Uber’s mixed Q1 earnings portray an evolving business

Today, Uber followed Lyft in reporting its Q1 2021 earnings this week. And like its rival, its results take a little bit of work to understand. So, this afternoon, we're going to parse them as a pair so that we both understand what's going on at the ride-hailing and food-delivery giant.

Let's start with the big numbers: Uber's revenue missed sharply, while its profitability beat expectations.

Let's start with the big numbers: Uber's revenue missed sharply, while its profitability beat expectations. In numerical terms, Uber reported $2.9 billion in revenue for the three-month period, sharply under the $3.28 billion investors had expected. However, while the street had anticipated that the company would post a $0.54 loss per share, Uber's GAAP results actually came to a far more modest $0.06 per-share loss.

How did investors vet Uber's performance? The company's stock is off around 4% in after-hours trading.

Surprised by the revenue miss? Shocked by the profit beat? Startled by the sharp drop in the value of Uber's stock? Let's unpack the numbers.

Uber's quarterA number of things impacted Uber's quarter. The first, of course, was COVID-19. The pandemic shows up in a host of ways across Uber's results, but most critically it continued to negatively impact Uber's ride business and positively impact its delivery business.

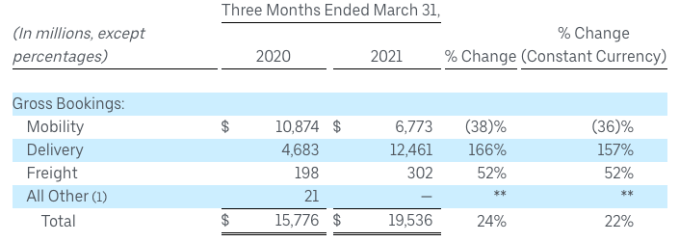

Turning to numbers, here's the company's gross bookings data, which includes both segments:

Image Credits: Uber

A few things to note. First, Uber's total platform spend went up in aggregate on a year-over-year basis. That's good. And as we look at the year-over-year changes, that delivery's growth compared to the year-ago period was nearly legendary. (Postmates is in there, so take that into account.) The ride-hailing business's decline feels somewhat modest in comparison. And we'd note that Uber's freight efforts are very nearly material.