NET Power Consolidates Business to Gear Up for Allam Cycle Power Plant Deployment

NET Power will combine with Rice Acquisition Corp. II (RAC II), a decarbonization solutions special purpose acquisition company (SPAC), in a new business direction designed to accelerate the deployment of NET Power's much-watched novel natural gas-fired power plant technology.

When the business combination transaction closes as expected in the second quarter of 2023, the new company, NET Power Inc., will be listed as NPWR" on the New York Stock Exchange. The transaction will also result in a leadership shuffle, with current RAC II Director and former CEO of Rice Energy Inc. Danny Rice taking over from current NET Power CEO Ron DeGregorio as head of the new combined company.

NET Power and RAC II's business combination, which has an implied" pro forma enterprise value of $1.5 billion will help position NET Power Inc. to capture the substantial market opportunity that is developing for its novel technology, the companies told investors during a briefing on Dec. 14.

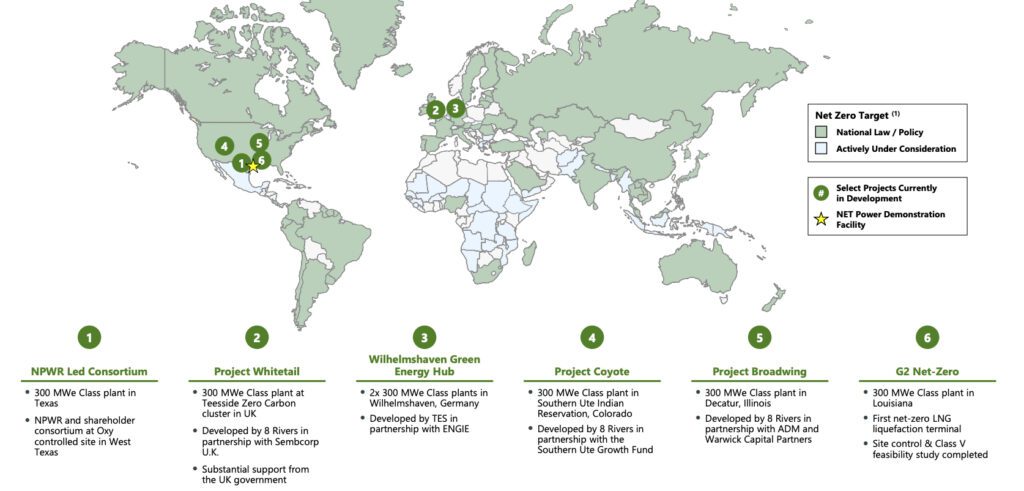

NET Power says it has to date logged over 155 total project opportunities from a diverse set of companies." So far, six projects-four in the U.S. and two in Europe-are targeting utility-scale 300-MW sized plants based on the NET Power cycle. All have completed feasibility studies or similar due diligence and could be commercially operational in the 2026-2027 timeframe, it said.

The transaction to combine with RAC II, meanwhile, follows a strategic investment and partnership with Baker Hughes to deliver key turbomachinery for future NET Power plants," DeGregrio noted. The business combination properly capitalizes NET Power and enables the company to commercialize this revolutionary technology," he said. The Rice Group is a logical strategic partner, and I am excited to hand the reins to Danny to lead NET Power."

The Big Boost From Technology ValidationAs POWER has reported in-depth, NET Power's technology is based on the Allam-Fetvedt Cycle (AFC), which is essentially a specialized Brayton cycle in which the combustor is supplied with three flows: fuel gas, which is compressed in the fuel compressor; oxygen, which is produced in an air separation unit and then compressed; and a carbon dioxide working fluid that is heated in the multi-flow regenerator.

The process begins with a commercially available" air separation unit, which separates air into its constituents of oxygen, argon, and nitrogen, explained NET Power Chief Technology Officer Brock Forrest. While argon and nitrogen can be sold as industrial gases or vented, the oxygen is mixed with natural gas and combusted (a process known as oxy-combustion) to create a stream of supercritical carbon dioxide (CO2) and water vapor. This high-pressure CO2 moves to a specialized turboexpander to generate electricity.

NET Power's platform uses a semi-closed loop cycle that inherently captures CO2 and produces power. It does so by combining two processes: oxy-combustion, which produces CO2 and H2O, with a supercritical carbon dioxide power cycle (which was formerly referred to as the Allam cycle but is now the NET Power cycle"). The CO2 from oxy-combustion is recirculated back to the combustor, and a portion (about 820,000 tonnes per year for the second-generation design) is exported for utilization or sequestration. Courtesy: NET Power

NET Power's platform uses a semi-closed loop cycle that inherently captures CO2 and produces power. It does so by combining two processes: oxy-combustion, which produces CO2 and H2O, with a supercritical carbon dioxide power cycle (which was formerly referred to as the Allam cycle but is now the NET Power cycle"). The CO2 from oxy-combustion is recirculated back to the combustor, and a portion (about 820,000 tonnes per year for the second-generation design) is exported for utilization or sequestration. Courtesy: NET Power

This patented, high-efficiency cycle inherently captures over 97% of CO2, which can then be utilized or sequestered, transforming natural gas into clean baseload power," the company said last week. NET Power is designed to generate reliable power with a carbon intensity similar to solar or wind coupled with a short-duration battery at a levelized cost of electricity of approximately $21-$40 per megawatt hour."

During the presentation, notably, Forrest refrained from calling the cycle AFC," referring to it instead as the NET Power cycle," a label NET Power confirmed it would use going forward for the novel power cycle. Forrest also suggested the company's technology offering has evolved. While the company's Generation 1 design-its initial 300-MW commercial utility-scale design-is expected to have plant efficiencies of about 50% (but with a higher firing temperature), its Generation 2" design is expected to achieve efficiencies over 60%, in-line with combined cycle natural gas plants," he said.

The technology evolution stems from efforts to validate the technology's many first-of-a-kind components at NET Power's test facility in La Porte, Texas. Since May 2018, when the company achieved the first fire of a novel industrial-scale (1/11th the size of a utility-scale plant ) 50-MWth combustor designed by Toshiba, the company has run three separate testing campaigns at the test facility to validate the technology, amounting to 1,500 hours of operational uptime.

The multiple 24-hour test campaigns tested start-stop sequences, steady-state, and ramping operations, the company said. Among key highlights are that the supercritical CO2 turbine generated power while synchronized to the grid. In addition, the facility exceeded its 925C design temperature expected of a utility-class plant turbo expander through optimized combustion and recycle temperature controls. Meanwhile, balance of plant (BOP) exceeded 300 bar pressure operation, consistent with utility-scale plant specifications. Heat exchanger performance, too, has been robust, resilient, and tested at temperatures meeting and exceeding required benchmarks," it said.

Most importantly, La Porte has given us and Baker Hughes the confidence to move forward with designing the key equipment necessary for utility-scale deployment," said Forrest.

A Significant PartnershipAccording to Brian Allen, NET Power's president and chief operating officer, sealing the partnership deal with global equipment firm Baker Hughes in February 2022 marked an incredibly important milestone" for NET Power. Baker Hughes, which has a vast portfolio of gas turbines and compressors installed globally, agreed both to invest in NET Power as well as develop and commercialize a turbo expander equipment package with performance guarantees. In addition, however, Baker Hughes will jointly market NET Power's technology through their global sales channels.

Further, Baker agreed to only sell jointly developed turboexpanders to NET Power licensees, which will further deepen NET Power's competitive moat," Allen said. Lastly, Baker was willing to provide industry-standard warranties and guarantees to enable future customers to move forward with constructing projects."

Allen said Baker Hughes could begin quoting units for customers as early as summer 2023. It is also poised to test the first industrial-scale Baker Hughes combustor and turbo expander at the La Porte facility in 2024-2015. First delivery of the utility-scale equipment package is expected by 2026," he said.

An Expanding Project PipelineWhile we only signed the partnership seven months ago, the teams are working well together and hitting milestones set out in the original scope of work on both our technical and commercial workstreams. We are on track and have started fielding reverse inquiries from several large customers seeking to deploy NET Power plants in the near future, while strategizing to enter new markets across the world," Allen added.

The technology certainty has sparked widespread interest and extended the project pipeline, Allen suggested. So far, six projects have completed feasibility studies and are on track to kick off front-end engineering (FEED) in 2023 and have targeted commercial operation dates in the 2026 to 2027 timeframe.

The first project-serial number one"-will be a 300-MW natural gas-fired power plant at an Occidental-hosted site near Odessa, Texas. Construction is slated to begin in the third quarter of 2024, and NET Power is targeting commissioning in the third quarter of 2026.

NET Power said that it has already secured $200 million through committed investments" to fully fund corporate operations through the commercialization of the Odessa project in 2026. Allen, however, noted that the company may still be exploring a range of options to finance the Odessa plant's design and construction. First, a portion of the SPAC capital raised can be applied to the project. We will also pursue [Department of Energy] funding through loan and grant programs that are currently in place. The shareholder group can also provide financial assistance as necessary."

Importantly, we expect each [of NET Power's shareholders] will play a meaningful role in moving the project to completion. Baker will provide the key rotating equipment, and [Occidental] will provide CO2 and power offtake. Constellation can provide [operation and maintenance] services of the plant as well as power offtake, and 8 Rivers can provide project development support," he said. This level of shareholder support is a key differentiator of NET Power relative to many other early-stage technologies. We are confident we have the expertise and capital to deliver serial number 1 to set the stage for commercialization."

Occidental, NET Power's biggest shareholder, last week also highlighted the importance of the first project, including demonstrating how a supply of emissions-free power could be beneficial to the direct air capture (DAC) sites and sequestration hubs Occidental is developing. Occidental is advancing feasibility studies to incorporate NET Power plants into DAC hubs being developed by its 1PointFive subsidiary, where approximately 30 - 40 plants could provide enough clean power for a DAC program capturing 100 - 135 million tonnes of CO2 per year," the company said.

Other publicly announced NET Power projects include the Coyote Clean Power Project in southwest Colorado, which will be located within the Southern Ute Indian Reservation, and the Broadwing Clean Energy Complex, which is being developed under a partnership with agricultural and processing firm Archer-Daniels-Midlands Co. (ADM) at an existing CO2 storage facility site in Decatur, Illinois. A 300-MW natural gas-fired NET Power station is also under development at an existing site at Teesside, potentially making it the first UK installation.

During the briefing last week, NET Power also revealed a project comprising two 300-MW NET Power plants is moving forward at the Wilhelmshaven Green Energy Hub in Germany. TES Energy Solutions is developing that project with ENGIE. TES is notably cooperating closely with NET Power in its effort to offer green power-on-demand and independent from the intermittency of European solar and wind power production," NET Power said. Finally, a 300-MW NET Power plant is under development at G2 Net Zero, a pioneering net-zero liquefied natural gas (LNG) liquefaction terminal in southwestern Louisiana.

A project pipeline of potential near-term NET Power plants. Courtesy: NET Power

A project pipeline of potential near-term NET Power plants. Courtesy: NET Power

Looking ahead, a substantial market may be developing for NET Power plants, officials from NET Power and RAC II said. One of the combined company's primary use cases will be to replace existing baseload capacity slated for retirement. That alone would equate to over 1,000 NET Power plants in the U.S. alone, and over 15,000 NET Power plants when including global baseload retirements and expected electrification demand growth," said RAC II's director, Danny Rice.

Market potential also lies in global decarbonization, which will require lower-carbon power generation solutions. But today's lower-carbon solutions are unreliable, unaffordable, or limited by scale," he noted.

Both companies also suggested natural gas may have a solid future as decarbonization efforts gain momentum. In the U.S., we've nearly doubled supply in the last 15 years of natural gas and have over 75 years' worth of it in some of the most responsibly produced and lowest-cost gas reserves in the world," said Rice. But here's the challenge: With this growth in gas supply comes growth in gas emissions which recently surpassed U.S. coal emissions. And in order for natural gas to have a permanent role in a clean energy future, policymakers have made it clear that the industry needs to develop ways to rapidly decarbonize natural gas," he added.

Unfortunately, the challenge is that traditional carbon capture for gas plants is very expensive and inefficient, and clean hydrogen options have significant cost and logistical challenges. Even the new incentives recently passed into law aren't high enough to make economic sense."

NET Power's business model-an asset-light, licensing-based revenue model"-offers a simple and straightforward" approach, Rice said. These licenses are expected to generate a fee stream of approximately $65 [million] of PV10 per utility-scale plant, most of which is received by the time the plant is commissioned. For investors, you can multiply $65 [million] by the expected addressable market to understand future value potential. [Ten] plants are worth $650 [million], 20 plants are worth $1.3 billion, etc."

Rice also suggested the current policy environment and market economics are compelling. A further boost to the company's momentum was the recent passing of the Inflation Reduction Act [IRA], which increases the 45Q [tax credit] price for CO2 capture and storage to $85/ton and materially increases the NET Power value proposition for our future customers," he said.

Under the revised 45Q, a NET Power plant, which is designed to capture up to 820,000 tonnes of CO2 per year, becomes more economical to deploy than carbon-emitting coal and natural gas-fired alternatives, he said. Moreover, the IRA sends a very strong signal to NET Power's prospective customer base that carbon capture will have long-term support in the U.S."

-Sonal Patelis a POWER senior associate editor (@sonalcpatel,@POWERmagazine).

The post NET Power Consolidates Business to Gear Up for Allam Cycle Power Plant Deployment appeared first on POWER Magazine.