Dramatic Innovation-Driven Ramp Up of Floating Offshore Wind Anticipated by 2030

A drumbeat of floating offshore wind-related developments this year suggests the pipeline for the long-nascent wind technology sub-sector may be finally beginning to grow. While floating wind's current contribution of total wind installations is only 0.1%, recent developments suggest floating offshore wind is slated to expand to 16.5 GW by 2030, accounting for 6.1% of global wind installations, said the Global Wind Energy Council (GWEC).

The representative forum for the entire wind energy sector at an international level in a March report said that floating offshore wind has officially cleared the demonstration and trial phase in its roadmap to commercialization and is now definitively in its pre-commercial" phase. In the past decade MW-scale floating technologies have been tested through demonstration and pilot projects in both Europe and Asia," it noted.

Following installation of the first megawatt-scale offshore wind turbine in Norway in 2009, industry firsts" have included the 2017 connection of Equinor/Masdar's 30-MW Hywind Scotland wind farm, which deployed five Siemens Gamesa Renewable Energy (SGRE) 6-MW turbines, in the UK-the world's first floating offshore wind project. In May 2020, the 25-MW WindFloat project became fully operational off the coast of Viana de Castelo, Portugal. In October 2021, the largest current floating offshore wind project, the 50-MW Kincardine project in Scotland, which uses a Principal Power Windfloat platform and five Vestas V164-9.5 MW turbines, went online (Figure 1). And in December 2021, China grid-connected the 5.5-MW Sanxia Yinling Hao, the world's first typhoon-resistant" floating offshore wind turbine.

|

1. The 50-MW Kincardine Offshore Windfarm, one of the world's largest floating wind farms to date, became fully operational in October 2021. Located 15 kilometers off the coast of Aberdeenshire, Scotland, in water depths ranging from 60 meters to 80 meters, the project consists of five 9.5-MW Vestas V164 turbines and one 2-MW V80 turbine, each installed on WindFloat semi-submersible platforms designed by Principle Power. Cobra Wind, a subsidiary of Cobra Group, was responsible for the delivery of the project, including engineering, construction, installation, and commissioning. Courtesy: Cobra Wind |

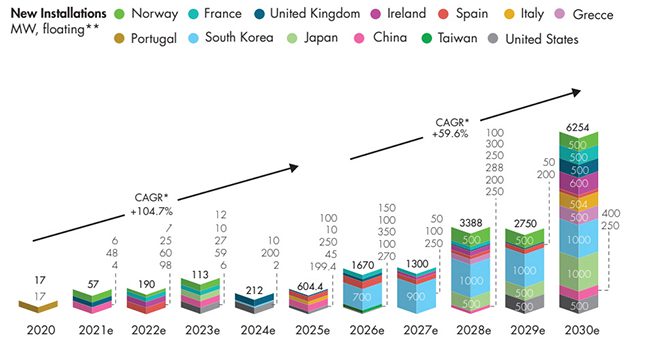

Focus is now quickly moving to larger first of a generation schemes," GWEC said. However, by 2026 we expect annual installations to surpass 1 GW per year, a milestone that fixed offshore wind reached in 2010. From this point forward, floating offshore wind will be in its commercial phase." Starting in 2026, installation rates will continue to increase and project size will grow, bolstered by developments in South Korea, Japan, Norway, France, and the UK, the organization said (Figure 2).

GWEC suggested growth for the sub-sector is bolstered by several factors. The most prominent is the opportunity to harvest untapped potential in a world seeking to rapidly decarbonize. About 80% of the world's offshore wind resource potential lies in waters deeper than 60 meters (m), it noted. As well as providing even better wind resources and larger technical potential than bottom-fixed offshore wind, floating wind could help create socio-economic benefits such as jobs and most importantly engage the oil and gas industry to complete a smooth energy transition, for example, bringing their expertise in foundation construction and unparalleled skills in delivering huge engineering projects into offshore wind while re-skilling workers who may be dislocated from the fossil fuel sectors," it said.

|

2. The Global Wind Energy Council (GWEC) projects Europe will account for up to 68.2% of total floating offshore wind installations added in 2021 through 2025, followed by Asia and North America. However, the global market share of Asian countries is likely to more than double in the second half of this decade. Courtesy: GWEC |

Investment and interest from some of the world's largest energy players has also revitalized technology advancement. While the floating offshore industry has so far mostly relied on semi-submersible floating structures-such as are deployed at the Kincardine project-oil and gas experience could refine other floaters," including deep-water floating spar, tension-leg platforms, and barge types (Figure 3).

It is worth to mention that no universal solution is available for floating wind. Different geographical situations will favor different solutions, and factors such as political need, opportunity for localization, local infrastructure, and different turbine design will also come to play in floating foundation selection," GWEC said. As the total installations for floating wind is relatively lower than fixed-bottom wind, operations and maintenance (O&M) solutions to maintain the floating turbines are still being developed at present and it may favor some types of designs considering the [operational expenditure] control."

|

3. This graphic illustrates several different types of wind turbines. From left to right: monopile (which are limited to water depths of about 50 meters), four-legged jacket, twisted jacket, tension-leg floating platform, semi-submersible platform, and spar-buoy. Source: Josh Bauer/National Renewable Energy Laboratory |

GWEC added that as the market evolves, the industry anticipates innovation in construction and O&M, particularly to perform activities in port or in sheltered waters that could make use of different types of vessels. Continued innovation is expected in the market, with new technologies and products expected to support better mooring and anchor solutions, longer-term maintenance regimes, deep water substations, and dynamic cabling," GWEC said.

The floating offshore industry, however, will need to navigate a variety of formidable technical and market challenges to achieve the significant expansion it envisions. Along with ensuring port access and ease of manufacture, water depth, turbine integration, cost, and performance remain integral concerns. GWEC said it does not expect the market to consolidate significantly, but it noted platform companies will need to secure developer partners to be able to supply the first cluster of commercial projects or be confident that they can deliver significant innovation and cost reduction to be considered as part of a second generation of platform options."

The floating offshore sector, meanwhile, shares some concerns afflicting the larger wind industry. While GWEC's April-issued Global Wind Report 2022 highlighted an upward trajectory for wind growth, among uncertainties it underscored are policy-related, such as permitting, regulatory shifts, and incentive expiry. Infrastructure and interconnection concerns, and social acceptance are also emerging issues. Finally, market disruptions, such as sky-high freight costs and increasing commodity prices, are also heaping pressure on project developers, it said.

Booming Investment and Interest in Floating OffshoreDespite these challenges, recent developments suggest significant lift for the floating offshore project pipeline. This year alone, the U.S. Bureau of Ocean Energy Management (BOEM) identified three call areas in the Pacific Ocean offshore Oregon, while the California Energy Commission approved renovations at Port of Humboldt Bay to further offshore project development in areas northwest of Morro Bay and offshore Humboldt County in California. Potential projects include the 150-MW Redwood Coast floating wind farm, which a consortium comprising Principle Power, Aker Offshore Wind, H.T. Harvey & Associates, Herrera Environmental Consultants, and Ocean Winds North America is developing.

Another project, the 1-GW Castle Wind floating offshore wind project, which is shooting for a 2025 to 2027 operational timeframe off the coast of Morro Bay, also gained steam with new backing from TotalEnergies. In April, Washington-based Trident Winds also notably submitted an unsolicited lease to BOEM for a commercial lease that could host the 2-GW Olympic Wind project, Washington state's first offshore wind project.

Development kicked up in Europe, too. Offshore construction of the 88-MW Hywind Tampen floating project-a project that will comprise 11 SGRE 8-MW wind turbines installed on concrete spar-type floating foundations in water depths of between 260 m and 300 m, kicked off about 140 kilometers off the Norwegian coast in late March. When the project is commissioned by the end of 2022, the $518 million Hywind Tampen project will become the first floating offshore wind project to supply dedicated renewable power to oil and gas installations.

However, much larger projects are on the horizon. In January, EDF Renewables and DP Energy partnered to explore developing the 1-GW Gwynt Glas project in the Celtic Sea. Meanwhile, in anticipation for substantial demand for floating offshore wind, Danish wind giant Orsted acquired a majority stake in the 100-MW Salamander floating offshore wind development project off the Scottish coast.

In France, Ocean Winds and the Banque des Territoires in March signed an agreement with Euroports for port services to support the construction on the 30-MW Eoliennes Flottantes du Golfe du Lion (EFGL) pilot project, which will comprise three 10-MW turbines supported by Principle Power's WindFloat semi-submersible floating foundations. And in April, GreenIT, a joint venture between End subsidiary Plenitude, and CI IV, a fund managed by Copenhagen Infrastructure Partners, signed an agreement to develop two 750-MW floating offshore wind farms in Sicily and Sardinia. Madrid-based Repsol and Orsted also signed an agreement in April to explore floating offshore wind projects in Spain. More projects may be forthcoming in Spain, following that country's publication of the draft Marine Spatial Plan and Marine Energy Roadmap 2021."

Backed by oil and gas majors, floating offshore development is also ramping up in Asia. In March, Shell Gas & Power Developments and CoensHexicon signed a memorandum of understanding with power generator Korea Southern Power Co. to drive the 1.3-GW MunmuBaram project off the coast of Ulsan and secured two electricity business licenses from the country's Ministry of Trade, Industry, and Energy. And, in Japan, Aker Offshore Wind and Mainstream Renewable Power pushed on with early-stage development of an 800-MW floating project.

-Sonal Patelis a POWER senior associate editor (@sonalcpatel,@POWERmagazine).

The post Dramatic Innovation-Driven Ramp Up of Floating Offshore Wind Anticipated by 2030 appeared first on POWER Magazine.