Two investors weigh in: Is your SPAC just a PIPE dream?

This past year has brought many new developments to a historically traditional process: taking a company public. Many of the standard levers in an initial public offering (IPO) are being redefined as we write.

The emergence of direct listings is just one example. Even in more traditional IPOs, we have seen unique lock-up provisions, different auction approaches, virtual and rapid roadshows become the norm, and company-centric approaches to investor allocations.

But clearly the most disruptive trend of the past 12 months has been the predominance of the special purpose acquisition company, commonly known as a SPAC. A SPAC is a company with no commercial operations that is formed strictly to raise capital through an IPO for the purpose of acquiring an existing, private company.

Also known as blank check companies," these entities typically have 24 months to find a company to buy or merge with.

The fundamental thing to remember about the SPAC process is that the result is a publicly traded company open to the regulatory environment of the SEC and the scrutiny of public shareholders.

That process essentially makes the acquired company a publicly traded one. SPACs can, and generally do, raise additional capital in the form of a PIPE (private investment in public equity) in order to reaffirm the SPAC valuation and raise additional capital with the identified target company.

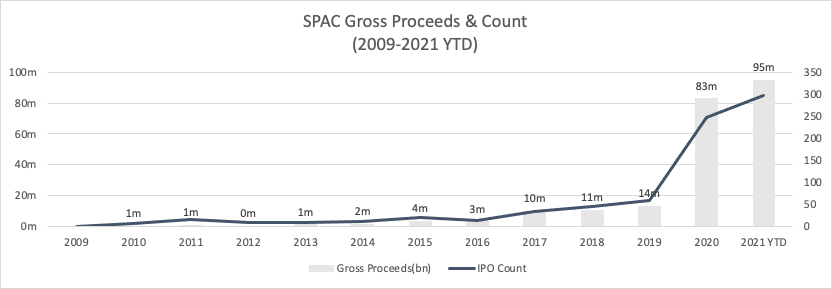

SPACs have been around for decades, but they took the 2020 IPO market by storm. For some context: 2020 had more than 248 SPACs - more than the sum of the SPACs in the previous decade. While SPACs and the general sentiment around them continue to evolve, 2021 started off strong with 298 newly formed blank-check companies to date that have raised a collective $95 billion (versus $83 billion in 2020). It's worth noting that there has since been some slowdown in new SPAC formation and an uptick in regulatory caution. We expect such shifts to continue in these early days.

For a SPAC, finding a company to merge with in 24 months might sound like a good amount of time, but in reality, the diligence and SEC process can easily consume six months or more. So identifying the target company relatively quickly becomes critical. As a result of this new trend, many private companies are being approached and courted by a number of newly formed SPACs.

Image Credits: Madrona Venture Capital

At Madrona, we invest in companies early in their journey (often Day One), and walk with them through the years of opportunities, challenges and financing goals. As such, for many of our companies, the conversation around raising capital via a SPAC transaction has come up, and more than once.

How to evaluate the pros and cons of SPACs relative to other financing options can be convoluted and confusing, to say the least.

Are you ready to be a public company?The fundamental thing to remember about the SPAC process is that the result is a publicly traded company open to the regulatory environment of the SEC and the scrutiny of public shareholders.