FERC Okays NextEra-HEI, Duke-Dynegy Deals

The Federal Energy Regulatory Commission (FERC) gave its approval to two deals that will see shifts in electricity markets in Hawaii and the Midwest.

On Mar. 27, FERC approved Duke Energy's proposed sale of its merchant generation business to Dynegy for $2.8 billion. The deal, announced last August, covers 11 power plants in the Midwest and Pennsylvania comprising about 6.1 GW of capacity. Duke and Dynegy had hoped to close the transaction last year, but were delayed by concerns from FERC about potential anticompetitive impacts.

Those concerns were resolved by an agreement between Dynegy and PJM in February under which Dynegy will continue to offer its assets into the PJM markets consistent with past behavior. It further agreed not to retire any units unless they fail to clear capacity auctions or otherwise become uneconomic.

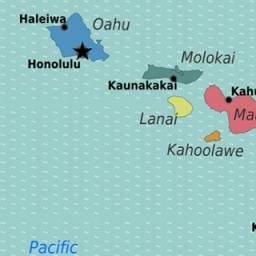

FERC also approved NextEra's proposed acquisition of Hawaiian Electric Industries (HEI), the state's main utility. The deal includes Hawaiian Electric Co. on Oahu, Hawaii Electric Light Co. on the island of Hawaii, and Maui Electric Co., which serves Maui, Lanai, and Molokai. Only Kauai, which has its own electric cooperative, will not be covered by the deal.

The $4.3 billion acquisition has been controversial in Hawaii because of the state's struggles in integrating rooftop solar generation. So much has been added by utility customers-installed capacity on Oahu is nearly 120% of that grid's minimum daytime load-that the system is straining under the output during peak periods. The state government is working to address the problem and facilitate greater renewable integration, but critics of the deal worry it may bring those efforts to a halt or at least slow them down.

NextEra is the parent firm of Florida Power & Light (FPL) and merchant generator NextEra Energy Resources. Though the latter has substantial renewable assets, observers accuse FPL of working to block solar adoption in Florida-the state has no renewable portfolio standard and third-party ownership models remain illegal. How NextEra will approach Hawaii's issues is not clear.

The sale must still be approved by Hawaii's Public Utilities Commission (PUC) and HEI shareholders. While the shareholder vote is scheduled for May 12, the PUC is under pressure from a variety of groups to extend its August 30 deadline to complete the case by two months for further study

-Thomas W. Overton, JD is a POWER associate editor.

The post FERC Okays NextEra-HEI, Duke-Dynegy Deals appeared first on POWER Magazine.