What it will take to unleash the potential of geothermal power

There's enough heat flowing from inside the earth to meet total global energy demand twice over. But harnessing it requires drilling deep underground and transforming that heat into a usable form of energy. That's difficult and expensive, which is why geothermal power-sometimes called the forgotten renewable-makes up only about 0.3% of electricity generation worldwide.

Now, though, it's getting a boost. The recently passed US infrastructure bill set aside $84 million for the Department of Energy to build four demonstration plants to test enhanced geothermal systems, an experimental form of the technology.

The funding is only a tiny fraction of the DOE's $62 billion allocation in the infrastructure bill, which also includes money to build more long-distance transmission lines, strengthen the supply chain for batteries, and help nuclear power plants stay afloat. But geothermal researchers say even these limited funds could go a long way in helping transition enhanced geothermal systems (EGS) to commercial use.

Geothermal is really ready for prime time," says Tim Latimer, founder and CEO of the EGS startup Fervo.

Geothermal's appeal is all about consistency: while the electricity output of wind and solar plants varies with the weather and time of day, geothermal power is always on, providing a stable source of electricity.

It's really the only baseload renewable," says Jody Robins, a geothermal engineer at the National Renewable Energy Laboratory. Nuclear power (which is carbon-free but not renewable) can serve a similar role, although cost, issues with waste, and public perception have limited its deployment.

Modern geothermal power plants have been running in the US since the 1970s. These plants generally pump hot water or steam from underground up to the surface to move a turbine and generate electricity. Then the water is pumped back down to maintain pressure underground, so the process can keep going.

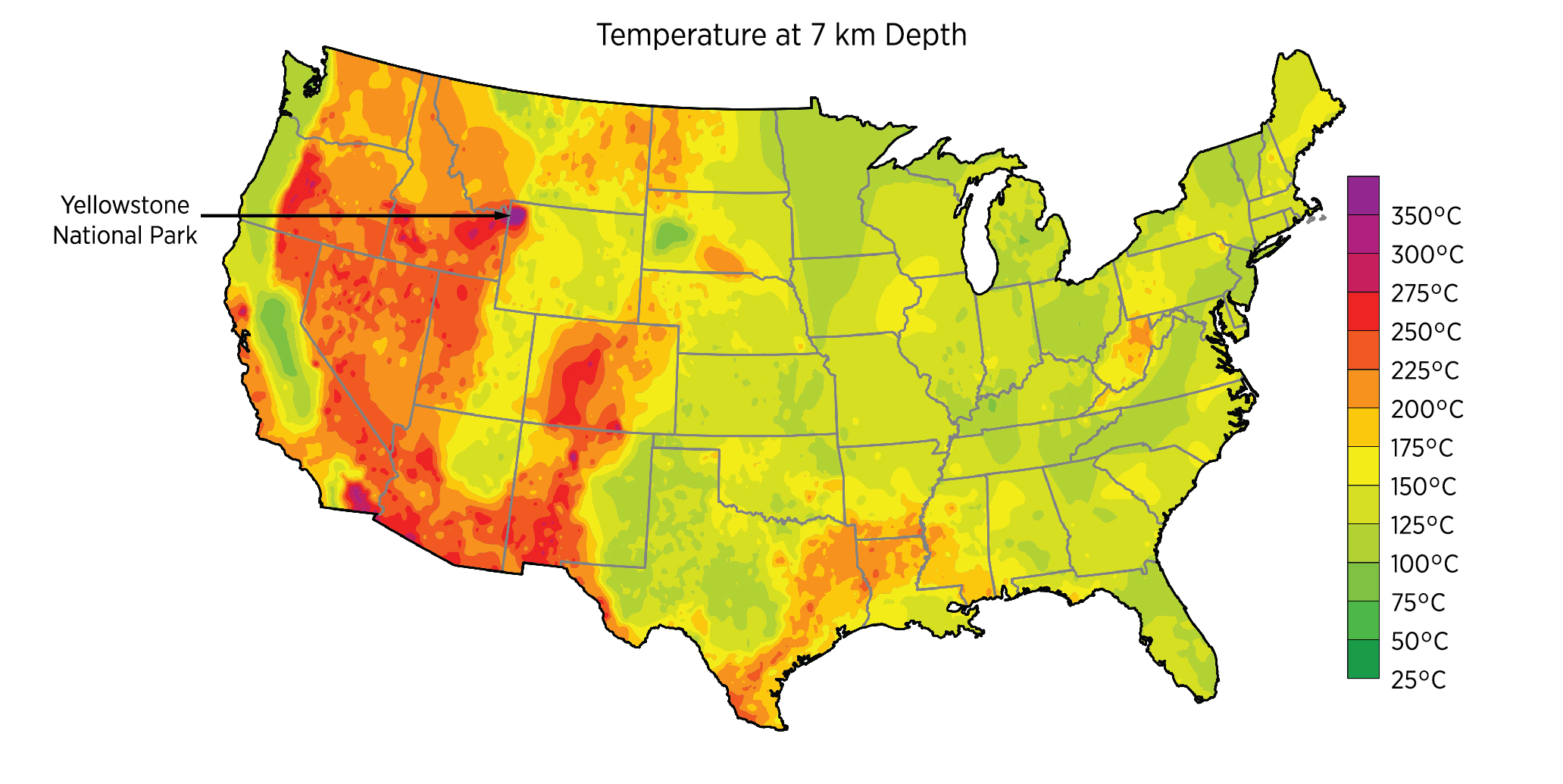

Prime geothermal sites share certain characteristics: heat, rock with fractures in it, and water, all close to each other and within a couple of miles of the surface. But by now the most accessible geothermal resources-in the US, they're largely concentrated in the west-have been tapped. Though researchers think there are many more potential sites yet to be found, it's hard to figure out where they are. And in most of the eastern US and many other places around the world, the rock underground isn't the right type for traditional plants to work, or the water isn't there.

Some researchers and startups are trying to expand geothermal into new places. With EGS, they're attempting to engineer what's underground by pumping fluid down into impermeable rock to force cracks open. This creates space where water is free to move around and heat up, producing the steam needed for power. The process has the potential to trigger earthquakes, as early projects in South Korea and Switzerland have shown. However, EGS is similar to fracking, which is widespread across the US, and the risks are likely manageable in most places, Robins says.

This approach could expand geothermal to places that don't have the groundwater or rock types needed for traditional plants.

Still, reaching these resources won't be easy. Commercial drilling doesn't usually go much deeper than seven kilometers (four miles)-for cost reasons, it's often even less than that-and many places that might benefit from geothermal aren't hot enough at that depth to reach the 150 C needed to generate electricity economically. Reaching sufficient temperatures may mean going deeper, which would require new techniques and technologies that can withstand high heat and pressure.

Courtesy DOE Geothermal Technologies Office

Courtesy DOE Geothermal Technologies OfficeFervo is working out some of those details in its own projects, including one announced earlier this year with Google to install geothermal capacity near the company's data centers in Nevada. It's also recently gotten involved in a DOE project in central Utah, called FORGE (Frontier Observatory for Research in Geothermal Energy).

Academic and industry researchers at FORGE are trying to find the best practices for deploying EGS, including drilling and reservoir maintenance. The site was chosen because its geology is fairly representative of places where other EGS plants might be built in the US, says Lauren Boyd, EGS Program Manager in the DOE's Geothermal Technologies Office.

With the new funding from the infrastructure bill, the DOE will fund four additional demonstration sites. That will widen what researchers understand about setting up EGS facilities, since they'll be able to work in different places and with different kinds of rocks. At least one plant will be built in the eastern US, where geothermal is less common.

But technological barriers aren't all that has slowed the progress of geothermal power, says Susan Hamm, director of the DOE's Geothermal Technologies Office. Building a geothermal plant can take up to a decade because of all the permits involved. Streamlining that paperwork could nearly cut that time in half and double the projected geothermal capacity by 2050.

Financing geothermal projects can also be a challenge. They require more capital investment than solar or wind projects: $3,000 to $6,000 per kilowatt, compared with $1,700 to $2,100 per kilowatt for wind and solar. (However, a geothermal plant will produce between two and four times as much electricity as a wind or solar plant of the same capacity.)

Geothermal is now getting some of the same tax breaks as other renewables. But since it can take nearly a decade for construction on a project to start, developers may not be able to count on the tax breaks to stay in place until they have a plant ready to run.

With a combination of policy changes and technology advancements, US geothermal generation could reach 60 gigawatts by 2050, according to a 2019 DOE report. That means geothermal would provide almost 9% of all electricity generation in the US, compared with 0.4% today.

The promise of geothermal-always-on, carbon-free power-remains compelling. If prices come down, and if it can be deployed widely enough, it could be the last piece in the puzzle to reach a carbon-free grid, Latimer says: That's the prize we're going after."