OnePlus, even joined with OPPO, will struggle to compete with Samsung

OPPO's now sub-brand OnePlus could try to take on Samsung's budget phone market after its integration, but experts say becoming a viable competitor to Samsung is a "stretch." They add the hope is now maybe the partnership will help OnePlus scale up marketing dollars and manufacturing scale, which Samsung has excelled in.

In a briefing with reporters, OnePlus CEO Pete Lau detailed further what the integration between the company and OPPO would look like. He said that OnePlus' next flagship phone, slated for early 2022 and likely called the OnePlus 10, will have a newly integrated OS between OnePlus' OxygenOS and OPPO's ColorOS, and that throughout 2022 OnePlus will update a subset of its existing phones to that new, as-yet-unnamed software.

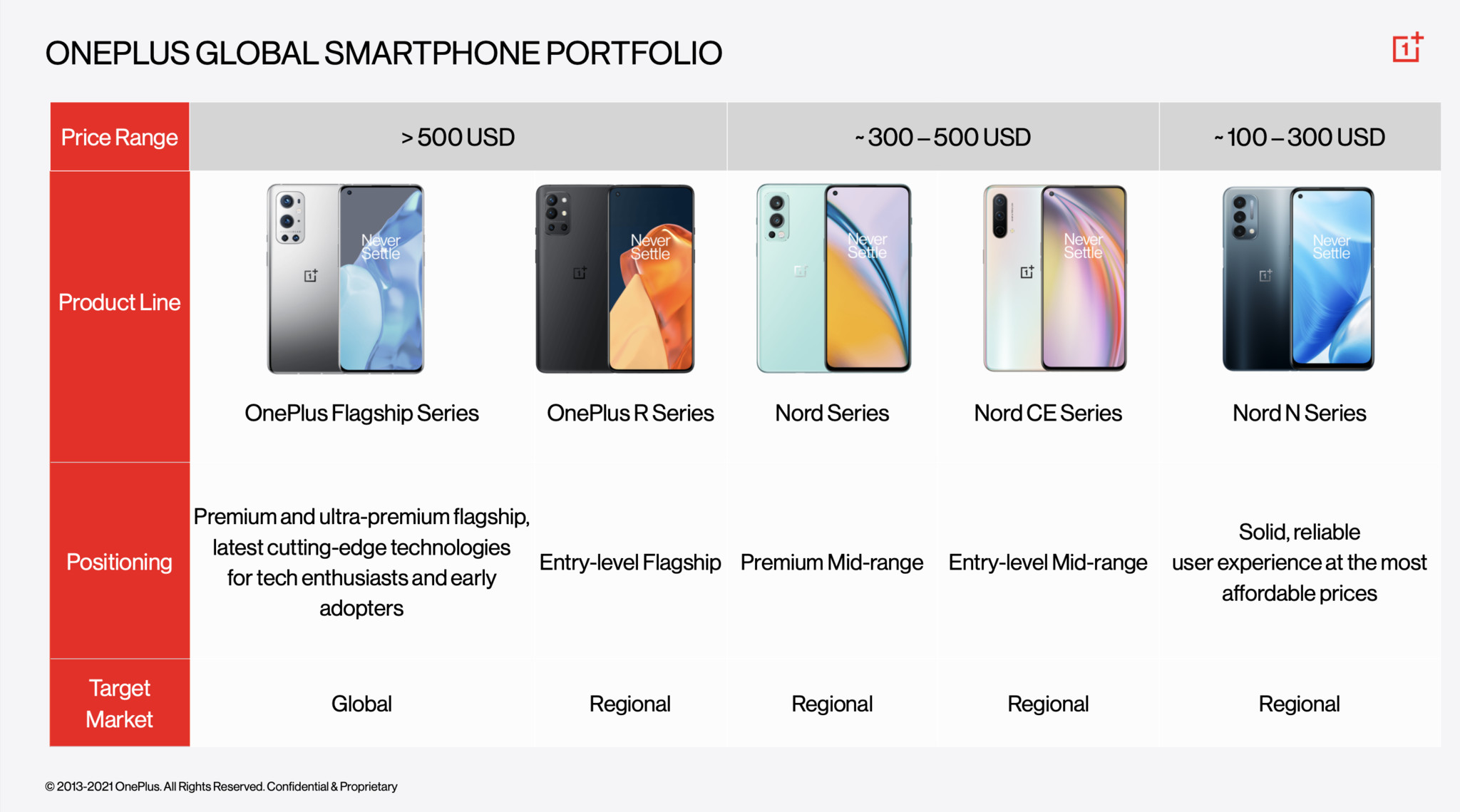

Internal documents viewed by Android Central showed the new breakdown of OnePlus' smartphone portfolio by series and region. For higher-end phones, the company will launch new flagship series phones globally, with a new R series phones (regional only). Android Central originally reported that OnePlus would forgo a T-series phone in late 2021, releasing instead a phone called the OnePlus 9 RT in select regions.

Mid-range phones regionally launched will include the Nord and Nord CE series. The Nord N series will remain the only budget series sold in North America, these are some of the best budget Android phones.

In an email to Android Central, OnePlus did not clarify if it was getting rid of the T series entirely, but it did say it will "not be releasing a global T version of the OnePlus 9 and 9 Pro in 2021."

"With a more comprehensive product range and more localized products, we are now better able to meet the specific needs of users in different markets," a spokesperson said.

In a press release, Lau said the company's more affordable product ranges "will become more localized, while continuing to offer our premium and ultra-premium flagship smartphones globally."

"Based on the growth and success we achieved last year, we will continue offering users a high-quality experience at multiple price points, together with even more competitive pricing," he said.

Lau, who is now also OPPO's chief product officer, also detailed that software updates are becoming more timely and over time "we have seen that the two operating systems [OxygenOS and OPPO's ColorOS] have been gradually converging in terms of the fundamental user experience."

OnePlus announced the merger of OxygenOS and ColorOS in July and during the briefing last week provided more detail of the new integrated system.

"With more resources as a larger and more integrated organization, we feel that we can offer even more to our users by adapting our approach to software," Lau said. "By combining our software resources to focus on one unified and upgraded operating system for both OnePlus and OPPO devices globally, we will combine the strengths from both into one even more powerful OS."

With these changes is OnePlus a viable competitor to Samsung?Jitesh Urbani, IDC's research manager of worldwide device trackers, says in an interview that Samsung's global presence is more exhaustive and evenly spread, while OnePlus and OPPO tend to have more of a regional or country-specific presence.

"Calling OnePlus, even with OPPO's might behind it, a 'viable competitor' to Samsung on a global basis would be a bit of a stretch," he says, adding that Apple is more competition for Samsung in the high-end market and Xiaomi in the mid to low end.

"Calling OnePlus, even with OPPO's might behind it, a 'viable competitor' to Samsung on a global basis would be a bit of a stretch."

OnePlus was started after its CEO Lau left OPPO in 2013 and partnered with Carl Pei (who left the company last year to start Nothing, a hardware startup). Throughout its independence, OnePlus, like OPPO and Vivo, was ostensibly owned by a parent company, BBK Electronics, but it touted itself to be a smart and exclusive brand that competed with bigger smartphone brands. While the companies were independent of each other, OPPO and OnePlus shared research and manufacturing resources, resulting in phones that looked very similar to one another but were released in different regions.

Since the launch of the OnePlus Nord in 2020, the company has released a number of devices that aim squarely at the budget and mid-range segments normally dominated by competitors like Samsung and Xiaomi.

Urbani says that the further integration with OPPO will likely benefit OnePlus with "expertise and dollars, allowing them to perhaps experiment a bit more while also taking them from the underdog status to a notable contender."

OnePlus will need to be aware of products that work in specific regions to succeedFor some time now, OnePlus has been very focused on one model at a time, which Anshel Sag, a senior analyst at Moor Insights & Strategy, says was a case of resources. It made it difficult to have too many people working on multiple projects at the same time, he says.

"The Nord phones were really appreciated by Android enthusiasts and not really marketed properly to the masses even though they brought a lot of the unique OnePlus goodness to a lower price point and were generally pretty well received. Although I think in that price segment outside of North America, they had much more competition from Xiaomi, Vivo, Realme, and other devices," he says.

It should be noted that Realme and Vivo are popular in specific markets like Asia and India and, like OPPO and OnePlus, are both owned by BBK Electronics. In fact, Realme began as a sub-brand of OPPO before it was spun off in 2018.

The new partnership will hopefully make OnePlus more aware of which products work in which markets, Sag says.

"OnePlus is realizing that not all models play well in all markets, something we've seen [when] companies like Xiaomi realize and only release certain models in markets where they are most competitive," he says, adding this strategy has worked well for Samsung, too.

Shah explains that Samsung for example has notably segmented their Galaxy phones in a more traditional homogenous on-brand but multiple line items with the F series, J series, M series, C series, Note series, Z series, S series (which is available in almost most markets), and A series.

OnePlus really needs to tap into marketing dollars to grow its market shareEven with OPPO's considerable financial backing and marketing resources, OnePlus may continue finding it difficult to compete in regions where it's most established.

The latest Counterpoint Research data for U.S. market share research for Q2 showed that, together, Apple and Samsung dominated the country with nearly 79% of the user base.

OnePlus, however, has benefited from its recent carrier partnership with T-Mobile and the introduction of the cheaper N10, N100 and N200 5G, with Counterpoint noting that "Motorola and OnePlus were big gainers in Q2, capitalizing on LG's weakness, especially in prepaid channels."

Sag believes that it will be hard to tell if these specific changes will really offer a significant difference in market share momentum.

"If anything, it will help the company focus more on making better products and that might help down the road," he says.

"If anything, it will help the company focus more on making better products and that might help down the road."

Neil Shah, vice president of research at Counterpoint Research, says in an interview that OnePlus' market share is low, but that could change. The company began its U.S. strategy with the original OnePlus One in 2014 but maintained a direct-to-consumer model until 2018 when it began selling the OnePlus 6T through Verizon.

"But the next big step to win in this market is by increasing stakes with a pot full of marketing dollars," he says. "This wouldn't happen with OnePlus' profit and loss but only with OPPO's deeper pockets. So ideally OPPO would like to expand OnePlus' brand across postpaid and prepaid segments of North America especially with LG leaving a vacuum of roughly 8-10% share."

Shah agreed, adding that despite the previously shared research and development budget, manufacturing with OPPO was limited by a narrow portfolio, marketing budget, geographic focus, channel reach, and margins that were available to share.

"For example, China is the biggest market for OPPO where OnePlus didn't focus, and other markets such as Latin America, Middle East, Africa, Eastern Europe and Asia Pacific. As a result, OnePlus' popularity hit a ceiling and thus it started to diversify its portfolio with a cheaper Nord series to widen market share," he says.

And unlike Apple, which has "fat margins and full-stack differentiation" in products, OnePlus will have to tap into market dollars and broaden its portfolio and addressable market, he says.

"Integrating into OPPO made more sense than reinventing the wheel with its profit and loss," he says.

OnePlus needs to focus on being unique and there should be less OPPO overlapWith the criticism that OnePlus and OPPO have been so similar, Shah notes that OPPO should try to "cleverly leverage OnePlus so there is minimal overlap with its Reno series." That means in terms of value propositions and price segments, he says.

He also adds that like Samsung, which has an entire ecosystem of products for different users, OPPO and OnePlus should capitalize on how they brand and integrate non-smartphone products seamlessly like headphones, smart TVs, and watches.

Sag notes that with this finalized integration, OnePlus really needs to refocus on becoming what made the brand unique in the market.

"I would like the brand to refocus on that as much as they can while this new organizational restructure takes shape. It would be a huge loss for OPPO if they were to cheapen such a brand that so many people fought so hard to build and grow into a competitive player in the global smartphone market," he says.

This might be a bit challenging for the company, though, as OPPO is cutting around 20% of staff in key software and device teams after the integration, per a Bloomberg report.

Those jobs will likely be cut in from teams that customize Android into its in-house OS, and its Internet of Things division which develops those wearables like smartwatches and earbuds.