Is protecting my device with T-Mobile phone insurance worth it?

Protect your new device with T-Mobile phone insurance

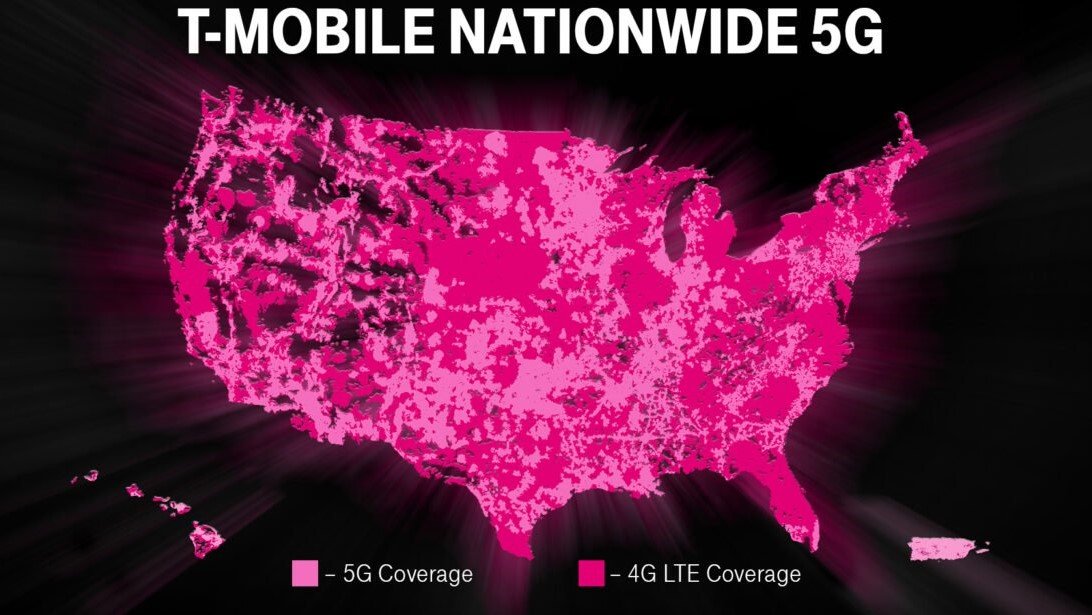

T-Mobile's coverage has significantly improved over the years, and today this carrier offers some of the best cell phone plans out there. There's no better time to join un-carrier, especially if you're a heavy data user and want to start taking advantage of 5G. In fact, T-Mobile is the nation's leader in 5G coverage and has some of the most ambitious plans to continue building out its 5G spectrum throughout the country with increased speed and capacity.

If you just purchased a new 5G phone like the iPhone 13 or you're considering making the switch to T-Mobile, adding T-Mobile phone insurance is a great way to protect your shiny new device should anything go wrong. Though most of us overlook phone protection plans, here's what you need to know to make the right decision for you.

Jump to:- What is T-Mobile phone insurance?

- Who can enroll for T-Mobile phone insurance?

- How much does T-Mobile phone insurance cost?

- What are the benefits of T-Mobile phone insurance?

- How do I file a claim under T-Mobile phone insurance?

- Is T-Mobile phone insurance worth it?

We've all owned a device that one day just stopped working, or got stolen out of our hands while vacationing in Europe. If that doesn't sound familiar, then you can consider yourself lucky. Accidents happen more often than we think, which is where a great phone insurance plan comes in. If you're new to T-Mobile and recently purchased a new device, you have the option of protecting your investment with one of its phone insurance plans: Device Protection or Protection 360.

Both Device Protection and Protection 360 protect your new phone should it break due to hardware or mechanical issues, encounter accidental damage, or get lost or stolen. A phone insurance plan is useful because it protects your device even after the manufacturer's warranty expires, which could save you a lot of money in the end.

Who can enroll for T-Mobile phone insurance?To take advantage of T-Mobile phone insurance you need to be a postpaid T-Mobile customer and enroll no later than 30 days after purchasing a qualified T-Mobile device. If you bought your device on your own (for instance, directly through the manufacturer) or want to enroll after that 30-day mark, you'll need to bring your device into a T-Mobile store to be inspected. Though it's still possible to enroll, it's easier to make up your mind as soon as you purchase the device.

How much does T-Mobile phone insurance cost?T-Mobile phone insurance, particularly Protection 360, can cost anything ranging from $7 per month plus tax up to $18 per month plus tax depending on the device you own. The more expensive the device, the more you can expect to pay in phone insurance. If you're paying $18 a month, that'll allot to at least $216 a year on phone insurance.

What are the benefits of T-Mobile phone insurance?T-Mobile offers two types of phone insurance plans: Device Protection and Protection 360. If you're looking for the most coverage you can get, Protection 360 is T-Mobile's most comprehensive insurance. If you're not sure, both insurance plans include the following:

- Convenient claim filing

- Extensive coverage for hardware service (mechanical breakdown) issues, accidental damage, loss, and left

- Replacement warranty coverage of at least six months

- Low fees and deductibles for a new replacement device

On top of that, the Protection 360 plan includes:

- AppleCare Services

- JUMP! upgrades that let you upgrade an EIP financed device more often

- McAfee Security for T-Mobile with ID Theft Protection

- Tech PHD by Assurant to file a claim for connected devices such as routers, game consoles, and smart TVs

- Unlimited screen protector replacement in T-Mobile stores

Also keep in mind that Device Protection accepts a maximum of two approved claims within 12 months while Protection 360 accepts a maximum of three for accidental damage, loss, or theft and all claims are subject to a service fee or deductible. But if you're experiencing hardware issues, there is no maximum for the number of claims you can file under either plan.

How do I file a claim under T-Mobile phone insurance?If you've encountered one of the scenarios covered by phone insurance (loss, theft, damage, or hardware issues) you can file a claim online, through the Tech PHD app, or by calling Assurant at 1-866-866-6285 or Asurion at 1-866-268-7221. For any accidental damage, loss, or theft claim, make sure you've jotted down the make and model of your device, the date of the incident, and the last time you used the device. You should also be ready to share your user ID and password information as well as have your ID handy.

If you're reporting a hardware issue such as a breakdown or malfunctioning phone, you can contact T-Mobile directly by calling 1-800-T-MOBILE or 1-800-937-8997 to request a replacement.

Is T-Mobile phone insurance worth it?T-Mobile phone insurance can absolutely be worth it if you recently purchased an expensive device and want to ensure that, should something happen to your phone, you won't lose all of that money. After all, devices today can cost an arm and a leg, and paying $7 to $18 a month is a reasonable price in the grand scheme of things, especially if you're known to be clumsy or careless with your phone.

Though new devices do come with a warranty from the manufacturer, this warranty doesn't cover any damage caused by accidents (and accidents happen). Nevertheless, for some people, T-Mobile's phone insurance may not be worth the extra expense. If you like to change or upgrade phones frequently, you can opt out of insurance at your own risk.