay is a critical part of Jumia's business, as 33.1% of its orders in Q4 2020 were paid for with the service, up from 29.5% in Q4 2019.

Share price and optimism around profitabilityJumia went public in April 2019. Since opening as Africa's first tech company on the NYSE at $14.50 per share, the company's stock has been on a rollercoaster ride.

Africa e-tailer Jumia reports first full-year results post NYSE IPO

It traded at $49 per share at one point before battling with scepticism about its business model, fraud allegations, and shorting by Andrew Left, a well-known short-seller and founder of Citron Research. What followed was the company's share price crashing to $26 before reaching an all-time low of $2.15 on the 18th of March 2020.

Later, Left made a reversal after claiming Jumia had handled its fraud problems. He took long positions at the company and later proposed it would hit $100 per share. That change in market sentiment, coupled with the fact that Jumia changed its business model and halted operations in Cameroon, Rwanda, and Tanzania, enabled its share price to climb back, reaching an all-time high of $69.89 this February 10th.

Before today's earnings call, Jumia was trading at $48.81. Since dropping its latest data, the company's share price has expanded by around 10% to just over $54 per share as of the time of writing, indicating investor bullishness despite its continued operating and adjusted EBITDA losses.