History of Power: Duke Energy’s Century-Old Legacy

Duke Energy, one of the largest energy companies in the world, grew out of a system of lakes and dams along the Catawba River to generate power for the Piedmont Carolinas. While the company has sustained a core value of investing in the future throughout its 118-year history, planning for the energy transition has posed critical new uncertainties for the corporate giant.

The half-century from 1880 and 1930 was a remarkable formative period in the history of power generation across the U.S. In the South, still predominantly agricultural and rural in 1900, development arrived rapidly, delivering stunning advances for the poverty-crushed region. The most enduring of those efforts came from two wealthy entrepreneurs from North Carolina, James B. Duke, and to a lesser extent, his older brother Benjamin N. Duke.

|

1. Catawba Power Co.'s 3.3-MW Catawba Hydro Station, which began operating on April 30, 1904, became the first generating station on the Duke Power Co. system. The date is considered to be the birthdate of Duke Power. Courtesy: Duke Energy |

Heavily involved in both tobacco and textile manufacturing, the Duke brothers began to explore the possibilities of hydroelectric power as early as the 1890s," wrote historian Robert Durden. Meanwhile, in 1900 Walker Gill Wylie and his brother Robert H. Wylie established the Catawba Power Co. to supply electricity to textile mills near Rock Hill, South Carolina." A hydropower power plant (Figure 1) the Wylie brothers completed on the Catawba River four years later that was later purchased by the Dukes kicked off the birth of a unique investor-owned electric utility. Through multiple mergers and acquisitions, that company would go on to play a major role in the industrial transformation of the Piedmont Carolinas, and later, as one of the nation's largest power generators and utility companies.

From the very start, that company-then known as Southern Power Co. before it evolved into Duke Power Co. in 1924 and eventually Duke Energy Corp. in 1997 (see sidebar, A Long Legacy")-was distinctive and different from most other investor-owned utilities in several ways," Durden noted. First, the company's pioneers envisioned a series of interconnected single-system generating plants and a comprehensive development of an entire river and its valley, as opposed to piecemeal development. Second, it enjoyed private capital autonomy from the Duke brothers that buoyed its operational and financial health, and served to insulate it during the Great Depression. And third, Duke Power's engineers adopted a do-it-yourself" policy that would continue into the atomic era, allowing the company to foray easily into innovation and transformation.

Duke Power became a national leader in its field by pioneering with numerous technologies," Durden wrote. The company's generating plants were recognized by trade journals and industry associations as the most efficient in the nation over a period of many years."

| A Long Legacy The giant company that is Duke Energy Corp., (formerly Southern Power Co., and then Duke Power Co.), evolved from a series of mergers and acquisitions, including companies that sought to provide gas lighting, decades before electricity was harnessed. Companies that Duke Energy predecessors acquired early in its evolution include the 1837-established Cincinnati Gas Light and Coke Co. (which became Cincinnati Gas and Electric); the 1849-established Nashville Gas Co.; and the 1899-established St. Petersburg Electric Light and Power (which became Florida Power Corp. in 1927); and the 1901-established Union Light, Heat and Power Co. 1904: Catawba Power Co.'s 3.3-MW Catawba Hydro Station, the very first power plant in the Duke Power Company system, begins operation. The plant's opening date, April 30, 1904, is considered to be the birthdate of Duke Power. 1905: Southern Power Co. is incorporated under the laws of New Jersey. 1907: Great Falls Hydro Station, the first hydroelectric construction project of Southern Power Co., is completed and placed in service. 1907: Carolina Power and Light is founded. 1909:Cincinnati Gas and Electric and Union Light, Heat & Power Co. become subsidiaries of Columbia Gas and Electric. 1910: James Buchanan Duke is named president of Southern Power Co., succeeding Dr. Walker Gill Wylie, who served as president since the company's formation. 1911: Greenville Steam Station, Duke Power Co.'s first coal-fired generating station, is completed and placed in service in Greenville, South Carolina.

1912: Samuel Insull, who played a significant role in utility consolidation, forms the Interstate Public Service Co. to provide electric rail car and utility services in Indiana. That company later becomes the Public Service Co. of Indiana. 1916: A historic flood along the Catawba River prompts Southern Power Co. engineers to pursue a series of interlocked reservoirs to help manage water levels and produce hydroelectric power. Lake James, named after James B. Duke, is formed in 1919 by damming three streams: the Catawba River, Paddy Creek and the Linville River. 1922: Construction begins on the Mountain Island Hydro Station, located on the Catawba River in Gaston County, North Carolina. 1924: James Duke, president of Southern Power Co., is elected president of Duke Power Co., reflecting an important evolution for the company. 1947: After various consolidations, Public Service Co. of Indiana becomes an all-electric utility. 1950: A group of business leaders from Spartanburg, South Carolina forms the Piedmont Natural Gas Co. to make natural gas available to the region. 1954: The three-unit, 575-MW coal-fired Sutton Plant, located near Wilmington, N.C., begins commercial operation. The station is named after Louis V. Sutton, one of the longest-running CEOs of Carolina Power & Light. 1956: Carolina Power & Light, Duke Power Co., and neighboring companies South Carolina Electric & Gas and Virginia Electric and Power Co. join forces to begin building a prototype nuclear plant in Parr Shoals, South Carolina. Groundbreaking of the 17-MW plant begins in 1960, but the project is retired in 1967. 1966: Carolina Power & Light's board approves plans to build the Robinson Nuclear Plant in South Carolina. The 741-MW plant is the first nuclear plant the Southeast at the time, and it reaches full power in 1971. 1968: Construction begins on the Jocassee Hydro Station-Duke Power Co.'s first pumped-storage facility. 1969: Cincinnati Gas & Electric, Columbus and Southern Ohio Electric Co., and Dayton Power & Light agree to jointly construct the Zimmer Nuclear Station near Moscow, Ohio. In 1982, the Nuclear Regulatory Commission (NRC) orders construction complete on the 97% complete unit 1. CG&E and its partners converted the nearly completed plant into a coal plant. 1973: Oconee Nuclear Station Unit 1, Duke Energy's largest nuclear power plant and a two-time POWER Top Plant winner, begins commercial operation. A child of the sixties," Oconee was first announced on July 5, 1966, as part of the Keowee-Toxaway Complex, Duke Energy has said. That massive engineering project created Keowee, Jocassee and Bad Creek hydro stations, in addition to Oconee." Oconee, Duke Power's first commercial nuclear project was originally planned as a two-unit facility, but by May of 1967 Duke decided to add a third unit at the site. In total, the project cost $500 million. When Oconee began commercial operation on July 16, 1973, (five years and five months after the first concrete was poured), it became the 18th U.S. nuclear plant. Units 2 and 3 began operation in 1974. The capacity of all three Oconee units and the hydro projects is 4,471 MW, and the complex remains a substantial part of Duke Energy's total generating portfolio.

1975: Carolina Power & Light's Brunswick Nuclear Plant goes online, providing the first nuclear energy in the state of North Carolina. 1977: Florida Power Corporation's Crystal River Nuclear Plant is completed and operational at a cost of $410 million. The plant is located in Citrus County, Florida. 1982: Florida Progress is formed as a holding company for Florida Power Corp., for the purpose of diversifying beyond utility operations. 1985: Piedmont Natural Gas Co. purchases Nashville Gas Co. 1994: Cincinnati Gas & Electric and Public Service Indiana merge to form Cinergy Corp. 1997: Duke Energy Corp. is established when Duke Power Co. and gas pipeline firm PanEnergy Corp. complete their merger. 2000: Florida Progress Corp., parent company of Florida Power Corp., is acquired by Carolina Power & Light for $5.3 billion. The combined company name becomes Progress Energy Corp. 2002: Duke Energy completes the $8 billion acquisition of Westcoast Energy. Duke Energy Corp. also decides to spin off its natural gas transmission and related business lines into Spectra Energy, which will be headquartered in Houston, Texas. That year, Duke Energy is also named to the Dow Jones Sustainability Index, and it produces its first sustainability report. 2006: Duke Energy Corp. completes a friendly" acquisition of Cinergy Corp. for $9 billion in stock. Jim Rogers becomes president and CEO. 2007: Duke Energy Renewables is established as a new commercial business. 2008: Duke Energy enters the wind power business, with nearly 400 MW and another 5,000 MW of potential development. 2009: Progress Energy's 860-MW Crystal River Nuclear Station goes out of service in September when a separation occurs in the outer layer of the containment building's concrete wall following steam generator replacement work. The plant is eventually retired. 2011: Duke Energy announces a $32 billion merger with Raleigh, North Carolina-based Progress Energy. The merger, which closed in 2012 ousted the Progress CEO Bill Johnson and resulted in a lawsuit, but it creates the largest electric utility in the U.S. with the largest regulated fleet in the U.S. 2013: Commercial operation begins at the 618-MW Edwardsport Integrated Gasification Combined Cycle Plant in Indiana. That year, the company also decides to scrap the Crystal River nuclear plant in Florida. A report of damaged containment structure at the nuclear plant in Florida was estimated to likely hover at $1.5 billion, but it could escalate to as much as $3.5 billion and take eight years to complete in the worst-case scenario, an independent review of a potential repair plan showed. 2013: Lynn Good becomes Duke Energy's president and CEO. 2014: Duke Energy announces it is preparing to sell its interests in 13 power plants in the Midwestern U.S. and exit the merchant generation market in that region. That year, a much-publicized accident at Duke Energy's retired Dan River facility releases 39,000 tons of coal ash into the Dan River, prompting North Carolina's General Assembly to pass the Coal Ash Management Act. Subsequent state and federal rules require closure of all Duke Energy's coal ash basins by 2029 or sooner. 2015: Duke Energy Corp. announces its intent to acquire the Piedmont Natural Gas Co. for $4.9 billion in cash. The acquisition closes in 2016. 2019: Duke Energy Indiana, the state's largest utility, says it will retire all nine of its coal-fired units by 2038. Parent company Duke Energy, meanwhile, sets a net-zero" target, aiming to produce zero carbon emissions from electric generation by 2050. Duke Energy also announces it will retire all coal-only units in the Carolinas, multiply its renewable portfolio, and cease emitting methane in its natural gas business by 2030. 2021: Duke Energy kicks off an effort to renew the operating licenses of all its 11 nuclear reactors for 20 more years, starting with Oconee Nuclear Station, its largest nuclear plant. 2022: Duke Energy expands its Clean Energy Action Plan, targeting a full coal phaseout by 2035. |

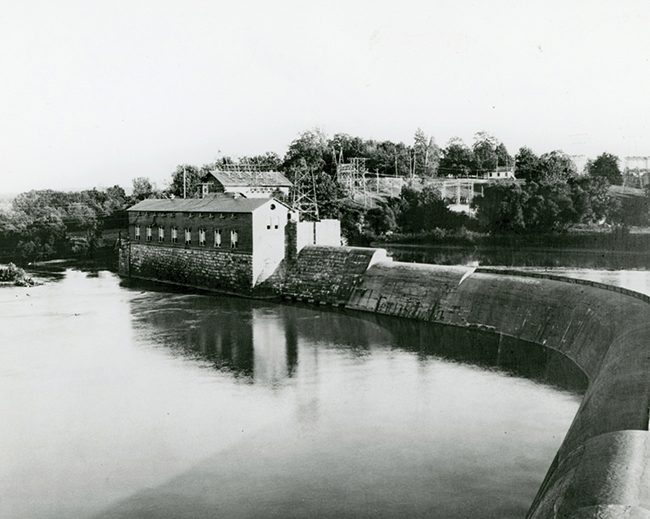

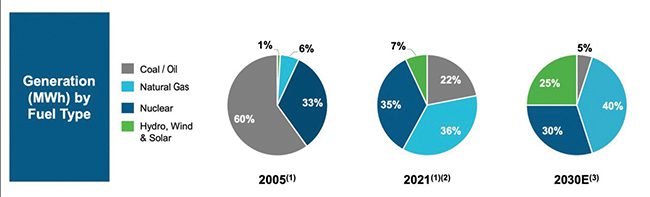

Today, Duke Energy Corp., headquartered in Charlotte, North Carolina, is one of the largest investor-owned utilities in the country. Its sprawling business comprises three main reportable segments: electric utilities and infrastructure, gas utilities and infrastructure, and commercial renewables. Its electric utility subsidiaries, which include Duke Energy Carolinas, Duke Energy Progress, Duke Energy Florida, Duke Energy Indiana, and Duke Energy Ohio, provide retail service through generation (Figure 2), transmission, distribution, and power sales, as well as wholesale sales to municipalities, cooperatives, and other load-serving entities.

|

2. Duke Energy subsidiaries own a massive generating fleet with a combined capacity of 50.3 GW. However, Duke Energy's power mix has transformed dramatically since 2005. Courtesy: Duke Energy |

In total, Duke Energy serves about 8.2 million customers within the Southeast and Midwest-in a service territory that spans 91,000 square miles across six states. All these businesses-with the exception of Ohio, which operates in a competitive electricity supply market-operate as sole suppliers of power within their service territories, with services that are priced by state commission-approved rates. The Federal Energy Regulatory Commission, however, also approves cost-based rates for sales to some power and transmission wholesale customers.

The gas utilities and infrastructure segment, meanwhile, conducts natural gas operations primarily through the regulated public utilities of Piedmont, Duke Energy Ohio, and Duke Energy Kentucky, serving residential, commercial, industrial, and power generation natural gas customers. Finally, Duke Energy's commercial renewables segment acquires, develops, builds, operates, and owns wind and solar renewable generation throughout the U.S. The segment's portfolio includes utility-scale wind and solar generation assets, distributed solar generation assets, distributed fuel cell assets, and battery storage projects, which total 3,554 MW across 22 states. These include 23 wind facilities, 178 solar projects, 71 fuel cell locations, and two battery storage facilities.

Duke Energy notes that revenues from the increasingly lucrative commercial renewables division are primarily generated by selling renewable power through long-term contracts to an array of customers, many of which have obligations under state-mandated renewable portfolio standards. Outside of these ventures, Duke Energy also owns a captive insurance company, Bison, which provides the company's subsidiaries with indemnification for financial losses. It also notably holds a 17.5% equity interest in NMC, a petrochemical and plastics producer based in Saudi Arabia.

Duke Energy's utility service territories as of May 2022. Courtesy: Duke Energy/2021 ESG Report

Duke Energy's utility service territories as of May 2022. Courtesy: Duke Energy/2021 ESG Report

While the company's business interests have historically been shaped by business opportunity and soaring power demand, recent changes appear to be more solidly driven by a combination of factors, including pressure from shareholders to improve its environmental, social, and governance (ESG) posture. In response to a recent resolution by non-profit advocacy group As You Sow that urged the company to revise its net-zero target, Duke Energy in February said it will expand its 2050 net-zero goals to include Scope 2 and specific Scope 3 emissions. (Scope 2 emissions are indirect emissions from power the company purchases from others to use in its facilities, while Scope 3 includes indirect emissions that arise from other sources in the company's value chain.)

|

3. By 2035, only one Duke Energy coal plant could be operational-the Edwardsport integrated gasification combined cycle (IGCC) plant. The 618-MW coal-fired project in Knox County, Indiana, started commercial operations in June 2013. A POWER Top Plant in 2013, the plant is one of only a handful of large-scale IGCC projects that are operating today worldwide. Courtesy: Duke Energy |

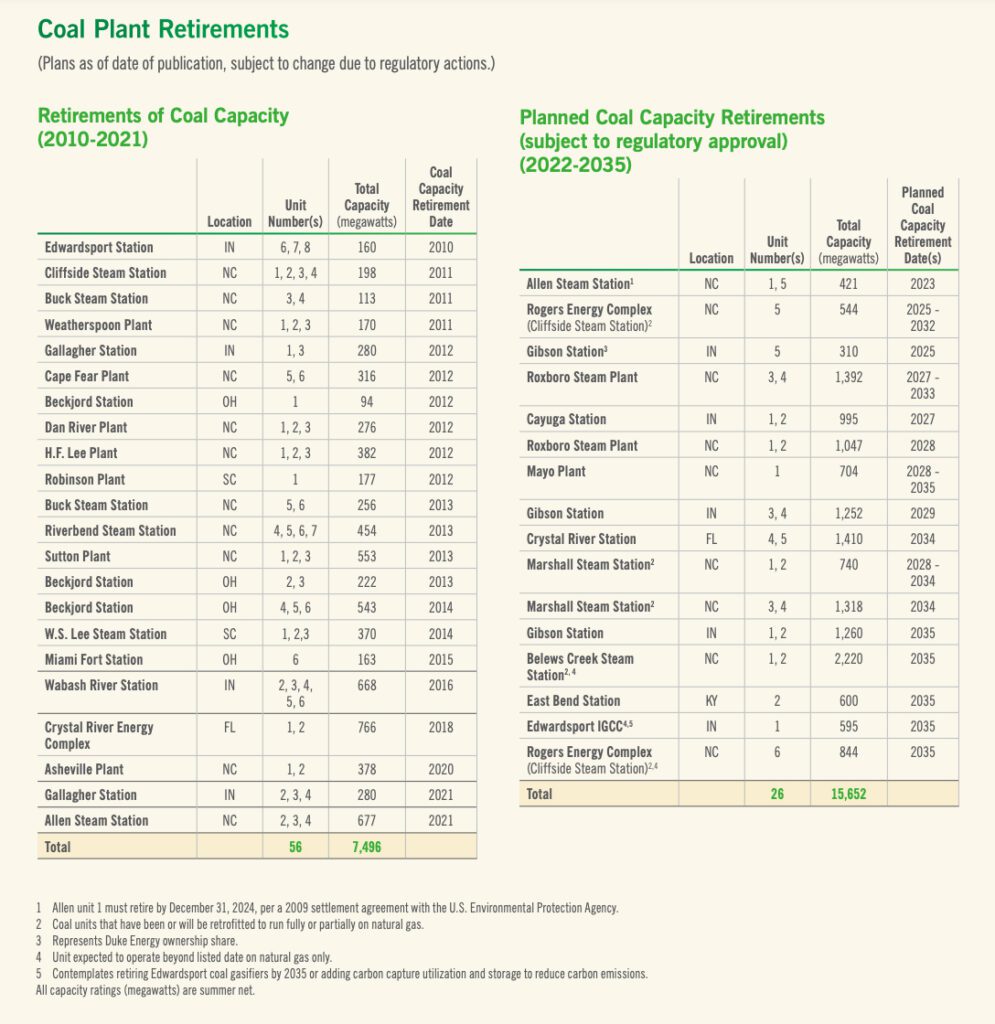

In tandem, as part of its expanded Clean Energy Action Plan," the company also said it would dramatically slash coal generation's share from the current 22% of total generation to 5% by 2030 and achieve a full phaseout of unabated coal-companywide-by 2035. Duke Energy has already reduced its Scope 1 carbon emissions from electricity generation by 44% from 2005 levels. The majority of those reductions were achieved through the retirement of 56 coal units-a combined 7.5 GW-since 2010.

Table. Duke Energy's coal plant retirements as of May 2022. Courtesy: Duke Energy/2021 ESG Report

Table. Duke Energy's coal plant retirements as of May 2022. Courtesy: Duke Energy/2021 ESG Report

But as Lynn Good, Duke Energy Corp. chair, president, and CEO, noted at the company's inaugural ESG Investor Day in October 2020, ESG efforts are also rooted in long-term sustainability, particularly as the company continues to navigate emerging industry disruptions and related uncertainties. We became a stronger, more agile company, intensifying our focus [on ESG] considerations, and accelerating our clean energy transformation," Good said. ESG-conscious changes to the company's generating fleet and business interests offer a compelling investment story," and investment, Good noted, will be crucial to the company's growth, given new infrastructure demands related to the energy transition. To achieve a complete coal phase-out by 2035, the company in February said it expects to deploy more than $130 billion over the next decade-$63 billion of which it will spend over the next five years-to fund investments in grid modernization and efforts to replace its coal fleet with renewables, natural gas, and emerging technologies.

Keeping customer bills affordable, however, remains a crucial priority for the company, which is why the company will strive to mitigate capital increases by reducing other costs. As you transition out of coal, you will have lower fuel costs," said Steve Young, Duke Energy executive vice president and chief financial officer. There are [fewer] people. The outages are less complex. The third area is our continual pursuit of efficiencies across our footprint to our business transformation model," he added. We have a good track record here as well. We will continue to find digital applications to automate processes," he said. We will use data analytics to tell us how to do things and when to do it better. And we have learned from the pandemic how to virtually move our workforce from areas of lesser importance to emergent work to help us displace the need for contractors."

Duke Energy's precarious attempts to strike the right balance between reliability, affordability, and sustainability aren't without risks, however. Duke Energy's results of operations depend, in significant part, on the extent to which it can implement its business strategy successfully," the company acknowledges. Duke Energy's clean energy strategy, which includes achieving net-zero carbon emissions from electricity generation by 2050, modernizing the regulatory construct, transforming the customer experience, and digital transformation, is subject to business, policy, regulatory, technology, economic and competitive uncertainties and contingencies-many of which are beyond its control and may make those goals difficult to achieve," it says.

|

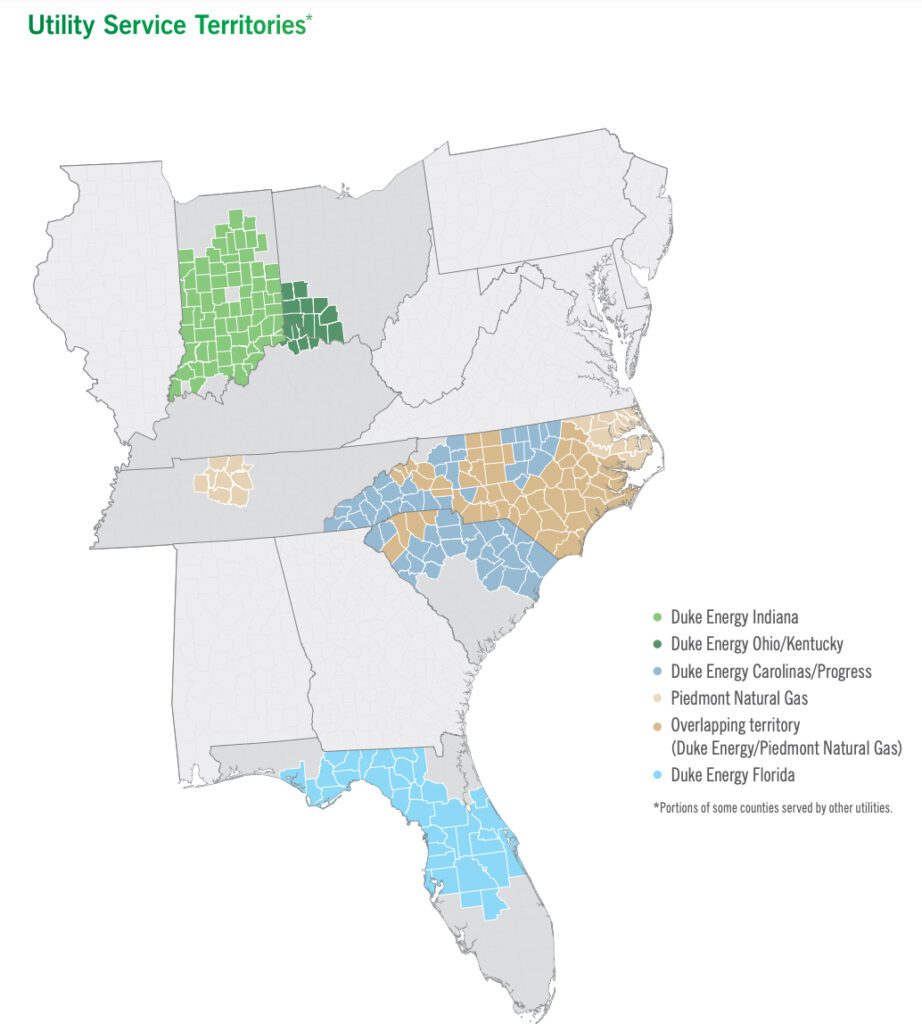

4. The Asheville Combined Cycle Station in Arden, North Carolina, is one of Duke Energy's newest gas-fired power plants. The $817 million facility, which began operating in July 2020, is a two-unit facility with a total capacity of 560 MW. The station normally runs on natural gas, but can also burn diesel fuel when necessary. Courtesy: Duke Energy |

The company is especially wary of federal or state policies that could restrict the availability of fuels or generation technologies," such as natural gas (Figure 4) or nuclear power, limit retirements, or limit investments in new capacity. It also actively advocates for supportive policies that could facilitate siting and cost recovery of transmission and distribution upgrades needed to build out large volumes of renewable and energy storage. In addition, the company has highlighted concerns about labor procurement constraints, including shortages, that may be needed to build new generation on time and on budget. As with other utilities, Duke Energy also faces a decline in customer demand-owing to energy efficiency measures and advances in distributed generation-cybersecurity risks, and environmental litigation, including from ESG concerns.

Continuing a Legacy of InnovationYet another prominent risk involves gambles on technologies that aren't yet commercially available, or are unproven at utility scale, but which could reshape its investment strategy if successful. If these technologies are not developed or are not available at reasonable prices, or if we invest in early-stage technologies that are then supplanted by technological breakthroughs, Duke Energy's ability to achieve a net-zero target by 2050 at a cost-effective price could be at risk," the company notes.

So far, the company has embarked on a careful vetting of an array of emerging technologies. Duke Energy is, for example, partnering with Siemens and Clemson University on a Department of Energy-backed study to evaluate hydrogen integration and utilization at Duke Energy's Clemson combined heat and power plant. The pilot project, which began in March 2021, is evaluating 30% co-firing of hydrogen in 2024 and 100% firing of hydrogen on or before 2030. Hydrogen's allure is entrenched is a longer-term play for the company's sizable natural gas fleet as well as for energy storage, Good suggested in February.

Under another project, Duke Energy is testing Honeywell's new flow battery technology, which can store and discharge electricity for up to 12 hours-exceeding the duration of four-hour lithium-ion batteries. Honeywell is expected to deliver a 400-kWh unit to Duke Energy's Emerging Technology and Innovation Center in North Carolina this year. Duke Energy also plans to begin testing an EOS zinc-bromine Znyth Gen 3.0 battery in late 2022.

For now, however, Duke Energy is doubling down on its existing nuclear fleet, buoyed by its noteworthy performance and low-carbon attributes. Good in February suggested Duke Energy's six nuclear plants in the Carolinas may factor heavily in a carbon plan it intends to file in May 2022 to comply with North Carolina's House Bill 951, landmark legislation that provides a framework to achieve a 70% carbon reduction by 2030. The company has since 2019 explored subsequent license renewals (SLRs) for all of its 11 reactors, which are sited at the six nuclear plants.

In 2021, the company filed its first SLR application for the three-unit 2.5-GW Oconee plant in Seneca, South Carolina, in a bid to keep that plant open until 2054. Meanwhile, recently announced federal tax incentives for nuclear could prove very favorable" from a cash flow standpoint, Good noted in February. However, if Duke Energy embarks on future new nuclear builds, they will likely be smaller, advanced reactors. As Good noted in February, smaller reactors appear much more attractive than a 10-year journey to build a large-scale nuclear reactor."

Duke Energy already provides consulting and advisory in-kind" services for the 500-MW Natrium sodium-cooled fast reactor plant at PacifiCorp's Naughton Power Plant site in Wyoming, a TerraPower and GE Hitachi Nuclear Energy project that is expected to be operational by 2028. The company has also been working with other advanced nuclear developers, including Holtec and NuScale, for potential investment in the 2030s, Good said.

Asked about a timeframe for Duke Energy to begin incorporating these technologies in its business, Good said the awareness" of what might be possible with hydrogen; advanced nuclear; and carbon capture, storage, and utilization (CCUS) is already part of conversations with all its regulators. The good news is we believe we have runway with existing technologies to achieve the majority of our aspirations around clean energy transition over the next five years or so," she said. These technologies could begin to grow more significantly in the 2030s when it would be more important to get to net-zero and the next tranche of carbon reduction," she added.

And so, I think time will tell on whether they get to commercial scale," she said. However, the company intends to be thoughtful, working with stakeholders and our regulators before we begin introducing any of these technologies, so that we have a common view of what we would like to achieve and invest in to meet our goals," she said.

-Sonal Patelis a POWER senior associate editor (@sonalcpatel,@POWERmagazine).

The post History of Power: Duke Energy's Century-Old Legacy appeared first on POWER Magazine.

Greenville Steam Station, Duke Power Co.'s first coal-fired generating station, was completed and placed in service in Greenville, South Carolina, in 1911. Courtesy: Duke Energy

Greenville Steam Station, Duke Power Co.'s first coal-fired generating station, was completed and placed in service in Greenville, South Carolina, in 1911. Courtesy: Duke Energy Oconee Nuclear Station, located on Lake Keowee in Seneca, South Carolina, is Duke Energy's largest nuclear station, with three generating units that produce more than 2,500 MW. Oconee's operating licenses are slated to expire in the early 2030s, and Duke Energy is seeking subsequent license renewals that could extend the units' operating licenses to 2053 and 2054. Courtesy: Duke Energy

Oconee Nuclear Station, located on Lake Keowee in Seneca, South Carolina, is Duke Energy's largest nuclear station, with three generating units that produce more than 2,500 MW. Oconee's operating licenses are slated to expire in the early 2030s, and Duke Energy is seeking subsequent license renewals that could extend the units' operating licenses to 2053 and 2054. Courtesy: Duke Energy