Novel UAMPS-NuScale SMR Nuclear Project Gains Participant Approval to Proceed to Next Phase

Despite a steep hike in the project cost estimate for the proposed 462-MWe Carbon-Free Power Project (CFPP), 26 of 27 public power entities have voted to continue development of the first-of-its-kind six-module NuScale Power VOYGR-6 small modular nuclear (SMR) plant.

The 26 project participants-subscribers who could eventually offtake portions of the project's power-lodged financial commitments to continue the CFPP in February, clearing the project's second off-ramp," which was triggered by a Class 3 project cost estimate put forth by CFPP contractors Fluor and NuScale in December 2022. The commitments spurred the CFPP Project Management Committee on Feb. 28 to approve a revised budget and financing plan, allowing the pioneering project to move into the next phase, which will entail completing and submitting a combined operating license application (COLA) to the Nuclear Regulatory Commission (NRC).

Utah Associated Municipal Power Systems (UAMPS), a political subdivision of the State of Utah that wholly owns CFPP LLC-the entity established to develop, build, and operate the first-of-a-kind SMR project at an Idaho National Laboratory (INL) site in Idaho Falls, Idaho-on Tuesday said the COLA is on track for submittal to the NRC in January 2024.

If the NRC approves the COLA, construction of the project could begin in 2026, with the first VOYGR-6 module scheduled to be in service by December 2029. All modules are slated to be in service by November 2030.

The Carbon Free Power Project (CFPP), spearheaded by Utah Associated Municipal Power Systems (UAMPS), will be the first VOYGR SMR power plant to begin operation in the U.S. The six-module plant will be built at the Idaho National Laboratory (INL) in Idaho Falls and will have a capacity of 462 MW. Courtesy: NuScaleTotal CFPP Project Costs Could Range from $9.24B to $5.1B

The Carbon Free Power Project (CFPP), spearheaded by Utah Associated Municipal Power Systems (UAMPS), will be the first VOYGR SMR power plant to begin operation in the U.S. The six-module plant will be built at the Idaho National Laboratory (INL) in Idaho Falls and will have a capacity of 462 MW. Courtesy: NuScaleTotal CFPP Project Costs Could Range from $9.24B to $5.1BThe overwhelming approval" by CFPP project participants during the February off-ramp period to continue with the project is especially notable because NuScale and Fluor's Class 3 project cost estimate failed to reach its levelized cost of electricity (LCOE) price target of $58/MWh (in 2020 dollars).

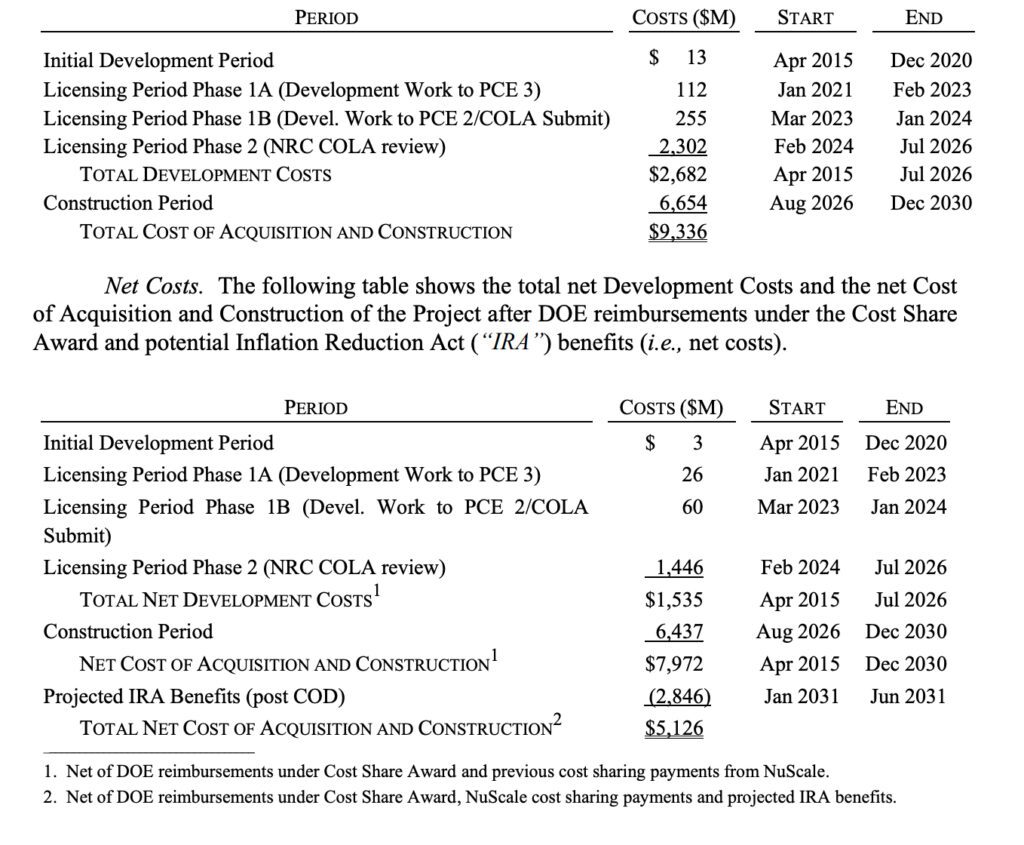

Under Fluor's Class 3 estimations, the total CFPP project cost-which factors in updated owner's costs, interest rate assumptions, the cost of acquisition and construction, and operating and maintenance costs-now hover at $9.24 billion. CFPP expects, however, that a 2020 cost-sharing agreement with the DOE will furnish the project with another $1.4 billion. Along with $9 million of prior cost-sharing payments from NuScale, that could reduce total costs to $7.972 billion. Further cost reductions could meanwhile come from the August 2022-enacted Inflation Reduction Act (IRA), it suggested. A preliminary CFPP analysis indicates that the project could reap about $2.8 billion in benefits, which could reduce net project costs to $5.1 billion.

In December 2022, meanwhile, as required by its Development Cost Reimbursement Agreement (DCRA) with CFPP, NuScale unveiled the results of an economic competitiveness test (ECT) to determine project LCOE. Factoring in findings from the Class 3 estimates, the DOE cost-sharing payments, estimated IRA benefits, and the owner's cost estimate, NuScale projected LCOE had soared to $89/MWh (in July 2022 dollars).

While the steep LCOE hike constituted an ECT failure"-and gave CFPP the right to terminate the DCRA-the CFPP Project Management Committee drafted a revised Budget and Plan of Finance (BPF) in January and adopted a new DCRA, which reflected the updated target price of $89/MWh. On Tuesday, the committee unanimously voted to adopt both the BPF and DCRA.

External Factors Have Driven Up CostsThe revised BPF's adoption is a significant step because the BPF is designed to manage and reduce risk to CFPP participants through the next project phase (spanning March 2023 through January 2024). It essentially provides UAMPS with an option to withdraw from the project and collect reimbursements for most out-of-pocket expenses if the CFPP's exceeds its target price.

We added in a new term that the subscription of the project must meet at minimum 80% or the agreement triggers opportunity for 100% reimbursement," noted Scott Hughes, Power director for Hurricane City, Utah, a municipality that currently holds the largest CFPP participant development share (of 17% and is entitled to 20 MW). The Project Management Committee also approved a resolution in the February project meeting that states if those terms are not met, the committee will terminate the project so as to help municipalities feel more comfortable that the goalposts don't just continue to move in the future."

But according to UAMPS and NuScale, the steep hike in the target price stems from multiple external factors, including inflationary pressures and increases in the price of steel, electrical equipment, and other construction commodities. These increases have not [been] seen for more than 40 years," NuScale noted. For example, the producer price index for commodities such as carbon steel piping and fabricated steel plates have increased by more than 50% since 2020. These inflationary pressures are increasing the costs for all power generation and infrastructure projects."

UAMPS also noted increases in interest rates have driven up project costs. Interest rates have risen dramatically, about 150% in the past 12 to 18 months, having a sizeable impact on project costs," it said. The entity is hopeful the August 2022-enacted Inflation Reduction Act (IRA) could provide a direct benefit, on the order of $30/MWh reduction in LCOE offsetting a measurable fraction of the inflationary and interest rate increases."

Estimated development costs and cost of acquisition and construction. The table at the top shows the total costs without accounting for the DOE cost share award or potential IRA benefits (gross costs). The bottom table shows net costs after DOE reimbursements and potential IRA benefits. Courtesy: UAMPS/CFPP

Estimated development costs and cost of acquisition and construction. The table at the top shows the total costs without accounting for the DOE cost share award or potential IRA benefits (gross costs). The bottom table shows net costs after DOE reimbursements and potential IRA benefits. Courtesy: UAMPS/CFPPNuScale and Fluor's Class 3 estimate, which is based on a cost estimate standard promulgated by the American Association of Cost Engineering (AACE), is so far the most granular look" at project costs and the ultimate cost of energy from the plant. It has involved a great deal of design work, outreach to vendors, consideration of inflationary tables, labor costs, construction, operations, utilities, supply chain outlook," UAMPS noted.

Still, the Class 3 estimate is a semi-detailed assessment that covers up to 40% of deliverables. Other activities for 2023 include the procurement of long lead material and the development of the AACE Class 2 construction estimate, which will provide a more detailed cost estimate for the project," UAMPS said on Tuesday.

Subscription Now Stands at 26% of the CFPP's Gross 426-MWeFor now, however, UAMPS is jubilant that 26 participants have voted to continue the project. Despite the project's rising costs, felt worldwide by all large energy projects due to interest rates increases and rapidly escalating inflation in commodities such as fabricated plate and structural steel, copper wire, and cable, not seen for over 40 years, participants felt overwhelmingly that the CFPP remains viable and is a key energy resource for the future," noted Mason Baker, UAMPS CEO and general manger, on Tuesday.

As of March 1, total CFPP entitlement shares amount to 119.9 MW (about 26%) of its 462-MW projected gross generating capacity-higher than the 115.9 MW of commitments the project had before the off-ramp period. UAMPS on Tuesday noted one potential participant-Morgan City, Utah-withdrew its 1.4-MW commitment, and another participant-Parowan City, Utah-reduced its subscription level from 3 MW to 2 MW. Los Alamos, New Mexico, meanwhile, substantially" increased its subscription in the project from 2.1 MW to 8.6 MW.

Table: Carbon-Free Power Project schedule of participants, entitlement shares, and development cost shares as of March 1, 2023. Courtesy: UAMPS/CFPP

As part of the amended DCRA, CFPP and NuScale now plan to implement a subscription plan that includes several collaborative efforts to increase subscription levels to 370 MW-or about 80% of the project's capacity-by the time the COLA is submitted to the NRC.

Efforts include further outreach to prospective power purchasers and equity investors; reducing the LCOE from the project through value engineering, additional funding options, and lower cost financing options; creating early-mover incentives in power purchase and ownership agreements; and engaging and supporting the existing participants to assess their generation needs and optimize their subscription levels under the power sales contracts," UAMPS said.

The re-evaluation by our participants has been intense but momentum is stronger than ever," UAMPS told POWERon Thursday. We are working diligently to increase subscriptions and talks are underway with numerous utilities. We expect announcements over the next few months."

Meanwhile, according to Dr. Shawn Hughes, CFPP project director, work is also underway to refine the approach to the limited work authorization (LWA), enabling the project to begin non-nuclear construction work before CFPP submits its COLA to the NRC. Efforts to procure long-lead materials and services are also underway. We are keeping a sharp lookout on this issue in particular; it's one of our most critical areas of focus due to potential impact to the schedule critical path," said Hughes.

NuScale, who will provide the VOYGR modules to the CFPP, is meanwhile focused on securing standard design approval (SDA) for the plant's six-module configuration, which will use uprated 250-MWth (77-MWe) modules. NuScale submitted an SDA application to the NRC on Jan. 1. CFPP documents suggest the target date for the final acceptance review of the SDA application is the end of March.

-Sonal Patelis a POWER senior associate editor (@sonalcpatel,@POWERmagazine).

The post Novel UAMPS-NuScale SMR Nuclear Project Gains Participant Approval to Proceed to Next Phase appeared first on POWER Magazine.