Android Automotive is Google's secret weapon to win the future of mobility

Google is taking seriously what car you're going to drive in.

If you listened closely to the slew of Google I/O announcements regarding the company's focus on vehicles, you would see that it drew proverbial lanes for automakers and app developers to ultimately go in the same direction.

There's at least some initial evidence that it's working because of early announced partnerships, but the more Google adds to the mix, the more complicated it all becomes. Android Auto and Android Automotive are still two distinct things, but does the average driver know that? Does the average person working at a car dealership understand the difference?

These are the things Google doesn't address at events like I/O, yet what it does lay out portends to what role it expects to play in the future of driving and mobility.

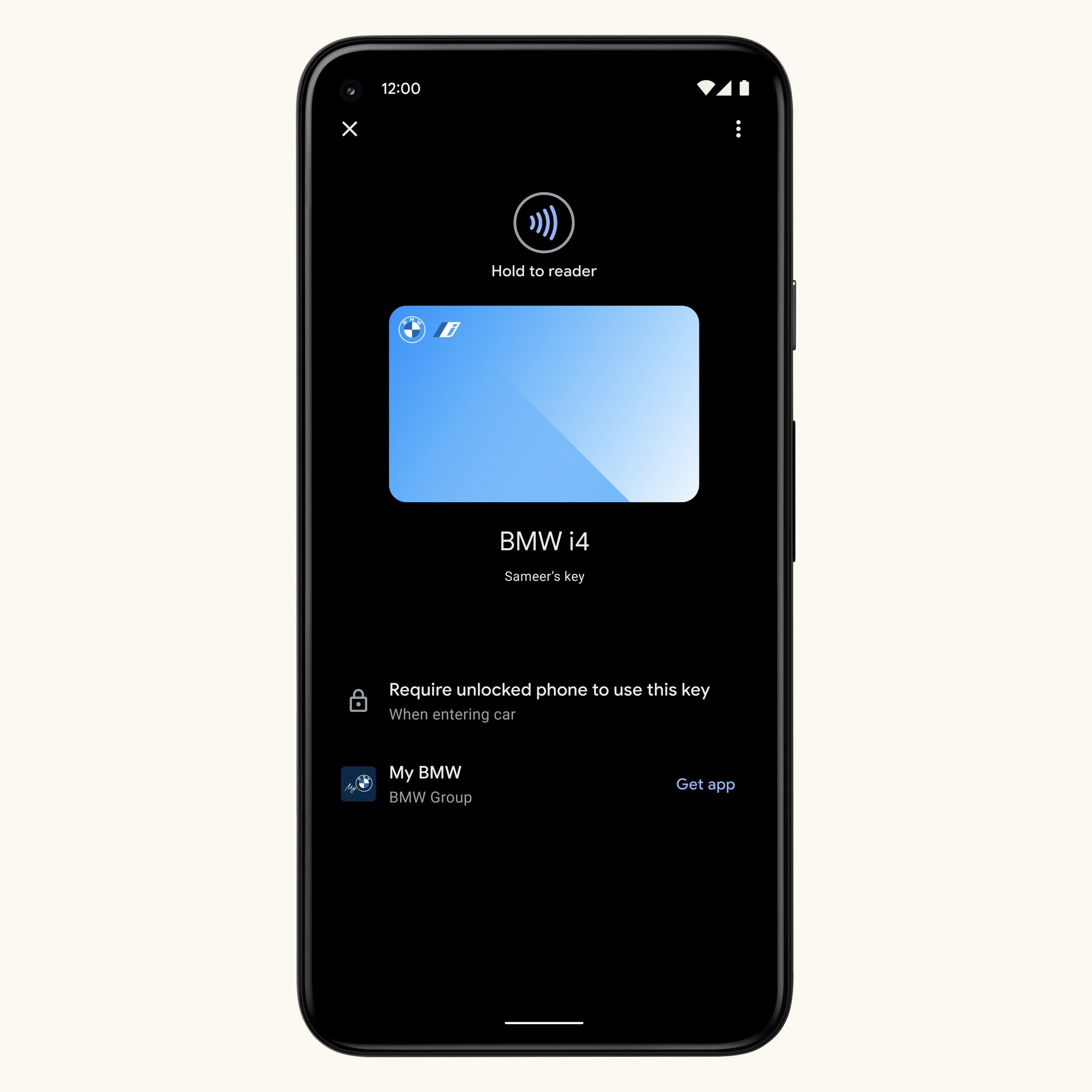

The disappearing car keyThe very idea of having a key for a vehicle already feels like a bygone era left behind, especially if you ask someone who drives a car without one. Google announced two features that, while distinct, are actually going to be closely related if the company is to realize its plans.

Digital Car Key and Fast Pair are likely going to be symbiotic in some way in the future because they both pursue the same end result. For instance, BMW has already chosen to integrate ultra-wideband (UWB) to remove the need to do anything when entering, leaving or starting the vehicle. There are fobs already doing that, but with a phone doing it, the fob effectively becomes obsolete because a data connection isn't necessary for the phone to communicate what it needs the car to do in that case.

Up to now, any app integration that let drivers control things like locking/unlocking doors and remote starting were delayed reactions. The reason why is because the data connection has to go from the phone and through a cell tower first before finally landing to the car's own SIM. It's a neat way to interact with your car, but it's clunky.

Digital Car Key doesn't fully solve that issue, but it does address the proximity part of the equation. And it also simplifies the idea of "handing the car keys" to a friend or family member. They don't need the fob, they just need the appropriate app with permissions in place to borrow the vehicle.

That's where Fast Pair also comes in. Rather than UWB, this is a Bluetooth feature with pretty much the same premise. We've seen moves toward faster pairing for Bluetooth connections, and since cars are connected devices, it only makes sense to simplify that, too. NFC chips in some cars did try to do that before, but Fast Pair handles it from a software perspective, and that should smooth out the experience. So far, BMW and Ford are to integrate it, though it's not clear which models will actually offer it.

Android Automotive picking up speedIt's entirely unclear how long Google plans to keep Android Auto around once Android Automotive gets into more vehicles, but don't count on the company putting it to pasture anytime soon. There will be millions of vehicles on the road that won't have any chance of having Android Automotive, since that's baked into the car's infotainment system. Android Auto works from any Android phone and projects onto a compatible head unit in the car. And with Google expanding the latter to more countries in Europe, expect development and expansion to continue.

Not to mention that Google will double down on offering it to vehicles and drivers wirelessly. It's about time. When wireless charging becomes almost a standard feature, it's probably a good idea to no longer force drivers to plug in a cable.

The expansion clearly sets its sights on what cars of the near future will need, particularly charging infrastructure. Parking and navigation are also on the table, and though Google already announced a lot of that back in January, the latest news streamlines things for app developers to make bringing apps to Android Auto faster.

All of that coincides with the real master plan, which is to push Android Automotive as the infotainment system of choice for any automaker willing to integrate it. So far, Volvo and Polestar are on board, with GM, Ford, Nissan, and Renault also ready to do the same. Porsche announced it will no longer be Apple-only, and will finally start supporting Android Auto with the upcoming 911, but won't commit to the Automotive OS.

The auto industry is largely about momentum. As a service or product offering grows in availability and sophistication, other automakers who held out start to jump onboard. That's what Google would like to see, as it makes its play to dominate the dashboard.

Let there be apps

Google acknowledged that better app support is what drivers request most. Without the apps, the integration doesn't feel all that deep anyway, so it makes sense. Safety measures and regulations naturally make the development process more complex. The new Car App Library will focus on navigation, parking and charging first, but app developers can expect that to grow further.

The new Car App Library will focus on navigation, parking and charging first, but app developers can expect that to grow further.

The only apps the company mentioned were PlugShare, ChargePoint, 2GIS, T map, Flitsmeister, Sygic and SpotHero. This would make it easier to find charging stations or parking spots by just asking for them by voice. I'd like to see this in action because just saying you've integrated these things doesn't mean they will work well. At the very least, adding charging stations should do wonders for range anxiety, except the charging stations themselves come from various brands. All of them will need to be in the in-car Play Store to truly make this a seamless experience, regardless of charging station.

The focus on apps also delves into something Google didn't really veer into during the event. There are still a number of apps in Android Auto that aren't in Android Automotive. While I don't expect it to take too long to bridge that gap, it is likely going to be a temporary issue for the next year or so. Part of the idea of making it easier for developers is to move those apps over to improve what is currently a pretty bare cupboard.

Making a dealGoogle also said nothing about how it plans to help automakers and their dealership networks. If you've ever gone to a dealership and asked about the infotainment system, you may not get someone who knows what they're talking about. I have gone, pretending like I didn't know anything, and came away surprised at how limited the associate's expertise was. That knowledge gap is going to be a big issue when considering how much of a selling point the car's technology actually is.

Android Auto is the stepping stone, but the real value is in Android Automotive OS. Once you're truly integrated in the car, you have some sway over the automakers. That's where things will get interesting. How might Google monetize a platform that could eventually be on millions of vehicles - without harvesting user data? How might the automakers look to make some extra coin from it? And what can we expect to see as far as payments and other services go when they mature in the vehicle?

Where there's money to be made, there's going to be some experimentation. Android Automotive is the big gamble, and while it will take a few years to see what its maturity derives, the dashboard takeover is already afoot.