Paytm, India’s most valuable startup, confirms plan for an IPO

Paytm, India's most valuable startup, confirmed to its shareholders and employees on Monday that it plans to file for an IPO.

In a letter to shareholders and employees, Paytm said that it plans to raise money by issuing fresh equity in the IPO, and also sell existing shareholders' shares at the event. The startup has offered its employees the option to sell their stakes in the firm.

This is the first time the Noida-headquartered firm, which is valued at $16 billion and has raised over $3 billion to date, has commented on its plans about the IPO. The startup said in the letter that it has received an in-principle approval from the board of directors to pursue the public market.

Paytm, which is backed by Alibaba and SoftBank, hasn't shared when it plans to file for the IPO, but has sought shareholders' response to their intention to sell stakes by the end of the month.

Two sources familiar with the matter told TechCrunch that Paytm plans to raise about $3 billion and is targeting a valuation of up to $30 billion in the IPO. Paytm declined to comment.

Paytm's letter - obtained by TechCrunch - to shareholders on Monday.

This isn't the first time Paytm has planned to explore the public route. Exactly 10 years ago, long before Paytm established itself as the largest mobile wallet firm and expanded to several financial and commerce services, the startup had filed with the regulator with intentions to become public. The startup at the time cancelled the IPO plan and instead raised money from VCs to explore new avenues for growth.

A lot is riding on a successful IPO of Paytm - which reported a consolidated loss of $233.6 million for the financial year that ended in March this year, down from $404 million a year ago. (The startup's revenue fell 10% during this period to $437.6 million.) India's stock markets are yet to be fully tested for tech startups' stocks in the country - though retail investors have shown good signs in recent years.

The startup, which competes with Google Pay and Flipkart-backed PhonePe, has realigned its payments strategy in recent years to assume leadership position in merchant payments market.

In a report to its clients late last month, analysts at Bernstein said the startup's credit tech vertical is likely to lead the next wave of its revenue growth.

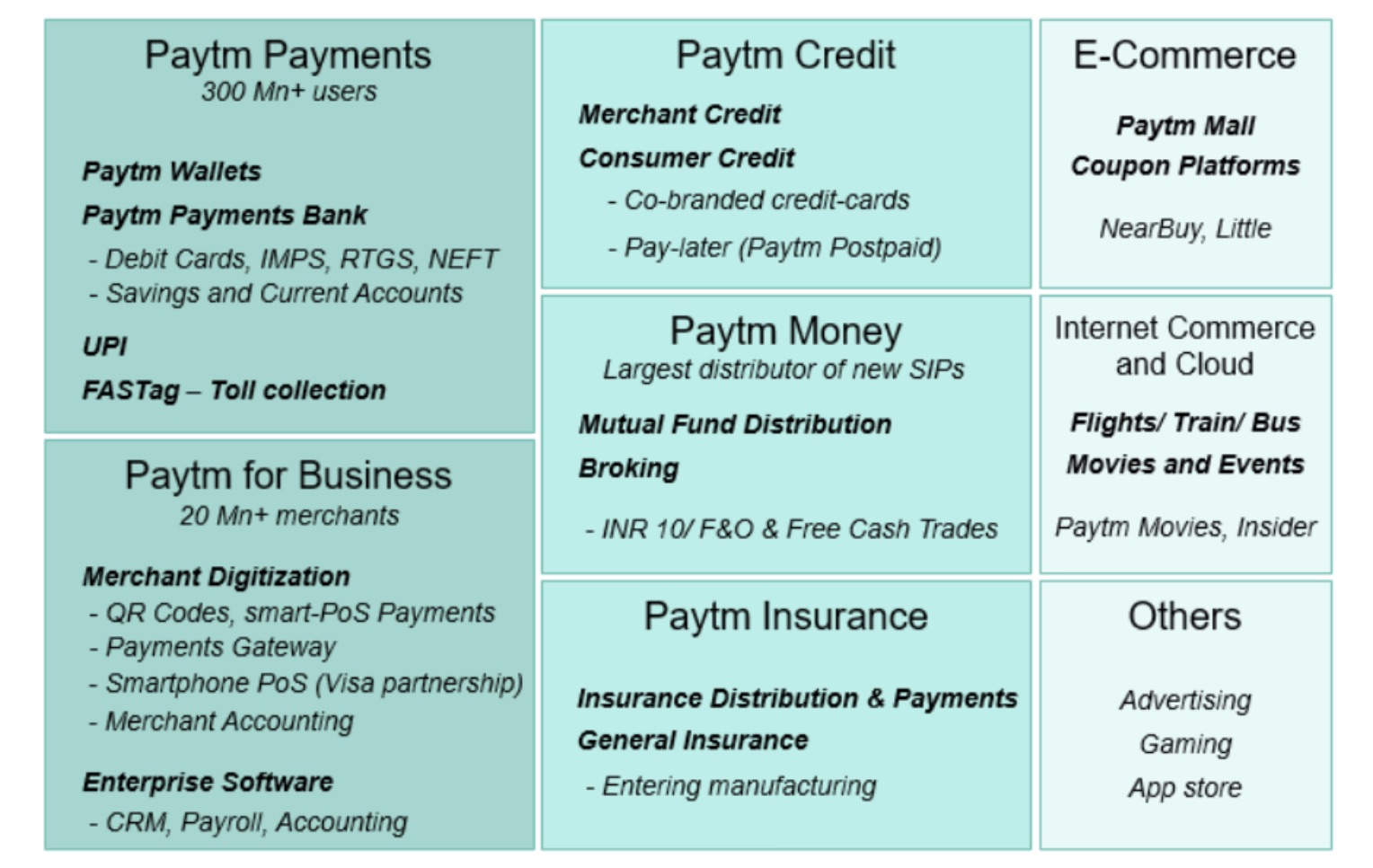

An overview of Paytm's financial services ecosystem (Bernstein)

With the advent of UPI, there has been a rising narrative that questioned Paytm's market leadership," the analysts wrote, referring to the exponential growth of payments stack developed by retail banks in India that has been adopted by several firms including Google and PhonePe (as well as Paytm), and which has somewhat lowered the appeal of mobile wallets in India.

However, under the hood, Paytm leads on merchant payments and has built an ecosystem of synergistic fintech verticals around its super-app.' The ecosystem spans payments (wallet/UPI), full-suite merchant acquiring, credit tech, digital bank, wealth, and insurance tech. We believe the super-app battle in India is not a winner takes all' but a game of execution, business building, and creating a superior customer experience with ecosystem integration," Bernstein analysts added.

Paytm is the latest Indian giant startup that has expressed an interest in becoming public in recent months. Earlier this year, food delivery startup Zomato said it plans to raise $1.1 billion through an initial public offering. TechCrunch reported last month that Flipkart was in talks to raise over $1 billion in what is expected to be its financial fundraise ahead of an IPO.

Indian logistics giant Delhivery raises $277 million ahead of IPO