Vistra Claims ‘Extortion’ by Pipeline Company, Says Natural Gas Supply to Texas Power Plants Threatened

Two Vistra Corp. subsidiaries have alleged in a complaint filed with the Texas Railroad Commission that a major pipeline firm has threatened to terminate natural gas service to five Texas gas-fired power plants-a combined 2 GW-at any time" after Jan. 23. If escalated, the issue could pose new hurdles for the state's electricity security as it braces for freezing weather this week.

Vistra Corp. subsidiaries Luminant Energy Co. and Dynegy Marketing and Trade in the Jan. 19-filed complaint urged the Texas oil and gas industry regulator to grant emergency relief," preventing two subsidiaries of Energy Transfer- Energy Transfer Fuel (ETF) and Oasis Pipeline-from terminating or suspending service.

| Update: On Jan. 20, Energy Transfer reached an agreement with Vistra subsidiaries Luminant Energy Co. and Dynegy Marketing to temporarily maintain natural gas service" through March 31, 2022. The details are here. |

The financial standoff stems from a dispute over operational flow order" (OFO) penalties of $21.6 million. According to Vistra's complaint, during the February 2021 Winter Storm Uri, Luminant undertook extraordinary efforts to secure" natural gas supplies to keep them running. The company spent about $1.5 billion for natural gas during the storm-twice its planned natural gas cost to fuel its entire Texas fleet for a full year," it said. Luminant said it paid Energy Transfer more than $600 million" for activity during the event, which works out to more than 96% of all amounts Energy Transfer invoiced.

But owing to extreme weather during Winter Storm Uri, natural gas suppliers struggled to keep pace with demand, suffering freeze-offs, failure or damages at wells, as well as other equipment or facilities. The resulting limited natural gas supply was complicated by reductions in power plant output and temporary outages.

At certain times during the storm, and in certain places, the total volume of natural gas Luminant secured and delivered into Energy Transfer's systems actually exceeded the volume that was redelivered to Luminant for power generation, the complaint says. The additional natural gas delivered to Respondents ameliorated supply shortfalls on Respondents' pipelines thereby improving system pressures," it said. Energy Transfer likely sold the volumes Luminant provided to other shippers at an enormous profit due to skyrocketing natural gas prices during this period," it said.

But at other limited periods" during the storm, Luminant was actually short-meaning that its natural gas usage exceeded its deliveries" to Energy Transfer's pipelines. ETF and Oasis charged OFO penalties for these periods. Luminant said it had already paid in full" for the natural gas as well as all applicable fees, charges, and penalties. However, when the winter storm was over, Energy Transfer tried to impose an additional $21.6 million in charges as alleged Operational Flow Order (OFO") penalties for over-supplying natural gas during a period their systems were threatened by scarcity-i.e., punishing Luminant for helping," the complaint alleges.

Vistra's complaint alleges Energy Transfer on Jan. 13 threatened to discontinue service to Luminant if it did not pay the $21.6 million in OFO penalties by Jan. 23. Under the circumstances, the imposition of these long OFO penalties constitutes an illegal rate, would generate an impermissible windfall, were imposed in a discriminatory manner, and violate the Commission's February 12, 2021 emergency order," it says.

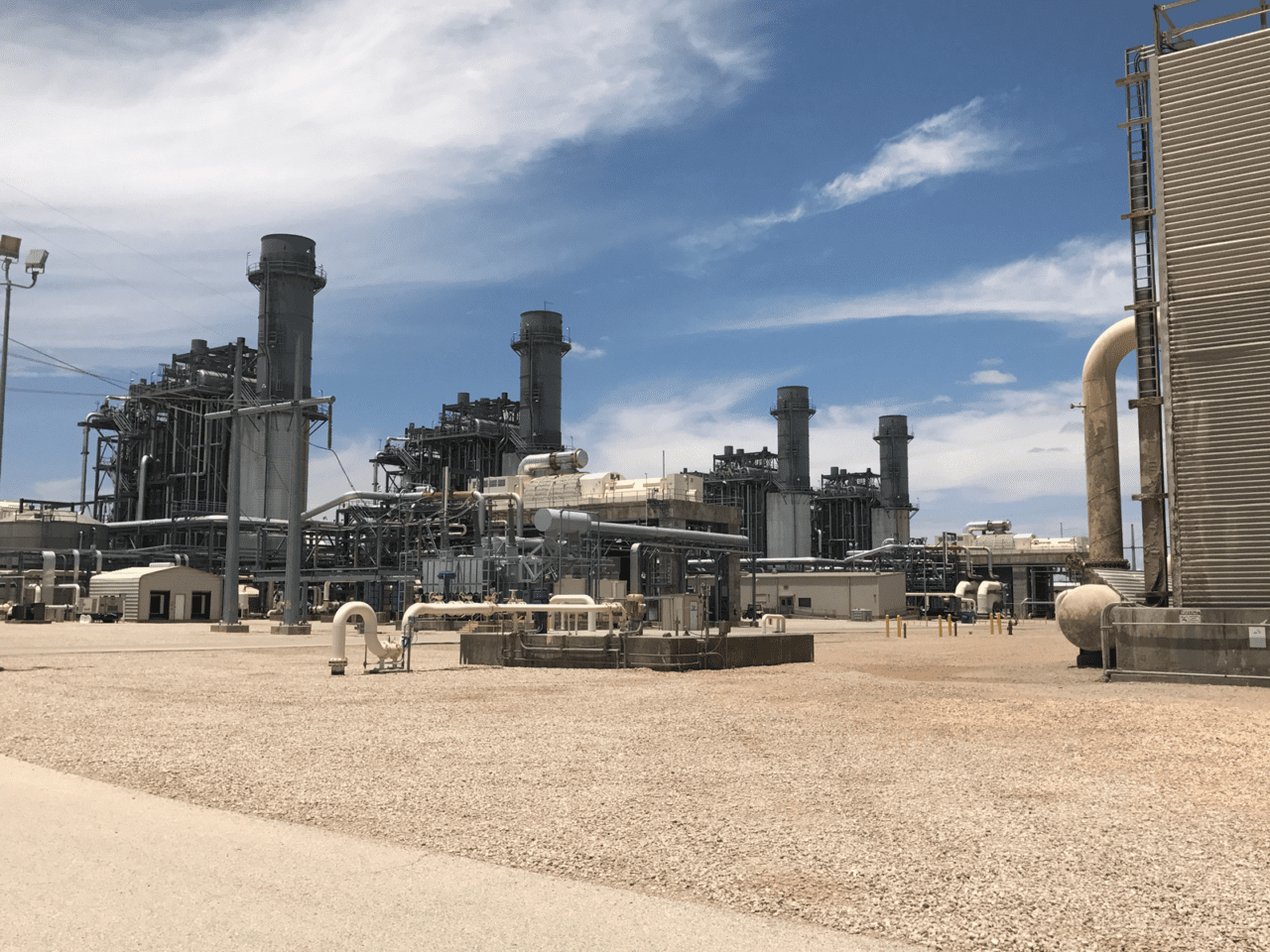

Limited Supply Options for Five Gas Power PlantsVistra told the commission that while Luminant's affiliates operate 14 gas power plants in the state, many do not have alternative sources of natural gas and they rely on limited on-site fuel to manage through emergency conditions.

The company's Texas gas-fired fleet includes Decordova, Ennis, Forney, Graham, Hays, Lake Hubbard, Lamar, Midlothian, Morgan Creek, Odessa, Permian Basin, Stryker Creek, Trinidad, and Wise. The 1.6-GW Midlothian, 630-MW Graham, 390-MW Morgan Creek, 685-MW Stryker Creek, and 244-MW Trinidad power generation facilities are served by the ETF system, and the 989-MW Hays facility is served by the Oasis system.

While certain facilities are served by two or more pipelines, the Graham and Trinidad facilities are served only by the ETF system. The Hays, Morgan Creek, and Stryker Creek facilities have access to other pipelines. However, due to constraints, these facilities may not be able to operate at maximum capacity if ETF or Oasis discontinue service," wrote Eric Wurzbach, Vistra vice president of Natural Gas, in a declaration attached to the complaint.

The plants all compete in the Electric Reliability Council of Texas market. If Respondents discontinue service to Luminant at any time after January 23, 2022, as threatened, its facilities will not have adequate supply of natural gas and substantial power-generating capacity for the state will be taken offline and made unavailable in the heart of winter, a time when a lack of power-generating capacity can have serious collateral consequences for the state and its citizens," the complaint adds.

The issue is made more complex by expiring transportation agreements and confirmations. Since December 2021, Luminant said it has bought natural gas from Energy Transfer at a daily spot price (of about $15/MMBtu for day-ahead gas, $25/MMBtu for no-notice gas, and a buy-back price of $3/MMBtu). Energy Transfer's subsidiaries have conditioned further service on payment of the illegal OFO penalties and have refused to negotiate any short or long-term natural gas transportation or sales arrangement with Luminant unless and until they pay the illegal and discriminatory penalty," the complaint alleges. Energy Transfer, meanwhile, hasn't sued Vistra to enforce the OFO penalties, likely aware that the basis for these penalties cannot withstand scrutiny," the complaint alleges.

Respondents' threatened termination is therefore a form of commercial extortion-calculated to compel Luminant to pay the illegal and unjust OFO penalties despite valid objections, and Respondents' action violates Texas law," it claims.

In a brief response filed with the commission late on Wednesday, Energy Transfer urged the commission to delay a ruling on Vistra's request for emergency relief until its subsidiary ETF has had an opportunity to respond within 10 days. However, the company added: ETF has and will continue to provide daily sales service(s) to Luminant and Dynegy pursuant to the same process, terms and conditions that have been in place since December 1, 2021, to ensure that it can fulfill its role to serve customers and maintain reliability on the electric grid, particularly for the cold weather."

-Sonal Patelis a POWER senior associate editor (@sonalcpatel,@POWERmagazine).

The post Vistra Claims Extortion' by Pipeline Company, Says Natural Gas Supply to Texas Power Plants Threatened appeared first on POWER Magazine.