As Coinbase looks to list, Robinhood rides the crypto boom

The impending Coinbase direct listing is a fintech debut to watch. The cryptocurrency-focused consumer trading concern is set to become a public company on the back of a strong 2020, and a particularly strong final quarter.

And it appears that the company is also having a strong kickoff in 2021. What Coinbase is worth is therefore hard to guess, though some are trying, as we've noticed.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

But Coinbase is hardly the only company enjoying a crypto bounce: Robinhood, another American consumer fintech we've spent too much time discussing in recent weeks, is also riding a wave in its users' cryptocurrency activity.

Between both companies, we're seeing signs of the sort of growing consumer interest and trading volume that has historically come with sustained periods of bitcoin price expansion. But Coinbase charges fees for trading, while Robinhood doesn't. And transaction-fee-based income is the vast majority of Coinbase's revenues - 96% in calendar 2020, for example.

Between both companies, we're seeing signs of the sort of growing consumer interest and trading volume that has historically come with sustained periods of bitcoin price expansion. But Coinbase charges fees for trading, while Robinhood doesn't. And transaction-fee-based income is the vast majority of Coinbase's revenues - 96% in calendar 2020, for example.

The situation sets up an interesting contrast.

This morning, let's see what we can learn about Coinbase's recent trading volume before looking into Robinhood's. And finally, we'll remind ourselves of how Coinbase talked about Robinhood in its S-1 filing. Is Robinhood crypto a possible threat to Coinbase's consumer trading volumes? Let's tinker.

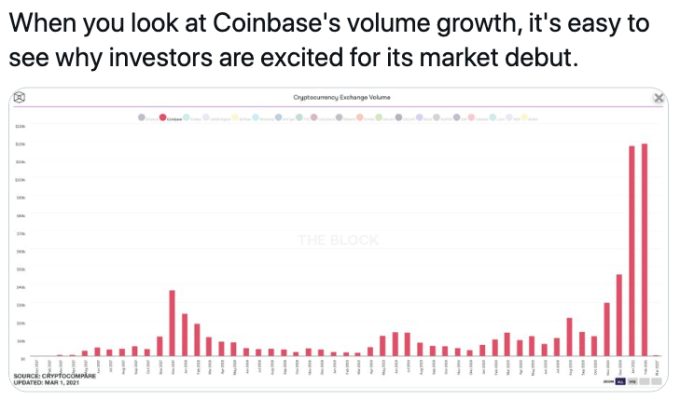

An argument called foreverKicking off with Coinbase, The Block's Frank Chaparro got us thinking this morning by tweeting the following chart:

You can see why the chart caught our eye. Now, we can't reproduce the same chart on CryptoCompare, as the tool required sits behind a locked door. But we can, however, leverage other services to confirm the gist of the image.

Other data agrees: Historical trading information via Nomics shows a steep rise in 2021 bitcoin trading on Coinbase Pro, a piece of the larger Coinbase empire. And Bitcoinity shows similar gains for Coinbase trading volumes over the same time period.

Chaparro is correct that the data paints a compelling Q1 2021 revenue story for Coinbase. But it's not the only company that is seeing crypto demand spike.