|

by Guardian Staff on (#BKZH)

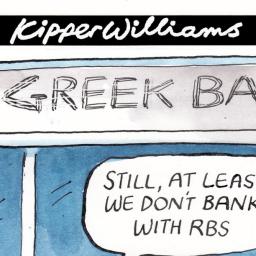

Greece warns of ‘uncontrollable crisis’ without a deal with creditors. Meanwhile, in the UK a glitch at RBS causes delays in payments, sparking anger among customers Continue reading...

|

| Link | http://feeds.theguardian.com/ |

| Feed | http://feeds.theguardian.com/theguardian/business/economics/rss |

| Updated | 2026-02-06 09:00 |

|

by Guardian Staff on (#BK7R)

This is a crunch week for the Greek debt negotiations, and could be decisive for the country’s membership of the eurozone. Day by day and meeting by meeting, we outline how the crisis could play out Continue reading...

|

|

by Oliver Pahnecke on (#BK2S)

The legal basis for forcing a member out is shaky: the European commission needs to debunk the ‘Grexit’ assumption and rediscover its role as guardian of the treatiesMonths of arguments about the Greek financial crisis have this week cumulated in a highly emotional debate about a possible Grexit. As Athens will be unable to satisfy its financial obligations after a default, many hardliners expect Greece to leave the eurozone, and printing as much neo-drachma as necessary. Some see this as the only solution to the Greek crisis: it would allow Greece to devalue its new currency, supposedly making the country competitive and resulting in economic growth and the ability to repay its debt. Others are more sceptical: they fear that the new drachma would be an obstacle to trade, increasing the cost of imports and making it impossible for Greece to ever repay anything.Related: Greece crisis: US urges compromise after Greek PM attacks IMF - as it happenedAccording to the EU treaty, its aim is to promote peace and the wellbeing of its peoples Continue reading...

|

by Heather Stewart on (#BJY2)

Organisation for Economic Co-operation and Development report finds growth is stifled in countries where strong financial industries are expandingCountries with bigger banking sectors suffer weaker growth and worse inequality, according to a report from the Organisation for Economic Co-operation and Development (OECD).Related: Pay low-income families more to boost economic growth, says IMF Continue reading...

|

by Guardian Staff on (#BJH8)

Greece’s prime minister says the financial institution has ‘criminal responsibility’ for the damage caused by the country’s austerity programmes Continue reading...

|

|

by Phillip Inman economics correspondent on (#BJ9A)

Concerns that jump in real wages, highest in seven years, will be short lived if inflation continues to rise over rest of 2015 and productivity remains flatWage growth in Britain hit a four-year high of 2.7% in April, according to official figures, delivering a welcome increase to household finances following the fall in inflation this year.But some analysts warned that the jump in real wages, the highest for seven years, would be short-lived if inflation continued to rise over the rest of the year and productivity remained flat.Related: Enjoy rising wages while they last – it won't take much to slow things down Continue reading...

|

|

by Nicholas Watt, Rowena Mason and Graeme Wearden on (#BHV4)

British chancellor George Osborne says government is taking ‘all steps’ to protect Britain amid fears that Greece is on verge of debt defaultThe British government is stepping up contingency planning to prepare for the “serious economic risks†posed by a Greek default and a possible exit from the euro, Downing Street has confirmed.

|

by Graeme Wearden (now) and Nick Fletcher on (#BDW1)

Pressure builds as Alexis Tsipras says IMF has “criminal responsibility†for the damage caused by Greece’s austerity programmes

|

by Larry Elliott, Ian Traynor in Brussels, and Helena on (#BG60)

Tsipras’s abrasive tone and accusations of ‘criminal conduct’ by IMF stokes more anger as EU officials prepare to gather at Luxembourg last chance saloonFears that the five-year Greek financial crisis will culminate in debt default and exit from the euro have intensified as Athens hardened its rhetoric against its creditors and insisted it would miss a payment to the International Monetary Fund unless it received debt relief.With just 48 hours to go before a meeting of eurozone finance ministers, seen as the last realistic chance to reach a deal before Greece has to pay the IMF at the end of June, Alexis Tsipras, showed no sign of bowing to demands for cuts in pensions and increases in VAT. Instead, the Greek prime minister accused the Fund of “criminal responsibility†for the situation and said lenders were seeking to “humiliate†his country.Related: Tsipras does want a deal, as the alternative is unthinkableRelated: Angela Merkel stands firm on finding resolution to Greece crisisRelated: Eurozone braces for Greek exit as Athens threatens to miss IMF payment Continue reading...

|

|

by Jon Henley on (#BG5Q)

Greece’s spiralling debt crisis saw cash withdrawals total €400m on Monday. While anxiety varies around Athens, few Greeks see benefit in leaving the euro“Everybody’s doing it,†said Joanna Christofosaki, in front of a Eurobank cash dispenser in the leafy Athens neighbourhood of Kolonaki. “Our friends have all done it. Nobody wants their money to be worthless tomorrow. Nobody wants to be unable to get at it.â€A researcher in the archaeology department at the Academy of Athens, Christofosaki said she knew plenty of people who had “€10,000 somewhere at home†and plenty of others who chose to keep their stash at the office. Was she among them? “If I was, I certainly wouldn’t tell you.â€Related: Greece crisis: Tsipras blasts 'criminal' IMF in defiant speech - live updatesRelated: Tsipras does want a deal, as the alternative is unthinkableRelated: Greece's latest attempt to reach deal with creditors collapsesRelated: Endgame looms for Greek crisis as both sides take debt negotiations to the brink Continue reading...

|

|

by Larry Elliott on (#BFX7)

Greece would face unprecedented hardship if capital controls were introduced, and the Syrizia party would see its populist support plummet rather fastHard though it is to believe sometimes, Alexis Tsipras does want to strike a deal. The increasingly abrasive language used by the Greek prime minister is a front for a politician who still thinks it is possible to negotiate his way out of the sticky situation he finds himself in.That has to be the assumption. The alternative to a deal would appear to be a Lehman Brothers-style moment sometime in the next 72 hours, when the Greek banks haemorrhage money and capital controls are introduced. At that point, support for Tsipras and his Syriza coalition is likely to dissipate rapidly, especially if Greece’s eurozone partners say capital controls are incompatible with membership of the single currency.Related: Greece crisis: Tsipras blasts 'criminal' IMF in defiant speech - live updatesRelated: Angela Merkel stands firm on finding resolution to Greece crisisRelated: Eurozone braces for Greek exit as Athens threatens to miss IMF payment Continue reading...

|

|

by Katie Allen on (#BE8P)

Consumer price index measure of inflation was up 0.1% on a year earlier in May after a 0.1% dip in AprilBritain’s brief flirtation with negative inflation ended last month, with official figures showing that prices rose again in May helped by higher air fares and petrol prices.The Office for National Statistics said its consumer price index measure of inflation was up 0.1% on last year after a 0.1% dip in April – the first negative inflation for more than 50 years.Read the Chancellor’s statement on today’s #inflation figures: pic.twitter.com/xrrSARPz4p Continue reading...

|

|

by Kate Connolly in Berlin on (#BFFA)

Chancellor clashes with her finance minister and German media over hardline stance regarding potential GrexitWhile the German chancellor, Angela Merkel, is publicly insistent on reaching a compromise deal that ensures Greece is saved from insolvency, expectation is rising – in Germany and elsewhere – of a Greek exit from the eurozone. With just two weeks to go for Athens to find a solution to creditors’ cash-for-reforms demands for a 1.6 bn euro repayment to the International Monetary Fund, a Greek default – and a Grexit with it – are viewed in Berlin as ever more likely.Related: Greece crisis: PM blasts 'criminal' IMF in defiant speech - live updatesRelated: Greek crisis: Europe has nothing to fear from Syriza's belligerence Continue reading...

|

|

by Matthew Weaver on (#BF7G)

Protest group accuses leadership contenders of being timid, and indicates support for Jeremy Corbyn’s bid ahead of Saturday’s marchThe organisers of an anti-austerity demonstration planned for the City of London this weekend have accused three of the four Labour leadership contenders of timidity for deciding to stay away.The End Austerity Now rally, organised by the People’s Assembly, is expected to be the biggest anti-government demonstration for four years; tens of thousands of people will march from the City of London to Parliament Square.Jeremy is the only candidate who takes a principled anti-austerity, anti-war stance consistently Continue reading...

|

|

by Ian Traynor in Brussels and Helena Smith in Athens on (#BEW2)

Greece’s prime minister Alexis Tsipras says the fixation on cuts is ‘most likely part of a political plan to humiliate an entire people’Greece’s prime minister has said the International Monetary Fund has “criminal responsibility†for the country’s debt crisis as it emerged Athens could miss a €1.6bn (£1.15bn) payment to the lender this month.Speaking in the Greek parliament Alexis Tsipras called on creditors to reassess the IMF’s insistence on tough cuts as part of the country’s bailout. Continue reading...

|

|

by Larry Elliott, Economics editor on (#BEK4)

There is still a risk that inflation could go negative again over the next couple of monthsWell, that didn’t last long. A month after the cost of living turned negative for the first time in more than half a century, inflation was back.In truth, there is little difference between the fact that prices on the government’s preferred measure fell by 0.1% in the year to April and that they rose by 0.1% in the 12 months ending in May. Inflationary pressure remains weak and is likely to remain so.Related: Inflation returns to UK as airline tickets and petrol prices rise Continue reading...

|

|

by Joseph Stiglitz on (#BE6V)

Crisis in Europe is just the latest example of the high costs – for creditors and debtors alike – entailed by the absence of an international rule of law for resolving debt crisesGovernments sometimes need to restructure their debts. Otherwise, a country’s economic and political stability may be threatened. But, in the absence of an international rule of law for resolving sovereign defaults, the world pays a higher price than it should for such restructurings. The result is a poorly functioning sovereign-debt market, marked by unnecessary strife and costly delays in addressing problems when they arise.We are reminded of this time and again. In Argentina, the authorities’ battles with a small number of “investors†(so-called vulture funds) jeopardised an entire debt restructuring agreed to – voluntarily – by an overwhelming majority of the country’s creditors. In Greece, most of the “rescue†funds in the temporary “assistance†programs are allocated for payments to existing creditors, while the country is forced into austerity policies that have contributed mightily to a 25% decline in GDP and have left its population worse off. In Ukraine, the potential political ramifications of sovereign-debt distress are enormous. Continue reading...

|

|

by Anatole Kaletsky on (#BDY3)

Alexis Tsipras thinks he holds another trump card: Europe’s fear of a Greek default. But this is a delusion promoted by his finance minister, Yanis VaroufakisThe good news is that a Greek default, which has become more likely after prime minister Alexis Tsipras’ provocative rejection of what he described as the “absurd†bailout offer by Greece’s creditors, no longer poses a serious threat to the rest of Europe. The bad news is that Tsipras does not seem to understand this.To judge by Tsipras’s belligerence, he firmly believes that Europe needs Greece as desperately as Greece needs Europe. This is the true “absurdity†in the present negotiations, and Tsipras’ misapprehension of his bargaining power now risks catastrophe for his country, humiliation for his Syriza party, or both. Continue reading...

|

|

by Katie Allen on (#BDSK)

Official figures due on Tuesday are expected to show Britain’s dip into negative inflation ended in May, as rising fuel costs pushed prices up againBritain’s brief flirtation with negative inflation came to an abrupt end last month, according to a Reuters poll of economists, with official figures expected to show prices started rising again in May.April saw prices fall on a year ago for the first time in more than 50 years. The Office for National Statistics said its consumer price index measure of inflation was down 0.1% in April. But economists believe May’s figures, due at 9.30am on Tuesday, will show inflation rebounded as fuel prices rose. The consensus forecast is for inflation of 0.1% last month, according to Reuters.Related: UK wages rising at fastest rate since October 2007, thinktank says Continue reading...

|

|

by Aditya Chakrabortty on (#BDSN)

This isn’t just Bullingdon Boys running amok – they’re using austerity to transform irrevocably our politics, our public realm and our societyEver since the crash of 2008, every economic argument worth having has been political. Rows over what to do about Greece or bankers may come swathed in a tarpaulin of jargon, or bearing a roof-rack of technicalities, but really they’re about the big stuff: who gets what and from whom, and what makes a society worth living in.Which makes austerity the biggest political debate in Britain today. Last week George Osborne vowed at Mansion House to make budget deficits all but illegal; next weekend there will be a national demonstration against the cuts. These events will look very different – a bunch of penguin suits discussing finance over a slap-up dinner versus an army of trainers tramping in protest at the human fallout of the past five years. Yet they are the yin and yang of the debate over what kind of country the UK should be.Related: Academics attack George Osborne budget surplus proposalWhat we expect from Whitehall or our town halls will come instead from G4S, Serco, Atos Continue reading...

|

|

by Graeme Wearden on (#BA35)

Dramatic day sees traders are spooked by collapse of negotiations last night, PM Alexis Tsipras vows not to cave in, and German media reports of an emergency ultimatum.

|

|

by Letters on (#BCA1)

If Greece gives in to the demands of the European banks and the IMF, the consequences for its pensioners and other poor people will be worse than anything Draco ever dreamt up. The pensions cut and the VAT increase are favoured by the banks because there will be an immediate impact on those perceived to have benefited immoderately from the government’s profligacy – a benefit not clear to people whose country has already been devastated by cuts.If the banks give way, however, who will notice? No one in the short term. In the long term, maybe the banks or hedge fund managers may have to adjust their books to reflect a bad investment.Related: Fears of Greece eurozone exit mount as EU deadline loomsRelated: Europe must save Greece to save itself | Timothy Garton Ash Continue reading...

|

by Nils Pratley on (#BCAD)

Previously Athens and its creditors always reached a deal, but this week’s increasingly belligerent standoff necessitates tangible plansFor almost the first time, investors have been obliged to assess seriously the risk of a Greek default and exit from the euro. Past Greek crises always seemed likely to end in a deal, and did. This time, even at the 11th hour, red lines are turning scarlet.Given that backdrop, the reaction of financial markets was remarkably sanguine. Greek stocks, especially banks, were clobbered, obviously. But the wider reaction was mild. Yields on the debt of eurozone stragglers rose but are well below levels seen in 2011-12. Stock markets outside Greece were down but not heavily.Related: Greece and the eurozone’s existential crisis | Letters Continue reading...

|

by Letters on (#BC96)

Ha-Joon Chang, Thomas Piketty and 77 others argue (Letters, 12 June) that there is “no basis in economics†for George Osborne’s plans to legislate for budget surpluses. This is reminiscent of the phrase used by the 364 economists who wrote to the Times arguing that there was “no basis in economic theory or supporting evidence†for Geoffrey Howe’s policies. The credibility of that group was not helped when growth returned the next month. Though I have reservations about Osborne’s proposal, to argue that “there is no basis in economics†for constitutional or legislative rules that constrain government borrowing, especially given the ageing of the population, is simply wrong. Furthermore, the specific complaints of the correspondents are based on the shakiest of assumptions, not least that there is no foreign sector in the economy that can absorb the impact of changes in government borrowing.Related: Osborne plan has no basis in economics | Letter from Ha-Joon Chang, Thomas Piketty, David Blanchflower and others Continue reading...

|

|

by Simon Goodley on (#BC7A)

Asia Pacific is now world’s second wealthiest region and will overtake North America this year, according to survey by Boston Consulting GroupNew millionaires in China and India have helped propel the combined wealth of Asia Pacific’s richest individuals past their peers in Europe, with the region’s wealthiest predicted to become more affluent than millionaires in North America over the next 12 months. New “millionaire households†were also created more quickly in Asia Pacific than anywhere else, according to the Boston Consulting Group’s (BCG) annual global wealth report, as the world’s 17m households worth more than $1m (£640,000) grew richer once again during 2014.For the first time in the survey’s 15-year history, the Asia Pacific region – which for the purposes of this report excludes Japan – overtook Europe to become the world’s second wealthiest region, with $47tn in private wealth, up 29% on 2013. North America, where private wealth totals $50.8tn, remains the wealthiest region, but it will be surpassed next year when the wealth of Asia Pacific’s so-called “high net worths†reaches $57tn, the survey predicts. Continue reading...

|

|

by Larry Elliott and Ian Traynor in Brussels on (#BC5F)

ECB chief, Mario Draghi, sounds warning as Athens and its creditors remain deadlocked, with markets getting jittery over fears of defaultMario Draghi, the president of the European Central Bank, has warned that time is rapidly running out to resolve the Greek debt crisis, as financial markets took fright at the prospect of a looming default. Shares fell across Europe after the latest breakdown in talks between Athens and its creditors diminished hopes of a deal being agreed at a meeting of eurozone finance ministers in Luxembourg on Thursday.Giving evidence to the European parliament in Brussels, Draghi said: “We need a strong and comprehensive agreement with Greece. And we need it very soon.†His remarks came amid evidence of the fragile state of Greece’s banks, where the pace of deposit withdrawals increased to €400m (£289m) on Monday.Related: Greek debt default looks more likely by the dayRelated: Why this week is vital for Greece and the eurozoneRelated: Unsustainable futures? The Greek pensions dilemma explained Continue reading...

|

|

by Larry Elliott Economics editor on (#BC18)

Greece and its eurozone partners have 72 hours to resolve their differences, but rather than edging closer together the two sides have never seemed further apartIt’s the morning of Friday 19 June. In Luxembourg, the finance ministers from the eurozone’s 19 countries are heading for home. Talks aimed at finding a solution to the Greek crisis have ended in failure. For once, there has been no 11th hour fudge. After years of kicking the can down the road, the end has been reached.In Athens, tourists out for an early look at the Parthenon find they can no longer get euros out of the cash machines. Contingency plans have been triggered to prevent a run on the banks. Strict capital controls are in force. Continue reading...

|

|

by Jim Tankersley for the Washington Post on (#BBZT)

The sudden slump in the US oil industry has left many men without college educations unemployed and struggling to find alternative workOther men bought big houses or new pickups with their oil money. Mike Gillham bought his favourite bar in Enid, Oklahoma. He heads there most nights, to lug in more beer, to throw darts with his regulars, to smoke Camels and sit with his wife and wonder how to keep getting by, now that his oil job is gone.Four years ago, Gillham stumbled upon what is more or less an economic lottery ticket for an American man whose education stopped after high school. It paid more than any other gig he’d had – more than all three of the jobs, combined, that he’d been working simultaneously before a buddy called and invited him into the well-paid world of the oil and gas industry.There’s going to be very few opportunities paying anywhere near what they’re making. That’s beginning to dawn on themImproved hydraulic fracturing technology made it possible to extract oil and gas from fields thought to be tapped out Continue reading...

|

|

by Ros Asquith on (#BBW9)

Minding your Ps and Qs to save schools from austerity Continue reading...

|

|

by Larry Elliott Economics editor on (#BBQ1)

Study indicates stagnating incomes of the poor and middle classes could have been instrumental in the financial crisisThe idea that increased income inequality makes economies more dynamic has been rejected by an International Monetary Fund study, which shows the widening income gap between rich and poor is bad for growth.A report by five IMF economists dismissed “trickle-down†economics, and said that if governments wanted to increase the pace of growth they should concentrate on helping the poorest 20% of citizens.Raising the income share of the poor and ensuring that there is no hollowing-out of the middle class is good for growth Continue reading...

|

|

by Katie Allen on (#BB1E)

Athens and EU finance ministers remain at loggerheads but if an agreement is not reached by this weekend there are many long-term consequencesThe Athens government has been in debt talks with its international creditors for months in a bid to get them to release a last chunk of held-up bailout funds and avert bankruptcy. It needs the money to meet debt repayments and without it there is a fear that Greece will end up defaulting, which could precipitate its exit from the eurozone.Related: Greek default fears hit markets, as commissoner predicts "state of emergency" - live updatesRelated: Markets slide as fears grow that Greece is close to defaulting on debtRelated: Unsustainable futures? The Greek pensions dilemma explainedThe fact is, unless some significant concessions are made on either side, a default is now more or less inevitable, and even if a plan were agreed that was agreeable to the creditors, it is unlikely that the Greek government would be able to get it through their parliament.Given that Germany won’t countenance anything like debt relief at this point, we are likely set to see a continuation of this game of political cat and mouse through this week’s Eurogroup finance ministers’ meeting on Thursday, and beyond to the end of the month.Our economists’ base-case scenario [60% probability] remains that a last-minute deal will be struck, leading to a semi-stable scenario, but most likely not before the EU summit on 25-26 June.Mr Tsipras had better get ready to blink if he wants to get a single additional euro from Germany or, indeed, any of the other member countries. Of course, he too may have given up on reaching an agreement and is keeping up appearances simply to impress Greek voters. Either way, he is no longer in last-chance saloon but no-chance saloon.Even in the event of default, Grexit should be avoided. It is not in anyone’s interests for Greece to leave the eurozone. For Greece, it would mean widespread bankruptcies. For the remaining eurozone members, the fact that a precedent of exit had been established would probably lead to a permanent upwards re-pricing of their sovereign debt. For both sides, it would be a very risky leap into the unknown.A short-lived default should not therefore lead to Grexit. It would not be the end of the road for Greece, but potentially the precursor to a breakthrough on a longer-term deal.Much would depend upon the response of the eurozone and the ECB in the short term, economic growth (or the lack of) in the medium term and of course the economic performance of Greece relative to the other eurozone countries in the longer term...So we could soon find out if the eurozone/ECB really do have a plan B. One would hope so, after all, as a certain Mr Wilde might have said: to lose one country may be regarded as a misfortune; to lose two looks like carelessness. Continue reading...

|

|

by Alberto Nardelli on (#BAS5)

The standoff between Greece and its creditors over pensions is part of a much wider problem: the conflicts between economics, politics, a dependent society, and inefficient accountingPensions are a significant sticking point in the standoff between Greece and the IMF, the European commission and the ECB.Greece’s creditors demand that Athens should cut pensions further. But the Greek government says it has gone as far as it can go. Continue reading...

|

|

by Graeme Wearden and Helena Smith in Athens on (#BAEZ)

Collapse in talks with creditors heightens default fears as Greek PM Alexis Tsipras attacks ‘five years of looting’ under bailoutsFears that Greece is close to defaulting on its debt swept European trading floors on Monday morning after talks between Athens and its creditors collapsed on Sunday.The Greek stock market slumped by almost 7% in early trading, as traders showed alarm that a deal will not be reached before the country’s bailout programme expires on 30 June.#Greece's 2yr yields jump to 28.3% as default risks rise after debt talks collapsed. pic.twitter.com/EXCdYd8WM1 Continue reading...

|

|

by Timothy Garton Ash on (#BA52)

Even if you don’t care about the Greek people, be warned – the faultlines of Grexit would shake the entire continentEurope must save Greece. The consequences of keeping Greece within the eurozone will be bad, but those of its leaving would be worse. They would be not just economic, but human, geopolitical and historic. Europe would never be the same again.I was in Greece two weeks ago, and grasped this at every turn, from standing on the ancient Pnyx, the birthplace of democracy, through talking to business leaders, journalists and academics, many of who were witheringly critical of the current Syriza government. But since then I have been back in northern Europe, in England, Belgium and now Poland, and in the north I find not just relative indifference (Greece is more often the subject of jokes than of deep concern) but also two dangerous illusions.Related: The case for radical change in Europe can’t be left to the nationalist right | Seumas Milne Continue reading...

|

|

by Phillip Inman Economics correspondent on (#B9A6)

Analysis: Chancellor’s policies favour old over young and sow the seeds for another crash that will hurt those he professes to be fighting forLight-sabre wielding George Osborne says he is fighting for Britain’s future generations. Central to his Mansion House speech was a warning that unless the state runs a budget surplus in normal times, a toxic legacy of debt awaits our children and grandchildren.The chancellor, who let it be known last week that he is a Star Wars fan who keeps several replicas of the Jedi weapons in his office, said that for the sake of future generations “governments of the left as well as the right should run a budget surplus to bear down on debtâ€.Related: Growth at all costs: climate change, fossil fuel subsidies and the TreasuryRelated: Academics attack George Osborne budget surplus proposal Continue reading...

|

|

by Phillip Inman Economics correspondent on (#B9A4)

Resolution Foundation predicts that weekly earnings growth will have hit an annual rate of between 2.5% and 2.6% between February and AprilEmployment figures for April due later this week are expected to show the biggest rise in real wages growth for nearly eight years, according to new analysis.The data will give George Osborne a post-election lift after a weak first few months of the year that have shown manufacturing output slide backwards and the biggest boost to growth come from the City and the hotel and restaurant sectors. Continue reading...

|

|

by Helena Smith in Athens on (#B997)

Exit from eurozone a step closer as EU officials dismiss Alexis Tsipras’s reforms as incomplete, with talks halted after less than an hourLast-ditch talks aimed at breaking the impasse between Athens and its international creditors have collapsed in acrimony with European Union officials dismissing Greece’s latest reform package as incomplete in a step that pushes the country closer to leaving the eurozone.What had been billed as a last attempt to close the gap between Alexis Tsipras’s anti-austerity government and the bodies keeping debt-stricken Greece afloat was halted late on Sunday after less than an hour of negotiations in Brussels.

|

|

by Helena Smith in Athens on (#B8TE)

After weekend of intense talks, Greek prime minister is thought to be hopeful of ‘viable’ but tough agreement before bailout accord is due to expire

|

by Phillip Inman economics correspondent on (#B80C)

Official view seems to be rates will rise early next year as recovery takes hold, but a rise in working-age population could keep a lid on salariesBank of England policymaker Ian McCafferty excludes two essential trends from his analysis of the economy. In a speech this week, he said a bounce back from a lacklustre first three months of the year was on the cards. With the recovery will come a steady rise in wages that will last the rest of this year and into the next, resulting in the first of several interest rate rises next spring.It’s not an outlandish statement. An interest rate rise in the first quarter of 2016 is what the market expects, too. Continue reading...

|

by Guardian Staff on (#B7KZ)

Joining the euro club was once a badge of political and economic advancement. Now, if Athens is pushed out, others may choose to followFinally, the endgame. After weeks of posturing, Greece is running out of time to escape bankruptcy and a forced exit from the European single currency. By Friday, as both sides scrambled to fix up a fresh round of talks for this weekend after the International Monetary Fund’s negotiators flew home in frustration, it appeared that European officials had been discussing how they might manage a Greek default.It’s hard not to be mesmerised by the day-to-day drama of walkouts, public posturing and political intrigue, which may finally reach its conclusion in the coming days.Greece has contracted by an extraordinary 20% at the behest, and under the supervision, of its eurozone partners Continue reading...

|

|

by William Keegan on (#B7M1)

An austerity-led attack on public spending and an obsession with ‘rules’ will not deliver a balanced economyThe inquest on Labour’s electoral defeat will run and run, and the recriminations will no doubt persist throughout the party’s inordinately long timetable for selecting a new leader. But there is a limit to which candidates should surrender to the Big Lie that George Osborne, more than anyone else, has managed to get away with.Take a report in the Times’s recent “investigation†into Labour’s “disastrous campaignâ€. We are told that “as early as 2010, Labour’s pollsters sent a memo saying the party should argue ‘the deficit is the number one challenge facing the country’ and back ‘tough spending cuts’.â€The truth is that the deficit was not the problem: it was the solution Continue reading...

|

|

by Chris Johnston and Ian Traynor on (#B5BD)

Greek finance minister says he does not believe Europe would let his country leave the eurozone, but decision on its fate is expected by ThursdayFears that Greece could leave the eurozone continued to mount on Saturday, despite its finance minister saying that Europe would not allow that to happen.Yanis Varoufakis told BBC Radio 4’s Today programme: “I don’t believe that any sensible European bureaucrat or politician will go down that road.†Continue reading...

|

|

by Staff and agencies on (#B4DE)

New exchange rate is $1 for 35,000,000,000,000,000 old dollarsZimbabweans will start exchanging “quadrillions†of local dollars for a few US dollars next week as President Robert Mugabe’s government discards its virtually worthless national currency.

|

by Martin Rowson on (#B3W4)

Continue reading...

|

by Phillip Inman economics correspondent on (#B3CS)

Thomas Piketty, David Blanchflower and other experts say chancellor’s law would risk crash by shifting debt from government on to householdsGeorge Osborne’s plan to enshrine permanent budget surpluses in law is a political gimmick that ignores “basic economicsâ€, a group of academic economists has warned.Related: Osborne plan has no basis in economics | Letter from Ha-Joon Chang, Thomas Piketty, David Blanchflower and othersRelated: The Guardian view on the RBS sell-off: a bad deal all round | Editorial Continue reading...

|

|

by Katie Allen on (#B3K0)

Credit rating agency joins other forecasters in warning about the potential damage to the UK economy from holding a referendumDavid Cameron’s decision to hold a referendum on EU membership has put Britain at greater risk of losing its triple-A credit score, according to Standard & Poor’s, the only big ratings agency to still give Britain the top ranking.Cutting its outlook for UK government debt to “negative†from “stableâ€, the agency highlighted serious risks to the pound and Britain’s ability to attract foreign investment were it to break away from the EU. There was also a danger that in the runup to the vote domestic party politics and negotiations with Brussels would divert attention away from the UK’s pressing economic problems.

|

|

by Julia Kollewe (unitl 1.45) and Nick Fletcher on (#B1MF)

|

by Katie Allen on (#B2A4)

ONS points to higher GDP reading for first quarter as new figures show building sector performance better than fearedBritain’s economy grew faster than previously thought in the opening months of this year, according to estimates from the Office for National Statistics, after it emerged that the construction sector had a better start to 2015 than feared.

|

by Letters on (#B39J)

The chancellor’s plans, announced in his Mansion House speech, for “permanent budget surpluses†are nothing more than an attempt to outmanoeuvre his opponents (Report, 10 June). They have no basis in economics. Osborne’s proposals are not fit for the complexity of a modern 21st-century economy and, as such, they risk a liquidity crisis that could also trigger banking problems, a fall in GDP, a crash, or all three.Economies rely on the principle of sectoral balancing, which states that sectors of the economy borrow and lend from and to each other, and their surpluses and debts must arithmetically balance out in monetary terms, because every credit has a corresponding debit. In other words, if one sector of the economy lends to another, it must be in debt by the same amount as the borrower is in credit. The economy is always in balance as a result, if just not at the right place. The government’s budget position is not independent of the rest of the economy, and if it chooses to try to inflexibly run surpluses, and therefore no longer borrow, the knock-on effect to the rest of the economy will be significant. Households, consumers and businesses may have to borrow more overall, and the risk of a personal debt crisis to rival 2008 could be very real indeed. Continue reading...

|

|

by Steven Greenhouse on (#B28C)

Trade authority approval would be a huge win for Barack Obama, but both supporters and opponents say anticipated Friday vote is too close to callWith fast-track trade authority expected to face a close House vote on Friday, Ben Wikler, the Washington director of MoveOn.org, has little patience for trade advocates who suggest that its only opponents are labor unions.Related: European politicians protest to Congress as TPP trade bill excludes climate deals Continue reading...

|