Billion-dollar B2B: cloud-first enterprise tech behemoths have massive potential

- Tracking the explosive growth of open-source software

- How viral open-source startups can build themselves into enterprise-IT powerhouses

More than half a decade ago, my Battery Ventures partner Neeraj Agrawal penned a widely read post offering advice for enterprise-software companies hoping to reach $100 million in annual recurring revenue.

His playbook, dubbed T2D3" - for triple, triple, double, double, double," referring to the stages at which a software company's revenue should multiply - helped many high-growth startups index their growth. It also highlighted the broader explosion in industry value creation stemming from the transition of on-premise software to the cloud.

Fast forward to today, and many of T2D3's insights are still relevant. But now it's time to update T2D3 to account for some of the tectonic changes shaping a broader universe of B2B tech - and pushing companies to grow at rates we've never seen before.

One of the biggest factors driving billion-dollar B2Bs is a simple but important shift in how organizations buy enterprise technology today.

I call this new paradigm billion-dollar B2B." It refers to the forces shaping a new class of cloud-first, enterprise-tech behemoths with the potential to reach $1 billion in ARR - and achieve market capitalizations in excess of $50 billion or even $100 billion.

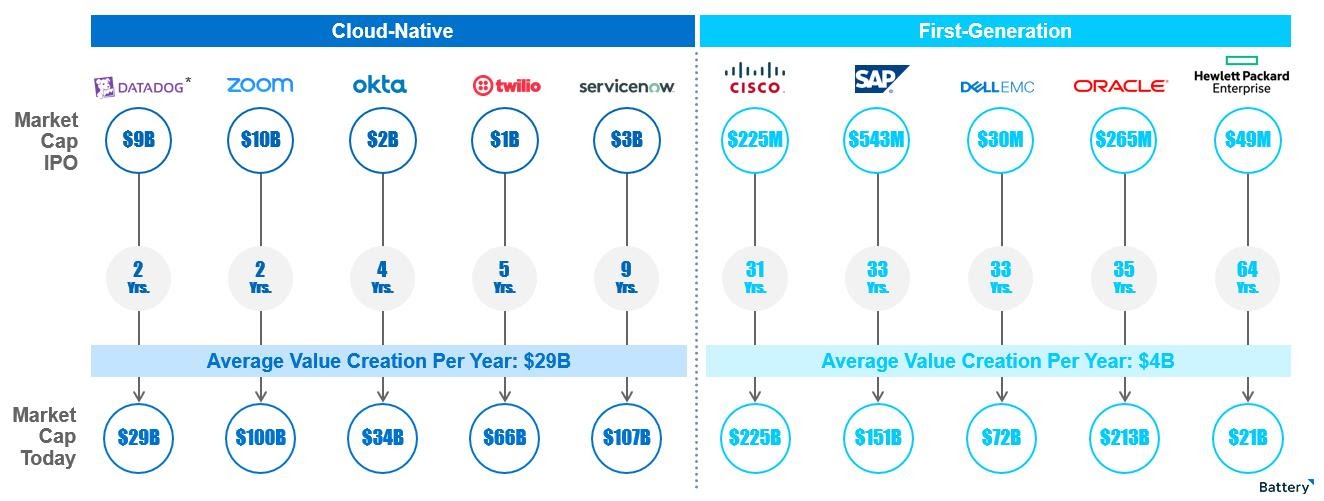

In the past several years, we've seen a pioneering group of B2B standouts - Twilio, Shopify, Atlassian, Okta, Coupa*, MongoDB and Zscaler, for example - approach or exceed the $1 billion revenue mark and see their market capitalizations surge 10 times or more from their IPOs to the present day (as of March 31), according to CapIQ data.

More recently, iconic companies like data giant Snowflake and video-conferencing mainstay Zoom came out of the IPO gate at even higher valuations. Zoom, with 2020 revenue of just under $883 million, is now worth close to $100 billion, per CapIQ data.

Image Credits: Battery Ventures via FactSet. Note that market data is current as of April 3, 2021.

In the wings are other B2B super-unicorns like Databricks* and UiPath, which have each raised private financing rounds at valuations of more than $20 billion, per public reports, which is unprecedented in the software industry.